The 2024 Bitcoin halving is due around April 19, 2020. Even though, at its core, the halving event is about making BTC more scarce, this once-in-four years event does have market-wide consequences. Today, we are going to explore every such consequence as part of this detailed Bitcoin halving 2024 prediction. We shall borrow insights from the previous BTC halving events, plan comparative analysis, and even explore mathematical models that can help us chart the price of BTC for 2024 and beyond, post-halving.

Methodology

Bitcoin halving was always on the cards. Keeping that in mind, BeInCrypto experts tested several exchanges across multiple parameters to enhance the buying and trading experience of users. From locating the availability of multiple BTC pairs to ensuring that the interface is easy enough for the newcomers to work with, the evaluation process was based on a number of several key aspects.

Here is a quick rundown of the platforms that BeInCrypto recommends:

Coinbase

- Highly liquid BTC trading pairs

- Advanced security standards, including biometric login and more

- Zero compliance issues

- Features a passive income generation feature in Coinbase Earn

Binance

- Only exchange to offer 10+ trading pairs for BTC

- Globally accessible

- Integrated Secure Asset Fund for Users

- Two-factor authentication

OKX

- Comes with an integrated wallet

- Highly liquid BTC/USDT pair

- Supports direct crypto purchases

- Conducts periodic PoR audits for added transparency

These are only a handful of reasons. Each of the mentioned exchanges also score those additional points in terms of user-interface, advanced trading features, and other elements. Here is the link with details if you want to know more about BeInCrypto’s verification methodology.

- Where to buy BTC before the halving impact kicks in?

- Coinbase

- Binance

- OKX

- What’s Bitcoin halving: A quick refresher

- Understanding the past halving events

- Analyzing the 2012 Bitcoin halving event

- Analyzing the 2016 Bitcoin halving event

- Analyzing the 2020 Bitcoin halving event

- Bitcoin halving 2024 prediction: Mathematical model

- Bitcoin halving 2024 prediction and technical analysis

- Bitcoin halving 2024 prediction and the role of fundamental analysis

- What to expect from Bitcoin post-halving

- Frequently asked questions

Where to buy BTC before the halving impact kicks in?

The Bitcoin halving countdown shows there aren’t many days left. And if we go by the historical data, halving is known to push the prices of Bitcoin upwards, certainly, if not immediately.

So, if fear of missing out (FOMO) is already creeping in, here are the top exchanges you can check out to purchase BTC. Remember to consider the traits of each exchange, as they differ based on your buying and trading habits.

Coinbase

•High liquidity score of 871 per CoinMarketCap

•Robust security standards

•Advanced trading features for pro traders

Binance

•Over 10 BTC-specific trading pairs

•All pairs are highly liquid

•Easy to use interface

OKX

•Multiple BTC pairs

•High liquidity

•Integrated trading bots

What’s Bitcoin halving: A quick refresher

Simply put, Bitcoin halving is about cutting Bitcoin miner rewards in half, approximately every four years. This process is expected to happen until 2140 when the last BTC is supposed to be mined. Halving aims to reduce the flow of new Bitcoins into the ecosystem, lowering the issuance rate and making Bitcoin a scarce commodity.

Did you know? Bitcoin halving isn’t just an economic event. Instead, it is also an environmental milestone as each halving lowers the mining reward, indirectly leading to a decrease in energy consumption. As the rewards dry up, the less efficient miners leave, lowering the overall carbon footprint of the ecosystem.

In this Bitcoin halving 2024 prediction, we aim to understand how aggressively this type of scarcity can increase demand. Plus, we consider whether the prices can be positively impacted in the short or mid-term.

Understanding the past halving events

Bitcoin saw its first halving event in 2012. Then came 2016 and 2020. Therefore, as part of this Bitcoin halving 2024 prediction, we have a number of data points to refer to. From a miner to a trader/investor looking to fund halving-specific investment strategies, it is crucial to understand how things were in 2012, 2016, and 2020. This will give an idea of how Bitcoin’s future might go over the next few months.

Before we jump to the analysis, here’s one perspective of the expectations surrounding the Bitcoin halving and 2024 price projections:

“So the Bitcoin halving this is a mega event for the entire cryptocurrency market not just Bitcoin. Although many people think well it’s just going to affect Bitcoin not everything in crypto, but those people forget that Bitcoin represents 50% of the market in total and a bullish Bitcoin equals bullish vibes for all of crypto.

This Bitcoin halving comes at a very interesting time because now we have these ETFs that are having massive impacts on the market. Bitcoin ETFs are creating more demand than Bitcoin miners can create supply. And that supply is is about to get cut in half as emissions drop from 900 to 450 coins per day. So what happens when you have unprecedented demand, meeting, declining supply?

The answer is the price will go up. This has been true for every bitcoin halving by the way. This event is a major milestone and guide post for the entire cryptocurrency market. that all being said, don’t get overly excited about the day itself markets tend to overreact to short-term events. The bitcoin halving is a fundamentally bullish event with massive implications long-term. So if you are looking at the short term, what the price does the day before the day of, or the day after the bitcoin having, then you might be disappointed. The big picture is that this is a major for the market, especially considering the fundamental realities of bitcoin ETF demand.”

Lark Davis, Founder of Wealth Mastery: BIC

Analyzing the 2012 Bitcoin halving event

The first halving event in 2012 happened at block number 210,000 in November. While we can always delve into the technical details, we shall primarily focus on the price action.

One week prior

Leading up to the event, BTC was trading in the $13 range, exhibiting moderate volatility. However, at that time, the market was less volatile, and there were hardly any relevant cryptocurrencies in the market.

One month after (and further)

The month following the halving was slow, with BTC trading in the $12 to $20 range. However, in early 2013, things started looking up for BTC, with the price going as high as $250 by April 2013. By November 2013, one year after the first halving event, BTC was closing in on $1200.

Fundamental changes

- New supply was tighter than before

- Even though the miner incentives were reduced, the price surge ensured more miners joined the ecosystem, contributing toward the security posture of the ecosystem.

- This was when the mining efficiency started increasing, which later paved the way for ASIC mining.

Analyzing the 2016 Bitcoin halving event

The 2016 Bitcoin halving event was much anticipated. It happened in July and at the 420,000 block number.

One week prior

On July 1, 2016, BTC was trading at around $700. The prices surged leading to the event, which meant that the news was priced in, and people were expecting the surge.

One month after

Some correction was seen by August 2016, with BTC hitting a low of $450. That was attributed to long-term holders booking profits. However, similar to the 2012 event, the prices started peaking a few months later. BTC reached a level of $3000 by July 2017. The $1000 was broken in January 2017.

Fundamental changes

- The second halving event led to the first proper BTC rally, which went almost as high as $19,700 by December 2017.

- After the December high, there was a correction, which pushed the prices to almost $3000, mostly led by miners selling their holdings.

- The network security posture wasn’t compromised as more miners joined than the ones who left the ecosystem.

- 2016 was the year when the difficulty adjustment algorithm stabilized the block time at a consistent figure of 10 minutes.

- Newer exchanges started listing, increasing Bitcoin liquidity.

Analyzing the 2020 Bitcoin halving event

The 2020 Bitcoin halving event happened in May 2024. By this time, BTC was already one of the most sought-after cryptocurrencies. Surprisingly, the price of BTC was mostly stable leading up to the event. This was due to the increased liquidity and massive trading volume levels across all exchanges.

One week prior

In Early May 2020, BTC was trading at around $10,000. However, at that time, the COVID-19 pandemic was garnering all of the attention, making many skeptical towards an asset as volatile as BTC.

One month after

The price of BTC held steady for one month after the halving. And when people realized that the market wasn’t as volatile as they expected it to be, the prices started showing strength, going as high as $11600 by July 2020. Soon, a rally followed, taking BTC as high as $65,000 by April 2021. This aligned with the price surge patterns of the previous halving patterns.

Fundamental changes

- Miners saw a decline in the rewards at 6.25 BTC per successfully mined block, but the price surge mitigated the extent of capitulation.

- Post-April 2021, the prices corrected, but the dip was limited to $30,000, give or take. By this time, the BTC market had matured, leading to a more manageable dip.

- Analysts thought the network security would suffer, but the hash rate surprised analysts regarding the resilience of the Bitcoin network.

- The 2020 halving event was the major driver of institutional interest, favorable macroeconomic factors, and increased adoption.

Bitcoin halving 2024 prediction: Mathematical model

Let us now take the price changes, pre-and-post each halving event, to create a mathematical model for the Bitcoin halving 2024 prediction.

Here are some references to check:

For starters, let us take the 2012-2020 values (approximate) into consideration:

Historical overview

2012 halving

- Pre-halving price: ~$12

- Time to post-halving peak: ~Four to five months

- Post-halving peak: ~$260

2016 halving

- Pre-halving price: ~$650

- Time to post-halving peak: ~18 months

- Post-halving peak: ~$20,000

2020 Halving

- Pre-halving price: ~$9,000

- Time to post-halving peak: ~Seven months

- Post-halving peak: ~$64,000

Do note that these prices are approximate.

Also, here is the model we are looking to factor in:

/Related

More ArticlesPercentage increase post-halving

- 2012: ((260-12)/12) * 100 = ~2067%

- 2016: ((20,000-650)/650) * 100 = ~2977%

- 2020: ((64,000-9,000)/9,000) * 100 = ~611%

Time to Peak

- Average across halvings: (4 + 18 + 7) / 3 = ~10 months

However, as Bitcoin has evolved into a less volatile crypto asset, the average percentage increase post-halving might not hold, especially considering the “heaviness” of the existing price.

To factor that in, let us take the rate of diminishing returns into consideration by calculating the rate of decrease in percentage gains from 2012 to 2020:

- From 2012 to 2016: (2977% – 2067%) / 2067% ≈ 44% decrease

- From 2016 to 2020: (611% – 2977%) / 2977% ≈ 79% decrease

The average rate of decrease: (44% + 79%) / 2 ≈ 61.5%

Based on the pointers listed above and the 2020 percentage increase of almost 611, we can locate the possible Bitcoin halving 2024 price prediction percentage.

This comes out to be: 611% * (1 – 61.5%) ≈ 235%

Therefore, if we take $67,000 as the approximate pre-halving BTC price for 2024, we can expect the post-halving peak to surge by 235% in approximately ten months. The projected post-halving peak for BTC, therefore, comes out to be:

$67,000 + (250% of $67,000) = $67,000 + $167,500 = $234,500

Bitcoin halving 2024 prediction and technical analysis

Now that we have the mathematical model, let us analyze the short-term Bitcoin halving 2024 prediction.

BTC is trading at $69,467 as of April 8, 2024, inside an ascending channel. Even though the higher highs and higher lows are not clearly visible, considering the broader market volatility, the prices do feel like trading within a range. A move above the $74,000 mark, followed by high volume levels, can push the prices higher closer to the halving timeline.

But then, based on the historical figures, BTC might experience some more sideways movement leading to the major event. Post that, especially in the first couple of weeks, the targets to beat for BTC could be $72,000 and $80,000, depending on the state of the crypto market.

Bullish vibes:

Short-term mathematical model

Also, here is a quick mathematical model to capture the short-term Bitcoin halving 2024 prediction, extending to a couple of months. Firstly, here are the key historical estimates.

- 2012 halving: The immediate months saw a gradual increase, with Bitcoin’s price moving from around $12 pre-halving to approximately $13-$15, indicating a roughly 25% increase in the short term.

- 2016 halving: Bitcoin’s price increased from about $650 to around $760 in the two to three months following the halving, marking a roughly 17% increase.

- 2020 halving: The price moved from around $9,000 pre-halving to about $10,000-$11,000 in the subsequent couple of months, reflecting an 11%-22% increase.

Considering the concept of diminishing returns, just like the long-term model, we can consider the following numbers to take effect:

- Pre-halving price assumption for 2024: $67,000

- Predicted short-term Increase Post-Halving: 10-15%

- Lower Bound Calculation: $67,000 + (10% of $67,000) = $67,000 + $6,700 = $73,700

- Upper Bound Calculation: $67,000 + (15% of $67,000) = $67,000 + $10,050 = $77,050

These levels align with our technical analysis.

Bitcoin halving 2024 prediction and the role of fundamental analysis

To validate the technical pointers, it is necessary to supplement these with on-chain metrics. Here are the key elements to consider:

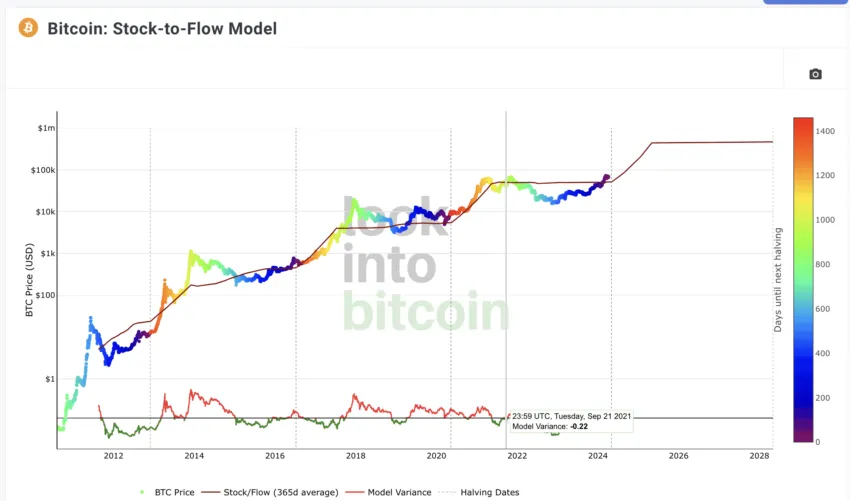

Stock-to-flow (S2F)

This metric compares the existing stock of BTC to the flow — the newly minted coins. If the ratio is high, which is expected post-halving, bullish momentum can surface.

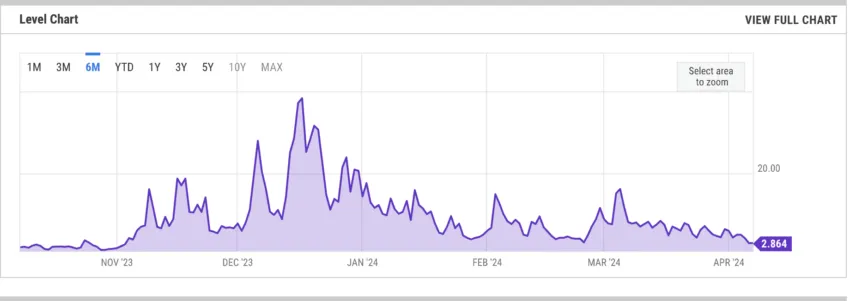

Average transaction fees

This becomes an important metric post-halving. Miners will rely more on transaction fees to enhance their earning opportunities, and therefore, a steady increase in this metric can be good for the overall Bitcoin ecosystem.

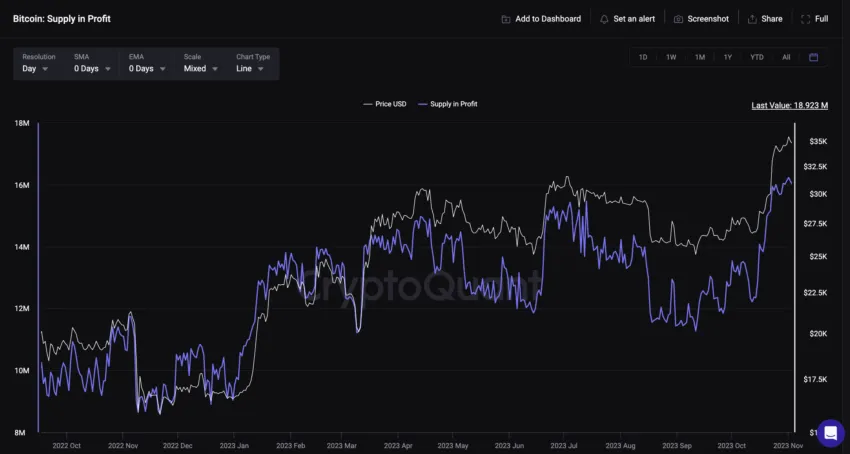

Supply in profit/loss

It is important to gauge the volume of coins that are in profit post-halving. That would help understand the selling pressure if paired with metrics like the mean coin age.

And finally, along with the technical analysis, you should keep monitoring the exchange flows — inflows and outflows both — to track the direction of the price move.

Impact of Bitcoin ETFs

The introduction of Bitcoin ETFs gives a whole new angle to this Bitcoin halving 2024 prediction. Pre-and-post halving, you may want to check the volume of BTC inflows/outflows led by the fund managers.

Macroeconomic factors, rate cuts, and the feds

The Federal Reserve has hinted at possible rate cuts for 2024. With spot ETFs blurring the lines between traditional finance and cryptocurrencies, it is crucial to note that steady or lowered interest rates can enhance individuals’ borrowing capabilities, leading to more aggressive ETF positions. That could lead to fund issuers gobbling more BTC than usual, pushing the prices higher in the process.

BeInCrypto spoke with Neil Roarty, an analyst at Stocklytics, regarding the macroeconomic elements that could impact the post-halving price of Bitcoin. Here is what he had to say in an exclusively to BeInCrypto:

“Bitcoin is down some 10 percent from the $73,000 all-time high it hit in mid-March — and it could be that the strong economic indicators coming out of the US are what’s dampening its performance.

“While the Federal Reserve remains committed to reducing inflation to its two percent target, with job growth strong and inflation steadily decreasing, Chairman Jerome Powell is under no pressure to accelerate interest rate cuts. Some argue that’s bad news for Bitcoin, speculating that cuts are needed to drive its price towards $100,000.“

Neil Roarty, Analyst at Stocklytics: BeInCrypto

What to expect from Bitcoin post-halving

Most expect the Bitcoin halving 2024 prediction to be as bullish as it was with the previous halving events. However, based on the historical data, it is important to keep the immediate expectations in check and let the market stabilize before BTC tries to scale new, post-halving highs.

Frequently asked questions

What is the Bitcoin prediction price in 2024 halving?

How much will one Bitcoin be worth in 2024?

What is the Bitcoin halving reward for 2024?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.