Bitcoin (BTC) has risen in prominence over the past few years. However, while it’s grown in several forms, transactions will always be central to its operation. How do Bitcoin transactions work? What’s involved? How much does it cost to send Bitcoin? Our guide is an in-depth review of how BTC transactions work and why they are now a popular means for transactions.

A Bitcoin transaction is simply a transfer of value between two wallets, which is recorded on the blockchain. To send money from a Bitcoin wallet, the sender must sign the transaction with his or her private key, as proof of ownership of the funds.

If you want to know more about trading Bitcoin, join BeInCrypto Trading Community on Telegram with like-minded people. Here you can share your experience, discuss and read all the hottest news on Meme coins, Web3 and the Metaverse. Join us

Table of contents

- How do Bitcoin Transactions Work

- Public and Private Keys

- The Characteristics of Bitcoin Transactions

- Transaction Verification and How it Works

- How Many Confirmations Does Bitcoin Need?

- How Long Does a Bitcoin Transaction Take?

- Why Some Transactions Can Take Longer than Usual

- Pros and Cons of Using Bitcoin For Transactions

- Pros of Using Bitcoin for Settling Transactions:

- Bitcoin for Transactions

- Frequently Asked Questions

How do Bitcoin Transactions Work

Bitcoin uses the UTXO model send transactions. In the UTXO model, every transaction consumes one or more unspent transaction outputs (UTXOs) and creates one or more new UTXOs. UTXOs represent a value of a certain number of bitcoin that is available to be spent in a future transaction.

Here is an example of how a bitcoin transaction works using the UTXO model:

- Alice has two UTXOs, one for 1 bitcoin and one for 3 bitcoin. She wants to send Bob 2 bitcoin.

- Alice creates a new transaction that consumes the 1 bitcoin UTXO and the 3 bitcoin UTXO, and creates two new UTXOs: one for 2 bitcoin that is sent to Bob and one for 4 bitcoin that is sent back to herself as change.

- Alice signs the transaction with her private key to prove that she is the owner of the UTXOs being consumed.

- The transaction is broadcast to the network and miners verify the transaction. If everything checks out, the transaction is added to a block and added to the blockchain.

- Bob now has a new UTXO worth 2 bitcoin, and Alice has a new UTXO worth 4 bitcoin. These UTXOs can be used as inputs in future transactions.

This is a very simplified example, but it illustrates the basic idea of how transactions work using the UTXO model. UTXOs are used to keep track of the availability of bitcoin and to ensure that bitcoin cannot be double-spent. If you want to see how transactions in BTC work first hand, buy some BTC and spend it.

Public and Private Keys

To understand how BTC transactions work, it might be better to get a picture of what a Bitcoin transaction looks like. Imagine you want to send money to a friend of yours. If you choose Bitcoin, then the transaction will consist of 3 parts:

- An input: A record of your address.

- An amount: The specific amount of Bitcoin that you’re planning to send over to him or her.

- An output: Your friend’s public key – or Bitcoin wallet address.

To send Bitcoin, you will need to have access to the public and private keys that are associated with the specific amount of Bitcoin you want to send. Essentially, a person who has Bitcoins has two pair of keys, which includes:

- A public key to which some Bitcoin was sent earlier.

- A private key that allows that Bitcoin to be sent somewhere else.

These public keys are enclosed in the Bitcoin wallet. The wallet address is a hashed version of the public key, and the keys themselves are random combinations of numbers and letters that function like a password and a username to a social media account. These keys are public, so you can share them with other people if you want – for instance, when they want to send you some Bitcoin.

Like a mailbox

The private key has a similar setup, but they are to be kept secret at all times. Private keys are used to sign off on transactions. They take different forms, which makes them more challenging to crack.

Think of all these like a mailbox. The public address is the box itself, while the private key is the key to the box. While anyone can come to deposit mails into your box, you’re the only person who can take out content from it.

If your wallet address is available to the public, as with exchanges and other popular individuals, people can look up your address on the blockchain to figure out how much Bitcoin is stored. But no one can move your funds without your permission – or, in this case, your private key.

- Using the example above, you want to send some Bitcoin to your friend. Thus, you use your private key to sign the transactions. The message is sent to the network, containing the input (your address), amount (how much is to be sent), and the output (your friend’s address).

- From there, the transaction is broadcast to the Bitcoin network, where miners will verify that your keys can access the funds that you claim to control. This is part of the mining process.

The Characteristics of Bitcoin Transactions

So, from the explanation so far, we’ve learned the following properties of a Bitcoin transaction:

1. They’re irreversible

Once a transaction is confirmed, reversing it is impossible. Since there’s no central entity that controls the network, all transactions are one-and-done. The downside to this, of course, is that there’s no help for you if you mistakenly send money to the wrong recipient. Once it leaves your wallet, it’s never coming back.

2. They’re pseudonymous

Bitcoin transactions and Bitcoin wallet accounts aren’t connected to actual human identities. Your wallet address is a chain of almost 30 characters, and while it’s possible for the flow of transactions to be tracked and analyzed, connecting them to the real-world identities of users isn’t always possible.

3. They’re on a global scale, and they’re fast

A Bitcoin transaction is conducted almost instantly on the Bitcoin network. Since the blockchain is a network of computers around the world, transactions can be sent just about anywhere – you can send money to your next-door neighbour to chip in for your joint dinner tomorrow night, or you can send money halfway around the world.

4. They’re secure

All Bitcoin funds are locked in a cryptographic system. Only private key owners can send Bitcoin to another wallet address. Once funds are sent out, they are broadcasted to the network, where miners confirm their validity before adding them to the blockchain. This decentralized process ensures that no one can hijack your transactions in the middle and divert your funds.

/Related

More ArticlesTransaction Verification and How it Works

Roughly every ten minutes, a new block is added to the Bitcoin blockchain. But, how does verification work? Once you sign off a transaction with your private keys, the transaction would be sent out and wait to be picked up from the mempool by a miner.

Mempools

A Mempool is simply a waiting area for transactions verified by a node, pending when a miner picks it up and inserts it into a block. If a transaction is not picked up by a miner, it will remain in the pool of unconfirmed transactions—basically a list of transactions waiting to be verified. Bitcoin miners select transactions from these pools, and form them into a ‘block,’ which is a collection of transactions sent out to the network.

Blocks and PoW Algorithm

Before a transaction is included in a block, the miner has to ensure that the transaction is valid. It does this by checking if the sender’s wallet has sufficient funds to execute the transaction. Once the transaction has been added to the block, the miner needs to find a signature before it can add the block to the blockchain. This is done through the ‘proof of work’ (PoW) algorithm that allows miners to find an eligible signature for the blocks by solving complex mathematical problems.

Once the miner finds the eligible signature, it broadcasts the block and the signature to other miners. Other miners in the network would also verify the legitimacy of the signature. If valid, other miners would reach a consensus to include the block in the blockchain. Once a block is added to the network, it would be distributed to nodes, which would save it to their transaction data.

Block Confirmation

After a block has been added to the blockchain, other blocks that are added on it count as ‘confirmation’ for that block. For example, if your transaction was included in block 400, and the blockchain is now 403 blocks long, it means the transaction has three confirmations. It’s called confirmation because every time miners add a new block on top of it, the blockchain reaches consensus again on the block and the collection of transactions in it. The more the confirmation, the harder it is for the transactions to be altered.

How Many Confirmations Does Bitcoin Need?

It takes at least three Bitcoin confirmations for transactions between $100 and $10,000. Most exchanges need six Bitcoin confirmations as a minimum for transactions between $10,000 and $1,000,000. You might need to wait up to 60 confirmations for transactions worth more than $1,000,000 in order to be safe.

Great! So, you’ve sent out some Bitcoins to your friend. But, you’re unsure if they’ve got it. It takes time for the funds to get to the recipient. How do you track the funds to know if it’s been confirmed or received by the recipient? This is where the Block Explorer comes into play.

To get started, head over to the Block Explorer, enter your transaction TXID in the search bar.

TXID is a transaction identification number used to track transactions on the blockchain.

The TXID is not to be confused with the wallet address. TXID shows you the movement of transactions in the crypto network. With the TXID, you’ll be available to find the Status of the transaction, Fee, Value of transaction, and others.

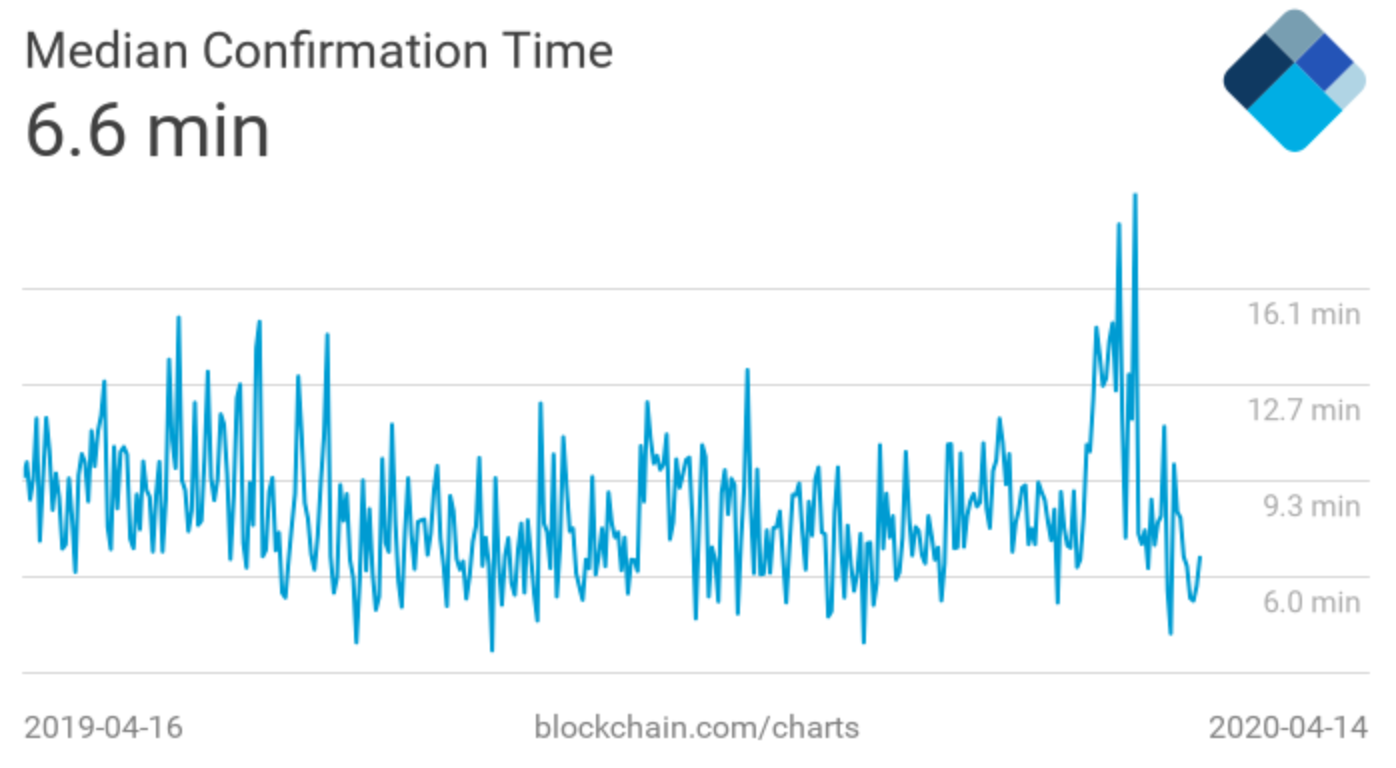

How Long Does a Bitcoin Transaction Take?

Before being completed, all Bitcoin transactions require six confirmations from miners in the network. Bitcoin transactions often take between one and five hours to complete. Ideally, a Bitcoin transaction should be confirmed in a matter of minutes. However, there are people who have to wait longer for confirmation and receipt of funds.

Why Some Transactions Can Take Longer than Usual

To explain this, it’s important to note that every transaction on the Bitcoin blockchain will need to be verified by miners. To achieve this, miners have to group transactions into blocks and add blocks to the blockchain. Sometimes, transactions take more time for verification due to the traffic on the network, leaving thousands of transactions unconfirmed for hours.

Miners use prices to determine what blocks to verify first. Every time you initiate a send transaction, it includes a “miner fee,” which is an incentive for miners for the work done in the network. If you want your transactions to leave the Bitcoin mempool quickly, then you need to add a sufficient miner fee in your transactions.

Another reason why some transactions might not be confirmed in time is that the protocol currently limits blocks to a maximum size of 1 MB. This puts a cap on the number of transactions that can enter a block per time. This limit also slows down confirmation times, and in general, the Bitcoin network.

Pros and Cons of Using Bitcoin For Transactions

As stated earlier, Bitcoin has grown into a substantial payment method, and several companies have now stepped up their infrastructure to include the asset as well. The question for newbie Bitcoin users is why so many people are using Bitcoin to facilitate transactions. How is it faster than the banks for cross-border payments? More importantly, if it’s that good, what’s holding it back from mass adoption?

Pros of Using Bitcoin for Settling Transactions:

1. Autonomy

Bitcoin allows users to transfer money while maintaining their anonymity, at least in theory – something that traditional asset transfer methods don’t allow at all.

2. Peer-to-peer transfers

With Bitcoin, users can send and receive payments to and from anyone without approval from any central authority.

3. No banking fees

You can store your Bitcoin in your wallet for as long as you want without having to pay maintenance fees to anyone. The bulk of the fees with using BTC for transactions is with withdrawal fees (on exchanges). These fees won’t apply if you store your funds on stand-alone Bitcoin wallets. You won’t have to bother with other charges that banks and payment processors charge.

4. Speed and low fees for international payments

Another significant benefit of Bitcoin is the fact that their fees are much lower for cross-border transactions. Since there’s no intermediary or government involved, transaction costs are much lower. Also, since transactions usually happen almost instantly, you don’t need to deal with any inconvenience with authorization processes.

Bitcoin for Transactions

There are instances where transactions take much longer than expected. This often occurs when there’s traffic on the network. If you’re looking to make a payment at a retail store, for instance, you won’t want to be stuck in a situation where your transaction hangs in the air.

There’s inherent volatility in the Bitcoin market that especially affects its use in retail payments and transactions. The fact that a store gets $10,000 in Bitcoin for an item doesn’t necessarily mean that they have $10,000 by the time the transaction clears. Frequent volatility is a must-have for investors but a deterrent for payments.

That being said, many developing nations still find utility in Bitcoin transactions. This is why is was created. Despite needing improvements any many areas, Bitcoin is strong in other areas. Because in many cases the alternative is worse, Bitcoin’s weaknesses have not stopped its increasing adoption.

< Previous In Series | Crypto | Next In Series >

Frequently Asked Questions

What is Bitcoin?

Can you use Bitcoin to buy goods?

Is Bitcoin a safe investment?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.