Only a few events in the crypto world are as anticipated as Bitcoin halving. As an event that occurs roughly every four years, bitcoin halving reduces BTC block rewards and minimizes the amount of bitcoin entering the supply. While at first glance, halving might look like a supply-reducing strategy, it has several deep-seated implications, including making the network more decentralized and inflation-resistant and miners less dependent on direct BTC issuance.

While the primary effects post the upcoming 2024-halving instance involve reducing block rewards from 6.25 BTC to 3.125 BTC and increased digital scarcity, secondary and tertiary effects like increased miner capitulation and network maturation are also on the cards. Yet, there is a lot more to discuss about this watershed crypto moment than a few use cases.

In this guide, we dive deep into the significance, need, mechanics, and diverse interpretations of Bitcoin halving. We also look at the historical price impact of the earlier halving events as part of the market cycles.

- Bitcoin halving and the fundamentals

- Bitcoin halving: the mechanics

- Are the BTC halving dates fixed?

- Should I invest in Bitcoin before halving?

- Indicators connected to Bitcoin halving: a primer

- How does halving impact miner profitability?

- Does Bitcoin halving come with concerns?

- What does Bitcoin halving mean for the broader cryptocurrency space?

- Frequently asked questions

Bitcoin halving and the fundamentals

To understand how crucial Bitcoin halving is, we need a quick refresher. Understanding how Bitcoin was meant to work as part of Satoshi Nakamoto’s vision is instrumental in gauging the importance of this seminal event.

Bitcoin mining

The Bitcoin network comprises miners who solve complex problems to validate and add transactions to the blockchain’s ledger. As the miners put in some real work, the consensus algorithm driving the network is termed proof-of-work (PoW).

When miners add new blocks to the blockchain by validating transactions, they receive newly created BTC for their efforts. You can consider this process akin to working at a gold mine, with miners trying to dig and unearth precious metals. However, Bitcoin’s creator, Satoshi Nakamoto, realized that the generation of these rewards needs to be regulated over time, like having a “digital thermostat” in place to ensure that the supply doesn’t grow way too rapidly or even come to a standstill. This is where Bitcoin Halving was conceptually implemented.

Here is a post that shows how BTC HODLing is on the way up, making room for additional digital scarcity:

Rewards and issuance

When Bitcoin came into existence in 2009, block rewards were set high at 50 BTC. This meant that mining each block attracted 50 BTC. However, the halving program was such that the base issuance — 50 BTC at the onset — would reduce to half after every 210,000 blocks. In 2023, the block rewards are set at 6.25BTC, which means that Bitcoin has already undergone three halving cycles.

By now, it should also be clear that halving aims to lower the issuance of BTC over time. It must be noted that BTC rewards were initially introduced to incentivize players to act as nodes and validate transactions. The aim was never really to give handouts. Instead, the very base of Bitcoin’s operations was supposed to be transaction fee-specific — something that halving cycles aim to propel by lowering issuance.

Decentralization

Bitcoin halving doesn’t just help control issuance. Instead, it helps keep the entire network decentralized via the following implementations:

- As rewards decrease, there is minimal emphasis on direct BTC issuance and more emphasis on actual work — solving computations and validating transactions.

- As work will always be needed to keep the Bitcoin network active, halving and putting more emphasis on fee generation gives miners a perpetual economic incentive for handling operations.

- Reducing issuance minimizes BTC hoarding over time.

- Improves direct competition between the miners as everyone will be trying to get a bigger share of the transaction fees, not direct rewards.

- Fee-based incentives are better at fostering a sense of adoption and utility. It would then be unlikely for miners to pool their collective mining power to get hold of directly issued coins. Work still needs to be done, period.

Security, incentives, and consensus

Besides fostering decentralization, Bitcoin halving also contributes towards several other network traits, including:

- Improved security of the network as miners are expected to put in more work to increase their chances of earning.

- As direct rewards go on reducing, pooling node power is discouraged. This means that more Bitcoin nodes are expected to exist over time, making the network more decentralized and secure.

- As miners, courtesy of issuance reduction, need to put in more work, halving can make mining hardware and computing power more elusive and popular over time.

Computing power, also known as hash rate, is also related to the Bitcoin halving cycle. Let us see how:

Hash rate and relation to halving

Mining BTC requires computing power, also termed the hash rate. Another way of looking at the hash rate is to gauge the number of calculations miners perform each second to win rewards. Now that Bitcoin halving lowers the chances of winning these rewards, post-event less-profitable miners have a tendency to switch off their rigs, eventually lowering the hash rate associated with the network.

A lower hash rate momentarily reduces Bitcoin’s mining difficulty, attracting more miners and specialized mining hardware into the mix. All of that adds up to again push the hash rate higher, further amplifying the security of the network. Also, it is worth noting that Bitcoin halving, hash rate, and Bitcoin’s built-in difficulty adjustment clock are interconnected.

Here is a quick demonstration of how it all works like clockwork:

As direct issuance drops, non-profitable miners often shut down rigs, lowering the hash rate. However, Bitcoin’s self-upgrading difficulty adjustment mechanism carefully tracks the changes in hash rate after every 2,016 blocks and typically lowers the same after every two weeks post-halving. This makes it easier to mine BTC, bringing new players into the mix. And once new miners and their gear come into the scheme of things, the hash rate again starts to go up.

Overall, Bitcoin’s halving schedule and difficulty adjustment strategy aim to restore the profitability equilibrium despite declining issuance. This mechanism is what keeps the network secure and miners interested.

Bitcoin halving: the mechanics

Now that we have explored every network-related aspect of Bitcoin halving let us delve deeper into how the numbers work over time.

Do note that Bitcoin has a maximum supply of 21 million BTC, and the initial block reward limit was set at 50 BTC. Based on the programming, the network is supposed to cut block rewards to half after every 210,000 blocks, with ‘0’ being the genesis block.

Also, as each block takes 10 minutes to form, the 210,000-block timeline typically translates to approximately four years. In case there is some network congestion, each block might take anywhere between 9.95 minutes and 10.10 minutes to form. This Bitcoin halving countdown considers all of these scenarios.

Therefore, as Bitcoin mining started on 3 January 2009 at the genesis block, the block rewards were at 50 BTC. On 28 November 2012, upon the completion of 210,000 blocks, the rewards dropped to 25: 50 x 0.5.

It is worth noting that BTC will continue to go through halving cycles till the value of rewards falls under 1 Satoshi or 0.00000001 BTC, per the divisibility limit. This calculation set the maximum number of halving events at 33, with the last one expected to happen in 2136 — 4 years before the last BTC gets mined.

/Related

More ArticlesBitcoin halving schema as a tweet:

Note: The ‘Last BTC’ part here relates to the last bit of BTC or Satoshi that miners can gain as a direct reward.

Also, based on the halving mechanics, the next halving is expected to happen somewhere close to April 27, 2024.

Post that, economic incentives will all be fee-specific and have nothing to do with direct rewards.

Impact on inflation

As mentioned earlier, Bitcoin halving does have a role to play in keeping the network inflation within manageable standards. Once we unlock the entire BTC supply by 2140, we can expect the issuance to even go deflationary from there, courtesy of the lost BTCs. However, till that happens, Bitcoin’s hard-coded halving schedule would aim to keep value debasing at bay.

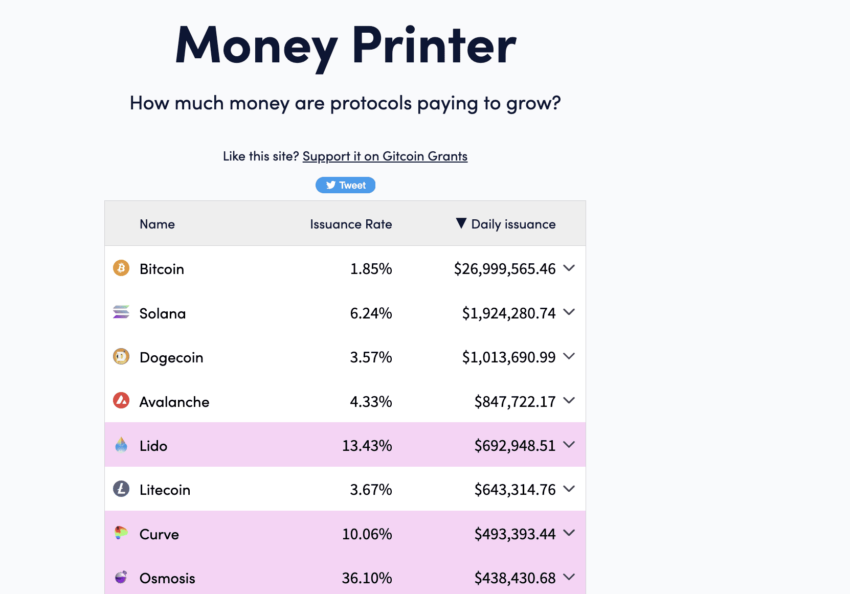

For instance, Bitcoin has an inflation rate of almost 1.85%, well under 2%, which most fiat currencies and central banks strive to achieve.

However, the inflation rate, thanks to the halving cycles, might be reduced. Here is a more simplistic take on things, explaining how and where BTC inflation can go post the 2024 halving.

- Current block reward (July 2023): 6.25 BTC

- Projected block reward after May 2024 halving: 3.125 BTC

- Projected annual issuance after halving (3.125 BTC per block): 1,642,500 BTC

- Projected Bitcoin supply after halving (May 2024): ~19,500,000 BTC

- Projected inflation rate after May 2024 halving: Annual issuance / Projected Supply

= 1,642,500 / 19,500,000 = ~0.84%

Confused as to how annual issuance works! Read through:

- Current annual Bitcoin issuance = 6.25 BTC * 144 blocks per day * 365 days = 3,285,000 BTC per year (approximate)

- Current Bitcoin supply (July 2023) = ~19,000,000 BTC (approximate)

- Current inflation rate (July 2023) = Annual issuance / Current supply = 3,285,000 / 19,000,000 = ~1.85%

It is evident that Bitcoin halving might have a positive effect on the monetary structure of BTC, making it a more desirable option compared to the money that can be printed at will.

Did you know? The difficulty adjustment timeline of 2,106 blocks is a measure to keep the average block creation time at 10 minutes.

Are the BTC halving dates fixed?

Not exactly. Bitcoin’s halving timeline depends on the block count. The event happens after every 210,000 blocks. Each block can take approximately 10 minutes to form, which translates to the 4-year theory.

While the 2024 BTC halving timeline is almost set, we have specially drafted a timeline-specific chart till the 13th halving event to help you fine-tune the long-term investment plans. This chart might even come in handy if you want your grandkids to hold onto some BTC.

Should I invest in Bitcoin before halving?

Asking anyone to invest in BTC before or after halving might sound speculative. However, a more balanced approach would be to take a look at the previous halving events, look at the price moves, and strategize the next course of action accordingly.

History of halving

2012 (approximate price points)

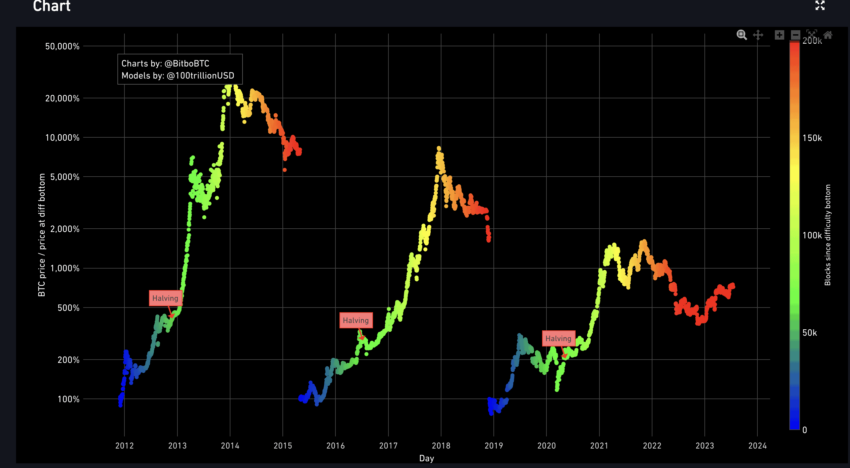

The first event happened on November 28, 2012, with the price of BTC at almost $11, 30 days prior to halving. Over the next 30 days, the price went up to $12. However, close to November 2013, BTC was trading at approximately $1,150. translating close to 10,000% in gains.

2016 (approximate price points)

The second halving event on July 9, 2016, saw the prices move from $650 to $600 (approximately), one month between the events. However, by July 2017, BTC was trading at almost $2,500 — translating to almost 300% in year-on-year gains.

2020 (approximate price points)

The last halving event happened on May 11, 2020, when the prices of BTC were trading between $8,500 and $9,500, one month before and after halving. Yet, we all know where the prices moved to by May 2021. At close to $56,000, BTC had amassed almost 500% in gains.

While we wouldn’t be speculating anything, post-halving price surges for BTC have been steady and sustained. However, riding these price waves wouldn’t make sense if you do not consider the following factors:

Hype cycles

It is important not to pay a lot of attention to social media talk around halving. There can be conflicting expectations surrounding the investors, and different social handles might present narratives differently. The best way is to cut out anything that happens three months prior and three months after the event.

Risks and drawdowns

You can expect the price of BTC to go through periods of volatility, anywhere between 6 to 12 months post-halving. This is due to the fact that the supply shock and miner dynamics take some time to kick in.

“Bitcoin halving cycle theory predicts bull markets after each halving, but external factors & market cycles can overshadow its impact.”

Gert van Lagen, Technical Analyst: Twitter

Besides hype cycles and risk management, long-term investors must also prioritize risk tolerance, a diversified trading strategy, and alignment with market sentiments before proceeding. However, we shall discuss the investing strategies associated with halving in a separate piece.

Indicators connected to Bitcoin halving: a primer

You can understand Bitcoin’s halving cycles better with a few important indicators . While we shall discuss them at length during our investing piece related to halving, it is appropriate to take a closer look at a few. As an aspiring or even an experienced trader/investor, you should keep a closer eye on these indicators, especially around the halving points, to better ascertain the price moves and possibilities:

Stock-to-Flow

Bitcoin S2F or Stock-to-Flow model furthers BTC’s scarcity narrative. As halving is a supply-restricting implementation, the S2F model projects a price rise around the event.

Hash Ribbons

This indicator uses the moving averages related to Bitcoin’s hash rate to locate bearish and bullish trends. Much like a standard moving average crossover strategy, the 30-day MA moving under the 60-day MA signals a bearish trend.

Hash ribbons give a more conservative approach towards post-halving price rises as miners do take some time to get back into the mix.

Realized HODL Ratio

This is an on-chain metric representing the ratio between long-term and short-term holders.

During halving, the ratio tends to increase as long-term focus increases, and short-term offloading happens as part of the buy-the-news, sell-the-event narrative.

NVT Ratio

NVT, or the Network Value to Transaction Ratio, is a metric that tells if the asset is in the oversold or overbought territory. Do note that NVT is a comparative ratio of BTC’s market cap and transaction volume. Around halving, the ratio seems to spike as the market cap increases due to speculative inputs, but the network activity stays nominal as it isn’t that easy to boost on-chain network activity.

A higher NVT ratio signifies an overbought zone, and the extent shows which point closer to the halving is better to exit or even enter.

Other key valuation models associated with Bitcoin halving:

How does halving impact miner profitability?

Bitcoin halving impacts the supply and demand dynamics of BTC. However, it even impacts miner profitability as they are the ones receiving direct mining rewards. Even though the profitability and economics of the Bitcoin network come back to the usual pace months after halving, miners do face initial jitters, captured perfectly by the state of miner revenue, mining hardware sales, and the miner capitulation indicator.

Impact on miner revenue

If we can consider that 90% of the miner revenue comes from block rewards — at 6.25 BTC per block, the next having is expected to make the same drop anywhere between 70% to 80%. While this will initially hit the miner revenue, lowering mining difficulty will bring more miners into the mix.

As for the key metrics, as a miner, you should keep a close eye on the following:

- Hashrate: Good time to enter into mining once it drops.

- Difficulty: Falls weeks after halving to restore profitability equilibrium.

- Hash price: This metric compares the per unit price of BTC and the cost of mining. A low ratio is what signifies mining profitability.

- ASIC Efficiency: The focus should be on high efficiency as that lowers operational costs and helps improve margins.

Impact on mining hardware

The impact of Bitcoin halving on mining hardware isn’t all that straightforward. Instead, the same goes through the following hoops:

- As block or rather mining rewards reduce, new hardware purchases do not happen all that aggressively.

- Better hardware options lead to higher ASIC efficiency and chances at profitability. This is where miners start reconsidering entry into the space.

- As BTC price increases, which is usually the case post-halving, new mining players come in as their new hardware investments are justified.

Miner capitulation and BTC bottoms

Miner capitulation is an important factor to consider if you wish to identify the price-based potential of a halving event. As a standalone indicator, long-term capitulation often coincides with price bottoms. However, you must pair the miner capitulation indicator with the likes of difficulty drop, hash rate, and price moves to confirm the actual bottoms.

Also, a period of high capitulation can mean a couple of things. Firstly, it can mean a higher selling pressure on BTC. And secondly, it can also mean that weak hands are slowly moving out, transferring the narrative to long-term holders.

Does Bitcoin halving come with concerns?

Bitcoin halving is one of the most sought-after events in the cryptocurrency space, more so due to the higher dominance of BTC. And even though halving aims to make the BTC supply-demand model more robust whilst furthering the concept of decentralization, it isn’t without its share of challenges. These include:

- Immediate and short-term volatility in prices.

- A drop in miner profits.

- Risks of miner centralization as larger players might consider clubbing operations to reap even the most minimal chance at profitability.

- Tighter liquidity immediately around the halving events.

- Increase hype and speculations, especially across social media.

- Chances of growing MEV (Maximal Extractable Value) strategies gaining a foothold as with reduced block rewards, miners will start prioritizing high-fee transactions.

In addition to the mentioned threats, growing FUD and FOMO can also surface closer to a halving event.

Bitcoin halving parties:

What does Bitcoin halving mean for the broader cryptocurrency space?

Bitcoin Halving is nothing less than a celebratory event in crypto. Bitcoin enthusiasts have even made halving parties a thing to celebrate each event. And 2024 is expected to be no different. While halving has several positive consequences for the supply and price of BTC, each halving instance isn’t without its share of short-term challenges. These include declining mining profitability, FUD, and more.

Regardless, Bitcoin’s quadrennial halving hints at a maturing crypto space. More so as it shows how different and robust its monetary policy is, compared to the legacy fiat solutions.

Frequently asked questions

Based on Bitcoin’s quadrennial halving schedule, the next event is expected to happen anytime between April-May 2024. During this halving event, the existing block reward of 6.25 BTC per block will reduce to 3.125 BTC. However, the exact date of the halving event will depend on when the next set of 210,000 blocks are added from the last halving date of May 11, 2020. For now, we expect the same to happen anywhere around 27-28 April, 2024.

Bitcoin halving in 2024 is a supply-management event that would reduce the existing block reward issuance of 6.25 BTC to 3.125 BTC. This issuance cut of 50% is on the expected lines, based on the hard-coded logic of the Bitcoin ecosystem. The upcoming halving event will also significantly lower BTC’s annual issuance from the current level of 1.85%.

Previous halving cycles have revealed that the price of BTC has surged 12 to 18 months after the halving event and not immediately. This might be due to the fact that any kind of supply shock takes some time to set in. Also, this lag, regarding price rise, can be attributed to immediate liquidity tightening, as people tend to hold longer post the halving event.

Halving has several positive implications for Bitcoin. The most important one is to help reduce the annual issuance or inflation associated with BTC by controlling the supply schedule. Lowering issuance provides predictability to a network’s or ecosystem’s monetary policy. Also, halving aims at making the miner network more decentralized by lowering reliance on mining rewards and increasing the importance of transaction fees.

Historically, halving is known to affect prices. In the case of Bitcoin, the first halving event that happened in 2012 led to a nearly 10,000% increase in prices within 12 to 15 months. The reason for this price-based optimism could be how halving impacts the supply and demand dynamics, making the same less prone to inflation. However, the price movements post-halving depend a lot on macroeconomic factors.

If previous halving instances are to be considered, the price of BTC moved by close to 10,000% 12 months after the effects of the first halving event settled. Two of the other halving events, 2016 and 2020, saw extended 12-18-month long bull runs. The broader trend suggests that BTC prices move higher after every halving event, but the surge takes time.

Per Bitcoin’s pre-programmed algorithm, there can ever be 33 Bitcoin halvings in total. The first 32 halving events would aim at reducing the block reward issuance from 50 BTC, right at the onset, to 1 Satoshi. The last halving, or the 33rd one, will lower the block limit to 0.5 Satoshi, post which there can be no further divisibility.

There are a lot of factors to consider if you want to mine crypto in 2023. These include looking at and analyzing mining hardware — ASIC for Bitcoin, mining difficulty, electricity costs, and even the prices of the associated crypto. Also, if you want to mine BTC in 2024, do note that the current block reward is still at 6.25 BTC, which would drop by 50% next year.

Bitcoin halving occurs to ensure that the fixed supply of BTC — 21 million — is reached in a controlled manner while controlling the supply issuance by reducing block rewards by half every four years. Notably, a gradual reduction in block rewards makes the ecosystem’s economic model resistant to money debasing and manipulation.

Bitcoin halving is meant to create a supply shortage. However, in July 2023, with over 19 million BTC already in existence, an immediate supply shrink due to halving doesn’t look obvious. Instead, a more conservative take here would be to lower the issuance of BTC, eventually lowering the inflation and paving the way for a deflationary token economics model post-2140.

Bitcoin halving can affect the network’s security by reducing the miners’ incentive due to the halving of block rewards. If the price of Bitcoin doesn’t increase to offset the reduced reward, some miners may exit, reducing the network’s hash rate. This decrease could make the network more susceptible to attacks. However, the overall impact has historically been mitigated by the increase in Bitcoin’s value and transaction fees, sustaining miner participation and network security.

Bitcoin halving plays a crucial role in its economic model by introducing scarcity, as it halves the rate at which new BTC are generated every four years. This process ensures that the total supply of Bitcoin caps at 21 million, creating a deflationary effect. The scarcity, like that of precious metals, alongside steady or increasing demand, can lead to price appreciation. This mechanism aims to preserve Bitcoin’s value over time, making it an attractive option for investors.

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.