Although Robinhood’s zero-commission trading popularized entry into high finance, it was crypto trading that really made it mainstream. A cottage industry of digital asset influencers and tutorials grew over the last two years. People soon found out there are basically two types of trading: set-and-forget and daily trading.

The latter is obviously more stressful, as it relies on daily price swings. However, there is the middle ground called dollar-cost averaging (DCA). Instead of timing the market entries precisely, it spreads out the investment, so that risk is distributed more evenly, rather than to plunge into a price wave with a large sum of money. Before we get into the nitty-gritty of DCA, let’s first understand why it is needed.

In this guide:

Inherent crypto market volatility

In the stock market, penny stocks are commonly known to be volatile, akin to cryptocurrencies. This is because they have small market capitalization, hence the name penny. In turn, small market cap assets react more intensely to larger trades. In other words, it would be like traversing across a small lake vs. going across an ocean.

The larger the market cap, the larger the trader — whale — needs to be to make waves. Likewise, in small market cap assets, up to $2 billion, whales don’t even need to be that big to erect buy or sell walls. This is what makes trading in small cap cryptocurrencies so risky. These whales can fake these walls, draw in traders, and then pump or dump for huge profits.

Such moves even affect mid-cap digital assets, up to $10 billion, and beyond, for another reason. Cryptocurrencies don’t inherently have value like you would find in a company that produces products. In such a scenario, it becomes easier to see what the company produces, the cost, the potential demand, and a tentative valuation.

Based on these metrics, a company’s stock value could be evaluated. In contrast, cryptocurrencies are far more abstract. Their value lies in speculation that they offer a superior alternative to central banking and payment networks. Case in point, bitcoin’s both limited and decentralized supply at 21 million coins means that no single actor can decide to flood the market with money.

DCA beats volatility

When the Federal Reserve made related policies to the USD in the last two years, it contributed to a 40-year high inflation. Meaning, the buying power of the dollar is lessened. Now, who would want to save their wealth in an asset that keeps losing buying power? When such a speculation is made, people often come to the conclusion that bitcoin is a better choice for storing value. One could say that this is the service bitcoin provides, similar to a software company but without a CEO.

Moreover, bitcoin’s Lightning Network serves as a utility upgrade, allowing for superfast transfers at near-zero costs, similar to the Visa network. Yet, even bitcoin with its present $731.5 billion market cap is subject to speculation, therefore, volatility.

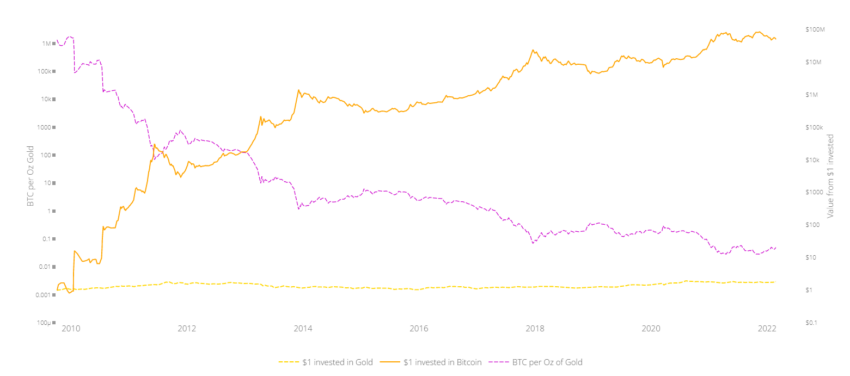

The Fed’s tightening of monetary policies, the pullback of institutional investors, geopolitics — all of these can drastically affect volatility. However, it is precisely volatility that gives cryptocurrencies allure compared to more static assets like gold. After all, how else would one make 2x–10x gains in short time periods?

/Related

More ArticlesThis double-edged sword of volatility is what makes dollar-cost averaging (DCA) a useful tool.

What is dollar-cost averaging (DCA)?

Simply put, dollar-cost averaging is a risk-averse investing strategy in which an investor enters the market through small increments over time. This way, the investor takes advantage of market volatility, by distributing the risk. In the last couple of months, we have seen multiple occasions when bitcoin went under $40k, or even $35k.

Therefore, instead of going all in with a sum of hypothetical $10k to invest in, an investor would use DCA to invest $10k portions daily or weekly or monthly. Otherwise, if the investor decided to invest the entire $10k immediately, they may do so at a higher price hill point. In which case, the overall gains would be much lesser than if investment increments all took place at low valley points.

With that said, DCA investing strategy can also:

- Be employed within all money ranges: $10, $100, $10,000, etc. After all, while $10 is small for someone, by the same token, other investors view $10k as small.

- Be employed regardless if the market is bearish or bullish, as long as the investment distribution is consistent over time.

For this reason, an investor engaging in DCA must be certain in the asset’s fundamentals. After all, the core of the dollar-cost averaging strategy is to invest fixed amounts in regular intervals.

In a nutshell, dollar-cost averaging is dividing the risk by dividing the money allocated for investing over a prolonged period of time. This requires discipline and resistance to market FUD (fear, uncertainty, doubt).

How would DCA work in practice?

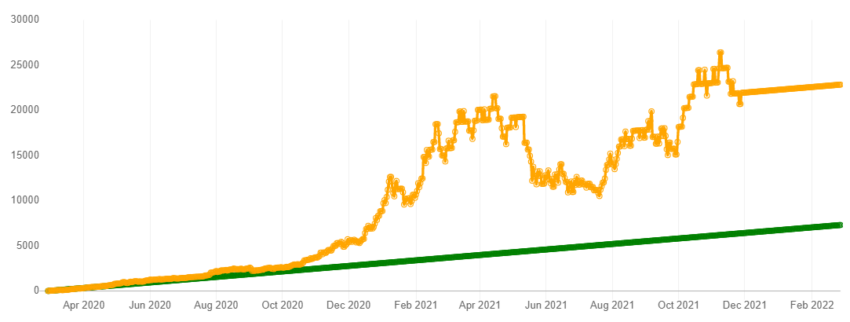

Let’s say you allocate $10 to invest daily in bitcoin over a period of two years. If you had started doing that in 2020 until now, this means that you would have invested a total of $7,310. What would you get in return?

By using a DCA calculator, you would have gained $22,965, which represents a 214.16% profit margin. The difference between your total investment of $7,310, by $10 daily increments, and bitcoin’s appreciation over two years, is the space where you gain profits.

Of course, there is much speculation of where BTC price is heading, but its historical chart clearly shows an upward trajectory. Meaning, bitcoin’s new lows are always higher than the previous lows at worst bear market periods.

This is understandable given that bitcoin’s supply is eternally limited. There will only ever be so much BTC in existence. Then, if more people want to buy it, the remaining bitcoins will appreciate in value. In short, it is a matter of supply and demand, the fundamental law of economics.

What are DCA’s advantages?

Dollar-cost averaging investors are inherently long-term bullish, timing the market. While others would panic-sell during a price drop, DCA investors would dive in, counting on long-term fundamentals. This infers that dollar-cost averaging is superior to simply hodling.

Hodlers are also convinced of bitcoin’s long-term appreciation. However, they consider it a meaningless chore to invest during dips in increments. Instead, whenever a DCA investor forgoes to buy a thing they know they don’t need, and invest that small sum in BTC when it is down, they would do better in the long run.

Furthermore, because DCA relies on small regular intervals for investments, it is impossible to overtrade. This is very important, as it avoids emotional damage as well as financial one.

Lastly, instead of trying to read the often unreliable technical analysis (TA), DCA simply allows you to put your asset’s confidence to the test. Likewise, DCA allows for diversification and risk-budgeting across the board for altcoins as well.

What are DCA’s drawbacks?

As a low-risk strategy counting on crypto market’s inherent volatility, there are not many negatives to this investing tactic. However, if the market goes into a prolonged bull trend, it would then be a more lucrative option to enter the market with a large sum at a single point.

In such an uptrend scenario, DCA would have lower gains. Nonetheless, retail investors rarely have such sums of money at immediate disposal. Additionally, there is the matter of fees on crypto trading platforms to consider.

Obviously, DCA requires more frequent trading, which incurs more trading fees. With that said, dollar-cost averaging is a long-term game, so such extra costs would turn negligible compared to future gains.

Dollar-cost averaging: perfect for volatile markets

Although dollar-cost averaging is a lucrative strategy in any market, it is more so in the more volatile crypto market. Cryptocurrencies are not anchored in physical products or services like companies are.

This allows crypto investors to reap the benefits from both worlds, volatility from speculation, and long-term prospect of a blockchain project. While bitcoin was the example in this guide because it determines the flow of the entire crypto market, one could make a strong case that many smart-contract platforms have an even greater long-term appreciation window.

After all, projects such as Ethereum, Cardano, Polkadot, Avalanche, Radix, etc. are all set to replace the banking sector with a more efficient and transparent suite of lending and borrowing services. Without having gateways, they have already demonstrated their use cases, which means their long-term prospect is sound.

However, because they require some personal initiative, not many will get in until it becomes the obvious thing to do. Within this adoption window is where volatility occurs, with DCA as the best risk-investing strategy.

Frequently asked questions

What is DCA in crypto?

Is DCA good for crypto?

When is the best time to invest in crypto?

Is DCA a good strategy?

What does DCA mean in investing?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.