Like any other high beta space, the crypto market is driven by sentiments. The fundamentals and technical aspects matter, but nothing beats the emotional triggers. And what could be a better tool than the crypto fear and greed index to gauge the unpredictability of user emotions? The growing FUD, the building FOMO, and the “When Lambo” expectations — user emotions in crypto are random and diverse.

Imagine this: you have created a solid bitcoin portfolio by checking the key short-term technical indicators like candlestick patterns and MA (Moving Average) crossovers. You feel confident with your research. Yet, the portfolio suddenly starts bleeding, leaving you questioning your methods and analysis. What could have gone wrong?

When Fear and Greed Index is in the extreme low zone, most people just stop trading… and miss lots of opportunities to get a profit. To feel the finest movements of the market and learn how to use them for gaining profit join BeInCrypto Trading community: pro traders share the tips, price movements analysis, alerts on critical market events and answer your questions. Join now!

The answer: you didn’t consider the bitcoin fear and greed index! But it’s never too late. Here, we explain what the crypto (or bitcoin) fear and greed index is and how to use it.

In this guide:

- Why do we need another index?

- Unpacking the crypto fear and greed index

- How is the crypto fear and greed index calculated?

- Benefits of using a fear and greed index

- Criticisms of the fear and greed index

- How do traders use the bitcoin fear and greed index?

- How are they related?

- Is the fear and greed index reliable?

- Fear and greed < DYOR: closing thoughts

Why do we need another index?

Wait, don’t we already have enough crypto indices — the NASDAQ crypto index (NCI), the NYXBT (New York Stock Exchange Bitcoin Index), and the S&P Bitcoin Index (SPBTC)? As much as these indexes are resourceful, their primary job is to track the performance of the assets. None of these indexes take the user emotions and the broader market sentiments into account. See, there is a glaring gap.

The crypto fear and greed index is meant to fill this gap — taking several data points into account and combining them as a standalone statistical entity. Just to be clear — the index isn’t a financial instrument but a sentiment-analyzing market indicator— meant to complement your investment-focused analysis.

Unpacking the crypto fear and greed index

The crypto fear and greed index is among the many popular sentiment indicators. It is an often used tool to analyze market participants’ thoughts, feelings, and responses — those with digital proclivities.

Other sentiment-driven indicators, like WhaleAlert and Augmento’s Bull & Bear Index, exist.

Simply put, the fear and greed index analyzes user sentiments and crypto-specific emotions daily, crunched from different sources and presented as a simple number.

The history

Ironically, the fear and greed index was developed, keeping traditional financial products in mind. CNN Money developed the index in 2012 to serve as a multi-factored measure of market sentiments — the stock market, to be precise.

It was later tailored for the crypto ecosystem by Alternative.me as a generic crypto sentiment index. This index analyzes several market indicators and returns a daily value of 0 to 100. While 0 is extreme for fear (market participants are wary of the conditions), 100 is extreme for greed (showcasing widespread participation/buying and building FOMO).

The elements

Even though the mentioned index underpins two specific emotions: fear and greed — the transition from one to the other spectrum concerns multiple elements.

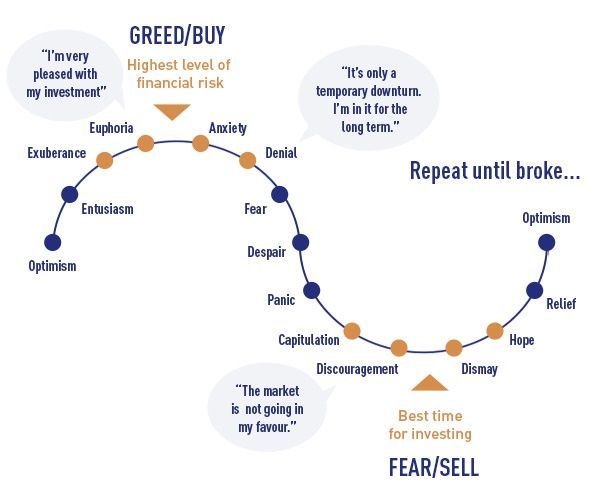

At 100, participants are most optimistic and on a buying speed. The index drops with profit booking, and the optimism starts moving into the “anxiety” territory. Anxiety is followed by denial when the participants shrug off any dip as a minor correction.

With dipping prices come panic and discouragement, with the fear and greed index moving closer to the sub-40 territory. Participants perceive subsequent index drops as buying opportunities, pushing the emotional bandwagon into the hope and optimism territory.

It is interesting to find that you encounter optimism at the extremes of the crypto fear and greed index.

Here is a detailed wave showcasing the emotional ride from 100 to 0.

How is the crypto fear and greed index calculated?

The fear and greed index takes several market indicators into consideration, crunches data according to the predetermined weightage, and condenses everything to come up with a number between 0 and 100. Here are the sub-index indicators in play along with the weights:

1. Volatility

Market volatility is a key indicator. And it has a weightage of 25% in developing the fear and greed index. This indicator looks at the maximum bitcoin drawdown (for the bitcoin index) and the current market volatility relative to the monthly and quarterly volatility averages. High volatility means more fear but might also lead to trader enthusiasm.

/Related

More Articles2. Market momentum

This indicator is also called the crypto fear and greed index volume indicator. It also has a 25% weightage. Regarding the calculation, the index factors in the current trading (buying) volumes and compares them with the monthly and quarterly averages. High current volumes hint at an overly greedy space.

3. Social media

It is only appropriate to have a social media indicator as part of the index, primarily to gauge coin-specific chatter across social platforms (for example, BeInCrypto Trading Community on Telegram where traders and experts share their opinions about cryptos). This indicator has a 15% weightage and is calculated using hashtags and social responses.

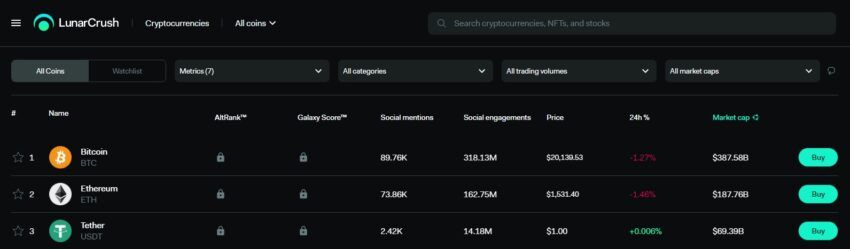

Here is the Lunar Crush platform that lets you check the social mentions and engagements:

4. Dominance

With a weightage of 10%, dominance is easily one of the trickiest and most effective sub-index indicators. Here is how it works in relation to the fear-greed narrative:

Growing bitcoin dominance means lesser greed for other altcoins. Therefore, if the cryptocurrency’s dominance is seen growing, the market starts moving towards the fearful zone. Similarly, a drop in bitcoin dominance hints at growing greed.

Due to the 39+% market dominance, bitcoin fear and greed index is often used interchangeably with the crypto Fear and Greed Index.

5. Trends

The fear and greed index pulls search queries from Google to determine the coin-specific search volume — primarily bitcoin. The change in search volumes helps measure the change in the index values. This indicator also has a 10% weightage.

6. Surveys (Paused for now)

Currently paused, surveys have a 15% weightage when it comes to their role in helping populate the fear and greed index. When active, surveys usually comprise crypto polls with a standard sample size of 2,000 to 3,000 individuals.

And that’s how the fear and greed index takes shape. The value is updated daily, depending on how the sub-index indicators change.

Benefits of using a fear and greed index

By now, you should know how the fear and greed index is put together. Now before we move to the real-time implementation of the same, are the advantages of using the same in the first place:

- Helps present a broader view of an otherwise volatile market.

- It doesn’t change overnight; instead, it moves slowly in a particular direction.

- Comes forth as a relative index that changes (drops or surges) as per the relative price levels

- Helps traders save valuable market research time as it covers volatility, dominance, volume, and other important data sources.

- Gives clear information about the market extremes — like when the assets are available at a discount and when they are entering the bubble territory.

- Presents a fairer picture of the crypto market during a bull run and a bearish phase.

- It can be used to make aggressive investment decisions, much like a short-selling bitcoin or any other crypto asset.

- Helps sketch out the riskiest phases using market sentiment without directly giving any financial advice.

Criticisms of the fear and greed index

As we saw, the crypto fear and greed index has its advantages. Yet, it’s far from perfect and has been known to attract the following criticisms:

- Projects the short-term sentiment analysis and hardly helps with the bigger picture.

- Skewed heavily toward two erratic indicators: volatility and volume.

- Doesn’t offer a lot of trading support when the index is near the neutral, 50 levels, or the price action is sideways.

- Still needs technical and fundamental indicators to present a clearer picture.

- Doesn’t take whale activity, exchange inflow, and trade intensity into account.

- It can change significantly even when the price doesn’t move much.

How do traders use the bitcoin fear and greed index?

Despite the numerous advantages and a handful of shortcomings, the crypto fear and greed index is a reliable trading tool. Here is how the traders use the same to gain a competitive edge in an otherwise volatile market:

Dividing the index scale into four quadrants

You can divide the index into four different zones:

- Extreme fear or the Orange zone (0–24)

- Fearful or the Amber/Yellow zone (25–49)

- Greed or the Light Green zone (50–74)

- Extreme Greed or the Green zone (75–100)

Zone 1 projects extreme fear. It also offers the best buying opportunity and might also mean that a price reversal is near. Zone 2 is the fearful zone. This happens at the onset of a bear market when the prices start dropping sharply. These levels can quickly go up in a bull market, but in a deep bear market, the fearful zone often means more correction.

No one knows where the bottom will be. Therefore, it isn’t prudent enough to start buying blindly when the index is in Zone 1. Instead, we should look for multiple moves into Zone 2 to clearly indicate buy.

Prices start improving in Zone 3. Furthermore, the volatility is the least in this zone. You can also see an increase in buying volume, hinting at some bullishness. Zone 4 is when the market is the most overbought. This quadrant is a breeding ground for price reversals/corrections.

Traders can check the quadrant that the index is in and take decisions accordingly.

Here is how Twitteratis use the fear and greed index as a trading tool:

We did talk about how traders can use the different index quadrants to execute decisions. Here is a real-time analysis of how the crypto fear and greed index directly relates to the bitcoin price chart.

We shall use the BTC/USD price chart as bitcoin is directly correlated with the fear and greed index and is the most dominant crypto yet.

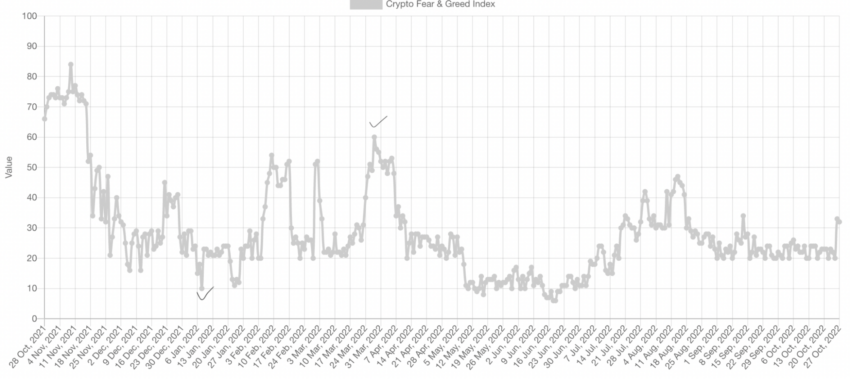

Crypto fear and greed index data (28 Oct. 2021 to 27 Oct. 2022)

Standard BTC price action (28 Oct. 2021 to 27 Oct. 2022)

How are they related?

See the first tick from the left on the fear and greed index chart. This was 8 Jan. 2022 when the index value dropped to 10 (extreme fear zone). On the BTC/USD price chart, this point coincides with the black circle, which is close to the $40,000 level. This shows that the sentiments quickly changed to fearful when bitcoin dropped close to $30,000 from its all-time high of $68,789.63.

Yes, the market has dropped quite a bit since then. This shows that the fear and greed index doesn’t drop with every drop but changes slowly and according to market levels.

The second tick from the left is on 28 Mar., when the index went up to 60. Compared to 8 Jan., the fear and greed index moved 50 points, which translated into a price upmove of only $7,000, give or take. This sideways trading action, also known as whipsaws, can be a bit confusing and must be traded carefully. The fear and greed index isn’t all that effective during sideways movements.

However, 60 was the highest point for the fear and greed index this year, yet after that, you can see how the bitcoin prices started dropping. Therefore, even Zone 3 can be considered an overbought zone for crypto in a bear market.

Is the fear and greed index reliable?

Before talking about how reliable the fear and greed index is, here are a few things we could infer from the real-time example above:

- Even a low Zone 1 fear and green index value in a bear market doesn’t mean a bottom. It can just be growing panic and volatility.

- In a bear market, Zone 3 or the light green zone can also trigger a sell-off.

- This index doesn’t best depict sideways trading.

- Sentiments can be overblown during a bull run or during a crypto winter.

Overall verdict: Yes, the fear and greed index is reliable to a certain extent. More so when you are using it with technical and fundamental indicators; also, it is good to track the sentiments and investment decisions in the short term. We would not recommend using it for long-term analysis and for crypto investors who take decisions based on social chatter.

Fear and greed < DYOR: closing thoughts

To wrap things up, we can say that the crypto fear and greed index — more so, the bitcoin fear and greed index — is a good tool to forecast the overall market sentiment. However, it isn’t right to focus your entire DYOR plan around this tool only.

The perfect combination would be to look at the broader buy/sell zones using the bitcoin rainbow chart, gauging market sentiments using the fear and greed index, and eventually using the on-chain and on-chart tools to fine-tune the entries/exists. To succeed would require a team effort.

What is the crypto fear and greed index?

Does the crypto fear and greed index affect NFTs too?

What is a fear and greed index?

What are the best indicators for trading cryptocurrency?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.