When one steps outside the zone of safe investing, it is not accompanied by proper emotional safeguards. When it comes to crypto trading emotions, the investing territory — crypto assets — is inherently volatile, often leading to crypto depression.

Although crypto trading has become lucrative for many, it’s important to not let your emotions get the better of you. Before we explore what coping and preparatory strategies you’ll need, let’s first examine what makes crypto trading so emotionally draining.

Want to ask a PRO trader a question? Join BeInCrypto Trading Community on Telegram: read the hottest news on crypto, discuss currencies, ask for technical analysis on coins and get answers to all your questions from PRO traders & experts! Join now

The dangers of crypto investing

It is a well-known fact that penny stocks pose an investment risk. This is due to a few key reasons: low liquidity, lack of information, and small market capitalization. The same applies to crypto trading as well.

Even the top cryptocurrencies are volatile

Outside of major assets, cryptocurrencies often have small market caps, and often the developers themselves are either anonymous or pseudonymous. This can lead to price volatility, on top of the crypto market’s general volatility. After all, code can be copied, tweaked, and launched under a new name.

This is how dogecoin emerged onto the scene, over the weekend, according to its creators Palmer and Markus. Hard forks are also quite common, ethereum classic from ethereum and bitcoin cash from bitcoin, to name a few. On top of the volatility, we also have external factors that affect even top assets like bitcoin.

We’ve seen single tweets in the past drastically affect the market. The quick nature of events in the crypto space coincides with the viral nature of social media. Millions of people can sell BTC if someone significantly expresses negative sentiment.

This happened recently when BTC eventually cascaded down, leaving bitcoin to struggle at $30k resistance level for over a month. Meanwhile, the cooler heads — the ‘strong hands’ — were taking advantage of this and kept buying the dip. After all was said and done, crypto traders expressed deep regrets, as shown in a recent survey conducted by Crypto Vantage.

Clearly, misunderstanding the market, FUD (Fear, Uncertainty, Doubt), and putting hopes into a single asset are rookie mistakes. The latter is especially egregious since diversifying one’s portfolio is the staple of stock trading since its invention.

Margin and options crypto trading

Sitting on an asset with great expectations is one thing, but betting on its specific price move is another altogether. Such an active trading strategy can lead to overnight riches, but also to the crippling of emotions.

For instance, depending on the exchange of your choice, you can leverage your market entry by up to 300X. Therefore, if you margin trade $50 times 300, you enter the market at $15k. If the crypto goes up, you can set up an automated Take Profit (TP) order at a certain percentage. However, if the price goes down since your entry, you would have to continually top the funds in order to avoid margin calls and in the hopes the price will go up.

/Related

More ArticlesThis could be exceedingly addictive and leave you with depleted funds far beyond the measly $50 you leveraged. Likewise, crypto options trading — betting the price will long or short can place you in a bind as well.

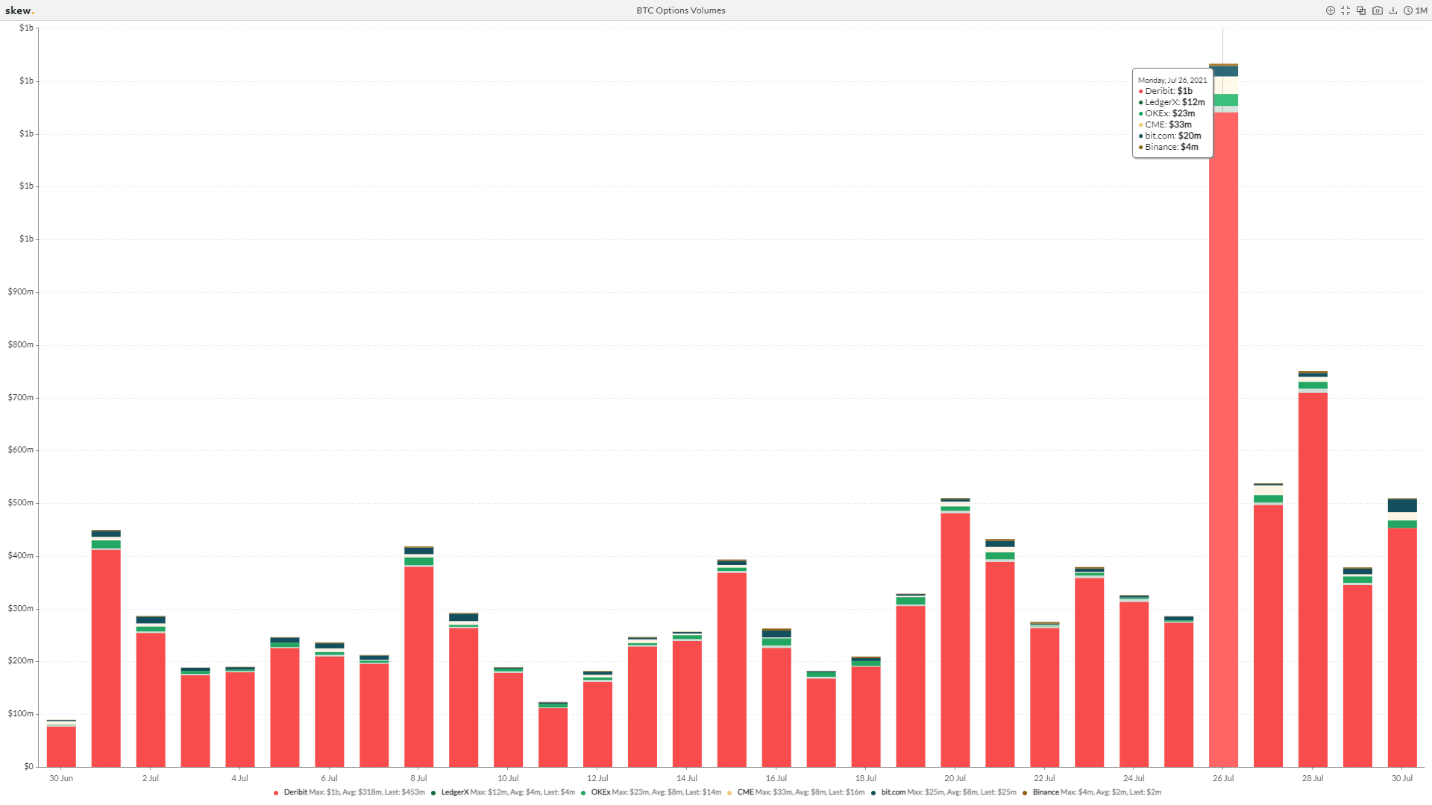

Over 887,000 options traders had to liquidate $1.2 billion worth of BTC in July, 92% of which were short positions. They misunderstood the market and placed a bet that BTC price would go down, instead of rallying, which turned out to be the case. We could go through these cases of wins and losses all day long.

The question that necessarily poses itself, how can you minimize your loss risk to such an extent that crypto trading emotions don’t even enter the equation?

How to subdue crypto trading emotions

What is the primary reason crypto traders lose their heads? Simply put, their monetary stake is equal to their emotional stake. They don’t perceive their assets as funds but what they could be — a car, house, or a future without debt.

This is a fundamentally wrong mindset with which to approach crypto trading. Here are some steps to avoid crypto trading emotions that will sabotage you.

1. Prepare for loss

While there are degrees of safety in investing, funds in crypto shouldn’t be a last-ditch effort towards financial freedom. Instead, the funds should already be viewed as lost. Imagine the money you spent to buy crypto, and consider them evaporated, flushed down the toilet or what have you.

This leaves your emotional state detached from your investment. Any positives that happen then are happy coincidences, while losses are completely expected and accepted. Consequently, crypto trading emotions never enter the equation when to exit the market. In practice, this means you should start small to build confidence, only putting in as much as you can lose.

2. Validate FUD information

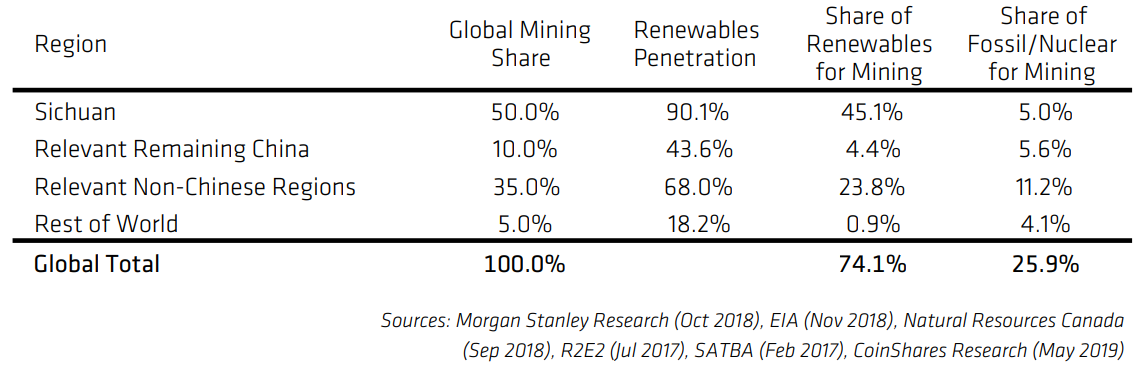

Let’s take Elon Musk’s tweet as an example again. Long-term BTC holders, prior to 2021, were not much fussed about it because they understand bitcoin’s fundamentals. They know that 74% of its mining network comes from renewables, as seen in a 2019 report. They also understood that China’s crypto mining ban was a positive development because it would westernize and decentralize the network.

This was the case as Fidelity Investments bought a 7.4% stake in Marathon Digital Holdings. This is one of the biggest bitcoin mining operations in North America, poised to increase its output by five times. Then, there is the core reason to remain confident in bitcoin — never-ending money printing by the Federal Reserve and soaring inflation.

As long as the stock market is high, the Federal Reserve will have to keep printing money to keep it stable. Deflationary assets will benefit the most from this dynamic, which is another reason to take a long-term bearish view on bitcoin as a deflationary cryptocurrency outside the federal monetary system.

Accordingly, while panic-sellers hurled toward the door busted open by Elon Musk, HODLers welcomed the dip to buy more BTC at a discount. The lesson then is two-fold:

- Understand the underlying value of an asset you are investing in.

- Emotionally detach yourself from your investment by already considering it a loss.

This way, when FUD happens, you’ll have time to think about it, and do more research before selling.

3. Distribute your potential loss

In the stock market, investing in the blue-chip S&P 500 ETF index is already considered diversified enough. After all, it covers the most stable companies from manufacturing and tech to the hospitality service and banking. Indeed, over time, the S&P 500 went upwards, always able to count on the Federal Reserve for extra monetary injections.

Decentralized crypto space has no such luxury, so each crypto asset should be viewed based on its own merit. For instance:

- Bitcoin as a widely adopted, hard deflationary cryptocurrency

- Ethereum as both a cryptocurrency and a DeFi infrastructure to host DeFi protocols that recreate traditional financial infrastructure

- Chainlink as the provider of off-chain world data to on-chain smart contracts

- Axie Infinity as a blockchain game with its own NFT and farm-yielding ecosystem

With so many assets, your evaluation must consider the unique proposition, team, its history, and competitors. Then, you select about five that show the most promise across different categories and put them into a diversified investment basket. Correspondingly, their price fluctuations spread out to minimize potential losses.

4. Practice makes confidence

Most investors settle for holding crypto assets and diversifying, applying the adage “don’t invest more than you can lose.” However, if you’re willing to adopt the active approach of high-frequency (margin) crypto trading, you’ll need to know technical analysis.

Many exchanges have demo accounts filled with virtual funds to apply your knowledge before using real money. By understanding the technical indicators across different charts, you’ll be able to correctly interpret certain patterns. Sometimes, those patterns can lead astray, but more often than not they provide a lucrative opportunity.

Nonetheless, even if you grasp technical analysis entirely, you must know that you’ll never be able to predict the future. They are called indicators for a reason, not fortune-tellers. It is better than gambling, but still rife with risk. Just like the stock market, most traders become successful by using one strategy and exploiting it repeatedly.

5. Learn from both losses and wins

When a trade loss inevitably happens, type it down step-by-step how it transpired. Did you misread a technical indicator? Apply the wrong one for the situation? Did you veer off the plan and get too greedy?

If you did everything correctly, maybe your assumptions about your trading strategy were wrong. Furthermore, when you lay it all down for wins as well, you will sometimes notice that you won because you got lucky. Basing your strategy on flukes is then a sure recipe for greater losses down the line. This is why it is even more important to analyze your trading logic for successful trades.

First, to improve on the recipe, and second, to discard flukes as a building block for your trading strategy. By doing this daily, you will become habituated to handle things analytically instead of emotionally.

It’s about finding the right balance

On a final note, not engaging in crypto investing may be a risk in itself. The U.S. dollar will keep losing value as the money supply keeps increasing. In many countries across Europe, banks already charge people for bank deposits via negative interest rates. Therefore, it is all about finding the acceptable risk level and then sticking to it.

Frequently asked questions

How do emotions affect investing decisions?

How do you manage emotions when investing?

What are the consequences of emotional investing?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.