Just when you thought nothing much was happening in the crypto sphere, bitcoin — the original crypto — surprised the world with Bitcoin NFTs or Ordinals. While bitcoin NFTs are very different from those we are used to encountering, on the likes of Ethereum and Solana, they have added a new (and controversial) dimension to the original blockchain.

Bitcoin NFTs have created somewhat of an ideological divide within the Bitcoin community, with BTC purists setting themselves as ardently against this move. This article will explore Ordinals in their entirety and touch upon the arguments and polarization within the community. But first, let’s look at the history of Bitcoin and tokenization (it’s likely richer than you think!)

This piece has been updated with new information, per May 11, 2023, illustrating the current state of Bitcoin NFTs (Ordinals).

BeInCrypto Trading Community in Telegram:

Discuss crypto projects & NFTs, watch Trading Basics course & get answers to all your questions from PRO traders & experts!

- Bitcoin and NFTs: a quick history

- Unpacking the Bitcoin Ordinals

- How do Ordinals NFTs work?

- Block sizes: SegWit, Taproot, and Ordinals

- How many Ordinals can there be?

- What about the transaction fees of Bitcoin NFTs?

- Ordinals and unique traits

- Bitcoin NFTs: happy news for the miners

- How do you inscribe your first Ordinal?

- Bitcoin NFTs (Ordinals) vs. regular NFTs

- The current state of Bitcoin NFTs: growing popularity and more!

- Division in the community post the Ordinals launch

- Bitcoin NFTs: not Ordinary but Ordinaly

- Frequently asked questions

Bitcoin and NFTs: a quick history

In 2013 and 2014, Mastercoin and Colored Coins were envisaged and introduced to the Bitcoin ecosystem in order to extend functionality and bring in new cases. Mastercoin had smart contracts in mind, which weren’t successfully adopted due to inherent incompatibility with the Bitcoin base chain. But Colored Coins had a more simplistic vision. The idea with Colored Coins was to color any specific bitcoin (BTC) to tie its identity with a real-world asset.

Restricted adoption, an incompatible base layer, and the rise of Ethereum meant Mastercoin and Colored Coins never materialized as fully-fledged projects. But both employed the concept of asset tokenization and attempted to build on the Bitcoin blockchain, similar to NFTs.

The rise of Counterparty Protocol

In 2014, the Counterparty Protocol surfaced. Built atop the base Bitcoin layer, Counterparty allows users to create new chains and crypto assets (including NFTs) while tapping into the security offered by the Bitcoin network — the original one.

Imagine a bunch of new apps allowing you to enhance productivity, work performance, and more. Each of these apps is synonymous with a Counterparty digital asset. The computer or the OS where all these apps thrive is synonymous with the original Bitcoin ecosystem. Think of Counterparty as more like a Layer-2 solution for Bitcoin.

Many NFTs and digital collectible-focused gaming solutions like Age of Chains, Sarutobi, Spell of Genesis, and RarePepes were created using the Counterparty protocol. And that was the closest NFTs came to the Bitcoin network before the advent of Bitcoin NFTs or the Ordinals.

Rarepepes: Bitcoin NFTs?

As mentioned previously, Rare Pepe is one of the more popular NFT (digital card) collections, with a meme frog as the central theme. The project itself housed several Rarepepes or Rare Pepe Cards, created on the Bitcoin blockchain, using the Counterparty protocol.

What makes RarePepes special is the unique identifier or token that tags them. The same identifier is stored on the base Bitcoin chain. Also, they came into existence in 2016.

As for the features, the following stand out:

1. Rarepepes follow the “Pepe the Frog” theme — an original internet meme.

2. This was one of the first NFT projects to introduce the concept of digital rarity.

3. RarePepes can be bought and sold using BTC.

Spell of Genesis: a Bitcoin-specific game?

Spell of Genesis, or SoG, was the first mobile game on the blockchain, launched in 2016. The card-based game uses collectibles and ties them with the concept of arcade and Point-and-Shoot games. It is unique because even SoG is based on the Counterparty Protocol and uses the Bitcoin chain to exist and remain secure.

Both Rare Pepe and Spell of Genesis are some of the first Bitcoin-powered NFT/gaming options. However, none of these could use the base Bitcoin chain to thrive; a layer-2 in Counterparty was needed.

Liquid side chains and more NFT projects

While Counterparty Protocol introduced full-fledged NFTs to Bitcoin, large-scale NFT adoption required more firepower. So in 2018, the Liquid Network was created by Blockstream — a sidechain to the Bitcoin Chain — allowing faster transactions and support for token issuance.

Some of the more popular NFT projects that thrived on this sidechain include the MakersPlace, CryptoArt.ai, and Nifty Gateway.

Here is a detailed list of NFT platforms on the Liquid Network.

Bitcoin Stacks and the NFT bandwagon

Still looking for Bitcoin NFTs prior to Ordinals? Stacks — a blockchain built on top of Bitcoin — hosts NFT projects while staying connected to the Bitcoin network via the “Stacking” tech. Some of the more popular NFT collections on Stacks include:

- BNS (Bitcoin Name System)

- Crash Punks

- Bitcoin Birds

Now with the NFT craze or the Ordinals craze heating up, the supposed layer-2s related to Bitcoin — Sovryn, STX, etc — have also been picking up some decent pace regarding price action.

Bitcoin Sidechains and more NFTs

Apart from the Liquid Network, Bitcoin has other sidechains, such as the Rootstock (RSK), known for hosting a version of the popular Cryptopunks NFTs. SideShift AI is another sidechain that hosts Non-Fungible Pepes, one of the Rare Pepe collections, for trading.

And all of this occurred/was built prior to Bitcoin Ordinals.

Unpacking the Bitcoin Ordinals

The Ordinals Protocol is a way of specifically identifying the Sats or Satoshis and sending them with a “data attachment.” The data attachment can be anything: text, video, images, etc.

And just so you know, one BTC is made of 100 million Sats or Satoshis. The name “Ordinals” is derived from the fact that the Sats associated with BTC are numbered as ordered sets, per the rules of Set Theory. And by ordered sets, we mean that Satoshis are numbered depending on the mining and transferred order.

Bitcoin Ordinals, therefore, follow the Ordinals Protocol and the mentioned ordered sets to show up as on-chain NFTs.

Also, the process of attaching data to Satoshis is known as “inscription,” which is synonymous with “mining,” especially in standard NFT terms. What makes these Bitcoin NFTs or Ordinals revolutionary is that there are no sidechains involved. Even Bitcoin Core doesn’t have to experience changes at the code level.

Casey Rodarmor — the creator of Ordinals — considers these “Digital Artefacts.” And with that tag, he believes that Bitcoin NFTs make better NFTs. We shall cover the comparison later in this discussion.

Michael Saylor, one of the most vocal proponents of bitcoin, is also bullish on Ordinals.

“What happened with Ordinals and NFTs is we crossed this chasm from what was a bearish scenario to a bullish scenario. If I was a miner I would be ecstatic.”

Michael Saylor, founder and chairman of Microstrategy: Twitter

Note that Casey Rodarmor has previously worked on the Bitcoin Cre Software, making him an integral part of the OG community.

How do Ordinals NFTs work?

As mentioned earlier, Ordinals are nothing but the natural number allocation to the transacted Satoshis. In simple terms, an Ordinal Number or the unique Bitcoin NFT identifier is the natural number assigned to a given set of Satoshis — a process that can help with tracking.

With the Ordinals Protocol, the numbered Satoshis can now be tied to something more tangible — a digital file like an image, video, or anything else. The numbered and tagged Satoshis are now the NFTs relevant to the Bitcoin network.

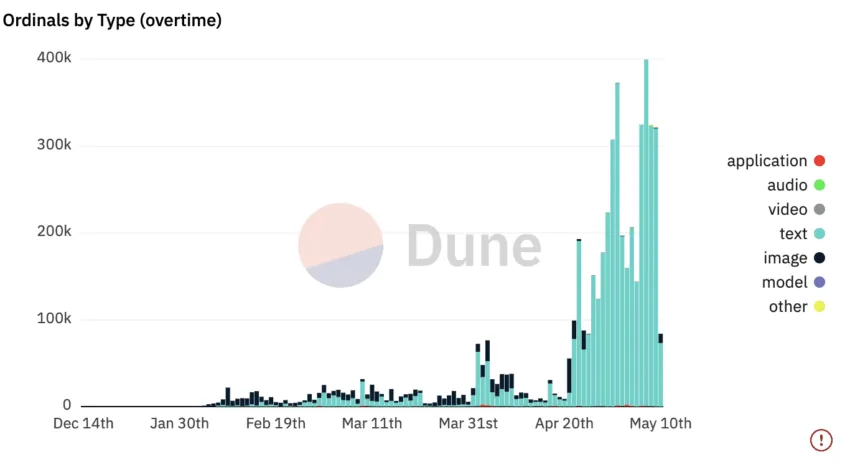

Below is a chart showing the type of digital tagging Sats up until Feb. 15, 2023. Notice how users started with images but soon started adding in texts as well. This could be due to the rise in transaction costs and delay.

/Related

More Articles

Also, as these tagged and numbered Satoshis can be broadcasted to the Bitcoin network, these are the only NFTs that are actually on-chain and not hosted elsewhere.

Block sizes: SegWit, Taproot, and Ordinals

Initially, each Bitcoin block could only hold 1MB worth of transaction data. With the SegWit update showing up in 2017, the theoretical size went up by 4MB.

Note: This was due to the introduction of a new approach to measuring block sizes.

Bitcoin NFTs or Ordinals make use of this SegWit enhancement by pairing optional digital files with the Satoshis. And while the max size is 4 MB, here is a chart that shows the average block size each Ordinal has been capturing to date.

Also, the Taproot upgrade that surfaced in late 2021 is the tech that actually allows users to tag the Satoshis by facilitating inscription. Therefore, while the SegWit opens the doors for Bitcoin NFTs with larger block sizes, the ability to inscribe data was handed over by Taproot. And Taproot even introduces new smart contract capabilities to the Bitcoin core, courtesy of the new scripting language — Tapscript.

This shows that every upgrade to the Bitcoin network till 2021 had a planned future in sight.

Also, notice how the mean block sizes and transaction sizes grew following the launch of Bitcoin NFTs.

How many Ordinals can there be?

Now we have taken a closer look at the creation of ordinals, it’s time to consider the possible number of Ordinals that can exist.

The calculation is simple. There are 21 million bitcoins and 100 million Satoshis corresponding to each bitcoin. The total Satoshi supply is fixed at 2100 million million, or 2.1 quadrillion. Also, each inscription takes in 10,000 or 10K Sats by default — as mentioned in the Ordinals Protocol fine print.

Also, close to 1.7 million BTCs are still left to join circulation, meaning that (1.7 million x 10K) additional Ordinals can be created. This equals 17 billion more Ordinals. And the total number of something is termed as Cardinals.

As of March 1, 2023, the Bitcoin network has already seen almost 224K inscriptions. So, we can expect a maximum of 17 billion + 223,987 Ordinals to exist (approximately) from March 1, 2023, onwards.

So for Bitcoin NFTs, the cardinal and ordinal numbers, post-March 1, 2025, can be as follows:

Cardinal numbers = 17 billion + 223,987

Ordinal numbers = 0 to 2,100,000,000,000,000 (2.1 quadrillion)

But that’s not the only metric you need to be aware of:

Ordinal creator Casey Rodmarmor also created a classification metric to track the Ordinal rarity, depending on the position of the first Sat of the inscription. Here is the list:

And keeping that in mind, there can be 2.1 quadrillion common, 6,929,999 uncommon, 3437 rare, 32 epics, five legendary, and one mythic rarity level.

What about the transaction fees of Bitcoin NFTs?

There is a way to quickly guess the cost of inscribing and sending each Ordinal or Bitcoin NFT to a compatible wallet.

But before being able to understand how transaction fees are calculated, you should know:

- SegWit transaction weight is measured as vB or Virtual byte. And one vB is equal to 4 actual bytes.

- Therefore, if your transaction size is 100 KB or 100 kilobytes, it comes down to 25,000 vB or Virtual bytes.

Now, if we take a look at the Bitcoin fee estimates, a standard transaction with a 1-hour delay has a fee rate of 5 Sat/vB or $0.17. (This might change in the future).

Hence, a 25,000 vB transaction would cost somewhere close to 1,25,000 Sats. And that’s just for the transaction.

If you consider inscription, note that each inscription automatically takes 10,000 Sats in play, as mentioned above. Therefore, an inscribed transaction with a size of 100 KB would cost:

1,25,000 + 10,000 = 1,35,000 Sats. This also means BTC-equivalent transaction fees of 0.00135 BTC or $31.99.

Here is a chart that would give you an idea regarding the network fee, what kind of delay people are selecting, and what standard block sizes to consider.

Here is another interesting chart surfacing near the 100,000 inscription mark. Users are seen choosing low Sat/vB rates, which shows that the craze of appearing earlier in the mempool is waning. This development hints that the 100K inscription mark was more of a milestone for Bitcoin NFTs.

The state of transactions in May 2023

Here is a quick update showing that the transaction fees have duly skyrocketed since March 3, 2023. At present, a transaction with a 1-hour delay can now set you back by 87sat/vB — which is almost 18 times since before. That seems to be an effect of the “Ordinals” wave.

With the transaction costs rising up, courtesy of more inscriptions and limited block size, the stage looks set for Lightning Network in years to come. Imagine the ability to inscribe on “Sats” outside the base layer and eventually relay the info for security and record-keeping.

“If we are in a new regime of higher Bitcoin tx fees due to Ordinals/BRC-20s, think there’s a very compelling setup for the lighting network over the next few years.”

Will Clemente, co-founder of ReflexivityRes: Twitter

Ordinals and unique traits

We have discussed the creation of Ordinals, Cardinal, and Ordinal numbers keeping the basics of Set Theory in mind. Plus, we’ve covered transaction fees, block sizes, and more. Now here are some of the unique traits of Ordinals:

- These Bitcoin NFTs come with a supply cap.

- After repeated halving cycles, these NFTs can act as reasons to keep miners incentivized.

- Ordinals Protocol has already welcomed many projects, some even inspired by popular Ethereum-specific NFT marketplaces and projects like Bored Ape Yacht Club (BAYC).

Yuga Labs, one of the largest NFT entities and the name behind the Bored Apes collection, has even announced a 300-piece Ordinals NFT collection — TwelveFold.

Barring the network fees surge seen until Feb. 15, 2023, the cost of inscribing Bitcoin NFTs has remained steady. For the past week or so (as of March 1, 2023), the popularity looks to have dipped. The reason might be that users are looking more at texts as opposed to images and even selecting longer timeframes.

Ordinals have also increased Taproot utilization as this protocol is the inscription facilitator for Bitcoin NFTs.

Also, you can even store Bitcoin Ordinals on Metamask, giving you some additional options to play around with your Bitcoin NFT.

And finally, you can locate Ordinals to buy and sell with the order type being OTC.

Here are two of the recently surfaced NFT marketplaces for the Ordinals:

- Scarce City

- Ordinals Market

- Magic Eden

- Gamma

- OKX NFT Marketplace

Did you know? Binance, the leading centralized crypto exchange in the world, is contemplating support for Bitcoin NFTs or Ordinals.

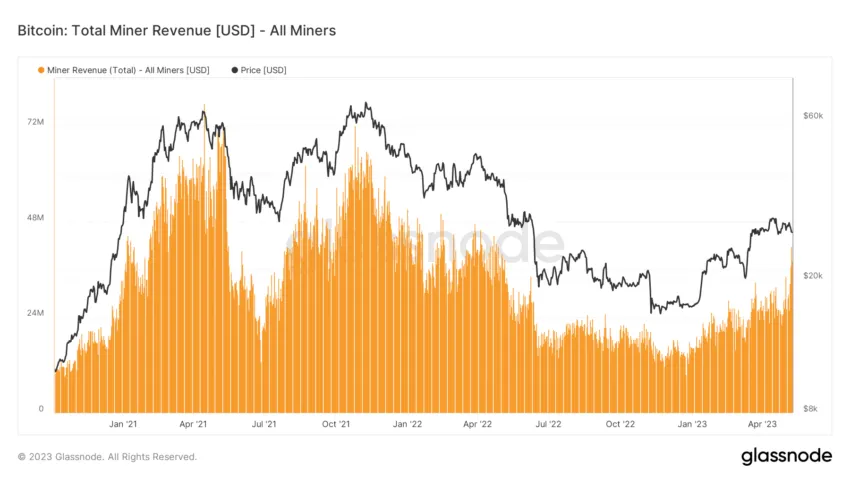

Bitcoin NFTs: happy news for the miners

The bear market in 2022 wasn’t kind to the miners. We can blame the low BTC prices for this Yet, 2023 seems like a harbinger of hope, courtesy of a sizable price rise and an Ordinal-led fee rise. Also, with the Ordinals craze paving the way for the BRC-20 token standard, the new wave of profitable miner incentivization might just be here to stay.

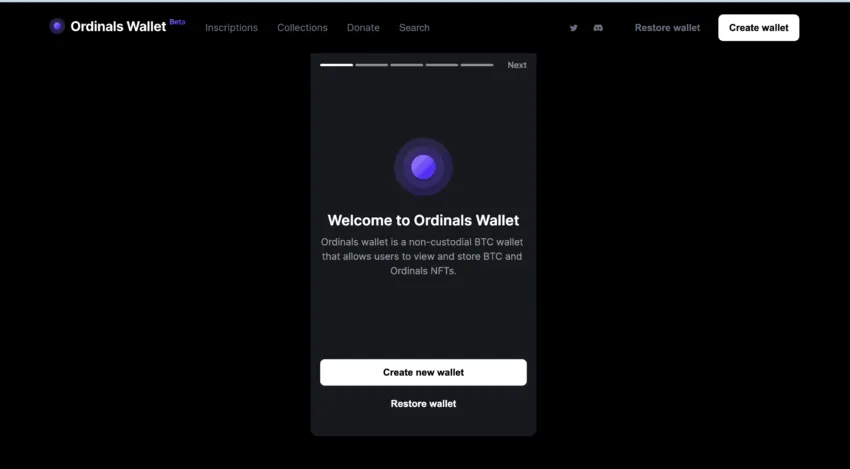

How do you inscribe your first Ordinal?

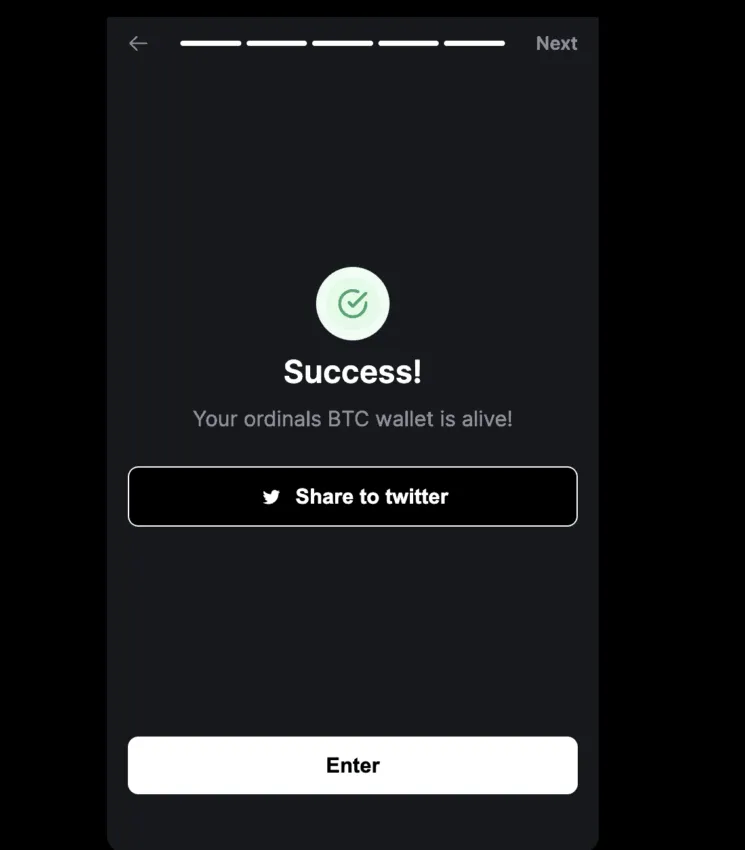

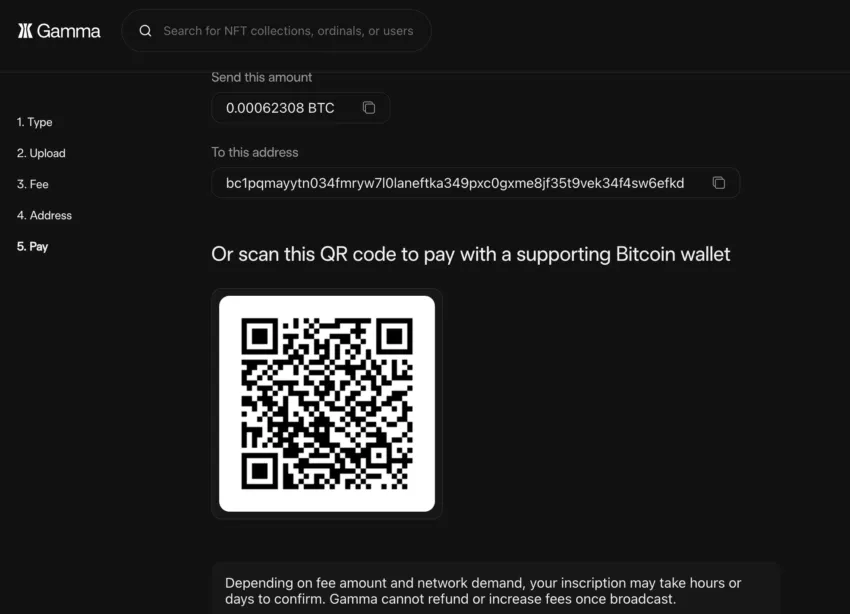

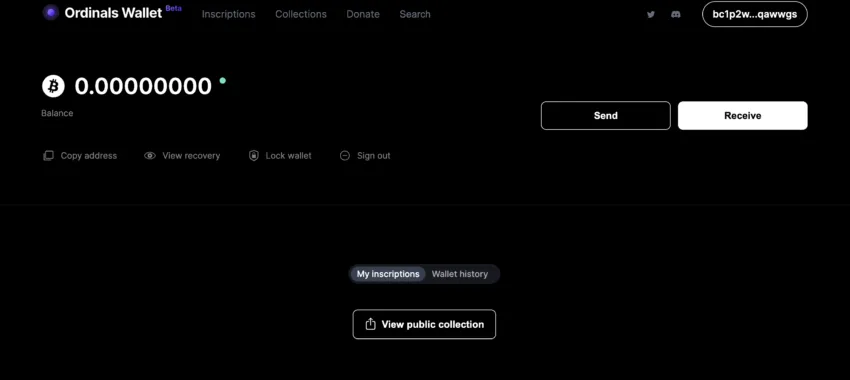

So, how do you inscribe an ordinal? Let’s trace the entire process step-by-step. We are using the recently launched Ordinals Wallet for this example.

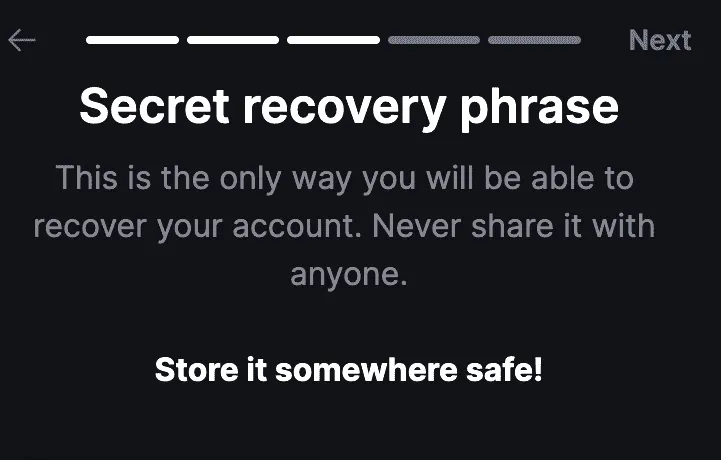

The setup process, involving the seed phrase and verification, is like any other crypto wallet.

Once the wallet is all set, use Gamma — the no-code inscription service — to get your Bitcoin NFT ready, uploaded, and sent.

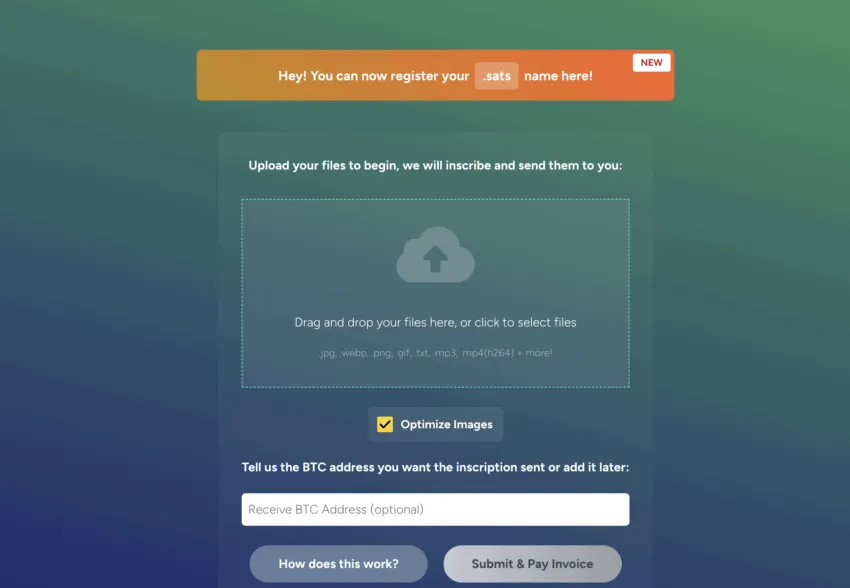

Ordinals Bot for inscribing sats

However, we shall use Ordinalsbot.com — created by team Satoshibles — to make the process easier. The below shows how simple the UI is. Upload the digital entity that you want to inscribe and let the bot do the rest of the work for you.

Here are the steps:

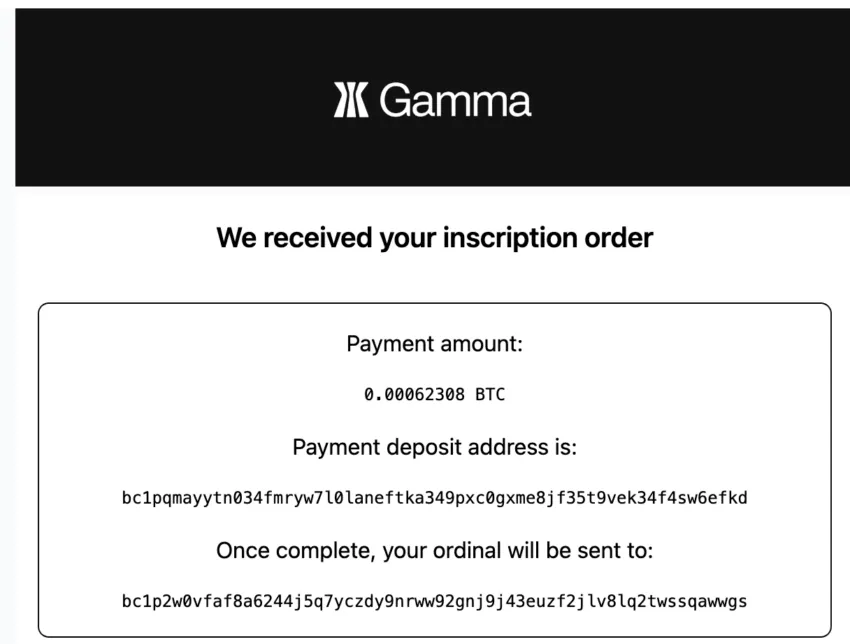

Once you make the payment and get the receipt, expect the inscription to reach your Ordinals wallet address in 24+ hours.

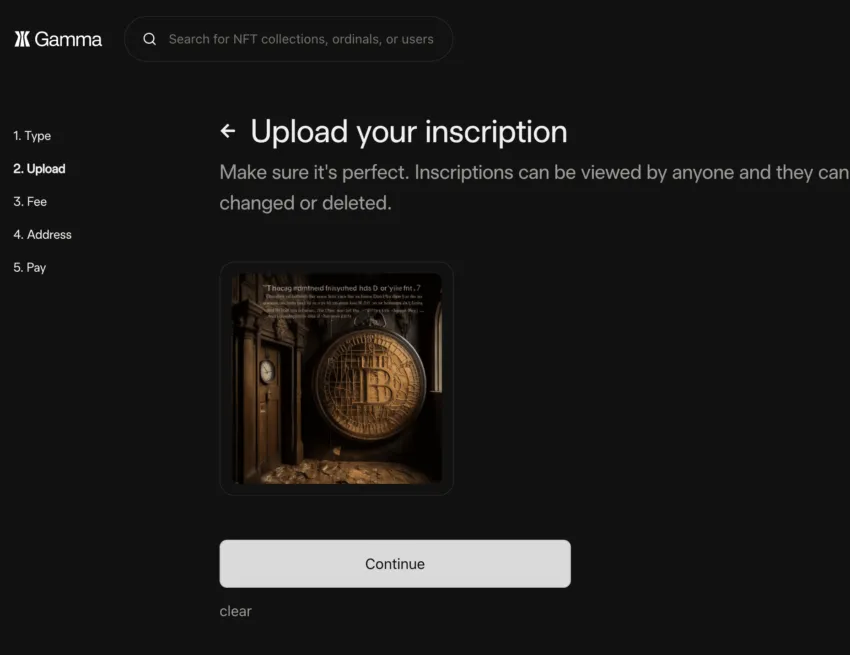

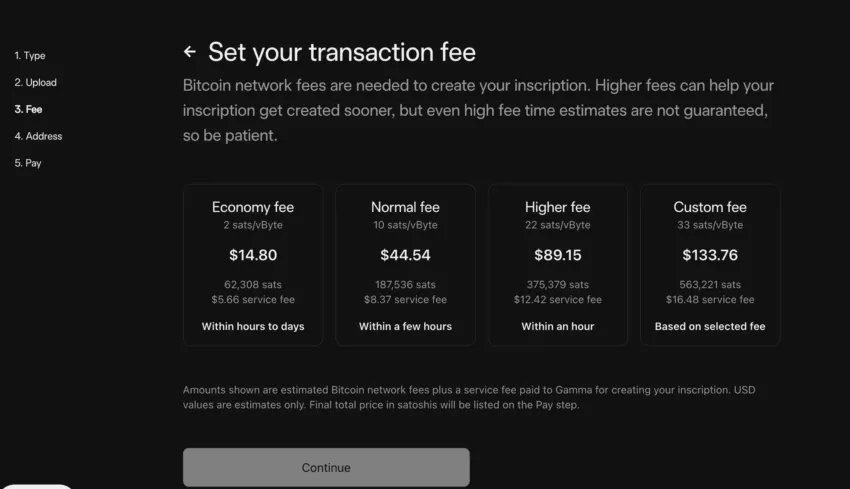

Now, let us see if we can create another inscription, this time using Gamma. Here is the image we uploaded:

Notice how the service fee is lower on Gamma:

Once you make the payment, the Bitcoin NFT or Ordinals will be sent to your Ordinals Wallet.

Note: To make the payment, load up your preferred wallet by sending USD or BTC from any other compatible wallet. Also, when you receive an Ordinal or inscribed Sat in your wallet, you must secure it carefully. Otherwise, it can be spent away as standard Satoshi.

And once your Ordinal is live on-chain, you check the status on the Ordinals website.

Also, here is what the receipt looks like:

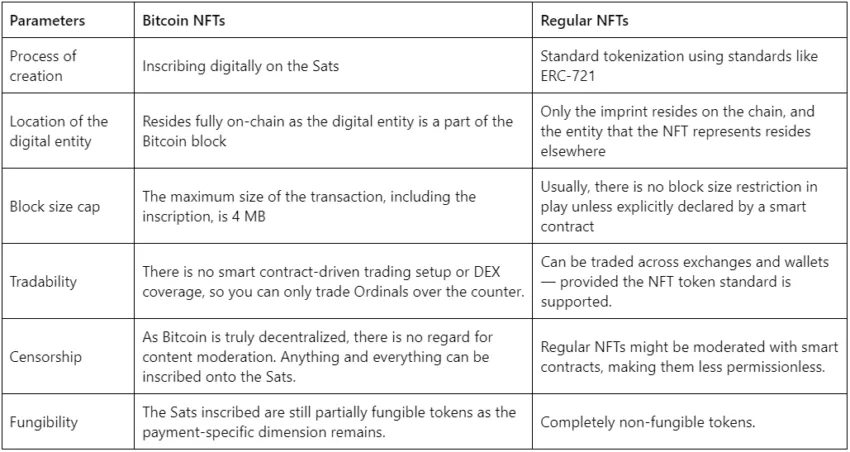

Bitcoin NFTs (Ordinals) vs. regular NFTs

Bitcoin NFTs are nothing like regular NFTs — the ones we see in the popular Ethereum-biased NFT marketplaces. Yet, it is only fitting enough to compare the Bitcoin NFTs or the Ordinals with the regular NFTs. Here is a table that might help.

The current state of Bitcoin NFTs: growing popularity and more!

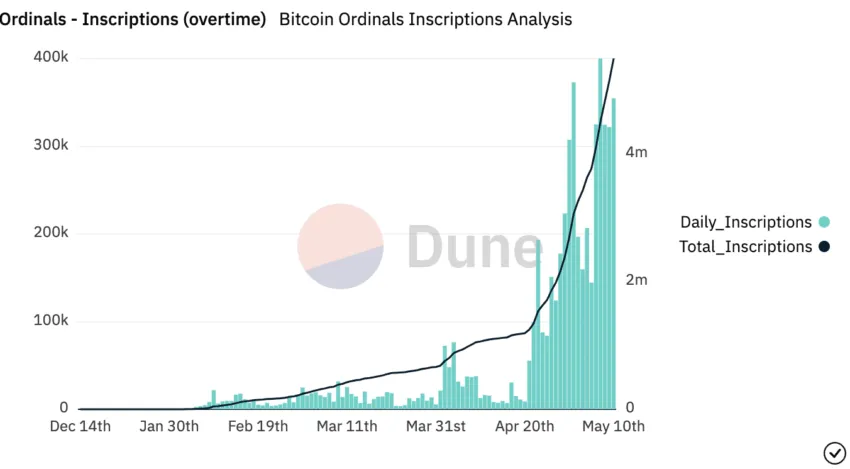

The Ordinals space has spiced up a lot since 3 March 2023 when we first posted this piece. With Bitcoin NFTs pushing forth a new concept of BRC-20 tokens, initially, as an example, the craze surrounding the “inscriptions” seems to have picked up.

With BRC-20 token trading on select markets requiring Ordinal inscriptions as a verifying mechanism, the rise in many NFT-specific metrics has been significantly high.

Now we can see the broader picture, (as of May 11, 2023), it is clear how the number of inscriptions has risen since March. Some experts have been arguing that the increase in the number of inscriptions is blocking the Bitcoin network and shooting transaction costs through the roof.

This transaction backlog seems to be the reason that Binance halted BTC withdrawals in early May 2023. And guess what? Binance integrated the Lightning Network to get out of the muddle. Another reason to look at the layer-2s!

Another interesting trend is the increase in the number of text-based inscriptions. With the BRC-20 token standard, led by the newly launched tokens like ORDI, PEPE on BTC, and more — the new era of sats is being text-inscribed. This shows that on Bitcoin, NFTs were the only base layer use cases.

And that’s not it. Here is a tweet that captures the growing popularity of Ordinals, corresponding to CEX, DEX, and other kinds of exposure.

Division in the community post the Ordinals launch

Ordinals have the entire Bitcoin community divided. Two camps have surfaced:

The neutrals/supporters

This camp believes that anything that follows the network validity is fine. Plus, Ordinals might bring a new dimension to Bitcoin, helping even the naysayers look at the network more welcomingly.

Bitcoin educator Dan Held believes this is an opportunity to build better and bigger on Bitcoin:

The purists/opponents

This camp believes Ordinals are only eating up the block space, filling up the mempool, spiking transaction costs, and planning only to benefit miners, post-halving cycles. According to this camp, Bitcoin NFTs are not aligned with Satoshi’s vision.

Also, here is a Tweet that portrays the purists differently. A retort, if you will:

Bitcoin NFTs: not Ordinary but Ordinaly

To sum it up, NFTs coming to Bitcoin is no ordinary event. It shows that the OG crypto network is willing to grow, evolve, and compete with the relatively new ecosystems — Ethereum included. Perhaps you are on the side of the purists and believe that Ordinals represent a divergence from Satoshi’s original vision. Or, maybe you welcome innovation on the Bitcoin network. Either way, Ordinals clearly show an appetite for tokenization within crypto communities.

Frequently asked questions

What are Bitcoin NFTs?

Are there NFTs on the Bitcoin network?

Does Litecoin support Ordinals?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.