Before you buy bitcoin (BTC) or any other cryptocurrency, it’s important to have a clear idea of the mechanism and ethos behind the asset. As the first commercial cryptocurrency — also termed “digital gold” by evangelists — bitcoin has an illustrious history, an intriguing present, and a promising future.

This comprehensive guide touches upon every aspect of this digital innovation, from its foundation to the technology underpinning the network. We urge you to read through every segment before you decide to buy bitcoin. And fret not; this discussion also details the best avenues and strategies to buy BTC with minimal effort.

Methodology: How we chose the platforms to buy Bitcoin

The methodology for selecting platforms ideal for purchasing Bitcoin involved evaluating key factors to ensure a comprehensive and reliable choice for users. The process prioritized platforms with strong security measures and a proven track record of reliability to safeguard user assets and data. User experience, particularly ease of use and interface design, was a critical factor. The range of services offered, such as trading, staking, and payment processing, was also considered.

Kraken

Known for its strong security measures and low transaction fees, Kraken is a great choice for both beginners and experienced traders. It offers a wide range of cryptocurrencies and advanced trading features.

dYdX

This platform is unique for offering decentralized margin trading and derivatives. It’s ideal for those looking to engage in advanced trading strategies in a decentralized environment.

OKX

Offers a comprehensive trading platform with a wide range of cryptocurrencies. It’s suitable for users seeking a blend of traditional trading and innovative crypto services. Its known for its robust API, making it suitable for algorithmic traders, and offers a wide range of crypto-related products including futures and options.

eToro

Known for its social trading features, it’s great for beginners wanting to learn from experienced traders. It also features a unique social trading aspect where users can interact and copy strategies of successful traders

Cash App

Offers a straightforward and user-friendly way to buy and sell Bitcoin, ideal for beginners. It also allows users to send Bitcoin to others easily. eToro integrates Bitcoin transactions seamlessly with everyday finance, offers easy peer-to-peer transactions which support the Lightning Network.

Stripe

Though primarily a payment processor, Stripe’s integration with Bitcoin allows businesses to accept Bitcoin as payment, making it a good option for commercial transactions.

Revolut

Combines traditional banking features with cryptocurrency trading. It’s an excellent choice for those who want a seamless experience between managing fiat and cryptocurrencies.

PayPal

Provides a simple and familiar platform for buying and selling Bitcoin. It’s suitable for casual users who prioritize convenience and are already familiar with PayPal, which offers a familiar platform for those new to crypto, with easy integration into existing PayPal services.

Skrill

Offers an easy-to-use platform with additional features like instant exchanges between various cryptocurrencies. It’s ideal for users looking for a quick and straightforward way to trade Bitcoin.

To know more about BeInCrypto’s methodology verification, click on the link.

- Methodology: How we chose the platforms to buy Bitcoin

- What is bitcoin?

- How do I buy bitcoin?

- How to buy bitcoin: step-by-step

- How to sell bitcoin?

- Where to buy bitcoin

- Who invented bitcoin? Other historical elements

- The fundamentals of bitcoin

- Bitcoin volatility

- Bitcoin transaction and fees

- Is bitcoin halal or haram? An Islamic law perspective

- Want to buy bitcoin? Check laws in your location

- Comparing bitcoin with other PoW cryptos

- Why buy bitcoin?

- Anonymity and security

- Understanding bitcoin and its ecosystem

- What can I buy with bitcoin (BTC)?

- Advanced bitcoin topics: what’s left of the ecosystem?

- The Bitcoin network and ecosystem is thriving

- Frequently asked questions

What is bitcoin?

Bitcoin is the world’s first decentralized, commercially-primed cryptocurrency. It isn’t backed by any real-world asset and isn’t governed by any central authority. Instead, it operates as a blockchain — an immutable ledger recording transactions and using cryptographic techniques to form a transparent and resilient setup.

Here is what the Bitcoin network stands for. No borders, no censorship.

A more simplified way of understanding bitcoin is to consider it a digital currency powered by a pre-defined set of codes or protocols. Unlike fiat currency like the U.S. dollar or the Indian Rupee, which can be printed at will, BTC has a fixed supply of 21 million coins.

But what is bitcoin? We know its supply and that it is the most famous crypto. Yet, to properly unpack this digital currency, we must understand how it works and how it impacts the broader cryptocurrency space.

How does bitcoin work?

Bitcoin is a standard proof-of-work cryptocurrency. Also, as it is blockchain-based, everything that happens across the Bitcoin network stays there permanently. Transactions made using BTC as the currency find a permanent place within the ledger. But the essence of Bitcoin’s operation lies in how the transactions happen.

Whenever a cryptocurrency transaction is initiated involving BTC or anything within the Bitcoin network, the transaction is attached to a block, awaiting confirmation or verification. As Bitcoin is PoW, miners must solve complex computational puzzles to verify transactions and ensure that they get recorded within the blockchain.

As the network is decentralized, there is no central authority. Everyone can see what kinds of transactions are being made within the ecosystem, including the verification status of those transactions.

How do I buy bitcoin?

To buy bitcoin, you can either connect your digital BTC wallet to make a direct bitcoin purchase or rely on different crypto trading platforms and exchanges.

Buying bitcoin with digital wallets

You can purchase BTC by connecting your bitcoin wallet to any exchange or a third-party service provider. As for the wallet, you can choose software wallets like Mycelium or Exodus, a specific exchange wallet from Coinbase or Binance, or even a hardware or cold wallet like Trezor. Most digital wallets have direct bitcoin purchase options.

How to buy bitcoin for beginners?

If you are starting out, you likely want to buy bitcoin without hassle. For that, you can simply create a cryptocurrency exchange account, choose BTC as the crypto to buy, enter the desired method of digital payment, and eventually purchase and store it in the digital or hardware wallet of your choice.

In most cases, buying bitcoin using digital wallets and exchanges requires you to pay fees — network or even exchange fees. However, to buy bitcoin without fees, you can rely on the peer-to-peer transactions or BTC buying avenues offered by leading exchanges like Binance, OKX, and more.

How to buy bitcoin: step-by-step

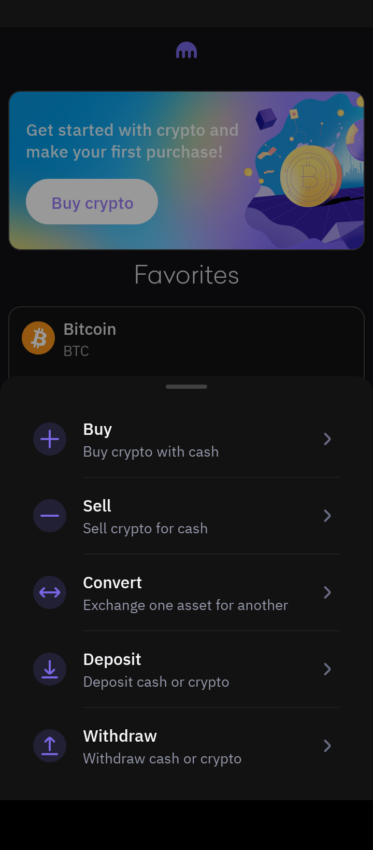

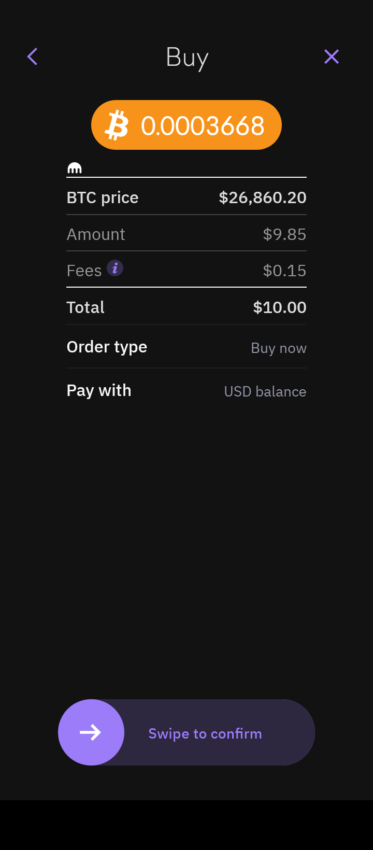

For this demo, we’ve used Kraken to show you how to buy BTC.

1. Firstly, open the Kraken app. Navigate to the bottom of the screen and press the purple exchange button.

2. Secondly, select “Buy” and choose bitcoin.

3. Select the amount you would like to purchase and press next.

4. Swipe the slider to the right to complete your purchase.

How to sell bitcoin?

Assuming you have already located the best crypto brokers for buying and selling bitcoin, it is now time to focus on liquidating holdings for some other crypto or fiat as an off-ramping process. While brokers and exchanges like Binance and Coinbase allow standard BTC selling, P2P selling, bulk selling on top OTC bitcoin markets, and seamless crypto conversions, the overall process remains the same regardless of the trading platform.

To sell bitcoin, you must head over to your exchange of choice, select BTC as the asset, and hit sell. You can place a limit, market order, or off-load BTC via peer-to-peer transactions.

That said, for beginners who are simply starting out in crypto, the exchange route is arguably the easiest. However, it isn’t anonymous. For experienced traders and crypto folks, the ability to buy BTC anonymously may be important. Let us discuss that in detail.

Where to buy bitcoin

Now we have explored beginner-friendly strategies to buy bitcoin and the best options to accumulate the currency anonymously, let us shift our focus to the standard exchanges and avenues supporting BTC purchases.

Best bitcoin exchanges in 2023

While several crypto exchanges allow you to purchase BTC with minimal handholding, some of the best bitcoin exchanges include:

- Kraken — Kraken is well-recognized for its dedication to security, providing you with the assurance needed when dealing with the often volatile crypto market. In our experience, the platform stands out for its diverse offerings, not just in cryptocurrency variety but also with comprehensive trading features. The fee structure is pretty transparent and competitive. We also found the educational resources on Kraken to be particularly useful — both for novice and experienced traders.

- dYdX — dYdX is a decentralized exchange (DEX) that emphasizes the core crypto principles of decentralization and transparent operations. It is a popular go-to option for those looking for advanced trading options without the oversight of a central authority. The use of smart contracts for trades gives you a sense of autonomy and security. Our team found dYdX’s core services pretty robust and practical — particularly the perpetual and margin trading features. Apart from that, we also found its lending and borrowing features to be relatively simple and user-friendly.

- OKX — OKX has been another exchange that you can turn to for its user-friendly interface that makes Bitcoin purchases swift and straightforward. We found the OKX mobile app to be pretty convenient for managing investments on the go, and the customer service was always responsive whenever we needed assistance or had inquiries about our transactions.

- eToro — What made eToro particularly attractive for our team was its copy trading feature. This feature enabled us to replicate the strategies of successful traders, which can be immensely beneficial for those new to trading or those looking to experiment with new strategies. Moreover, the ease of branching out into traditional investment options like stocks and ETFs without leaving the platform was a significant time-saver.

These platforms have been chosen as examples to signify the array of options you have when you set out to buy bitcoin. Each platform comes highly recommended — dYdX for its commitment to building a truly decentralized platform, Kraken for its security-centric status, and strong reputation for customer protection.

It is worth noting that for those less keen to use exchanges, a number of digital payment methods offer ways to buy bitcoin with ease. While some of these payment methods are exchange-specific, some can be initiated via third-party websites and platforms. Let us delve deeper.

Best payment methods to buy bitcoin

From using credit cards to buy BTC to using the likes of PayPal, Google Pay, Stripe, there are an increasing number of super easy and app-friendly options to choose from. Here is a brief introduction to how you can get started with each:

Buy bitcoin via Cash App

To buy bitcoin on Cash App, you can load the app with funds and place market or limit orders to execute a buy order instantly. Cash App also lets you make recurring purchases, which you can set daily, weekly, or fortnightly.

Buy bitcoin using credit cards

Several exchanges allow you to buy bitcoin with credit cards. These include StormGain — which levies a 5% fee on credit card deposits and purchases — and Paybis — which charges as high as 6.5%. Other options include Coinbase, Paxful, and more. On Binance, you can load up your “fiat and spot” wallet with fiat or crypto using credit cards, which in turn attracts a fee of almost 2%, depending on the fiat you are working with.

Buy bitcoin using debit cards

Just like credit card purchases, you can buy bitcoin using debit cards on the mentioned exchanges. Also, direct credit and debit card purchases are possible if you wish to purchase BTC directly from your digital crypto wallet.

Buy bitcoin with Stripe

Stripe, one of the most reputable payments processing global avenues, also lets you purchase BTC. To buy bitcoin using Stripe you must first create a Stripe account, link your bank to activate payments, and head over to the Bitstamp exchange to create an account.

On BitStamp, you can fund your account with a bank transfer and select Stripe as your choice of payment. Once your BitStamp account is loaded, head over to the “Market” segment. Then, select BTC as your cryptocurrency of choice and make the purchase.

Buy bitcoin via Revolut

Revolut, a U.K.-specific fintech platform, also offers crypto services in addition to supporting international fund transfers, budgeting tools, and more. Suppose you are a Revolut user or are looking to be one. In that case, you can buy bitcoin with Revolut first by creating an account on the app. Then, top up your account with funds via a bank transfer or your cards, and head over to the “Crypto” section of the app.

Once there, hit “Trade” and then select “Buy” to purchase bitcoin. The best thing about buying bitcoin with Revolut is that you can easily send your BTC to an external crypto wallet.

Buy bitcoin using PayPal

You can directly buy bitcoin with Paypal. To do so, you need to be a U.S. citizen. If you are, you can choose “Crypto” from the home page, log in using your PayPal account credentials, and make a direct BTC purchase. Note that eToro, AvaTrade, and Coinbase are some of the best crypto platforms to buy crypto (BTC) using PayPal as a payment method.

Buy bitcoin using Apple Pay

Even Apple Pay lets you buy BTC — or any other crypto, for that matter. However, to buy bitcoin using Apple Pay, you must have an account on compatible exchanges like Kraken or Coinbase. Once there, you should select Apple Pay as your desired payment method. Or, if you want to purchase other crypto assets, such as ETH, non-custodial wallets like MetaMask allow you to directly make a purchase using Apple Pay.

Buy bitcoin using Google Pay

To buy bitcoin using Google Pay, you must zero in on a crypto app that allows you to utilize this payment method. For starters, create a Google Pay account link to the desired payment method. You can link your bank account or credit or debit card at this point.

Once done, you can head over to any compatible exchange, say Binance or Coinbase, place a buy order for BTC, and choose Google Pay as your desired mode of payment.

Buy bitcoin with Skrill

The Skrill app lets you trade bitcoin and more than 40 other digital assets. However, to buy bitcoin with Skrill, you need to be smart and work around the regulations. You can start by setting up an account on Skrill and adding a payment method to fund your Skrill account. Do note that while bank transfers are free and can take up to five days, quicker options like Paysafe and debit/credit cards incur fees.

Once you load the desired sum to the Skrill account, you can choose “Crypto” from the available options and start buying BTC. Skrill, like Revolut, allows you to send the BTC to an external wallet.

Buy bitcoin via ATMs

We mentioned previously that you can buy bitcoin using ATMs. But what are bitcoin ATMs? If you’re still unsure, here’s a quick explainer.

/Related

More ArticlesBitcoin ATMs are just like fiat ATMs. However, instead of disbursing cash, they disburse BTC to your desired address. You simply need to deposit fiat into the ATM via your card of choice, feed in the wallet address, and the process of buying BTC concludes. And if you are unsure about the best bitcoin ATMs to buy bitcoin from, we recommend Pelicoin, Just Cash, and RockitCoin as some go-to options.

Understanding the cryptocurrency market

There was a time when bitcoin comprised the entire cryptocurrency market. Slowly came other crypto players. However, as of Sept. 21, 2023, bitcoin is still the most dominant crypto around, covering 49.07% of the entire space. Bitcoin dominance, therefore, is an important metric that determines the state of the broader market.

Did you know? While bitcoin was the first decentralized cryptocurrency, 2011 saw the next two players in the space — namecoin and litecoin. The technology powering both these cryptocurrencies is similar to that of bitcoin.

The market rallying and bitcoin dominance growth might be an indicator of an upcoming bull run at BTC’s counter. However, if the market rallies and bitcoin dominance keeps dropping, it might mean an upcoming bull run for altcoins.

Who invented bitcoin? Other historical elements

As mentioned, the Bitcoin network has an illustrious history. Let us understand how it all shaped up:

Satoshi Nakamoto: The founder

In 2008, a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” was published by Satoshi Nakamoto — an anonymous individual or a group. While the whitepaper first introduced the concept of Bitcoin, the network officially came into existence in 2009.

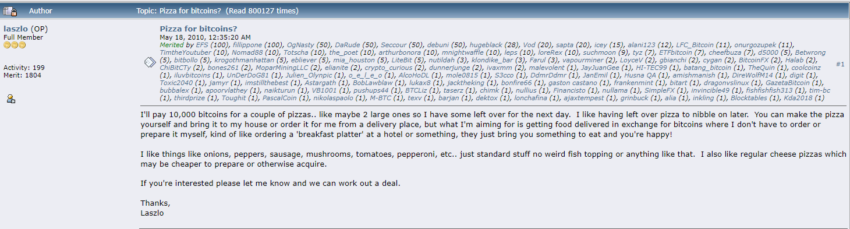

Bitcoin Pizza Day explained: A BTC transaction story

In 2010, an individual named Laszlo Hanyecz ordered two pizzas, paying 10,000 BTC. His entire corpus was valued at a mere $41 at that time.

This was on May 22, 2010, and since then, the crypto community celebrates Bitcoin Pizza Day every year. This day is an important element of BTC’s historical journey.

Who owned the most bitcoin in 2022?

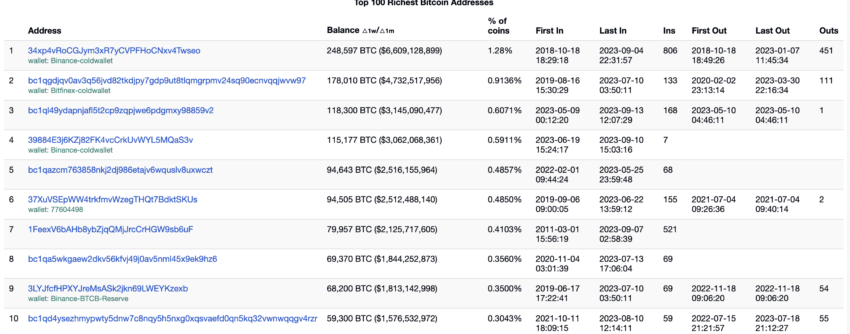

The holding pattern is another crucial aspect of bitcoin’s history and future. Unlike some of the lesser-known cryptocurrencies where holdings are largely centralized — often with a few whales holding most of the tokens — BTC has a more transparent map of holders. Also, a uniform holding pattern shows how valuable it is considered to be.

As of 2023, the holding pattern — signifying anything between 0 BTC to 1,000,000 BTCs, is pretty well laid out. Notably, the largest group of holders have anywhere between 0.0001 to 0.001 BTC in their wallets.

Bitcoin explorers like Bitinfocharts can also tell who owns the most Bitcoin. These numbers can help determine which whale accounts you must follow to track the next cryptocurrency price trend.

Since 2022, the wallet holding the most BTC hasn’t changed. Even the percentage of coins remains the same, 1.28%.

Many long-term holders are sitting on BTC:

What is a satoshi?

As of mid-September 2023, one bitcoin is priced at almost $27,000. Therefore, when it comes to BTC-specific transactions, people usually prefer fractionalizing BTC instead of moving around an entire coin. This is where one Satoshi, the smallest unit of BTC, comes to the fore. One bitcoin equals 100 million satoshis. This aspect lends the required divisibility to bitcoin, allowing holders to buy and sell any BTC value they please.

Other aspects of Bitcoin’s history are the bitcoin documentaries that allow new users to gain as much info about the OG crypto player. For instance, Netflix’s Banking on Bitcoin is one of the more detailed BTC-specific documentaries that help you trace the actual path taken by the creators.

The fundamentals of bitcoin

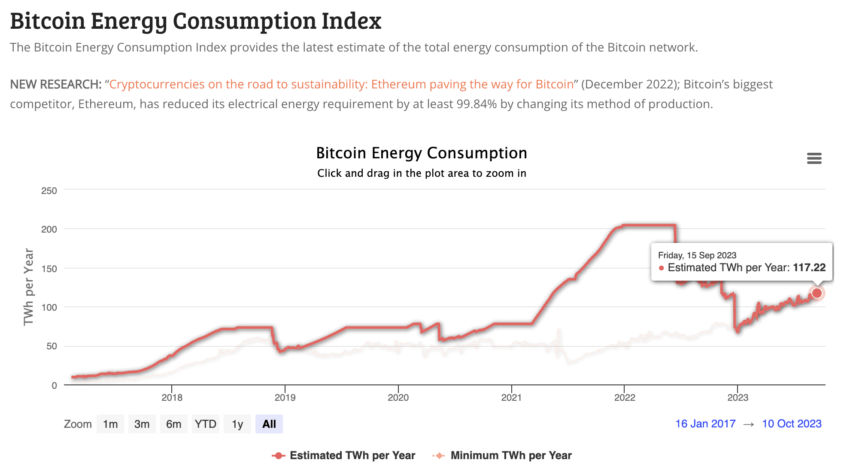

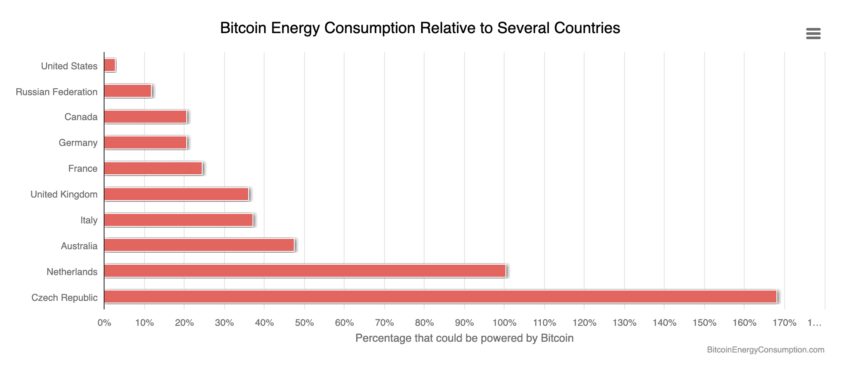

Bitcoin’s energy consumption has been discussed since the network’s inception. This has only increased with Ethereum, Bitcoin’s biggest competitor, reducing its energy-specific footprint post-merge.

Bitcoin energy consumption

Per estimates, the current electrical energy consumption is expected to be around the 117.22 TWh mark, which is still on the higher side. Also, despite El Salvador — one of the most pro-BTC countries — completely shifting to renewable sources, like volcano energy, to mine BTC, the energy consumption relative to that of several countries still remains high.

How much electricity does bitcoin mining use?

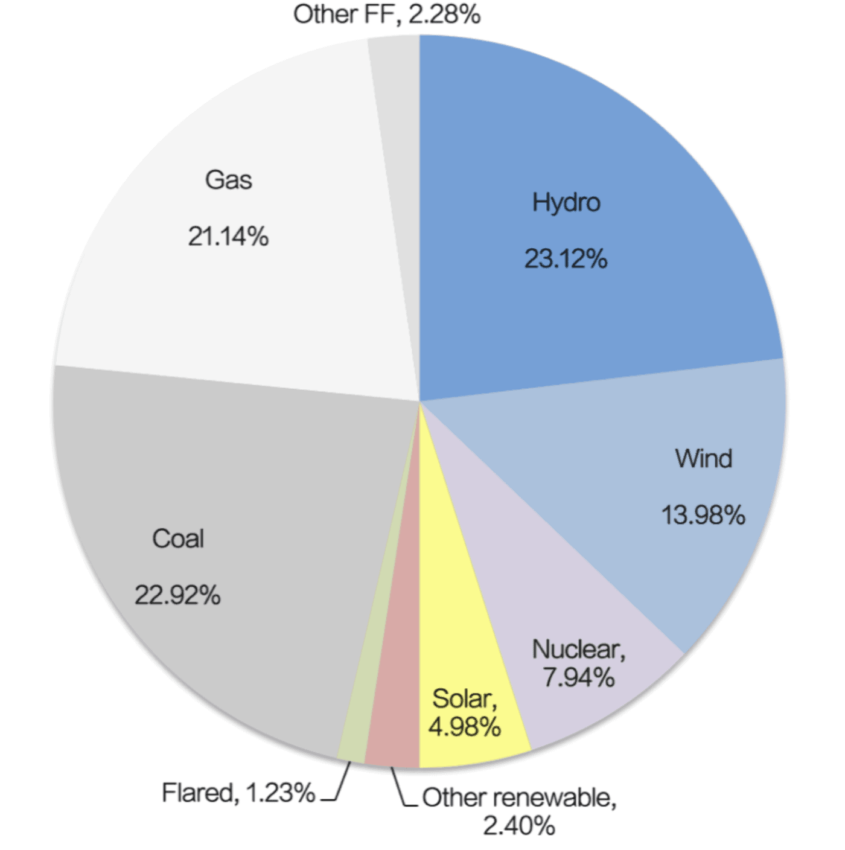

While we did see how much energy bitcoin mining consumes or is expected to consume as part of its footprint, the focus in 2023 shifts to greener alternatives to ensure the sustainability of the mining process. Per research insights released by Daniel Batten, an ESG analyst, there has been a reduction in the popularity of fossil fuels as bitcoin miners become more conscious about the electricity used for their activities.

Other research findings include:

- Almost 25% of BTC miners rely on water-based setups for harnessing energy.

- Wind-based power generation comprises almost 14% of Bitcoin’s mining strength.

- Nuclear and solar-powered mining setups account for almost 8 and 5% of the total mining power.

As of 2023, almost 53% of the entire BTC mining setup is reliant on renewable sources of energy, thus minimizing the electricity-specific load on coal and other fossil fuels.

Bitcoin volatility

Anyone looking to buy bitcoin safely should be mindful of volatility. But what causes bitcoin’s volatility, and how does it impact price?

What causes bitcoin volatility?

Despite being the first popular crypto and an asset with the most credibility in the crypto space, sentimental drivers can still push the cryptocurrency price higher or lower significantly. However, BTC volatility doesn’t just relate to the sentimental drivers. Instead, some other reasons include changing investor confidence, long-term holding patterns or sell-offs initiated by long-term holders, mainstream adoption — including the time when it was accepted as legal tender in El Salvador — social trends, media influence, market manipulation, and global macroeconomic factors like inflation rates, interest hikes, and more.

Regardless, every enlisted reason that might cause Bitcoin price volatility, somewhere, translates to the overall sentiments surrounding the crypto. While you can check the historical volatility of bitcoin using TradingView, the bitcoin fear and greed index also gives a good indication of market sentiments.

Impact on BTC price

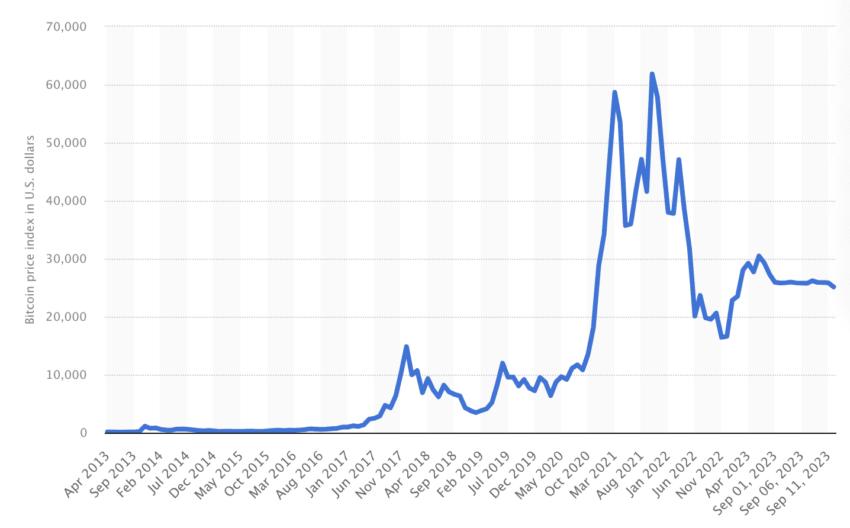

Bitcoin volatility can have a trend-specific impact on the price of bitcoin. If you look at the historical volatility indicator and compare the same with the prices, you will notice that a drop in bitcoin volatility often translates into higher price peaks. Therefore, if you wish to buy bitcoin, the volatility-price relation is something to consider.

Bitcoin transaction and fees

As a proof-of-work cryptocurrency, bitcoin relies on miners and nodes to validate and verify transactions. Let us understand how bitcoin transactions work, and the entire process flows.

How do bitcoin transactions work?

A bitcoin transaction can be as simple as moving BTC from one bitcoin wallet to another. Every transaction needs to have an input or the source information, the output or the destination information, and the value. The user initiating the transaction needs to sign it using their private key.

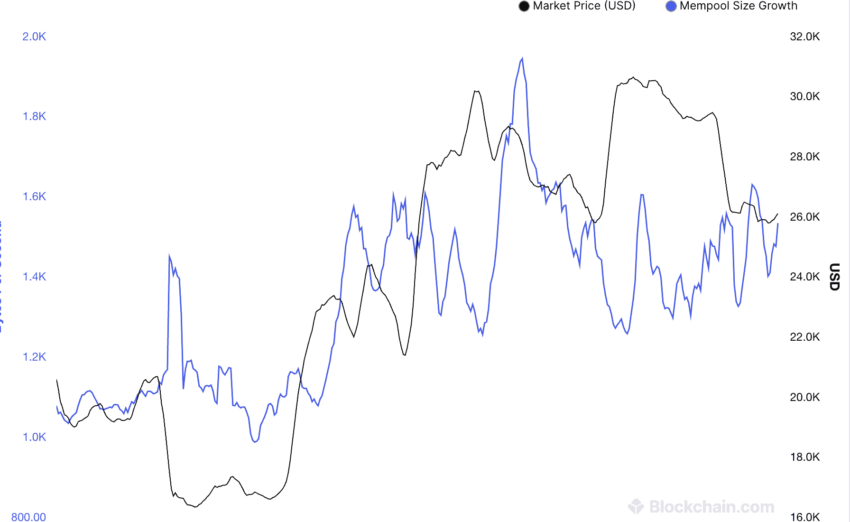

Once done, the transaction is broadcasted to the network, where nodes pick and validate them. Once validated, the transactions remain in the node’s mempool, which is then picked by the miners to add them to blocks upon solving puzzles. The first miner that solves a given puzzle creates the block with the validated and verified transaction to it. Once this is done, the new block is again broadcast to the network.

The nodes again come into the picture as they also validate the block, after which the miners get their block rewards. Once the mined block is verified, the nodes include the blocks in their version of the blockchain, which also gets updated.

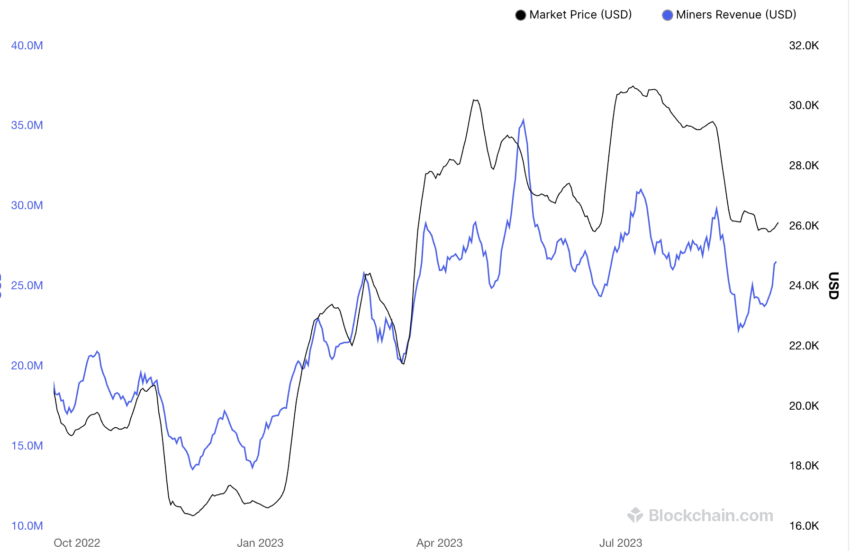

Explaining cryptocurrency fees and Bitcoin miner fees

While nodes are the building blocks of the Bitcoin network, miners are the ones lending solidarity to the same. Therefore, miners receive a part of the bitcoin transaction fees and even the block rewards, which are currently set at 6.25 BTC for every confirmed block. As no central authority exists, fees and rewards are the required incentives to keep the miners interested.

As for the fee determination, the same depends on the network congestion and how fast you want the transactions to get verified. Different wallets also come with integrated fee estimators, and miners often prioritize transactions attracting higher fees to earn more. Post bitcoin halving of 2024, with the rewards reducing to 3.125 BTC, miners might shift their attention towards fee-intensive transactions.

Is bitcoin halal or haram? An Islamic law perspective

If you wish to trade or simply buy bitcoin as part of the world’s second-largest religious group — Islam — you might want to look at its alignment with Sharia laws. Of course, to understand whether bitcoin is halal or haram, it is necessary to understand what is and what isn’t permitted in Islam.

Simply put, any aspect of finance that adheres to the basics of money movement, including business arrangements, lending, borrowing, and banking, is considered halal as per Islamic money laws. The idea is to use money for for non-interest-bearing purposes. As for bitcoin, its basis as a “store of value” qualifies the digital asset as halal by several scholars. However, the halal vs. haram debate is by no means settled, with several scholars, such as Shawki Allam, the Grand Mufti of Egypt, still believing cryptocurrencies qualify as the latter. In 2018, the Middle East Eye reported that Allam said in an official fatwa that trading with bitcoin was unlawful as per Islamic rulings.

More clarity is expected over the next few years as BTC further solidifies its presence as a global financial giant.

Want to buy bitcoin? Check laws in your location

Despite the worldwide regulations concerning bitcoin, buying BTC doesn’t require you to meddle in many legal issues. In countries like the United States of America, India, Canada, and more, you can legally buy bitcoin. However, nations including Bangladesh, Nepal, and Vietnam, have an anti-BTC stance, making buying much more risky.

Is bitcoin legal in your region? One clear indicator is to check whether any popular crypto exchanges operate in the area. For instance, Binance operates in over 100 countries. If your country is on this list or that of any other popular exchange, it is likely legal to buy bitcoin there.

Concerns about mining bitcoin?

If there are restrictions on buying bitcoin in certain countries, is bitcoin mining legal everywhere? Like buying BTC, even mining can have legal consequences if you haven’t done your research correctly. For instance, ideological and electricity concerns have ensured that mining bitcoin in Nepal, Ecuador, Bolivia, Morocco, and a few other countries is illegal. Even in China, there has been a blanket mining ban since March 2023.

Yet, countries where bitcoin is legal for mining are greater in number, with some of the notable names being Iceland, Sweden, Finland, Canada, and more.

Comparing bitcoin with other PoW cryptos

Despite the massively competitive crypto space, bitcoin remains unmatched in popularity, courtesy of its novel and highly decentralized existence. However, a few popular PoW cryptocurrencies have garnered a lot of popularity over the years, making them stand up even to BTC at times.

Here is how they compare:

Dogecoin (DOGE) vs. bitcoin

When comparing dogecoin vs. bitcoin, it is crucial to note that while bitcoin is a P2P digital currency, a store of value, and a utility-based cryptocurrency, dogecoin qualifies as a celebrated memecoin, dating back to 2013. Unlike BTC’s max supply cap of 21 million, dogecoin doesn’t have a fixed supply.

Bitcoin cash (BCH) vs. bitcoin

Any bitcoin cash vs. bitcoin comparison should reflect that the Bitcoin Cash network is a hard fork of Bitcoin. The ideology and the supply cap of both currencies are the same. However, the Bitcoin Cash network has a block size of 8MB as opposed to Bitcoin’s 1MB.

“I was optimistic about Bitcoin Cash specifically because I agreed with the big-blocker arguments in the scaling war more than the small-blocker arguments.”

Vitalik Buterin, co-founder of Ethereum: Twitter

Litecoin (LTC) vs. bitcoin:

And finally, any litecoin vs. bitcoin discussion worth its weight must be loaded with historical and operational insights. For instance, Bitcoin came into existence in 2009 and was quickly termed “digital gold,” Litecoin was created in 2011 as a sort of younger sibling, often considered “digital silver.” The Litecoin network employs the Scrypt mining algorithm. Also, while Bitcoin has a block time of almost 10 minutes, Litecoin manages the same in 2.5 minutes, making it a preferable network for those looking for faster transactions.

Why buy bitcoin?

Now that we know a fair bit about BTC, it is time to enlist the reasons why every crypto evangelist — from a beginner to an expert — should look to buy the leading digital asset.

Is BTC a profitable cryptocurrency investment?

Bitcoin is known to give astronomical returns on investment. Notably, the price of one BTC was $135.30 in April 2013. This moved all the way up to almost $69,000 by November 2021. In addition to beefy historical returns, buying BTC allows you to diversify your corpus with a less volatile cryptocurrency, experience high liquidity, and bear witness to continued adoption and innovation.

You can both invest in bitcoin, keeping the broader, long-term picture in mind, or trade bitcoin to make use of the trends and short-term price moves to amass profits.

However, apart from standard investing and cryptocurrency trading, there are other proven strategies to make money with bitcoin. These include buying and “hodling” BTC, lending bitcoin to earn interest, yield farming, and staking. Also, if you do not want to own BTC but are still interested in earning with it, setting up a lightning node is one of the more rewarding and straightforward strategies to employ.

BTC as a hedge against inflation?

For a long time, many bitcoin evangelists have been pushing forward the “hedge-against-inflation” narrative. Here is what that means. Unlike fiat currency that can be printed at will, the bitcoin has a finite supply cap of 21 million BTCs. This trait ensures that bitcoin isn’t primed to be devalued or inflated like central bank currencies. Yet, some might even argue against this hedge narrative, considering BTC has been moving sideways for quite some time now. Therefore, a better argument would be to consider BTC as a solution to the currency debasement, which involves fiat losing its value over the long term.

Anonymity and security

Bitcoin is pseudonymous. This means the way transactions happen is private and still traceable via public addresses. However, if you want to leave zero footprints while purchasing or transacting BTC, you might want to rely on anonymity instead of pseudonymity. Thankfully, in the crypto space, achieving secure transactions is possible.

Buying bitcoin anonymously (without ID)

There are several ways to buy bitcoin anonymously. These include purchasing BTC via decentralized exchanges, using the best bitcoin mixers and tumblers to shroud the public address, using a new email to create a cryptocurrency exchange account, or using a VPN. Using a bitcoin ATM is another flexible option, although they do come with purchase caps and aren’t available in every region.

Also, using Bitcoin anonymously isn’t just about buying the currency. For complete anonymity and secure transactions, you should even be able to cash BTC out without a trace. While some exchanges allow limited cashing out without KYC, bitcoin ATMs are still the best options for this. Or, you can convert BTC to the likes of XMR or DASH, taking advantage of the enhanced privacy and anonymity-specific traits of these cryptos.

Understanding bitcoin and its ecosystem

The BTC ecosystem extends beyond the basics of buying and selling. From a full-fledged NFT ecosystem to the extensive mining setup, cryptocurrency market-affecting indicators, and bitcoin-specific earning plans — the BTC ecosystem is both diverse and highly credible.

Bitcoin NFTs

If you have been following the Bitcoin network ecosystem in 2023, you will likely have heard about Ordinals. Considered Bitcoin NFTs, the Ordinals protocol is all about tagging satoshis — the smallest unit of bitcoin — with some sort of data attachment. Once satoshis or sats are tagged, they are perceived as bitcoin NFTs.

Ordinals were the reason that bitcoin-specific cryptocurrency transaction fees and network congestion shot up between April and August 2023.

Analyzing BTC technicals and charts

Bitcoin is the cryptocurrency market leader. Therefore, if you understand how bitcoin trades, its dominance chart works, and other bitcoin-specific technical indicators, it becomes easier to gauge the future of the altcoin space, too. Let us delve deeper and see which indicators are useful to the entire crypto community.

The trading ecosystem

While we have already mentioned some elements of bitcoin trading, especially in relation to volatility, there are multiple aspects to consider while taking positions. For instance, taking a close look at derivatives, including bitcoin margin trading and bitcoin futures, is important if you are serious about taking short-term positions and looking to buy bitcoin only to trade.

Bitcoin futures and options help you analyze the trend pro traders are betting on. Mastering the art of trading bitcoin options or tracking long and short trades can help you analyze the broader crypto space.

As a pro trader, gaining a better understanding of the bitcoin derivatives space can also help you multiply profits with leverage. Also, if you see pro traders better on future trades with a bearish mentality, you, as a new trader, might even consider shorting bitcoin — selling first and then buying at a lower price. This is another cryptocurrency margin trading angle to have in your back pocket.

Understand the key bitcoin metrics

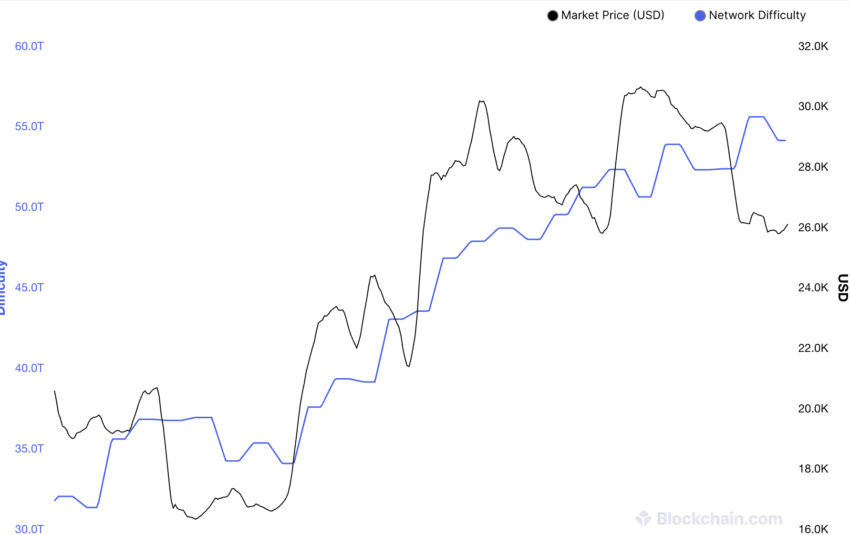

As mentioned earlier, understanding BTC’s price moves can be a good way to analyze the entire crypto space. Also, unlike some of the lesser-known cryptocurrencies, which haven’t been around for long, bitcoin has several specialized metrics that can help you understand the ecosystem better.

As a crypto beginner looking to buy bitcoin to trade or invest, you should keep a close eye on bitcoin halving cycles. Understanding the historical price moves in relation to the halving cycles can help you figure out general crypto investment strategies, as well as specific bitcoin halving investment strategies.

Next comes the bitcoin dominance chart that can help analyze the bullishness or bearishness associated with the altcoin space. As explained earlier, if the chart shows a dip while the price of BTC increases, the altcoin space might soon rally.

Another bitcoin-specific metric is the stock-to-flow model that hinges on the concept of a supply cap. This model ensures that the bitcoin price peaks every time the scarcity narrative takes center stage, especially during the halving cycles. Understanding the scarcity and the bitcoin stock-to-flow model can, therefore, give traders an edge.

Finally, the bitcoin rainbow chart is a metric or, rather, a tool useful to value-buying traders. This tool looks like a rainbow, with the structure divided into colored bands. The lowest band, or the blue band of the rainbow, is where the bearish trend takes center stage. However, if the price moves up to the light blue space, you can consider value-buying opportunities. Similarly, bitcoin price hovering within the dark red zone is certainly an overbought territory and prone to severe profit booking.

Another bitcoin metric that tracks sentiments is the fear and greed index:

The mining space

Bitcoin mining is one of the key elements of the ecosystem, as miners are responsible for maintaining the network’s security. While mining requires some sophisticated setup, you can rely on leading free cloud mining providers like StormGain to get started.

With free and even paid cloud mining services, bitcoin mining from home is now easy. You can even use the profitability calculator to check the prospective earnings before indulging.

Free cloud mining service providers like StormGain and Cointiply require you to complete specific tasks and earn free bitcoin in the process. However, there are some post-earning charges, which is a small price to pay for the investment-free gains.

If you don’t want to cloud mine, you can get started with free bitcoin mining, but it is necessary to conduct thorough research first. Once done, you should follow guides detailing free bitcoin mining methods to help you install software modules like Easyminer, BFGMiner, and more on your (powerful) PC.

The HODLing space

Finally, there is the bitcoin holding space that focuses on treating BTC as a store of value. While HODLing might sound boring to active traders, you can use specific platforms like BlockFi, Nexo, and more to earn sizable Bitcoin interest rates.

While the platforms mentioned above require you to present BTC as collateral for crypto-backed loans, there are other bitcoin interest platforms, like HODL HODL, that act as savings accounts. Or, you can head over to popular CEXs like Binance and earn steady APY on your holdings with flexible redemptions.

What can I buy with bitcoin (BTC)?

Bitcoin’s stead as a mode of payment is a highly controversial one. However, some businesses that accept bitcoin payments for services and goods include the likes of Microsoft and Wikipedia, both of which are pro-BTC firms.

As for food-based conglomerates, Starbucks accepts bitcoin via Flexa, as does Subway. And just for the kicks, you can even use cryptocurrency, including BTC, to help you travel globally. Websites like Bitcoin.Travel, Travala, Virgin Galactic, and more can help you plan your next vacation with bitcoin, opening options for customers to utilize BTC as a mode of payment.

Advanced bitcoin topics: what’s left of the ecosystem?

With concepts like layer-2 scaling and BTC-loaded debit cards, it should be clear by now that the BTC ecosystem is more widespread than initially meets the eye.

Unpacking bitcoin debit cards

Bitcoin debit cards are akin to fiat-loaded cards — except this variety only holds BTC. While there are many debit card providers, finding the best bitcoin debit card for you should involve considering interest rates and any card issuance fees. Also, be sure to check whether you can use the card seamlessly across bitcoin ATMs.

The Bitcoin Lightning network

The next element of Bitoin’s ecosystem is the scalability-enhancing lightning network. As for the definition, the Lightning Network refers to a protocol that allows BTC users to send and accept payments instantaneously. If you plan on using your BTC reserves to make payments, you might want to consider utilizing one of the leading Bitcoin Lightning Network wallets, such as Joule or Spark.

And that sums up our extensive guide to this first commercial crypto player. While the Bitcoin network isn’t without its limitations, including high cryptocurrency fees and scalability issues, Bitcoin’s problems are outweighed by the ecosystem’s ingenuity, security, potential, and sheer vastness.

The Bitcoin network and ecosystem is thriving

If you are looking to buy bitcoin, we recommend reading this entire piece closely to gain a true perspective of the sheer size and importance of the ecosystem. From top-notch security, courtesy of nodes, to wrapped bitcoin, a whole world of PoW miners and mining-specific services, the BTC ecosystem is a lot more than simply trading.

Instead, bitcoin also has a separate identity as a peer-to-peer digital currency, a concept that is slowly gaining traction across the globe. Despite ongoing bear markets, it is of little surprise that so many people — from all walks of life — remain eager to buy BTC.

Frequently asked questions

Can a beginner buy bitcoin?

Is bitcoin worth buying now?

How do I purchase bitcoin?

How to get bitcoin for free?

Can I buy bitcoin with Google Pay?

How to buy bitcoin directly?

What do you need to buy bitcoin?

How can I safely store my bitcoin after purchasing it?

Is it legal to buy bitcoin?

Can you get rich by buying bitcoin?

Why should I buy bitcoin (BTC)?

Which is the best bitcoin wallet?

How much bitcoin (BTC) can I buy?

What can I do with bitcoin (BTC)?

What are bitcoin miner fees, and why are they so high?

Are there any tax implications when buying bitcoin with cash?

How much bitcoin to buy the first time?

How many people own 1 bitcoin?

Is it safe to buy bitcoin online?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.