The trading space has evolved over the past few years, with new methods of making predictions on cryptocurrencies being introduced into the market. One of these methods is through margin trading. In this guide, we’ll explain what Bitcoin margin trading is, and how you can use it to your advantage.

What is Bitcoin margin trading?

Bitcoin margin trading primarily involves trading Bitcoin using funds borrowed from a source, typically the exchange where you are trading. In margin trading, the exchange permits you to borrow additional funds, allowing you to place larger orders. This approach amplifies the potential profits from successful trades.

How is cryptocurrency margin trading different from regular trading?

Margin trading in cryptocurrency markets, often facilitated by DeFi (Decentralized Finance) platforms on the blockchain, enables traders to borrow additional capital, amplifying their trading positions beyond their initial investment. This approach can significantly increase profits from successful trades and proportionately magnify losses if the market moves unfavorably.

Additionally, margin trading, a common feature in the blockchain-based financial ecosystem, involves the risk of liquidation, where a trader’s position can be forcibly closed if their losses approach the value of their initial investment. It requires more market understanding and risk management than regular trading, where traders are limited to their own capital.

How margin trading works

Say you want to buy Bitcoin worth $2,000, but you only have $500 worth of cryptocurrencies available. Margin trading allows you to borrow the extra $1,500 from the exchange, making it possible for you to trade.

If your $2,000 grows and earns $450 in profits, you can liquidate all your earnings and return the $1,500 you borrowed to the lender. Thus, you have your initial $500 and the $450 earnings, excluding trading fees.

Margin trades are liquidated once the market moves against the trader’s prediction. When this happens, the trading platform closes the trade automatically and the trader loses all the funds.

Leverage is an increased trading power that you get with a margin trading account. Essentially, leverage is the ratio between the amount of money you have and how much you can trade with. Leverage levels differ between exchanges.

Some exchanges offer 1:1 leverage, meaning that you can only borrow 100 percent of how much you have to facilitate a trade. So, if you have 2 BTC, such an exchange will allow you to borrow enough funds to buy 4 BTC and make the trade.

We’ll run through some of the popular cryptocurrency exchanges and how their margin trading features work.

The best Bitcoin margin trading exchanges

If you’re trying to get into Bitcoin leverage trading, here are some of the top exchanges you should consider:

1. Kraken

Kraken remains a leading U.S.-based cryptocurrency exchange, offering various services, including spot trading, margin trading, futures, and indices. It supports over 100 crypto assets and seven fiat currencies (USD, CAD, EUR, GBP, JPY, CHF, and AUD). Additionally, users can earn rewards through staking.

Here are some more facts about Kraken:

Supported coins: Kraken has expanded its support to over 120 coins, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), XRP, Ethereum Classic (ETC), Zcash (ZEC), Tether (USDT), and many others.

Margin trading: Kraken Pro offers margin trading for advanced users, with up to 5X leverage available. The specific level of leverage offered depends on the currency pair being traded.

Signing up on Kraken

On Kraken, only traders who complete the verification process will be able to access the margin trading feature. Essentially, you get to borrow more with a higher verification level.

To sign up for margin trading, complete the following process:

- Head to Kraken’s official website

- Enter your email, username, and password

- Conduct your account verification process

How to margin trade on Kraken

- Log in to your Kraken account

- Go to the “Trade” tab. Select “New Order,” then go to “Kraken Pro”

- Choose your crypto trading pair

- On the right side of the screen, you will need to select your parameters

- Select “Buy”

- The order becomes visible at the bottom left corner of the screen

- To close a position, you can select “Settle” or “Close”

Note that you can only select margin trading on the Intermediate and Advanced plans. Both of these plans come with some extensive AML and KYC requirements.

Trading fees

- Position opening and rollover fees: Kraken’s opening and rollover fees vary depending on the currency or cryptocurrency. For example, Bitcoin (BTC) has an opening fee of 0.01% and a rollover fee of 0.01% every 4 hours. In contrast, Tether (USDT) carries both opening and rollover fees of 0.02%.

- Fiat currency fees: The opening and rollover fees are 0.018% for fiat currencies like the USD. Similarly, the Euro (EUR), British Pound (GBP), Canadian Dollar (CAD), and Japanese Yen (JPY) all have an opening and rollover fee of 0.015%.

- No fees for settling: It’s correct that there are no fees for paying a margin trading position on Kraken. Kraken’s dedicated page for opening and rollover fees provides detailed information for various trading pairs, reflecting the current fee structure as of 2024.

| Kraken Pros | Kraken Cons |

| ⊕ High margin limits | ⊗ Extensive KYC/AML procedures |

| ⊕ Good liquidity | ⊗ Limited trading pairs |

| ⊕ Easy trading process |

2. Poloniex

Poloniex was established in 2014 and is one of the most established crypto exchanges in the industry. It underwent a significant transformation in 2018 when it was acquired by Circle, a fintech company involved in the blockchain space.

availability and services: Poloniex is a U.S.-based exchange but does not offer its services to US-based traders. The platform supports nearly 400 cryptocurrencies and offers services like margin trading, lending, staking, and copy trading. Users can fund their accounts through fiat deposits using Simplex, which facilitates the purchase of cryptocurrencies.

Margin trading: Poloniex uses a maker-taker fee structure for margin trading, and the fees vary based on a trader’s 30-day trading volume. Poloniex charges 1% margin interest fees on margin loans, though this rate may vary depending on the cryptocurrency borrowed.

/Related

More ArticlesSigning up on Poloniex

To open an account on the exchange, follow these steps:

- Head to Poloniex’s official website

- Enter your email and password, and complete the human verification

- Verify your email and conduct the identity verification process.

Margin trading on Poloniex

- Log on to your dashboard

- Click on “Margin” at the top left corner

- Once you’ve conducted your identity verification process, you will be able to access your margin trading account and start trading

- Go over to the “Balances” tab and select “Transfer balances”

- Transfer your funds to your margin wallet

- Go back to your margin tab, where you’ll find a portion under the chart, and you’ll see the trading parameters

- Enter the right parameters to open your position

Trading fees

- To calculate trading fees, Poloniex uses a volume-based maker-taker fee schedule. Primarily, the exchange charges fees on a per-trade basis. The higher your total trading volumes on a 30-day basis, the lower the percentage of fees you will pay.

- So, if you want to pay less in fees, you have to trade more. It’s an interesting structure, really. You can check the exchange’s Trading Fee Tier page to see which is applicable to you.

| Poloniex pros | Poloniex cons |

| ⊕ Low fees | ⊗ Not available for U.S. traders |

| ⊕ Extensive altcoin selection | ⊗ Lengthy KYC process |

| ⊕ High liquidity |

3. Binance

Binance, founded in 2017 by Changpeng Zhao, is the world’s largest cryptocurrency exchange by trading volume, hosting crypto-to-fiat and crypto-to-crypto trades. Initially located in China, the business moved to Japan due to strict cryptocurrency laws in China and later shifted its headquarters from Hong Kong to Malta following regulatory constraints. Binance supports a wide range of cryptocurrencies, with more than 500 cryptocurrencies available on the platform.

Margin trading: Binance offers margin trading with various features and different tiers of leverage. Both cross and isolated-margin trading options are available. The maximum power is 3x for a regular account and 5x for a master account in cross-margin trading, while isolated margin trading offers up to 10x leverage. Binance expanded its margin trading options to include several major cryptocurrencies like Dogecoin (DOGE), Cardano (ADA), Avalanche (AVAX), Chainlink (LINK), and Polygon (MATIC).

Trading pairs and strategic decisions: Binance supports over 600 trading pairs for margin trading, covering a wide range of cryptocurrencies such as BTC, ETH, BNB, USDT, and more. Additionally, Binance has made strategic decisions to adapt to market trends, such as removing several GBP pairs, including ADA/GBP and DOGE/GBP, to focus on more globally traded pairs.

Fiat currency support: Binance has broadened its support for multiple fiat currencies, including USD, EUR, GBP, and others, with no limitations, enhancing accessibility for a global user base.

Margin trading on Binance

- Log on to Binance’s official website

- Enter your email, password, and confirm that you’re over 18

- Complete your two-factor authentication

- Move your mouse to the top right corner and hover over your profile

- Click on your Email to open your dashboard

- Click on “Margin”

- You’ll see a reminder on the risks of margin trading, then click on the “Open margin account” button

- Read the agreement and click on “I understand.”

Margin trading on Binance requires a completed Know-Your-Customer (KYC) process and two-factor authentication. Once you activate your margin account, you can then transfer funds from your Binance wallet to the margin trading wallet. To do this, click on the “Wallet” tab, select “Margin,” and click on the “Transfer” button. Select the currency you want to transfer the amount to and confirm the transfer.

Borrowing funds on Binance

- Margin wallet and borrowing: Funds in your margin wallet dictate your borrowing capacity, with the exchange lending funds automatically based on applicable leverage when you open or close a position.

- Leverage details: Binance offers up to 3x leverage for regular accounts and 5x for master accounts in cross-margin trading, with isolated margin trading allowing up to 10x leverage.

- Dynamic interest rate system: Margin loan interest rates on Binance are updated hourly to reflect market conditions. Borrowers can check the latest rates on the Binance Margin Data page.

| Binance pros | Binance cons |

| ⊕ Quick leverage funding process | ⊗ Not available in all countries |

| ⊕ User-friendly trading interface | |

| ⊕ High leverage |

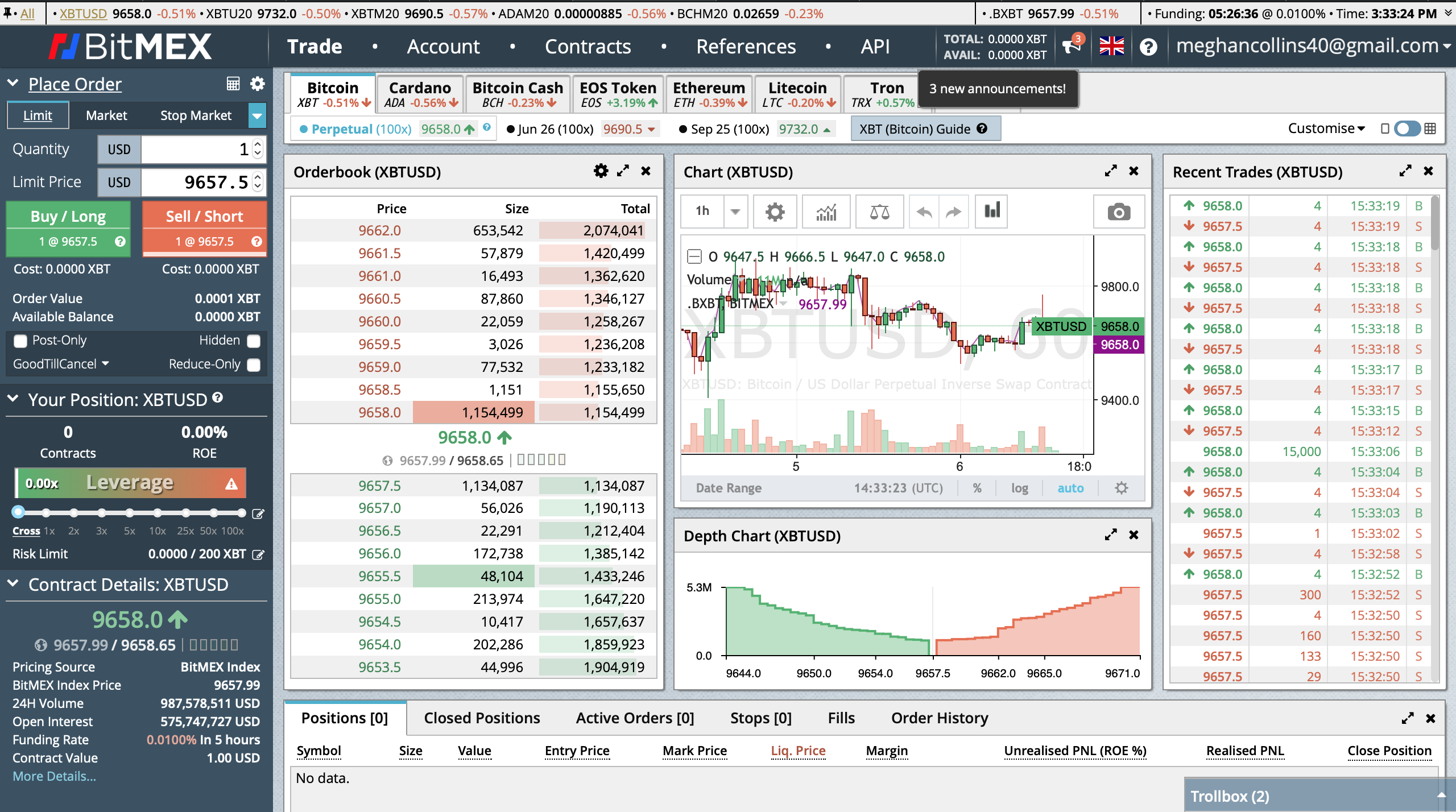

4. BitMEX

Signing up on BitMEX for margin trading

- Log on to BitMEX‘s official website

- Enter your name, email, password, and country of residence

- Log into your profile once you verify your Email

- Fund your account

- To fund your account, go to your dashboard

- Click on “Account,” then deposit fees into your wallet

- Your deposit will be confirmed after one confirmation on the Bitcoin network

Note that the minimum deposit amount is 0.0001 XBT (10000 Satoshi).

Margin trading on BitMEX

- Go to the “Trade” tab

- Find the Order box on the left side of the screen. Select the type of order you want to place.

- Enter the quantity of the trade, i.e., how much you want to buy or sell

- Set your preferred leverage level

- Once you review your trade details, click on “Buy” or “Sell,” depending on your order type.

BitMEX fees

Trading fees: BitMEX has a standard fee structure for spot products, offering discounts based on 30-day trading volume and BMEX staking. Typically, the taker fee is 0.075%, and the maker fee is -0.025%.

Deposits and withdrawals: There are no fees for deposits or withdrawals on BitMEX. However, Bitcoin withdrawals incur a dynamic Bitcoin Network fee based on blockchain congestion.

| BitMEX pros | BitMEX cons |

| ⊕ High leverage trading options | ⊗ Only Bitcoin deposits available |

| ⊕ Quick signup process | ⊗ Cluttered trading interface- not suitable for beginners |

| ⊕ Competitive fees |

5. StormGain

StormGain now offers up to 500x leverage on its trading platform. This is a significant increase from the mentioned 200x leverage, allowing traders to take much larger positions with the same amount of capital.

StormGain is a user-friendly crypto exchange platform and leveraged trading broker, supporting over 60 types of cryptocurrencies. It offers various services, including leveraged trading, margin trading, cloud mining for additional income, and no exchange fee for trading.

Fees structure: While StormGain does not have a commission for trading, it does take a minimum deposit of 10% of the profit share from traders’ profitable trades. The platform charges a range of fees from 0.010% to 0.030%.

Signing up on StormGain

- Download and visit the official Stormgain website

- Enter your email, phone number, and password

- Run through KYC and start trading

StormGain offers both a real and a demo account. While beginners can use the demo account to learn the ropes, the real account is for professional traders ready to try their hand.

Margin trading on StormGain

First off, StormGain requires email and phone verification to open margin trades on the platform, but the process is simple.

- Head over to your dashboard.

- Hover on the “Crypto Trading” tab.

- Click on “Trading”and “Open Trade”.

- Set the parameters of the trade: Price, Trade amount, Multiplier & Limit profit or stop loss

- Confirm the trade and you’re good to go

StormGain fees

- Trading fees: StormGain offers 0% commission on all trades. Instead of the standard maker-and-taker fee system, they have a unique fee structure that charges no fees for losing positions. However, the platform takes 10% of the profitsfor winning trades.

- Deposit and withdrawal limits: StormGain supports credit/debit cards and cryptocurrency deposits. The minimum deposit is $50, and there are no limits for minimum or maximum withdrawals.

- Withdrawal fees: The withdrawal fees for cryptocurrency and USD are specific. For instance, BTC withdrawals are charged at 0.0006 BTC, and USD withdrawals incur a 5.1% fee.

| Stormgain Pros | Stormgain cons |

| ⊕ Swift Verification Process | ⊗ A limited offering of assets |

| ⊕ Sleek, easy-to-use interface | |

| ⊕ Quick sign-up process |

Understanding long and short positions

Bitcoin margin trading comes with “short” and “long” positions—which is popular with traditional stock trading. Primarily, the terms relate to whether a trader believes that Bitcoin will rise or fall in the future.

When you “go long,” you believe that the Bitcoin price will rise over time. So, you could engage in leverage trading to back your bet up and amplify your winnings.

“Going short,” on the other hand, expresses your belief that Bitcoin’s value is about to dip. So, you could purchase an asset when it’s high to sell once it dips. When the value drops, you buy again and make more gains. Depending on your position, the outcome of the crypto’s price determines how much you gain or lose.

Margin trading tips

- Start small: Begin with small amounts of money you can afford to lose. Use small funds to experiment with various strategies and focus on building trading skills.

Understand interest rates:All loans have an interest rate that must be paid, regardless of the trade’s outcome. Understanding the varying interest rates across exchanges is key to success.Market conditions: Market trends and conditions influence cryptocurrencies.Research thoroughly before investing to ensure the decision is well-informed.Consider the squeeze: Be aware of your position’s liquidation price. Prepare for long and short squeezes and other price conditions leading to liquidation.

Risks associated with Bitcoin margin trading

1. Leverage risk

By all standards, margin trading is a risky endeavor on its own. The fact that you’re borrowing a significant amount of money from an exchange to facilitate a trade means that you’re under a lot of pressure to get things right.

Ambitious traders that go on to register for leverage over 2x tend to get into this mess quite a lot. Instead of making money, you end up owing a lot of money to the trading platform and can’t come out of that role.

So, you will need to have a definite conviction in the trade you’re placing and your market strategy before going in. Remember that you will need to repay the money you’re borrowing somehow.

2. Volatility risk

The volatility risk of Bitcoin margin trading is perhaps the most significant thing you should concern yourself with. Bitcoin is one of the most volatile investment assets in the world, and its price could rise or drop by thousands of dollars in a matter of hours. So, your price prediction will need to be accurate if you hope to maximize your wins.

3. System risk

Another common risk that Bitcoin trading carries is that of the system you’re trading with. For a trade to go through and your desires to be achieved, a lot of things will need to come together to work – your computer, your Internet connection, the exchange or platform you’re trading with, etc.

Any malfunction can put you in a position where you can’t trade. The longer you’re unable to, the higher the risk that you end up missing out on an opportunity to make gains.

Is Bitcoin margin trading for you?

Crypto margin trading, a widely debated topic in the cryptocurrency market, is notable for the high leverage offered by exchanges like BitMEX. This trading method can be highly profitable for seasoned traders with the necessary expertise. However, beginners or those less experienced should approach with caution. It’s advisable for newcomers to seek professional advice and conduct thorough research before engaging in margin trading.

Frequently asked questions

What is bitcoin margin trading?

How does bitcoin margin trading work?

What are the risks of bitcoin margin trading?

What is the difference between margin trading and leverage?

How can I multiply my profits with leverage in Bitcoin margin trading?

Which leverage is best for beginners?

What happens if you lose leverage in Bitcoin?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.