Crypto leverage trading is a powerful tool for traders seeking to maximize their potential returns. This guide explores the intricacies of leveraging trading strategies, risk management techniques, and short-term opportunities in cryptocurrencies like Bitcoin and Ethereum.

We’ll guide you through the essentials of crypto trading, from choosing the right exchange offering to opening an account. Here’s how to navigate the fast-paced environment of crypto leverage trading.

Methodology

For each crypto platform in this list, BeInCrypto conducted extensive testing over a period of six months. Our team tried out each platform’s unique features, from security protocols and technology used to the variety of supported digital assets and user feedback. All these were carefully assessed to ensure they meet traders’ needs for leveraged crypto trading.

Here’s a snapshots of some of the reasons that each crypto exchange made the list.

Coinbase is included for its user-friendly interface, making it ideal for beginners in crypto leverage trading. It is known for its strong regulatory compliance, particularly in the United States, adding a layer of security and trust for users. Additionally, while its leverage options might be more conservative (only up to 10x), they offer a safer entry point for new traders, coupled with comprehensive educational resources to assist in developing effective trading strategies and risk management practices.

Kraken’s traditional margin accounts appeal to short-term traders with its low minimum margin requirement and support for a wide range of cryptocurrencies. While its leverage fees are higher, its security standards and support for both limit and market orders make it a reliable choice.

KuCoin was selected for its innovative leveraged token markets that allow trading without the need for loans and for offering a range of cryptocurrencies in both long and short markets. Its user-friendly interface and flexible leverage options cater to both conservative and aggressive traders.

MEXC is chosen for its high leverage limits up to 200x, broad range of leveraged futures markets, and the substantial liquidity it provides, supporting rapid execution of large orders. Its user-friendly interface and non-mandatory KYC process for certain trading activities add to its appeal, especially for those who value privacy.

OKX is preferred for its unique offerings in options trading with a wide range of maturity dates and strike prices, alongside other leveraged markets like perpetual futures. It supports a diverse array of cryptocurrencies, appealing to traders looking for variety in their trading strategies.

Bybit is favored for its significant liquidity, supporting a variety of leveraged products including perpetual futures and inverse contracts. Its high leverage limits, up to 125x for Bitcoin, and competitive fees position it well for both high-volume traders and those new to leverage trading.

Binance stands out due to its wide range of cryptocurrencies (over 400), extensive leverage options, and comprehensive trading products like perpetual futures and leveraged options. Its low trading fees, robust security measures, and high liquidity make it a top choice for both beginner and advanced traders.

Overall, all these platforms were identified as solid options for traders looking to engage in crypto leverage trading, catering to a range of needs from high leverage and diverse trading products to robust security and user-friendly interfaces, enabling interaction with dynamic digital asset markets.

For additional info on BeInCrypto’s methodology and verification practices, follow this link.

- 7 best crypto leverage trading platforms

- 1. Coinbase

- 2. Kraken

- 3. KuCoin

- 4. MEXC

- 5. OKX

- 6. Bybit

- 7. Binance

- Crypto leverage trading platforms compared

- What is cryptocurrency leverage trading?

- How does cryptocurrency leverage trading work?

- Benefits and risks of leverage trading

- Leverage trading vs. margin trading

- What to look for while picking the best crypto leverage trading platforms

- Know the risks

- Frequently asked questions

7 best crypto leverage trading platforms

1. Coinbase

Coinbase is an excellent platform for crypto leverage trading because it’s recognized for its security and regulatory compliance, both of which are crucial when leverage trading.

Additionally, the leading CEX offers a broad range of products, including innovative features and a significant variety of trading pairs. The platform is designed to cater to both beginners and advanced traders, providing educational resources for newcomers and sophisticated tools for experienced users.

With high scores in security and product offerings and a solid overall rating, Coinbase stands out as a reliable choice for those interested in leverage trading in the cryptocurrency market.

• Futures

• Perpetual futures

- Most reputable and regulated exchanges globally

- Offers over 10,000 assets for trading

- Educational Rewards: Features a Learning Rewards program where users can earn crypto by completing educational courses.

- Prompt customer support

- Basic and advanced trading options

- Provides a Coinbase debit card

- The fee structure can be complex and vary between different activities

- Some features and assets may not be available in all countries

- Small leverage compared to other platforms

• Coinbase is one of the most reputable and regulated exchanges globally, ensuring a secure and compliant trading environment.

• The platform offers over 10,000 trading assets, including leading cryptocurrencies like Bitcoin, Ethereum, Dogecoin, and Ripple, catering to a diverse range of trader interests.

• Coinbase offers a unique Learning Rewards program where users can earn cryptocurrency by completing educational modules, making it an attractive platform for beginners wanting to learn more about crypto.

• Offers both simple and advanced trading platforms, catering to both novice traders and experienced professionals.

• The Coinbase Debit Card allows users to spend their cryptocurrency and earn rewards in various digital currencies, integrating everyday finances with crypto trading.

• Users can earn up to 10% in staking rewards, providing an opportunity for passive income from their cryptocurrency holdings.

• Coinbase Wallet supports hundreds of thousands of tokens and offers features such as trading, swapping, staking, and borrowing across multiple networks, making it a comprehensive tool for managing crypto assets.

• Coinbase Advanced, replacing Coinbase Pro, provides deep liquidity, real-time order books, and competitive fees for professional traders.

• Equipped with advanced tools like TradingView charts, high-throughput APIs, and sophisticated order types, facilitating strategic trading decisions.

• Offers one unified balance to trade, earn, spend, send, and borrow, simplifying the management of crypto assets.

• Available in over 170 countries and supporting 20 languages, making it a globally accessible platform for crypto trading.

2. Kraken

Kraken caters to those preferring traditional margin accounts, ideal for short-term trading, with a minimal margin requirement of 20%, equating to 5x leverage. It supports a wide array of over 200 cryptocurrencies, such as Bitcoin, Ethereum, Cardano, Dash, Solana, Arbitrum, and Dogecoin, accommodating both limit and market orders, including short-selling for speculative downturn bets.

However, Kraken’s drawback is its relatively high leverage costs; a 0.02% fee of the trade value is charged every four hours for open margin positions, plus opening and closing commission fees which vary from 0.01% to 0.02% depending on the cryptocurrency.

Additionally, Kraken presents leveraged futures markets for 95 cryptocurrencies with up to 50x leverage, featuring lower fees of just 0.05% of the position size and exempting rollover charges, unlike margin accounts.

• Margin trading accounts ( Opening/closing fee of 0.01% to 0.02%. Plus, 0.02% rollover fee every 4 hours.)

• Leveraged futures (0.05% without rollover fees)

- Regulatory compliance

- Diverse trading options

- Advanced trading tools

- Wide range of cryptocurrencies and trading pairs

- Geographical restrictions (Services not available in certain states for U.S. customers)

- Interface complexity

- Withdrawal delays

- Stricter KYC (Know Your Customer) procedures

• Offers a wide range of trading options, including spot, margin, and futures trading, suitable for different trading strategies and risk levels.

• Provides sophisticated trading features, customizable interfaces, and chart analysis to accommodate experienced traders.

• Adheres to regulatory standards, enhancing its trustworthiness and reliability for users worldwide.

• Implements robust security protocols such as multi-factor authentication and cold storage to protect user assets.

• Offers a sliding fee scale that decreases with increased trading volume, benefiting both small and large traders.

• Available in multiple regions across the globe, allowing a wide range of users to access its services.

• Supports over 230 cryptocurrencies and trading pairs, providing a variety of trading opportunities.

• Features an NFT marketplace with zero gas fees, enhancing the trading experience for NFT collectors and traders.

• Although restricted in some areas, offers staking services where users can earn rewards on their cryptocurrency holdings.

• Provides educational materials and support to help new users navigate the complexities of crypto trading.

3. KuCoin

KuCoin is suitable for traders looking to avoid liquidation risks. It provides leveraged token markets that don’t necessitate borrowing since the platform itself creates these markets. A variety of popular cryptocurrencies, including Bitcoin, Ethereum, Bitcoin Cash, Solana, and Arbitrum, are available for trading, with each offering being offered in both long and short markets.

Leverage options of 2x or 3x are offered, with the actual leverage slightly varying based on the market’s long and short positions. For instance, the Ethereum 3x long market presently provides leverage of approximately 2.992x. Beyond leveraged tokens, KuCoin caters to those interested in crypto futures.

The platform lists over 245 different contracts, spanning both USDT and USDC-settled as well as inverse contract markets, allowing settlements in the respective cryptocurrencies. On KuCoin, the highest leverage available reaches up to 100x, with starting fees for market takers at 0.06%, and potential discounts applied for higher trading volumes.

• Leveraged token markets without loans or liquidations

• Futures, including perpetual and inverse contracts. Supported cryptocurrencies depend on the contract type.

- Extensive cryptocurrency selection

- Competitive trading fees

- User-friendly interface

- Advanced trading features

- Security measures

- KuCoin earn

- Multi-language support

- Does not have a formal license to operate in the United States

- Past security breach

- Offers fewer options for purchasing cryptocurrencies with fiat than competitors

• Supports over 770 cryptocurrencies and 1300 trading pairs, providing a wide array of trading opportunities.

• Available in more than 190 countries, catering to a large and diverse user base.

• Offers spot trading, margin trading, futures trading, and leveraged tokens, catering to various trading strategies.

• Allows the automation of trading strategies using different types of trading bots, such as grid, futures, and DCA bots.

• Provides transparency by releasing proof-of-reserves reports, showing that user funds are safe and accounted for.

• Known for its easy-to-use platform, suitable for both beginners and experienced traders.

• Offers multiple earning opportunities through staking, savings, and other structured earning products.

• Offers low trading fees, with additional discounts for holding KuCoin tokens (KCS) and reaching higher trading volumes.

• Implements KYC and AML standards to ensure the security and legitimacy of its user base.

• Employs robust security measures, including encryption, multi-factor authentication, anti-phishing standards, and withdrawal address whitelisting.

Provides an all-encompassing web3 wallet for trading, storing NFTs, and tracking DeFi portfolios.

Offers various support channels, including live chat, a help center, and ticket-based support for resolving user queries.

New users can earn rewards by completing tasks such as making their first deposit or executing their first trade.

Offers VIP lending, market maker support, and rewards programs catering to institutional users.

Adheres to global KYC and AML standards, enhancing its credibility and trustworthiness.

4. MEXC

MEXC stands out as the prime choice for leveraged cryptocurrency trading. As one of the top exchanges by trading volume, MEXC saw over $1.5 billion in trades in the last 24 hours. It distinguishes itself by offering cryptocurrency futures without an expiration date, allowing traders to maintain leveraged positions indefinitely.

With leverage peaking at 200x, MEXC enables traders to leverage $100 into $20,000 of trading capital. It boasts a diverse array of leveraged futures markets, including major altcoins like Ethereum, Tether, Solana, Gala, Axie Infinity, and ApeCoin.

The platform accommodates both long and short strategies, facilitating profit-making even during market downturns. MEXC’s impressive liquidity and the capacity to process up to 1.4 million orders per second make it a standout. Moreover, it offers competitive fees, charging only 0.02% per transaction for leveraged futures trading.

For those engaging in spot trading, MEXC imposes no commission fees.

While KYC is not obligatory for all operations, it becomes necessary for fiat deposits or when exceeding a 24-hour trading volume of 80 BTC. However, traders should note that MEXC is not accessible in the U.S. or Canada.

Perpetual futures for Bitcoin, Ethereum, and popular altcoins.

- Global accessibility

- Extensive cryptocurrency selection

- High transaction capacity

- Competitive fees

- Native token advantages

- Strong security measures

- Educational resources

- Regulatory limitations, not available in the U.S. and Canada

- KYC policies less stringent compared to other exchanges

- Past security incidents

- Complex interface

- Limited fiat options

• MEXC serves users in over 170 countries, providing a broad market for various trading strategies.

• Supports over 1900+ coins, offering diverse trading opportunities.

• Capable of handling over 1.4 million transactions per second, it ensures a seamless trading experience.

• Offers a range of products, including spot, derivatives, and leverage ETFs, catering to different trading needs.

• Known for its low trading fees, making it cost-effective for frequent traders.

• Holding MX tokens offers various benefits such as trading fee discounts and access to special features.

• Its web interface is intuitive, suitable for both beginners and experienced traders.

• Implements robust security protocols to ensure the safety of user funds and data.

• Offers new users the chance to earn up to 1000 USDT worth of futures trading bonuses.

• Provides valuable learning materials and market insights for informed trading decisions.

5. OKX

OKX stands out as a premier platform for crypto leverage trading, particularly for options, although it currently caters only to Bitcoin and Ethereum. The platform boasts a comprehensive options chain featuring a broad array of expiry dates, along with a diverse range of strike prices for each maturity date.

Besides options, OKX extends its leverage trading to include other markets like perpetual futures and margin accounts, covering a vast selection of cryptocurrencies from Polygon and XRP to Solana, Dogecoin, Aave, and Cardano.

Regarding leverage limits, OKX provides up to 20x leverage in “full liquidation” mode, where your entire position is liquidated if it falls by a specific percentage.

Alternatively, “partial liquidation” mode allows for leverage of up to 100x. The fees for perpetual futures begin at 0.05% per transaction, while options fees start at 0.03%.

Bitcoin and Ethereum options

Perpetual futures

Margin accounts

- Global accessibility

- High security

- Advanced trading options

- Competitive trading fees

- Vast product range

- User-friendly interface

- Not available for U.S. audiences

- Delayed customer support

- Regulatory scrutiny

- The multi-tiered fee system, while beneficial for some, can be complex to understand for new users.

• Allows users to manage their cryptocurrencies and private keys directly within the platform with their integrated native wallet.

• Supports over 300 cryptocurrencies and 500+ trading pairs, offering a wide range of trading opportunities.

• Provides various DeFi strategies, such as staking crypto tokens and joining mining pools to generate passive income.

• Facilitates direct transactions between users, enabling them to buy and sell cryptocurrencies from each other.

• Offers a demo account that allows users to practice futures trading without risking real money.

• Enables users to purchase cryptocurrencies quickly using fiat currencies.

• Allows users to buy cryptocurrencies through third-party service providers like Banxa and Xanpool.

• A platform for investing in early-stage web3 and blockchain projects.

• Provides tools for easy conversion between different cryptocurrencies and fiat to crypto conversions.

• Enhances security through multiple layers of user authentication, including biometric identification and device fingerprinting.

• Allows users to engage in over-the-counter (OTC) trading before the official launch of a new token.

• Supports One Cancels the Other (OCO) orders, allowing traders to place two orders simultaneously and execute one based on market conditions.

• Demonstrates that user assets are backed on a 1:1 basis, adding an extra layer of transparency and trust.

• Supports over 50 fiat currencies and 70+ payment methods, including P2P, bank cards, bank transfers, and SEPA.

• Provides leveraged tokens without the need for collateral or margin maintenance, reducing liquidation risks.

6. Bybit

Bybit stands out as a significant player in the leverage trading market for cryptocurrencies, boasting over $37 million in derivates trades within the last 24 hours (as of March 14, 2024), thus providing substantial liquidity. The platform offers an array of leveraged trading options, including perpetual futures, with Bitcoin reaching leverage levels up to 125x.

While Bybit supports other cryptocurrencies like Ethereum, Solana, Dogecoin, and XRP, these typically have lower leverage limits. Traditional crypto futures are available as well, though limited to Bitcoin and Ethereum, with contract expiry dates spanning from December 2023 to June 2024.

Additionally, Bybit is recognized for its “inverse” contracts, differing from typical futures as they are settled and margined in the actual cryptocurrency instead of USDT. Fees on Bybit are competitive, starting from 0.055% for futures and 0.02% for options, with spot trading market takers being charged only 0.1% per transaction.

• USDT-backed perpetual futures

• Traditional futures and options cover Bitcoin and Ethereum

• Inverse contracts

- High leverage options

- Advanced derivatives exchange

- High transaction speeds

- Robust security measures

- Comprehensive educational resources

- Global accessibility

- Complexity for beginners

- Regulatory concerns

- Customer support issues

- Not available in certain regions like the U.S. and some parts of Canada

• Registered under the Bybit Fintech Limited entity in the British Virgin Islands, ensuring adherence to specific financial regulations.

• Utilizes a unique dual-price mechanism to address issues of market manipulation and to provide fair asset liquidation prices.

• Partnership with Borussia Dortmund: Engaged in a notable partnership with the Borussia Dortmund football team, showcasing its commitment to community and global presence.

• Introduced spot trading to its platform in 2021, allowing users to trade cryptocurrencies directly without leverage, broadening its appeal beyond just derivatives traders.

• Features additional elements like market sentiment indicators and trending sectors, providing users with more in-depth market data and insights.

• Allows users to swiftly convert one cryptocurrency to another, facilitating easier portfolio management.

• Simplifies the process of purchasing cryptocurrencies, making it more accessible for all users.

• Supports P2P transactions, enabling users to buy and sell cryptocurrencies directly with each other.

• Allows incremental purchases, enabling users to automatically invest in cryptocurrencies over time.

Offers a branded card that functions like a standard MasterCard debit, allowing payments using crypto balances.

Bybit Wallet supports interactions across multiple blockchain networks, enhancing its utility for Web3 activities.

Provides early access to new products and web3 projects, offering investment opportunities in emerging technologies.

7. Binance

Binance ranks as a top choice for leveraged cryptocurrency trading, offering support for over 400 cryptocurrencies, each with the option for leverage. Among its offerings, many traders opt for perpetual futures, with Binance providing up to 125x leverage on Bitcoin futures and varying levels for other cryptos, like up to 100x for Ethereum and 20x for Uniswap.

Another avenue Binance offers is leveraged options, where traders can pay a small initial fee, referred to as the ‘premium,’ and choose their strategy’s strike rate and expiration date.

Regarding fees, they vary based on the leveraged product and your trading activity over the month. For example, futures trading fees begin at just 0.05% per transaction, while options start lower at 0.03%. Beyond leveraged trading, Binance also provides spot trading markets, with commissions initiating at 0.01%.

Futures and options

- High liquidity

- Extensive range of trading pairs

- Advanced trading features

- Educational resources

- Global availability

- Regulatory restrictions

- Complexity for beginners

- Variable fee structure

- Recent regulatory scrutiny

• Binance Earn offers users various passive earning plans, including Simple Earn setups and BNB Vault.

• Binance Launchpad allows web3 startups to launch their tokens, providing users with early investment opportunities.

• Binance provides a platform for buying, selling, and trading NFTs, including unique digital assets.

• Binance enables users to participate in PoW mining by offering cloud mining services across multiple algorithms.

• Binance integrates with DEXs and DeFi applications, offering a bridge to decentralized finance.

• Offers crypto loans and asset management tools, supporting a broad range of digital assets for collateral.

• Provides over-the-counter trading for large transactions, avoiding slippage and ensuring price security.

• Binance caters to institutional users by providing API access to create advanced trading systems.

• Through Binance Academy, users have access to a vast array of learning materials and the chance to earn while learning.

Crypto leverage trading platforms compared

| Cryptocurrencies offered | Trading pairs | Max leverage | Countries supported | Leverage trading fees | |

| Coinbase | 240+ | 390+ | 10x | 170+ | 0% |

| Kraken | 240+ | 600+ | 50x | 190+ | 0.02% or 0.05% + rollover fees |

| KuCoin | 770+ | 1300+ | 100x | 190+ | 0.06% |

| MEXC | 1900+ | 2500+ | 200x | 170+ | 0.02% |

| OKX | 310+ | 640+ | 125x | 180+ | 0.05% (futures) and 0.03% (options) |

| Bybit | 560+ | 800+ | 100x | 160+ | 0.055% (futures) and 0.02% (options) |

| Binance | 400+ | 1500+ | 125x | 100+ | 0.05% (futures) and 0.03% (options) |

What is cryptocurrency leverage trading?

Cryptocurrency leverage trading involves using borrowed funds from an exchange to increase the potential returns on a digital asset like Bitcoin or Ethereum. Traders use various strategies, combining technical and fundamental analysis to predict market movements.

Leverage in any form of trading is a double-edged sword. Yes, it amplifies

Siam Kidd, crypto financial mentor and author of the bestseller “The Crypto Book”

your upside, but the downside edge is normally sharper.

Leverage amplifies both gains and losses, making risk management crucial. Futures derivatives are essentially bets placed on whether a crypto will go up or down. Futures allow you to achieve a much more substantial position than if you were to buy the same amount of tokens.

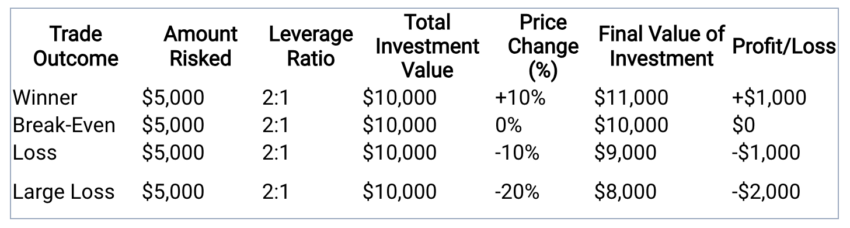

According to this simulation of Tradeciety, potential outcomes of margin trading with a 2:1 leverage (2x) ratio are major, with only a 10% price change.

Source: Tradeciety

Traders should employ stop-loss orders and understand the exchange’s order book to mitigate risks. While leverage can magnify short-term profits, it also increases the trading fee and potential losses.

Therefore, it’s essential to have a solid understanding of the crypto market and use payment methods approved in your jurisdiction. Before engaging in leverage trading, investors should thoroughly research and apply careful financial decision-making.

Types of crypto derivatives trading

Cryptocurrency leverage trading can take several forms, each offering different mechanisms and risks. Here are the main types:

- Traditional futures: These contracts have an expiry date. Traders agree to buy or sell a digital asset at a predetermined price on a specific future date. Leverage is also available in these contracts, allowing traders to amplify their positions.

- Perpetual futures: These are futures contracts without an expiry date. Traders can hold positions for as long as they want, as long as they can maintain the margin requirements. They closely mimic the spot price of the digital asset and allow high leverage.

- Options: Options give traders the right, but not the obligation, to buy (call option) or sell (put option) a cryptocurrency at a specified price (strike price) before a certain date. Leverage in crypto options trading comes from the ability to control large amounts of tokens with a relatively small capital (the premium).

- Leveraged tokens: These are ERC-20 tokens that represent a leveraged position in an underlying asset. They allow traders to gain exposure to leveraged positions without worrying about collateral, margin, or liquidation. However, they can be volatile and are subject to rebalancing events.

- Margin trading: This involves borrowing funds to increase the size of a position. Traders must maintain a minimum margin level, and if the market moves against them, they may face a margin call or liquidation.

- Inverse futures: These are futures contracts where the quote currency is a cryptocurrency rather than a fiat currency. They allow traders to hedge against price drops in the digital asset.

How does cryptocurrency leverage trading work?

Cryptocurrency leverage trading allows traders to amplify their market positions beyond their account balance. For instance, if you engage in crypto leverage trading by opening a $500 Ethereum position at 20x leverage, your effective market exposure increases to $10,000.

This method is popular among traders aiming to enhance profits without committing additional funds, using strategies supported by technical and fundamental analysis. However, the increased leverage magnifies both gains and losses. If the market moves unfavorably, positions can be liquidated, leading to a total loss of the initial stake.

Various platforms offer this type of trading, with options like perpetual futures, leveraged tokens, and both long and short positions, allowing for diverse trading strategies in both bullish and bearish scenarios. Traders should be familiar with the order book and trading fees and use proper deposit funds.

It’s crucial to conduct technical analysis, understand candlestick patterns, and have a solid strategy before engaging in leverage trading, especially in volatile markets like Bitcoin, Ethereum, and other altcoins.

Benefits and risks of leverage trading

Understanding both the benefits and risks is crucial before engaging in leverage trading. Remember it’s essential to have robust risk management strategies in place to mitigate potential losses.

Benefits of leverage trading

- Capital efficiency: Leverage allows traders to open larger positions with a smaller amount of initial capital, maximizing the potential return on investment.

- Market access: Traders with limited capital can access more expensive markets and assets, increasing diversification and opportunity.

- Profit potential: In favorable market conditions, leverage can significantly amplify profits from small price movements.

- Hedging: Leverage can be used to hedge other investments, protecting against market downturns by opening opposite positions.

- Short selling: Leverage enables traders to short-sell, profiting from declining prices by borrowing and selling high, then buying back lower.

- Strategic trades: Allows for more complex trading strategies, such as spread trading or pairs trading, that may require leveraging multiple positions.

Risks of leverage trading

- Amplified losses: Just as leverage can amplify profits, it can also amplify losses if the market moves against the trader’s position.

- Margin calls and liquidation: If the value of the position falls below a certain level (margin requirement), traders may face margin calls requiring additional funds or face automatic liquidation.

- Market volatility: High leverage can be particularly risky in volatile markets, leading to rapid losses and liquidation.

- Interest costs: Holding leveraged positions overnight can incur interest costs, eating into potential profits.

- Complexity and overtrading: Leverage trading is complex and might encourage overtrading or taking poorly thought-out positions due to perceived low entry costs.

- Counterparty risk: In leveraged trading, there is a risk associated with the lender or platform, which could affect the trader’s position or funds.

- Psychological pressure: Leveraged trading can induce stress and lead to irrational decision-making due to the potential for high losses. Make sure to learn how to master your crypto trading emotions.

Leverage trading vs. margin trading

Leverage trading and margin trading are popular methods in the crypto trading community, often employed by those looking to capitalize on the volatile nature of digital assets.

/Related

More ArticlesBoth involve borrowing funds to increase potential returns, but they cater to different trading strategies and risk management approaches.

Leverage trading

- Definition: In crypto leverage trading, investors borrow funds to increase the size of their trade, amplifying potential profits. For instance, using 10x leverage, a $1,000 investment controls a $10,000 position.

- Pros: High leverage magnifies profits on successful trades, suitable for short-term trading strategies, and allows traders to capitalize on small price movements.

- Cons: Amplified losses can exceed the initial deposit, leading to rapid liquidation in volatile markets. This requires constant vigilance and effective risk management techniques, such as setting stop-loss orders.

- Best for: Experienced traders who perform technical analysis and have a clear understanding of market trends. This method is favored in fast-moving markets like crypto, where candlestick patterns and fundamental analysis play crucial roles.

Margin trading

- Definition: Margin trading involves borrowing funds to trade a digital asset, using the asset as collateral. Unlike leveraged trading, margin involves a more conservative borrowing level, usually up to 5x.

- Pros: Provides additional capital for trading without requiring full investment upfront; is suitable for both long and short positions; offers the opportunity to diversify trading strategies.

- Cons: While less risky than high-leverage trading, losses can still exceed the initial investment. Interest fees on borrowed funds can reduce profits.

- Best for traders looking for moderate amplification of their positions, longer-term positions, and those implementing detailed risk management practices.

Both trading forms require users to open an account on an exchange offering these services, with adherence to risk management being paramount.

While leverage trading suits those seeking aggressive, short-term gains, margin trading is preferred by those aiming for steadier, more calculated exposure.

Note that payment methods for deposit funds vary by platform and location. Traders in the United States need to ensure their chosen exchange complies with local regulations.

Regardless of the type of trading chosen, traders should use technical analysis, understand the order book dynamics, and adhere to strict trading fee and risk management principles to navigate the volatile crypto market effectively.

What to look for while picking the best crypto leverage trading platforms

When selecting the best crypto leverage trading platform, you should consider several key factors to ensure a safe and positive experience. These include the integration of trading analysis tools like the RSI indicator and the ability to recognize patterns such as the Wyckoff pattern and the “bull flag” pattern.

Always remember that leverage trading involves high risk, so start with small investments and never invest more than you can afford to lose. Be wary of the “falling knife” scenario in volatile markets.

Regulatory compliance and security

Ensure the platform complies with regulations in your country, especially if you’re in the United States. A platform adhering to legal standards is more likely to offer secure trading environments. Check for security features like two-factor authentication (2FA), cold storage for digital assets, and insurance against cyber theft.

User interface and support

Newcomers should opt for a platform with an intuitive interface and robust educational resources. This could include tutorials, guides on grid trading, and demo accounts for practicing free crypto trading without real funds. Effective customer support, accessible through various channels, is crucial for addressing any questions or issues.

Leverage limits and terms

Different platforms offer varying leverage levels. While high leverage can lead to significant gains, it also increases risk. Start with a platform offering lower leverage options (like 5x or 10x) to manage risk better while learning the fundamentals.

Trading fees

Understand the fee structure, which can include trading fees, overnight fees, and withdrawal fees. Lower fees can significantly impact your profitability, especially when starting. Consider the cost-efficiency of your trading strategies.

For instance, DeFi platforms may offer a lot more assets than centralized crypto exchanges. But in the DeFi realm, you might need to know about additional transactions and fees, such as crypto slippage.

Liquidity and order book depth

High liquidity is crucial as it means your orders are more likely to be executed at desired prices with minimal slippage. To ensure efficient trade execution, thoroughly check the platform’s order book depth and overall market liquidity.

Understanding how to trade cryptocurrency effectively involves analyzing these liquidity indicators before executing trades, which can significantly impact your trading outcomes.

Asset variety and trading pairs

Look for platforms offering a wide range of cryptocurrencies and trading pairs. This allows more flexibility in trading strategies and the opportunity to diversify your portfolio. Understanding a variety of digital assets can enhance your trading experience.

Risk management tools

Seek platforms that provide risk management tools like stop-loss orders, which can help mitigate losses when the market moves against your position.

Crypto trading bots can be beneficial for automating trading strategies. It’s important to ensure the platform offers legitimate and effective bot services, especially when engaging in leverage trading.

Deposit and withdrawal options

Evaluate the platform’s payment methods for depositing and withdrawing funds. Ensure there are convenient and cost-effective options available to you, and understand any deposit or withdrawal limits. This will help you manage your funds effectively and execute your trading strategies without unnecessary delays.

Community and reputation

Research the platform’s reputation within the crypto community. Read reviews and testimonials from other users, especially those who are also new to leverage trading. A strong community can also provide support and learning opportunities, enhancing your understanding of market trends and risk management techniques.

Know the risks

Navigating the world of crypto leverage trading requires a blend of knowledge and caution, especially for newcomers. It’s vital to approach trading strategies with a clear understanding, employing both technical and fundamental analysis to guide decisions.

Risk management should be at the core of your activities. Familiarize yourself with candlestick patterns, market indicators, and the crypto fear and greed index to better anticipate market movements.

Ensure you select a reputable exchange offering detailed educational resources and robust customer support. Lastly, whether dealing with any digital asset, always start with short-term trades to build your confidence and experience. By adhering to these guidelines, you’ll set a solid foundation for successful leverage trading in the dynamic world of cryptocurrencies.

Frequently asked questions

What is leverage crypto trading?

What is 100x leverage on crypto?

What is the best leverage for crypto?

What is 20x leverage in trading?

Is 10x leverage risky?

What is a good leverage for a beginner?

What is the best platform for crypto trading in 2024?

Which crypto has the highest leverage?

Which exchange is best for leverage crypto trading?

Which crypto is best for leverage trading?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.