Dollar-backed, commodity-backed, and even smart contract-backed algorithmic stablecoins exist in 2024. Yet, prior to Ethena Protocol, no one has introduced the concept of a synthetic dollar, where the protocol relies on novel technologies like delta-hedging and tried-and-tested entities like ETH to maintain the dollar peg. Ethena Protocol aims to change the DeFi landscape with its USDe token, promoted as a censorship-resistant synthetic dollar with innovative use cases.

This guide delves deep into what Ethena Protocol stands for, what it offers, and the ground-breaking technologies introduced by Ethena Labs — the firm behind the protocol.

Methodology

When recommending any exchanges or brokers to readers, BeInCrypto conducts stringent testing of all platforms over a number of months. In this case,BeInCrypto thoroughly assessed Coinbase, in particular focusing on the platform’s user experience and security measures.

Our product teams assessed the security measures implemented by Coinbase, including but not limited to two-factor authentication (2FA), cold storage of funds, and encryption protocols.

We reviewed past security incidents and the platform’s response to mitigate risks and protect user assets.

BeInCrypto product teams also tested the platform’s interface, ease of use, and accessibility across different devices.

We considered factors such as account setup process, deposit and withdrawal methods, and availability of customer support.

Coinbase came out as the leading option as a reliable and trustworthy centralized exchange which supports USDe. The platform prioritize a seamless user experience and provide educational resources for beginners.

To learn more about BeInCrypto’s verification methodology and product testing, click this link.

Buy USDe on Coinbase

- Buy USDe on Coinbase

- Unpacking the Ethena Protocol

- The Internet Bond by Ethena Finance

- What is Ethena USDe?

- Buy USDe on Coinbase

- Understanding Delta Hedging: Ethena’s novel take on stability

- How do you mint USDe on the Ethena protocol?

- What are Ethena Shards?

- Is USDe similar to Terra’s UST?

- Risks associated with the Ethena protocol USDe

- The future of staked ETH and scalable dollar

- Frequently asked questions

Unpacking the Ethena Protocol

Ethena Protocol, led by Ethena Labs, is behind the USDe token concept. As of Feb. 27, 2024, the USDe token or cryptocurrency has already climbed to the ninth position as per CoinGecko’s ranking of global stablecoins by market capitalization.

Still, it is worth mentioning that Ethena Labs refrains from calling USDe a stablecoin. Hence, the term “Synthetic Dollar”.

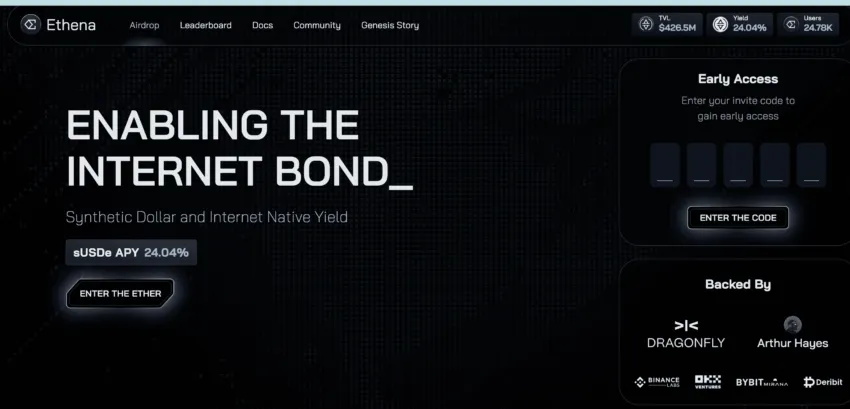

With USDe, Ethena Protocol aims to liberate the DeFi space with its novel Ethena Finance setup. The web-based Ethena Finance interface transforms ETH into a yield-bearing synthetic dollar via the USDe token.

Moreover, the USDe token isn’t the only thing that Ethena Labs has pioneered.

The protocol started with $6 million in funding as part of its seed round and then raised $14 million, bringing the 2024 valuation to $300 million.

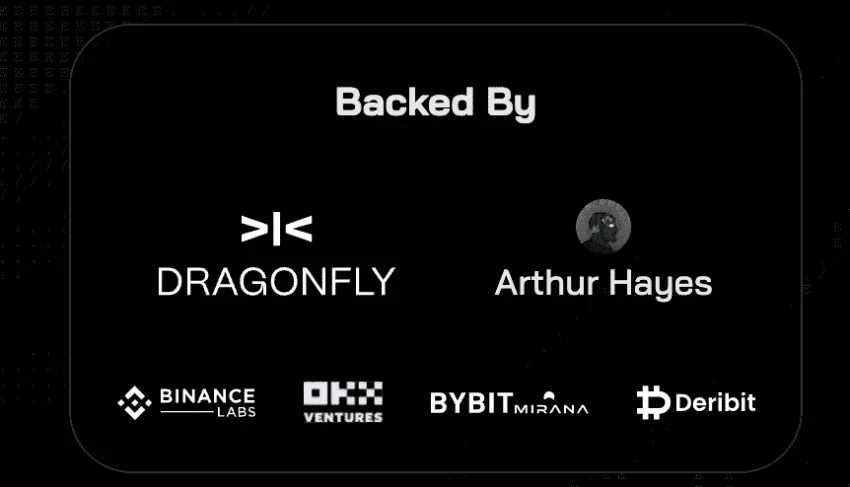

Did you know? Ethena Protocol has attracted investments from prominent names in the investment space, including the likes of Arthur Hayes, Brevan Howard Digital, Dragonfly Capital, and more.

The Internet Bond by Ethena Finance

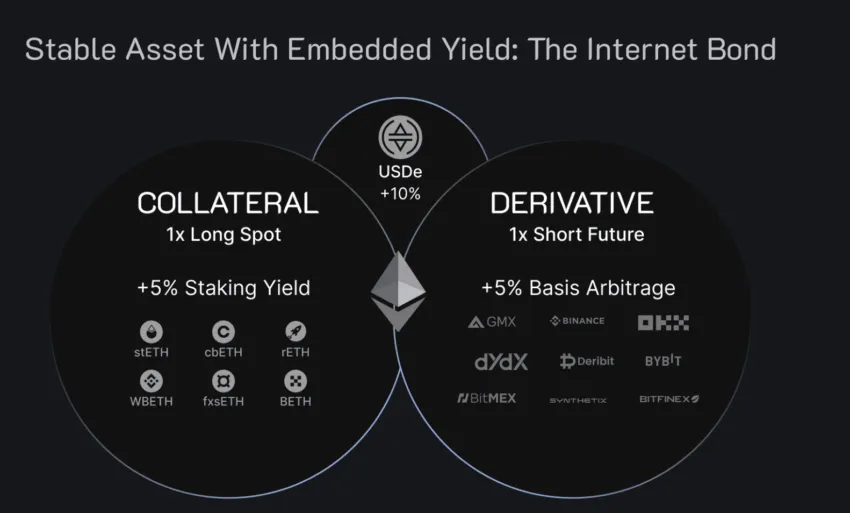

Ethena Finance issues the Internet Bond, a financial instrument meant to democratize investment opportunities and the concept of savings. The internet bond is a high yield-generating concept that comes as a by-product of the USDe token, combining yields from the derivatives markets and staked Ethereum.

Simply put, Ethena Labs’ aim to maintain the USDe peg rests on the shoulders of staked ETH and the derivatives market. And these concepts are not just peg-maintaining options but also massive yield generators.

“The team has been blown away by the interest in @ethena_labs only 5 days into our launch, and we are attempting our best to balance: i) a responsible, controlled and secure roll out of the product ii) with being fair, transparent and upfront with our users.”

Guy Young, aka Leptokurtic, Founder of Ethena Labs: X

The crucial elements of the Internet Bond

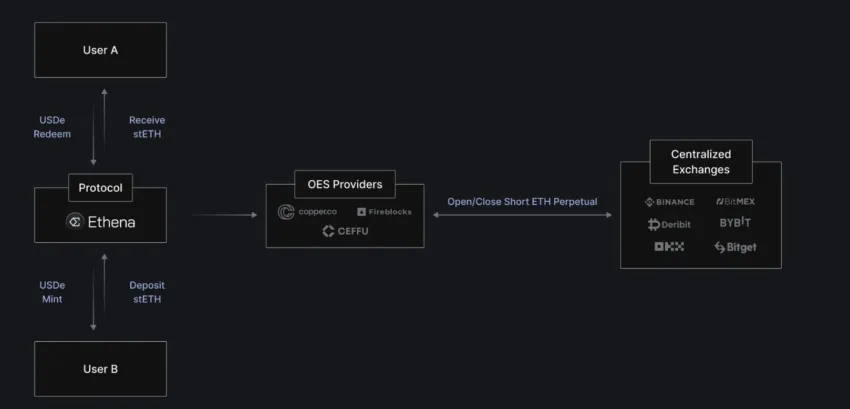

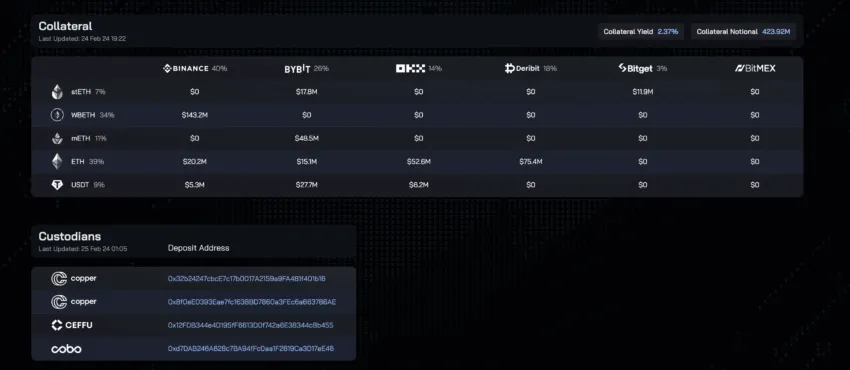

If you wish to look at the Internet Bond from a more technical perspective, several elements are involved. Firstly, it is based on the concept of off-exchange settlement, where centralized liquidity sources, or rather CEXs, are utilized while adhering to the principles of on-chain custody.

So when you lock LP tokens and mint USDe, the locked LP tokens are sent to off-exchange settlement providers or custodians, like Copper.co, Fireblocks, and more. These create receipts, which can be used on CEXs for opening and closing the short ETH perpetual positions. We discuss this further in the USDe peg maintenance section.

Here’s a practical example.

Imagine you have an online piggy bank where you put digital funds. The piggy bank is digitally locked and only opens when you and the bank agree. The bank here is akin to the OES provider. The piggy bank itself issues receipts, which you can use to purchase gifts, food, and other items from the store without directly showing the service providers your digital funds.

What is Ethena USDe?

USDe is at the heart of the Ethena Protocol. Additionally, it runs the Ethena Finance ecosystem by generating yields. Let us now delve deeper into what USDe is and how it works.

As the Ethena protocol is built on top of the Ethereum blockchain, USDe qualifies as an ERC-20 cryptocurrency.

USDe is marketed as a synthetic dollar, ensuring scalability, stability, and resistance against the TradFi censorship. With USDe, which isn’t a run-of-the-mill stablecoin, Ethena Labs aims to open a more accessible financial system.

USDe is fully backed by ETH, which is used as collateral. Of course, the price of ETH can be volatile, and Ethereum alone might destabilize USDe’s peg to the dollar. But Ethena Labs have considered this already, adding another innovative stability mechanism — Delta Hedging — into the mix.

Buy USDe on Coinbase

Understanding Delta Hedging: Ethena’s novel take on stability

USDe might be a synthetic dollar, but for the sake of understanding, let us call it a stablecoin expected to maintain its peg to the USD. Ethena employs the delta hedging strategy to keep the peg intact. This financial strategy isn’t exactly algorithmic. Instead, it is a standard TradFi method where specific positions are incrementally hedged for risk mitigation.

In the case of USDe, staked ETH is the collateral. However, if the price of ETH drops suddenly, USDe might be vulnerable to systemic risks. In this scenario, an ETH price drop leads to a quick de-peg, forcing others to withdraw their ETH, leading to an implosion. This is something that was witnessed with UST — the Luna ecosystem stablecoin.

Therefore, having ETH alone as the collateral wouldn’t cut it. So Ethena Labs introduced delta hedging, where Ethena also takes a short position in ETH or ETH-based derivatives. If the price of ETH goes down, the short positions become rewarding, making the peg stand offset the ETH price erosion.

Note: Ethena opens a 1:1 short ETH position on the deposited collateral. No leverage is involved; therefore, it adds another line of credibility.

/Related

More ArticlesThe delta hedging strategy aims to make things delta-neutral, ensuring that the portfolio value of the firm remains intact despite the smallish ETH-based price changes. Do note that Ethena Finance’s Internet Bond also derives its profitability from the delta hedging strategy.

Even though the primary task of delta hedging is to neutralize risk, strategies like options premium collection and exploiting the price differences, courtesy of carry or even basis trades, can generate yields — something that the Ethena protocol promises.

USDe and the associated tradability

USDe isn’t just an entity pegged to the dollar. In fact, it aims to be highly tradable across DeFi platforms like Curve. It also serves as a bridge between digital assets and traditional fiat currencies, courtesy of the synthetic dollar tag.

As USDe can be staked, it is a compelling asset to lend and trade across yield farming and liquidity provisioning avenues. And yes, this brings another use case for those holding ETH and planning to maximize its potential.

USDe and the earning opportunities

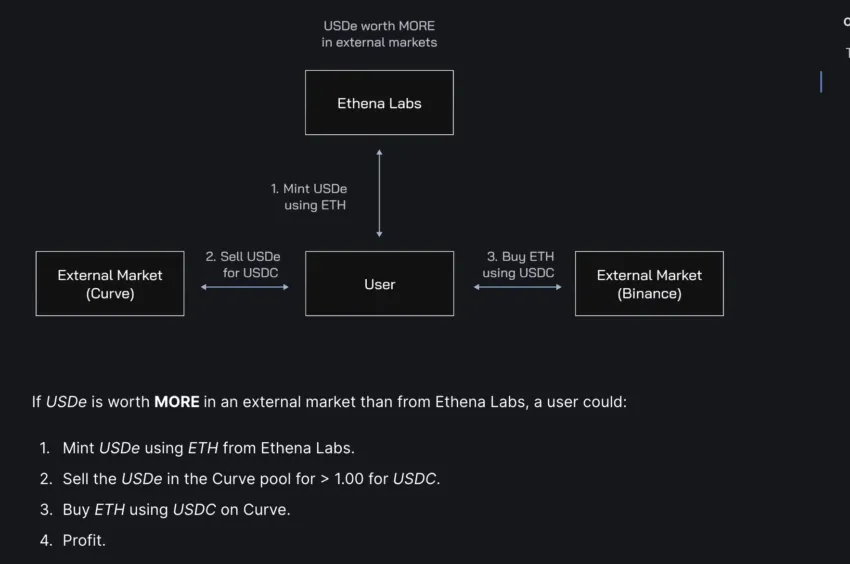

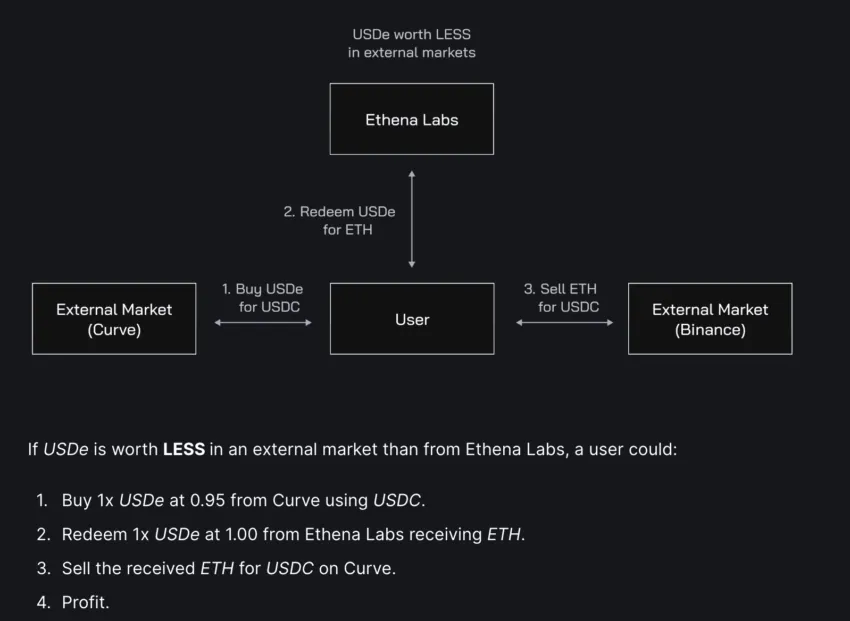

USDe, the synthetic dollar, offers significant earning opportunities to the participants. Firstly, locking USDe for sUSDe can generate yields as high as 27.6%. Besides that, if and when USDe trades on external markets and the prices turn volatile, there are peg arbitrage opportunities.

These opportunities can help participants earn a significant profit, all while contributing towards maintaining the stability of the Ethena protocol.

How do you mint USDe on the Ethena protocol?

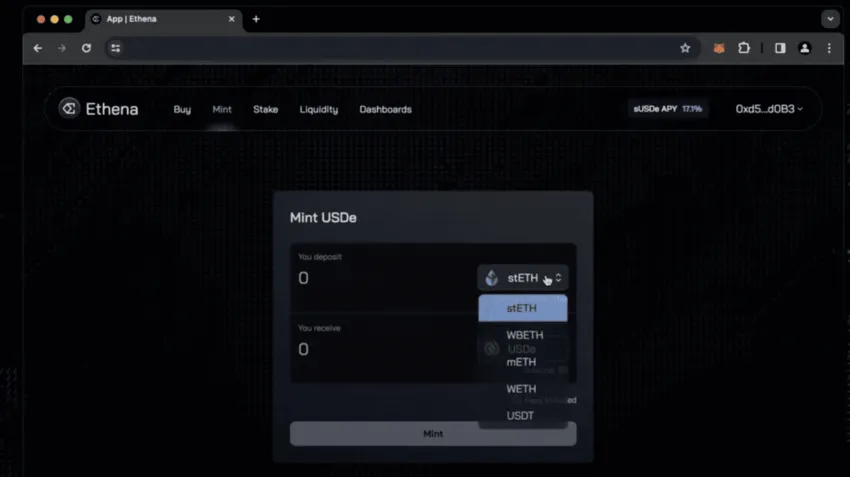

Minting USDe is about sending the right kind of staked ETH as the backup asset. Or, you can even use USDT to mint USDe as it is the nearest representation in terms of face value.

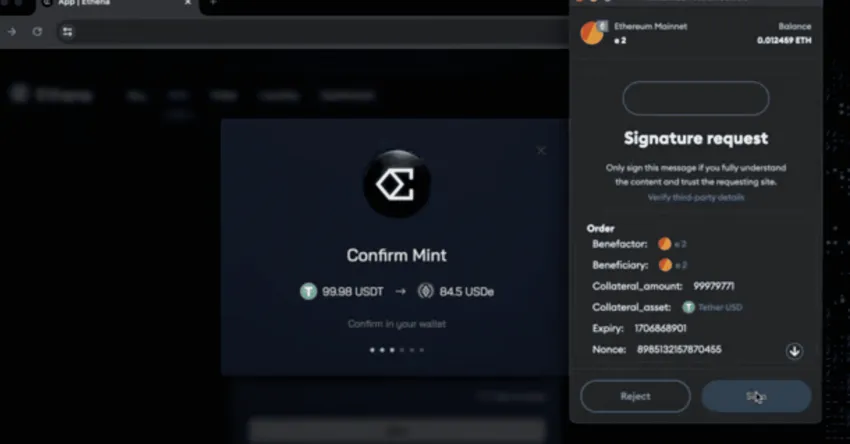

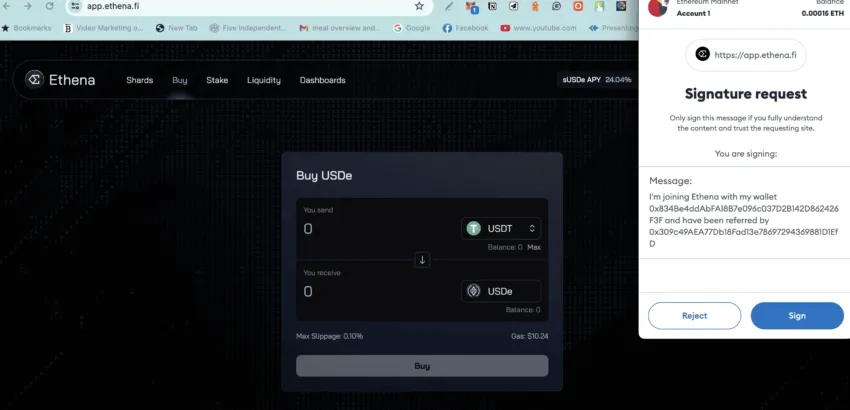

First, zero in on the right minting asset and approve the mint by connecting the right wallet. In this example, we’ve used MetaMask, which will let you acquire USDe tokens. Do note that USDe tokens can be further staked within the Ethena Finance ecosystem to stabilize the economy and even earn rewards in the process.

Here is a quick step-by-step guide:

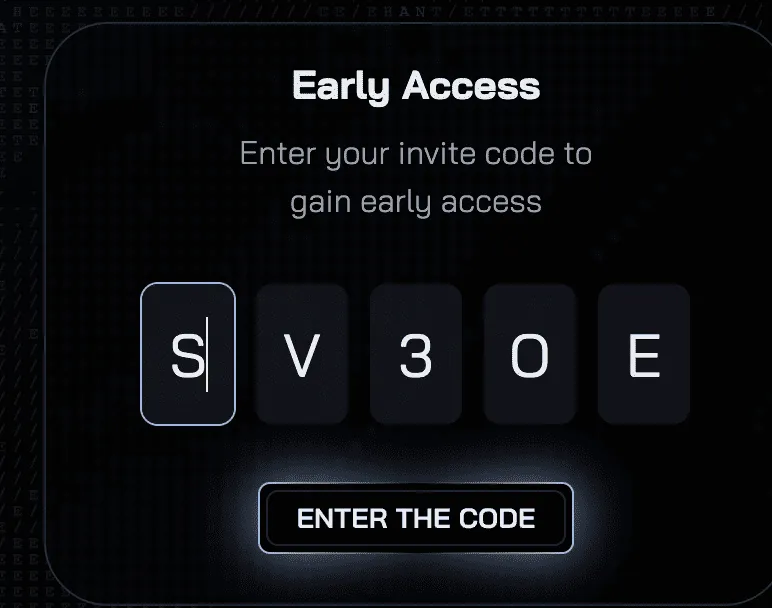

- Access Ethena.fi and enter using the referral code (You can use BeInCrypto’s invite code to join: y1rj8)

- Once done, connect your wallet — MetaMask, in this case.

- Select the minting option, which shows right at the top, depending on whether the protocol is allowing new mints. You can choose from LP tokens like stETH, or USDT.

- Specify the amount of collateral you want to use for minting.

- Lock the collateral by hitting “Mint” and approving the transfer.

- The MetaMask UI will then ask you to provide the digital signature — EIP712 style signature.

- Once signed, USDe will be available, corresponding to the asset value.

Here is a thread identifying the key USDe and sUSDe balances:

You can even buy USDe using other stablecoins. For that, too, you would need to connect the wallet and pay the gas fees.

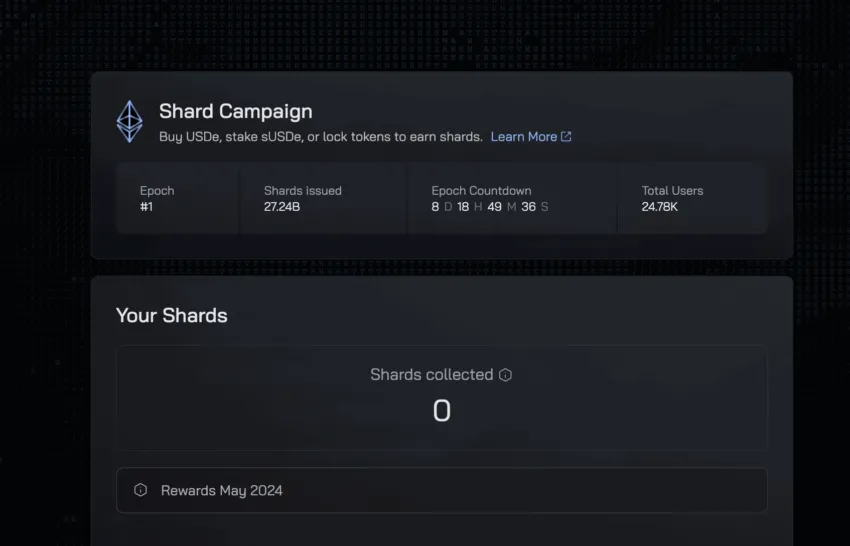

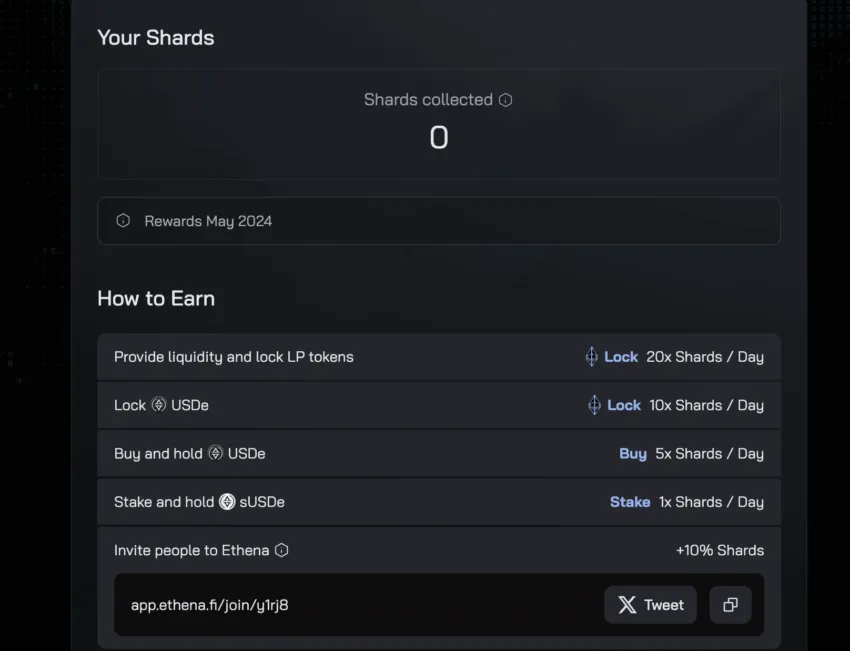

What are Ethena Shards?

Firstly, Ethena Shards has nothing to do with the “Sharding” principle for enhancing blockchain scalability. Instead, it is part of Ethena’s Shard Campaign, which fosters engagement and community involvement. You can consider it a reward program for undertaking activities within the Ethena protocol.

Here is the list of activities and the corresponding Shard credits.

Shards and Epochs: How do they connect?

As mentioned, Shards are like points assigned to users following the completion of certain tasks. However, these shards encompass multiple development phases within the Ethena ecosystem, with each phase named an Epoch. Hence, shards belong to Ethena’s multi-epoch architecture, which, unlike the technical elements like USDe and delta-hedging, is more focused on community building.

Do note that the Shards campaign might very well be a stepping stone or, rather, an eligibility metric for the Ethena token airdrop if and when it arrives. The epochs would then be measured as the qualifying steps for an airdrop that brings more to the table than just a delta-neutral stablecoin — USDe. However, this is all speculative as of late February 2024.

Further, taking the mainnet USDe and using it on Curve or any other DeFi platform to provide liquidity may help improve possible Ethena token airdrop eligibility.

Is USDe similar to Terra’s UST?

It makes sense, to an extent, that parallels between USDe and Terra UST are drawn. Here are the insights that imply similarity:

- The stablecoin or USD-pegged nature

- Big talks about DeFi integration

- Yield generation mechanisms with USDe depositors promised up to 27.6% APY, similar to what Terra’s Anchor protocol promised to the UST depositors at 19.5%

But that is where the similarities end. Here is how USDe differs from UST:

- The fundamental difference is that UST is/was algorithmic, rebalanced with the LUNA token, whereas USDe has actual collateral backing it, stored in off-exchange custody accounts and not exchanges.

- UST’s pegging, or rather stability mechanism, was code-bound, whereas USDe actually employs traditional Delta-hedging techniques to offset ETH’s price volatility.

- UST’s way of generating yields was dubious — borrowing/lending, liquid staking rewards, and seigniorage. In contrast, USDe clearly mentions how delta-hedging and smartly navigating the shorting Ether strategy can help generate yields as high as 27.6%. Plus, even ETH staking rewards are involved.

The earning options associated with USDe are clearly highlighted by the Ethena protocol.

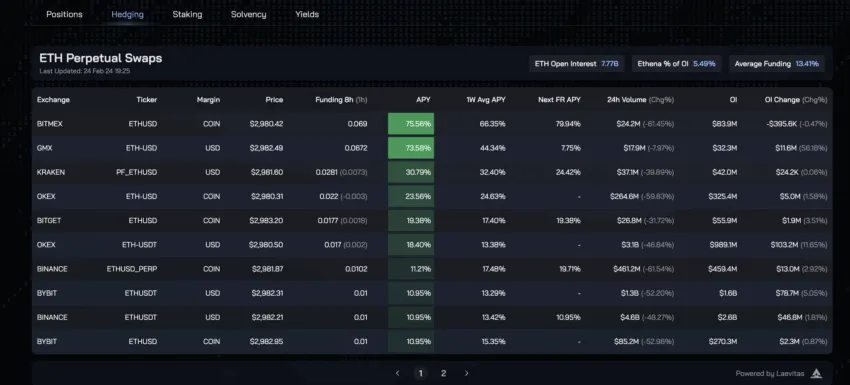

Also, Ethena, while promising the said yield levels, has taken the historical average of the stETH yield and the open interest-based funding rates, all while keeping the derivatives in mind. This is how this can be charted:

Risks associated with the Ethena protocol USDe

USDe isn’t risk-free. Upon further inspection, here are the anomalies that we detected:

Funding risks

While opening and closing short ETH derivatives positions on exchanges, it is important to note the nature of funding rates. Negative funding rates are not beneficial as the shorts need to pay the longs, making shorting Ether less favorable. If the negative funding issue persists, the Ethena protocol has a $10 million insurance fund in place. However, things could go wrong if the funding rates remain negative for a longer period.

A risk mitigation strategy

Having a dynamic insurance fund that adjusts itself based on market conditions could be a good approach. This might involve utilizing smart contracts.

Liquidation risk

Even though the Ethena protocol’s delta hedging is meant to handle liquidation risk, concerns might show up if the price of ETH drops significantly within a short span.

Custodial risk

This risk concerns the OES services like Fireblocks and their business models.

Exchange failure risks

Short derivatives positions are opened on CEXs. However, sudden unavailability during periods of withdrawal can be detrimental. This might be the reason why the claiming USDe process has a seven-day escrow period.

Collateral risk

Another issue could be the possible price difference between the likes of stETH and ETH. However, Ethena has mitigation plans in place, as it lists a wide range of LSTs within the broadest possible industry support.

Even though Ethena seemingly has these risks covered for now, it will be interesting to see how things unfold in the future.

Here is a detailed thread on USDe and Ethena’s risk profile:

The future of staked ETH and scalable dollar

With protocols like Ethena and Eigen Layer, ETH holders are finding yield-generating use cases for the Ethereum blockchain. However, the Ethena Protocol goes one step further with its synthetic dollar in USDe, aiming for a novel decentralized financial solution. Even though the concept isn’t without its share of risks, it is still novel courtesy of innovative strategies like the Peg arbitrage setup, Internet bond, delta hedging, shards, and more. It will be interesting to see how these mechanisms and the Ethena protocol evolve in 2024.

Frequently asked questions

How does USDe maintain its peg to the U.S. dollar?

What are Internet Bonds, and how do they work?

Can I mint USDe using my staked ETH?

What risk mitigation strategies does the Ethena protocol employ?

Is USDe a stablecoin?

How does Ethena challenge the traditional banking system?

What is the Ethena protocol whitepaper?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.