Users can now buy bitcoin with Apple Pay. But is buying bitcoin and cryptocurrencies with Apple Pay a good idea? How can you buy crypto with Apple Pay? And which are the best platforms that you can use Apple Pay on? Apple Pay works with any card reader that accepts contactless payments. That means Apple Pay users can purchase nearly anything they want using their phone, so long as the transaction size doesn’t exceed the limit associated with the bank card in question.

Since its release back in 2014, Apple Pay has become one of the most popular payment services in the world. It is now just as common to see someone paying for something by tapping their phone on a card reader than pulling out their actual bank card. But what about Apple Pay and crypto? Let’s take a look.

Want to get reviews on the best crypto exchanges & wallets? Join BeInCrypto Trading Community on Telegram: read reviews, discuss crypto project & get answers to all your questions from PRO traders & experts! Join now

What is Apple Pay?

First, a quick reminder. Apple Pay is a fast, convenient, and secure way for users to approve bank card transactions on their Apple iPhone or Apple Mac computer. Users can approve card transactions on these devices using various biometric security features, such as Face ID and Touch ID. Apple Pay can also be authorized using traditional passwords and pin codes.

Apple Pay and its rivals, such as Google Pay, which is used on non-Apple devices, have grown in popularity in recent years. The process is more streamlined than entering a physical bank card into a machine and then entering the pin. Physical bank cards are easily lost, and pins are easily forgotten.

Meanwhile, contactless physical bank cards introduce new risks. If an owner lost their physical bank card, anyone who finds it could immediately start spending the money on the card without knowing its pin. In contrast, Apple Pay introduces an additional security barrier (such as a pin or biometric test) prior to the approval of a transaction.

Why use Apple Pay to buy crypto?

Cryptocurrency investors may be tempted to use Apple Pay for crypto purchases for speed, security, and convenience. A number of crypto trading/investing platforms offer highly simplified processes for using Apple Pay to purchase crypto. It can be a great option for those keen to gain crypto exposure in a stress-free, intuitive way.

How to buy bitcoin with Apple Pay

Several trading platforms/wallets have made it easy to purchase cryptocurrencies using Apple Pay. For most centralized cryptocurrency exchanges, the process of buying crypto using Apple Pay is very similar.

- You will need to set up an account by inputting personal data.

- To gain full account access, you must complete Know Your Customer (KYC) requirements. This normally involves some combination of providing a photographic ID and proof of address.

- Once your account has gained full KYC approval, select the cryptocurrency and amount you want to purchase.

- When selecting the payment method, you can opt for Apple Pay before completing the transaction.

It is even easier to buy crypto using non-custodial crypto wallet platforms such as MetaMask. These platforms do not require users to conduct KYC upon setting up an account. Users buy crypto using Apple Pay instantly, though they may have to provide some personal information to third-party providers.

For reference, with non-custodial wallets, only the user can access the wallet’s private keys. Thus that user has sole control over their crypto. With a wallet on an exchange, this is not the case. The exchange has custody of a user’s crypto and holds the private keys to the wallet.

Here are the top seven platforms that let you buy crypto using Apple Pay.

1. Kraken

Jesse Powell and Thanh Luu founded Kraken, a U.S.-based exchange, in 2011. It launched in September 2013, offering bitcoin, litecoin, and euro trades. Kraken is one of the first Bitcoin exchanges to be listed on Bloomberg Terminal.

Hummingbird Ventures and Bitcoin Opportunity Fund made a $5 million Series A investment in Kraken in March 2014. In 2016, the SBI Group was the lead investor in Kraken’s Series B round. Early in 2021, Kraken partnered with Tribe Capital to seek out further capital from investors at a valuation of above $20 billion.

In July 2015, Kraken shifted its focus to other markets due to issues with U.S. regulators. What’s more, Kraken has undergone regular audits by Armanino LLP, showing it has sufficient cryptocurrency reserves to support its operations.

Website: www.kraken.com

Funding limits are determined by various factors, including your residency, verification level, and the asset you are attempting to deposit or withdraw. Limits for crypto vs. fiat, daily, monthly, and annual activity are calculated separately. The monthly and daily deposit and withdrawal limits for express accounts are $9,000 each. Intermediate accounts can be as high as $500,000 per month, while pro accounts can be as high as $100,000,000 monthly.

How to buy bitcoin using Apple Pay on Kraken

1) First, open up the Kraken app on your iPhone. Select the crypto you want and press the “Buy” button at the bottom of the screen.

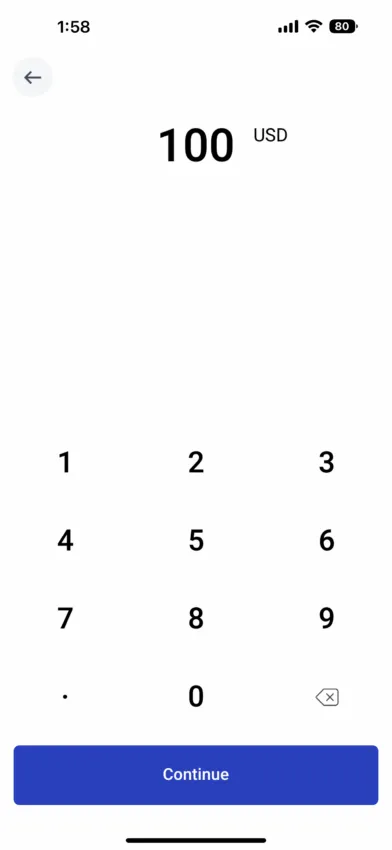

2) Enter the amount of cryptocurrency you would like to purchase.

3) Finally, select Apple Pay to complete your purchase.

Kraken charges & fees

A number of factors, including transaction size, transacted assets, payment method, and market conditions, among others, determine fees on Kraken. Kraken’s maker-taker fees, which max out at 0.26%, are among the lowest in the industry. Furthermore, Kraken charges a fee of 0.5% plus 0.9% or 1.5% for ACH purchases.

The fee for purchasing, selling, or converting all crypto assets using your Apple Pay or Google Pay wallet is displayed on the final confirmation page before you complete the transaction. That being said, digital wallet purchases have no hidden or additional fees. The total value displayed on the confirmation page is what Kraken will charge to your wallet.

Buying crypto using Apple Pay on Kraken: pros & cons

Pro: Security driven

The Global Settings Lock (GSL) prevents unauthorized changes to your Kraken account and conceals sensitive account information. Kraken also offers 2FA withdrawal email confirmation, air-gapped cold storage, strict monitoring, precise API key permission control, and SSL encryption.

Pro: Availability

Kraken facilitates trading in 176 countries. However, the functions vary depending on location and verification level. For example, Kraken is not available in New York or Washington.

Pro: Funding and withdrawal options

Several cryptocurrencies and fiat currencies are supported for account funding. In addition, Kraken’s funding and withdrawal options are in abundance. These include SEPA bank transfer, SWIFT, wire transfers, ACH, Fedwire, Silvergate Exchange Network, Etana Custody, and e-Transfer.

Con: Geographic restrictions

US services may not fully support all buy, sell, send, receive, exchange, futures trading, Cryptowatch, and staking features. This varies based on the account level, region, cryptocurrency, fiat currency, and type of transaction. For instance, margin trading is only available to U.S. clients who meet certain criteria, whereas futures trading is completely unavailable to U.S. clients.

2. Coinbase

Coinbase is one of the oldest and largest cryptocurrency exchanges in the world. Its trading platform has been operational since 2012. The largest U.S.-based cryptocurrency exchange generated a splash amongst Wall Street and retail investors alike in 2021 when it went public on the Nasdaq.

73 million users traded over $300 billion worth of volume in Q2 2022. According to CoinGecko, Coinbase has the second highest trading volumes of any crypto exchange, second only to global behemoth Binance.

Users holding crypto in their Coinbase exchange account hold their crypto in a so-called “custodial” wallet. That means users do not theoretically have complete control over their crypto. Rather, they have a claim to crypto being stored in a wallet managed by Coinbase. However, Coinbase also has its own non-custodial wallet platform called Coinbase Wallet.

Some crypto investors may see Coinbase’s custodial exchange wallet as a drawback. However, there is a convenience element for beginners. Investors storing their crypto in their Coinbase exchange account aren’t responsible for managing/recording their private keys.

Coinbase account holders must provide identification documents to gain full account access, given that Coinbase is subject to KYC regulations. This puts users in a better position to regain access to their accounts if locked out. But for crypto purists who place a high value on anonymity, KYC could be a deterrent against using the Coinbase platform.

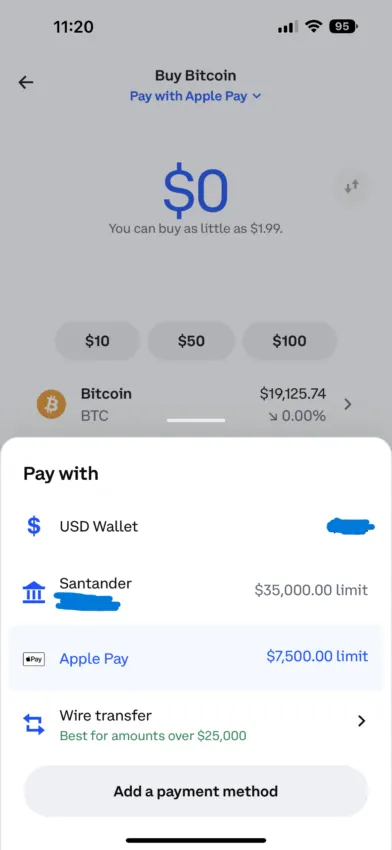

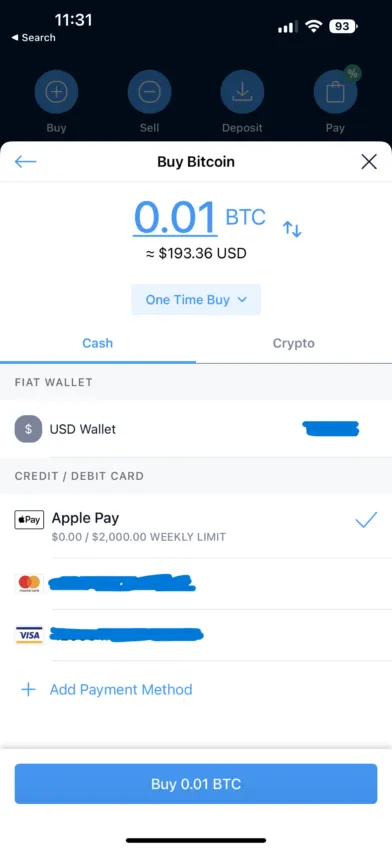

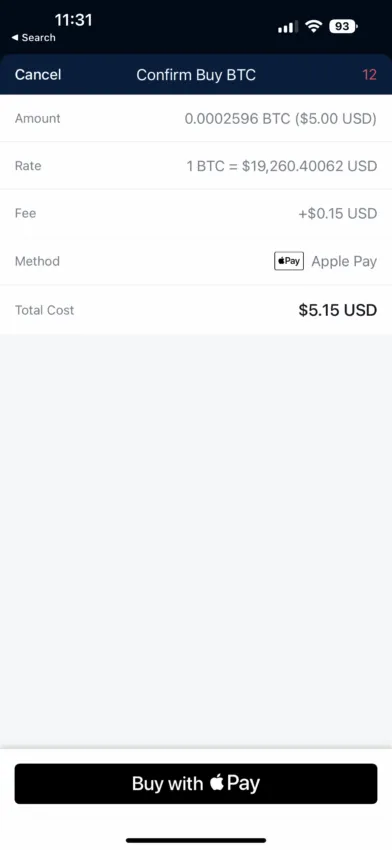

How to buy bitcoin using Apple Pay on Coinbase

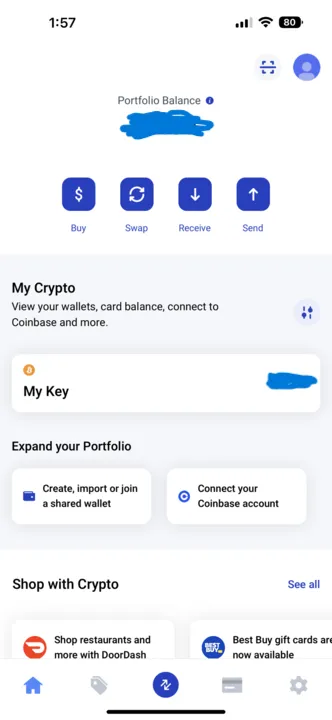

1) Open up the Coinbase application on your iPhone. In the top left of the home panel, press the “Buy” button.

2) Enter the amount of bitcoin (or other cryptocurrencies) you want to buy. Then press “Pay with” to choose your payment method.

3) Select Apple Pay as the payment method.

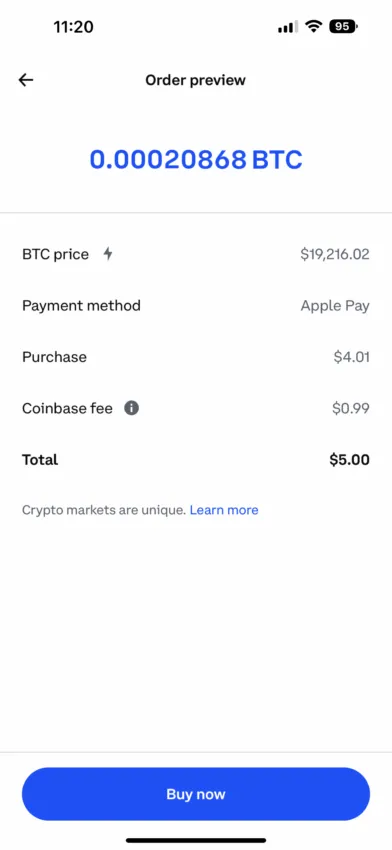

4) Once you have done this, press the “Preview buy” button. Coinbase will now offer an exchange rate and detail the service fee for the card purchase. If you press the “Buy now” button, Apple Pay will pop up on the phone so that you can confirm the purchase.

Coinbase charges & fees

Coinbase has faced criticism for what some claim is a confusing fee structure. The exchange calculates its fees at the time of order placement based on a combination of factors. This includes factors such as location, payment method, order size, and market conditions.

US-based users buying crypto on Coinbase via Apple Pay face a 3.99% conversion fee. That might be enough to deter some investors from using Apple Pay on the platform.

Users also pay spread fees and maker-taker fees to compensate Coinbase for its market-making activities. This can be up to 2%. Coinbase charges 1% on crypto withdrawals. That comes on top of the standard network fees crypto users must pay to process their transactions on the blockchain.

Buying crypto using Apple Pay on Coinbase: Pros & cons

Pro: Convenient and user friendly

Buying bitcoin via Coinbase using Apple Pay offers investors a convenient way to get their hands on crypto. It is ideal for retail investors looking to make small, ad hoc crypto purchases. The platform’s mobile app is one of the most user-friendly on the market. Coinbase scores 4.7 out of 5 in Apple’s app store according to 1.7 million ratings. And it ranks as the 27th most popular app in the finance category.

Pro: Range of crypto assets

Coinbase users can use Apple Pay to buy any of the cryptos that trade on the Coinbase exchange. At present, over 100 cryptocurrencies are available on the platform.

Pro: Easily earn yield on crypto assets

Coinbase’s Earn product enables users to easily earn yield on their crypto assets. For example, the platform allows users to easily stake their ETH and SOL coins for 4% APY. Users can also benefit from a variable APY via Coinbase’s DeFi Yield product on their DAI and USDT holdings.

Pro: Coinbase card

U.S.-based Coinbase users can spend their crypto via the Coinbase Visa debit card. The card works anywhere in the world where merchants accept Visa. Users do not incur any fees when spending their USD account balance or USDC. There are no credit check or staking requirements to get hold of a Coinbase card. Users can earn crypto rewards on their spending.

Con: Transaction size limits

For those looking to make larger cryptocurrency purchases, using Apple Pay on Coinbase may not be suitable. Crypto purchases using Apple Pay are limited by the daily transaction limit of the associated debit/credit card. Coinbase recommends bank account/wire transfers for those looking to make larger crypto purchases than their daily debit card limit enables. The drawback with such transfers is that they are not instant.

Con: Apple Pay only works for buying crypto

Another drawback of using Apple Pay on Coinbase is that it can only be used to buy cryptocurrency directly. Apple Pay cannot be used to add cash to your Coinbase account, withdraw cash, or sell crypto.

Con: High transaction fees

While Coinbase is widely viewed as having one of the most user-friendly platforms, its 3.99% service charge on card purchases is amongst the highest of the major crypto exchanges. Its other fees (market making and crypto withdrawal) are also high by industry standards.

Con: Poor customer service

According to the more than 7500 Trustpilot reviews of Coinbase, the company scores just a 1.6/5 for customer service. Most complaints revolve around improper account restrictions, closures, and a lack of support for hacked accounts.

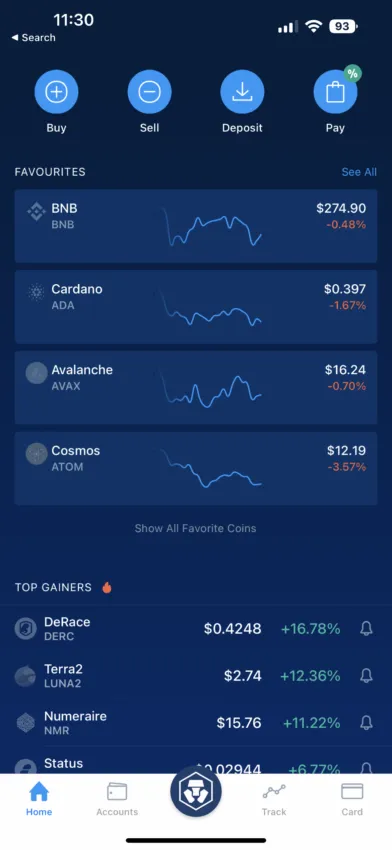

3. Crypto.com

Crypto.com is a Singapore-based cryptocurrency exchange and financial services platform founded back in 2016. The platform boasts over 50 million users. According to CoinGecko, the exchange ranks 11th in terms of daily transaction volumes, excluding Binance’s U.S. subsidiary, Binance.US.

/Related

More ArticlesThe platform has a popular Visa Card program. Users can get as much as 5% cash back on all purchases, plus other benefits. To receive these perks, users need to own and stake Crypto.com’s native cryptocurrency CRO. The platform also has an attractive “earn” program, where users can earn yields of up to 14.5% on cryptocurrencies and 8.5% on stablecoins.

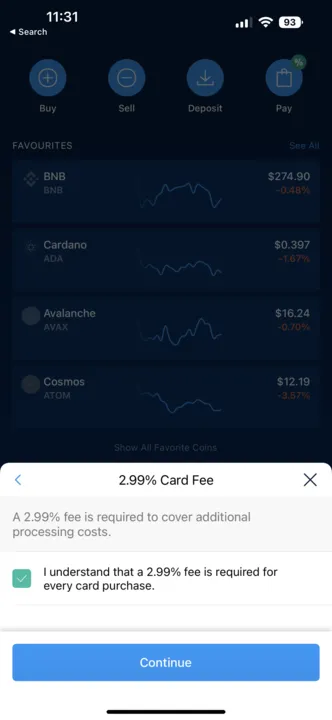

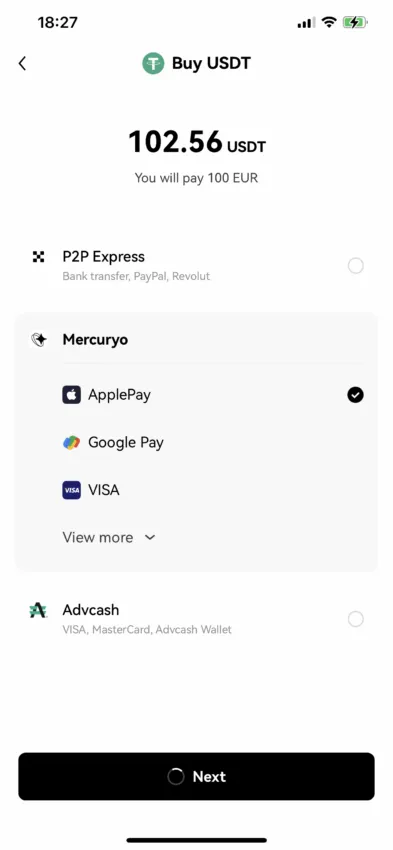

How to buy bitcoin using Apple Pay on Crypto.com

- Open the Crypto.com application on your iPhone. Go to the home panel and press on the “Buy” button at the top left.

2) Enter the amount of cryptocurrency you want to buy and select Apple Pay as your payment method. Then press the “Buy” button at the bottom.

3) You will be prompted to accept Crypto.com’s 2.99% service fee for card purchases. Tick the relevant box and press continue.

4) You will then be given a final prompt to confirm that you are happy with the exchange rate and Crypto.com fee. Press the “Buy with Apple Pay” button at the bottom. Apple Pay will then pop up to confirm the transaction.

Crypto charges & fees

Crypto.com charges a variable fee on all crypto withdrawals. For bitcoin withdrawals, 0.0005 is charged. Users will also have to pay standard network fees in order for their transactions to be processed on the blockchain.

Crypto.com’s 2.99% processing fee for card purchases includes Apple Pay purchases. Users can avoid these fees if they fund their Crypto.com account via bank transfer. However, this process is more sluggish than a bank card purchase (including via Apple Pay).

Buying Crypto using Apple Pay on Crypto.com: Pros & cons

Pro: Convenient and user friendly

Buying crypto via Crypto.com using Apple Pay as a payment method offers investors a convenient way to buy cryptocurrency instantly. Like Coinbase, Crypto.com’s platform is well known for its easy, intuitive user interface. The platform is thus considered to be highly beginner friendly. But Crypto.com also offers advanced trading features for more serious cryptocurrency traders/investors.

Pro: Wide range of crypto assets

Over 250 cryptocurrencies are available for purchase (including via Apple Pay) on the Crypto.com platform, more than enough for most users.

Pro: Large, versatile suite of crypto products

Crypto.com is much more than just a platform for users who want to trade cryptocurrency. As noted, it offers a Visa Card scheme where users can get as much as 5% cash back on all purchases depending on how much CRO they have staked.

Crypto.com also offers users an instant credit line, a payment processing service, an in-house non-fungible token (NFT) platform, and a yield-generating service called “Crypto.com Earn.” Users can get an APY as high as 14.5%, depending on how much CRO they have staked.

Con: Apple Pay crypto purchases limited

Daily crypto purchase limits via Apple Pay on Crypto.com depend on your Crypto.com Visa Card tier. For those without a card or with the lowest tier Midnight Blue, purchases are limited to $750 weekly. Ruby Steel card holders can purchase up to $2,000 worth of crypto per week using Apple Pay.

Jade Green/Royal Indigo can purchase $5,000 per week. Icy White/Rose Gold can purchase up to $20,000 weekly, while Black Obsidian card holders can purchase up to $100,000 weekly in crypto.

Apple Pay is convenient for small-time investors looking to make ad hoc purchases without using Crypto.com’s Visa Card scheme. But those looking to make larger purchases will find that they need to use the Visa Card scheme. This might not be suitable for every investor.

For example, to get the Ruby Steel card, which offers 1% cashback, investors will need to purchase and stake $400 worth of Crypto.com’s native CRO token. To get the Black Obsidian card, which offers 5% cash back, they will need to buy and stake $400,000 worth of CRO.

Con: High card purchase fee

Purchasing crypto using Apple Pay on the Crypto.com platform will incur users a 2.99% service charge levied on all card purchases. Crypto.com’s normal trading fees are fairly competitive by industry standards.

Con: KYC requirements

Like with Coinbase, Crypto.com users will need to pass various KYC requirements. For some crypto users who prioritize anonymity, this may deter them from using the platform.

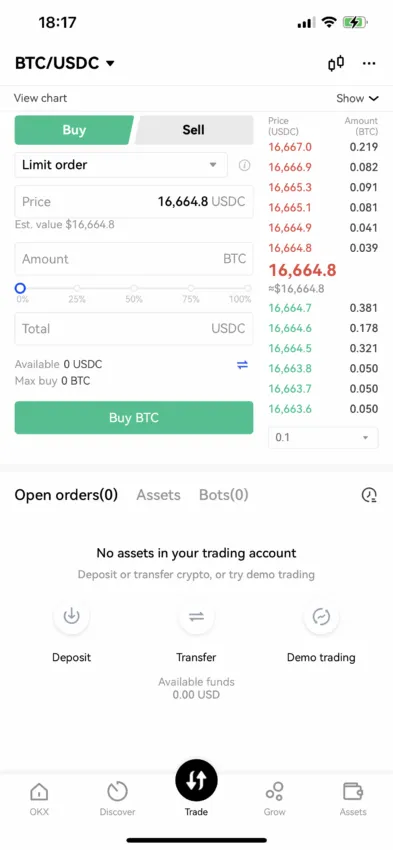

4. OKX

OKX is a Seychelles-based cryptocurrency and derivatives exchange. Formerly known as “OKEx,” Star Xu founded the exchange in 2017. Xu previously worked at Yahoo as a development engineer and then as the Chief Technical Officer of Docin.

As of February 2023, OKX is the 10th largest cryptocurrency exchange by volume. It supports services in over 60 countries and offers cryptocurrency trading, futures trading, options trading, cloud mining, and margin trading. In addition to many trading options, OKX also supports more than 300 cryptocurrencies.

OKB is the ERC-20 exchange native token of OKX. It is used to offer customers discounts on their trades. Trading fees for OKX traders can be reduced by up to 25% by holding OKB in a sub-account. OKX Earn enables OKB holders to earn interest on their savings. Additionally, OKX Jumpstart enables holders of OKB to stake their assets and get incentive tokens from emerging blockchain initiatives.

How to buy bitcoin using Apple Pay on OKX

2) Secondly, enter the amount of bitcoin (or other cryptocurrencies) you want to buy. Then select “Apple Pay” to choose your payment method.

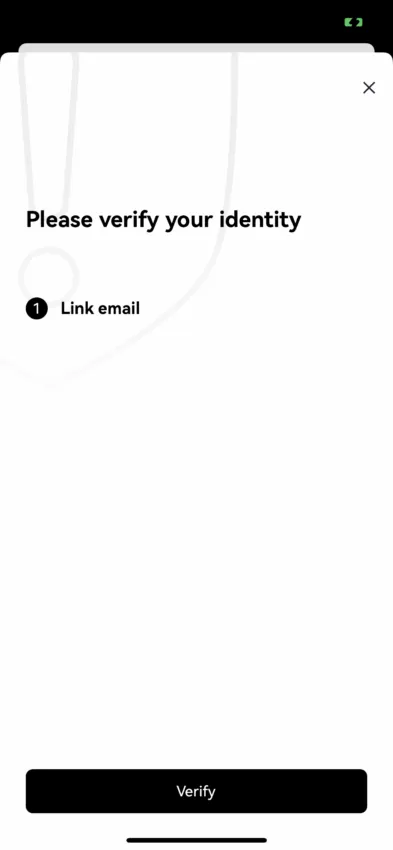

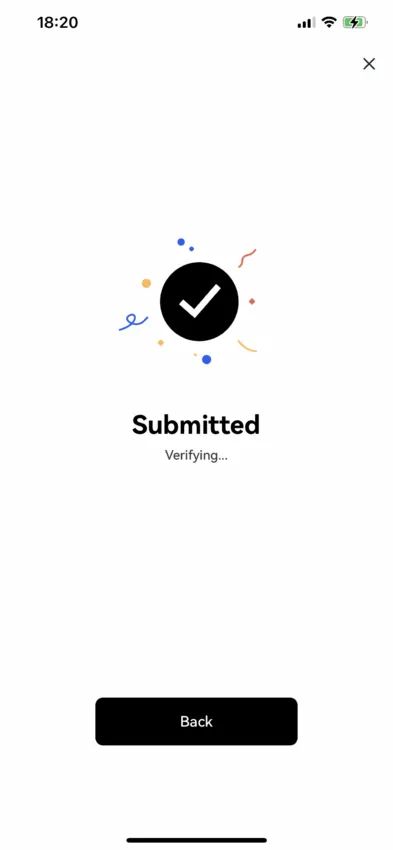

3) Thirdly, OKX will ask you to verify your identity. Enter your email to receive the verification code.

4) Next, enter the verification code.

5) Finally, your order will be processed after you submit the verification information.

Regular and VIP users pay varying trading costs on OKX. VIP customers have access to 30-day trading volumes and daily asset balances. Meanwhile, regular users are divided into levels based on their overall account holdings. Fee tiers depend on spot trading volume, the total trading volume of futures and perpetual contracts, options trading volume, and total assets. Users who meet OKX-defined parameters in relation to these tiers benefit from the highest fee discounts.

For example, the most a “Regular user” at the lowest level (Lv1) will pay in spot trading fees is 0.08% in maker fees and 0.1% in taker fees. A “VIP user” at the highest level (VIP 8) will pay -0.005 in maker fees and 0.02% in taker fees. These fees vary when trading futures, perpetuals, and options. Users must also pay withdrawal fees; this is used to pay miners as a reward, not OKX.

Buying crypto using Apple Pay on OKX: Pros & cons

Pro: Supports various trading options and currencies

OKX supports services in over 60 countries and offers cryptocurrency trading, futures and perpetuals trading, options trading, cloud mining, and margin trading. In addition to many trading options, OKX also supports more than 300 cryptocurrencies — 343 at the time of writing.

Pro: Buy crypto effortlessly

Purchasing cryptocurrency with a card, bank account, or digital wallet is simple. Crypto can be purchased in seconds using a credit or debit card, bank account transfer, Apple Pay, Google Pay, or other services.

Con: United States restrictions

OKX is not available to users in the U.S. However, you can access OKX and its services in more than 60 countries worldwide.

Con: Low liquidity on some currency trades

Because OKX offers such a wide array of cryptocurrencies, some currency trades have constrained liquidity pools.

5. BitPay

BitPay is a U.S.-based bitcoin-focused payments service and crypto wallet provider. The platform offers services to both individuals and businesses. The company was founded in 2011, making it a relative veteran in cryptocurrency. Individuals can use BitPay to buy, store, and swap crypto.

Users can also spend their cryptocurrency using BitPay’s crypto debit card. Based on the merchant, users can also receive a variable level of cashback. BitPay users can also make use of the platform’s non-custodial wallet and browser extension that facilitates easy online payments.

The wallet in which your crypto is stored on the BitPay platform is non-custodial. That means the user is tasked with safely storing and securing the private keys to their wallet. This means they have complete sovereignty over their crypto assets.

If something happened to BitPay and the company became insolvent, users’ crypto would not be in jeopardy. The same cannot be said for users’ crypto being stored in Coinbase of Crypto.com exchange accounts.

However, for crypto beginners, this might be somewhat daunting. Beginners may lose access to their private key information and thus irrevocably lose access to their crypto wallet and digital assets inside.

How to buy bitcoin using Apple Pay on BitPay

1) Open the BitPay application on your iPhone. Go to the home panel and press the “Buy” button in the top left.

2) Enter the amount of cryptocurrency you want to buy and press “Continue.”

3) Select the cryptocurrency and crypto wallet you want to add. Then select Apple Pay as the payment method and press “View Offers.”

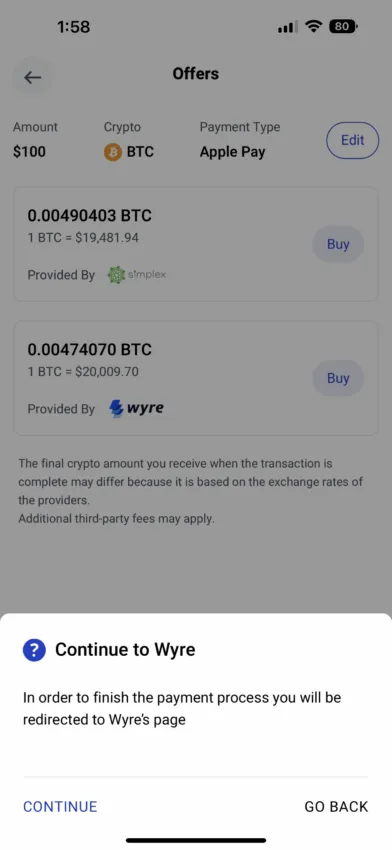

4) You will be presented with various exchange rate offers. Press the “Buy” button on the one you prefer.

5) BitPay will inform you that you will be redirected to the partner’s website to complete the transaction. Press “Continue” to proceed.

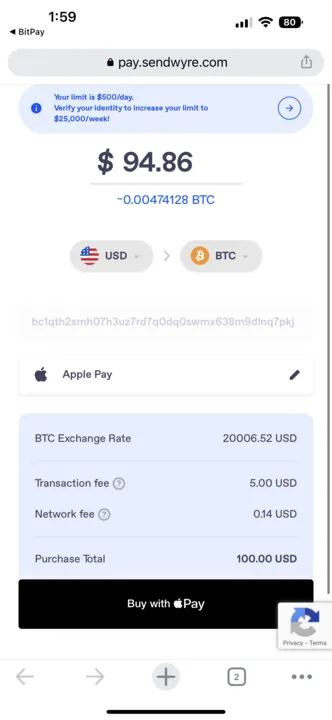

6) You will be directed to the partner’s website. Here, you will receive a breakdown of the fees you will pay and the exchange rate you will get. To complete the purchase using Apple Pay, press the “Buy with Apple Pay” button at the bottom. Apple Pay will pop up, and you can verify the transaction as normal.

BitPay charges and fees

All fees and charges are included in the exchange rate offered to users looking to buy crypto using a bank card (including Apple Pay). The fee users will pay depends on which third-party fiat-to-crypto payment processor the user chooses on the BitPay platform.

BitPay partner Simplex charges a minimum of $10 per crypto purchase or 5% of the transaction’s total value. BitPay charges an extra 1% of the total transaction value on top of this.

Buying crypto using Apple Pay on BitPay: Pros and cons

Pro: Convenient and user friendly

As with other platforms in this list, buying cryptocurrency using Apple Pay on BitPay is fast and convenient. The mobile application is simple to use, and BitPay’s crypto debit card is equally straightforward.

Con: Potentially high fees

The platform claims to offer highly competitive exchange rates with no hidden fees or markups. However, users might pay higher fees than if they bought crypto via bank transfer on an exchange. However, users are likely to appreciate BitPay’s transparent fee structure.

Cons: ID process for larger payments

BitPay requires users sending crypto over $3,000, or accepting refunds of over $1,000, to complete an identity verification process and obtain a “BitPay ID.” Cryptocurrency users who value privacy may be deterred from using the platform by this. However, the ID process does not impact those looking to make small crypto purchases using Apple Pay.

Cons: Lack of cryptocurrency options

Only 13 cryptocurrencies are available for purchase on BitPay’s platform. These include BTC, BCH, ETH, DOGE, LTC, USDC, USDP, GUSD, BUSD, DAI, WBTC, SHIB, and APE.

Cons: Poor customer service

85% of BitPay’s 156 reviews on Trustpilot give the company a 1/5. A lack of customer support is the most commonly cited reason for the poor reviews.

6. MetaMask

MetaMask is a non-custodial cryptocurrency wallet that was founded back in 2016. It allows its users to interact with the Ethereum network and dozens of other blockchains via its browser extension or mobile application.

The wallet gained significant traction in 2020 as interest in decentralized finance (DeFi) spiked. MetaMask users can easily interact with DeFi applications across numerous blockchains using the wallet. Thus, the wallet is often referred to as one of the market’s leading “web3” wallets. MetaMask wallet users can also use the platform to buy, send, receive, and swap cryptocurrencies.

How to buy crypto using Apple Pay on MetaMask

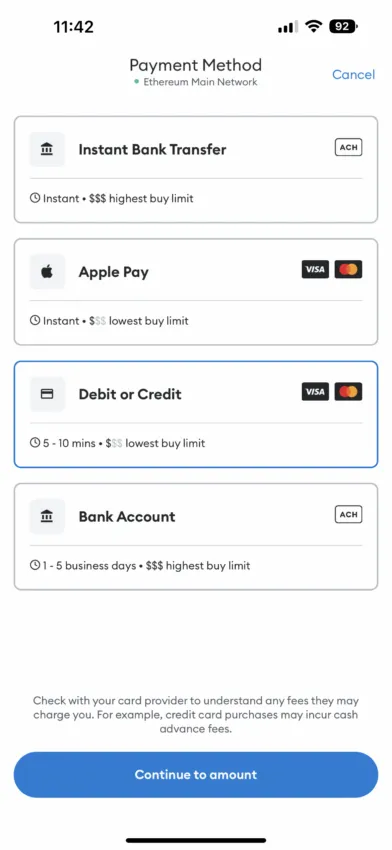

1) Open the MetaMask wallet application on your iPhone. Click on the “Buy” button.

2) Select Apple Pay as your payment method. Now press “Continue to amount.”

3) Select the cryptocurrency you want to buy and the fiat currency with which you want to buy it. Then, enter the amount you would like to purchase. Now press “Get quotes.”

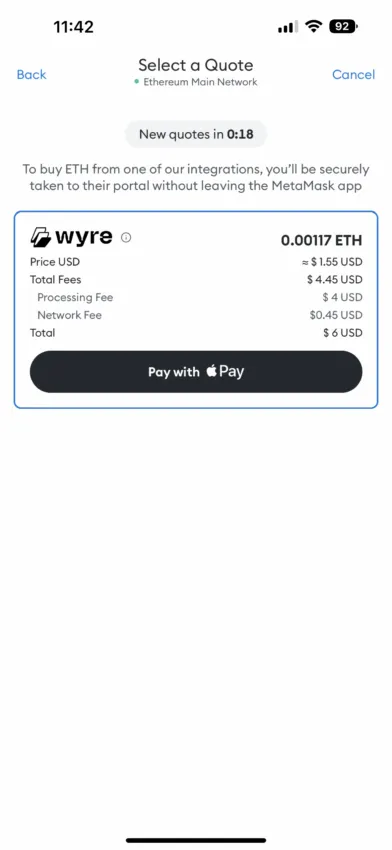

4) MetaMask will now fetch cryptocurrency exchange rate quotes.

5) You will be presented with a selection of exchange rates and fees from different MetaMask partners. Select your preferred quote from one of MetaMask’s partners. You will be taken to a portal to complete the transaction using Apple Pay.

MetaMask charges & fees

MetaMask has integrations with Coinbase, Transak, Moonpay, and Wyre for buying crypto directly in-platform. Users are able to buy crypto using Apple Pay with all four. Fees will vary depending on which MetaMask partner users opt to purchase with. MetaMask charges a 0.875% fee on all cryptocurrency swaps.

Buying crypto using Apple Pay on MetaMask: Pros and cons

Pro: User friendly

As far as web3 wallets go, MetaMask is one of the easiest to use and set up. It is predominantly used as a web browser extension that pops when users need it as they navigate the decentralized web. Setting up a wallet is very easy and only takes a few minutes. Once the wallet is set up, buying crypto, including via Apple Pay, is a very straightforward process.

Pro: Multiple wallets

MetaMask users can create multiple wallets within the MetaMask platform. This can improve anonymity for those who prioritize this.

Pro: Multiple blockchains and NFTs supported

MetaMask users can create wallets that interact with multiple different blockchains beyond just the Ethereum network. These include Binance’s BNB network, Polygon, Avalanche, and more. Users can also use the wallet to store NFTs. MetaMask connects simply and intuitively to OpenSea, the largest NFT marketplace.

Con: No support for bitcoin

MetaMask users cannot use the wallet to store their bitcoin. Users could convert their bitcoin to wrapped bitcoin, an ERC-20 token compatible with the Ethereum blockchain, designed to maintain a 1:1 price relationship with bitcoin. But wrapped bitcoin has its own risks, and many bitcoin purists would prefer to hold actual bitcoins on the Bitcoin blockchain.

Con: Third-party KYC requirements

MetaMask does not ask for any personal information to set up an account. However, if you want to purchase cryptocurrency via the MetaMask platform through one of MetaMask’s partners, such as MoonPay or Wyre, you must provide some personal information. As cryptocurrency payment processing companies, these companies are subject to KYC requirements.

MetaMask updated its privacy policy in December 2022, stating it would collect users’ IP addresses. This led to a huge backlash in the crypto community, with many users searching for MetaMask alternatives before the company issued a partial policy reversal/ clarification. The market leader announced new security features in February 2023, including phishing detection.

Con: Limits on Apple Pay transaction size

If users choose to buy crypto directly in-platform via one of MetaMask’s partners, they will face daily transaction size limits. These may be more restrictive if users want to buy crypto using Apple pay. For example, users can only purchase $400 worth of cryptocurrency per day using Apple Pay via the Wyre API. That is substantially lower than the daily Apple Pay transaction limit on many other crypto platforms.

Con: High fees

Users wanting to buy crypto using Apple Pay in the MetaMask platform via one of its partners will face higher fees than buying crypto on a traditional exchange via a bank transfer.

Con: Limited customer support

MetaMask offers very little by way of customer support. There are no options to receive live support from MetaMask representatives. Rather, most of the time, users will need to refer to MetaMask’s Help Centre or Community message board.

Con: Risky for beginners

Rookie crypto users could easily fall foul of one of the many scams designed to get hold of a user’s private keys. Crypto investors should research how MetaMask and web3 wallets work before committing substantial capital to a wallet.

7. Exodus

Exodus is a self-described web3 wallet. It allows users to receive, send, store, and buy bitcoin, other cryptocurrencies, and NFTs. The wallet comes in three forms: a browser extension, a mobile wallet, and a desktop wallet.

Like MetaMask, the wallet seamlessly integrates with a wide range of decentralized applications (DApps), including various DeFi protocols. Exodus is a non-custodial wallet, meaning users have sole access to and the responsibility of securely storing their private keys.

How to buy crypto using Apple Pay on Exodus?

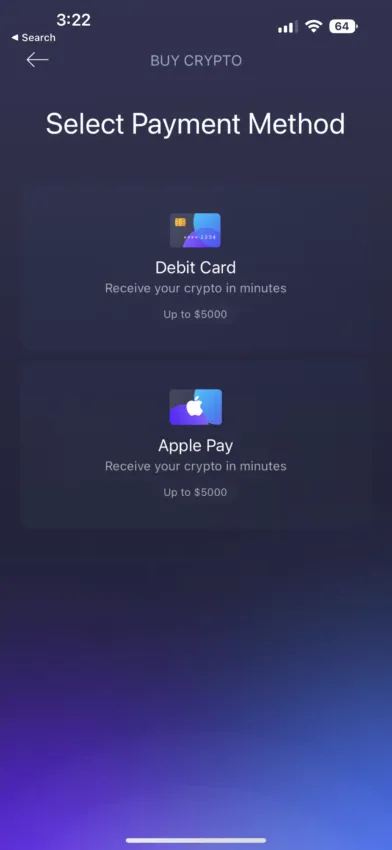

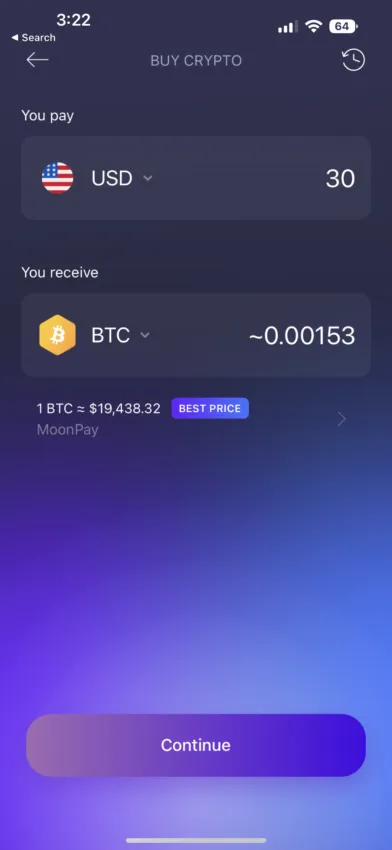

1) Open the Exodus Wallet application on your iPhone. Press where it says “Buy Crypto.”

2) Select Apple Pay as your payment method.

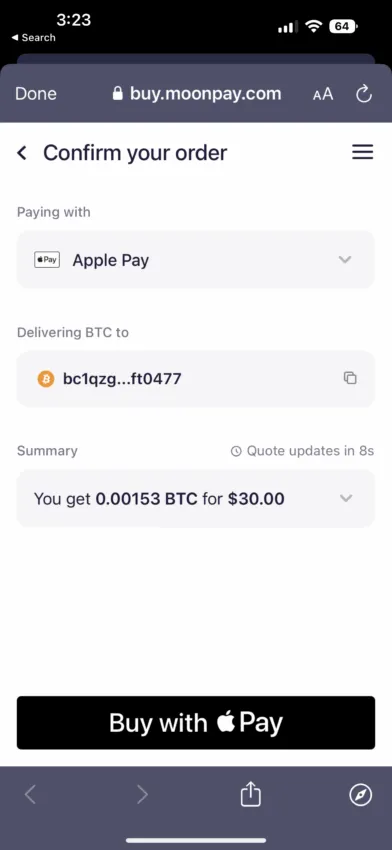

3) Choose the currency you want to buy crypto with and the amount you want to buy. You will then instantly receive a quote exchange rate from one of Exodus’ partners. Press continue to jump to the partner’s website and complete the transaction.

4) Press “Buy with Apple Pay” once on the partner’s page to finalize the transaction.

Exodus charges & fees

Exodus doesn’t charge fees for buying cryptocurrency via its platform. Rather, the wallet provider connects its users to two third-party fiat-to-crypto payment processors, Ramp and MoonPay. Both of these crypto payment processors charge a fee, which may vary according to market conditions.

Buying crypto using Apple Pay on Exodus: Pros and cons

Pro: User-friendly and easy to get started

Exodus wallet is ranked as one of the most user-friendly web3 wallets on the market. The wallet scores 4.6 out of 5 on the Apple app store, according to 17.6K reviews.

Pro: Good customer support

Compared to comparable web3 wallet services, Exodus provides high levels of support for its users. Support is responsive and available 24/7 through online chat and email.

Con: High card purchase fees paid to Exodus’ partners

Given the high fees that Exodus’ third-party crypto payment process providers charge on card crypto purchases, users buying crypto via Apple Pay in their Exodus wallet typically do not get competitive cryptocurrency exchange rates.

Con: Third-party KYC requirements

Setting up a wallet on Exodus does not require the user to enter any personal identification. However, buying crypto using Exodus partners Ramp and MoonPay will require the user to enter some personal information.

Both crypto payment processing companies are subject to KYC requirements in their respective regulatory regions. For crypto investors seeking to maintain anonymity, this could deter them from buying crypto using Apple Pay via Exodus.

Con: Apple Pay transaction limits

Users can only purchase up to $5,000 in crypto via Apple Pay per transaction/day.

Con: Custom network fees only for bitcoin, ethereum

Some users want to customize the fees they pay to have their transactions processed on the blockchain. Doing so prioritizes, or deprioritizes, their transaction in the network queue. Exodus wallet users can only customize their blockchain fees on the Bitcoin and Ethereum networks at present. For avid traders/users of other altcoins, this may be a deterrent from using the wallet.

Final verdict: Should you buy bitcoin using Apple Pay?

The likes of Coinbase, Crypto.com, BitPay, and MetaMask all offer users a convenient, fast way to buy crypto using Apply Pay. For small, infrequent crypto purchases, the higher fees associated with buying crypto using Apple Pay or any debit/credit card might not faze a beginner investor. It is much easier to pay an extra few dollars in fees than to have to go through the whole process of sending money to the crypto exchange/wallet platform via bank/crypto transfer.

The calculation changes as a user’s crypto investment intentions become more serious. For those wishing to invest significant sums in crypto, the best option would likely be to transfer money to a traditional exchange and then buy crypto using their exchange cash balance. These users will still be exposed to spread and maker-taker fees. But these fees are traditionally much lower than those associated with buying crypto directly via bank card (including Apple Pay).

In buying crypto via Apple Pay, crypto investors will likely need to provide personal information. That’s because many platforms/third-party providers selling crypto via Apple Pay are subject to KYC requirements. For cryptocurrency users who prioritize anonymity, this is a clear deterrent.

Frequently asked questions

Can I buy BTC through Apple Pay?

Can I buy bitcoin on Coinbase with Apple Pay?

How do you buy crypto on Binance with Apple Pay?

Can I use Apple Pay on Binance?

Can I buy crypto with Apple Pay?

How do I use Apple Pay with crypto?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.