Is the Bitcoin bull market here? Bitcoin ETFs have arrived as of mid-January 2024, opening up BTC to legacy markets. Plus, the halving event is on the horizon. All bullish indications! But then, with crypto, there is always more than what meets the eye. This Bitcoin price prediction piece will explore the lesser-known aspects of BTC — underrated fundamentals, hidden technical moves, and more — helping you decide if BTC is worth the effort in 2024, 2025, and beyond.

Most popular platforms to buy BTC

Coinbase

KuCoin

Wirex

Read more about BTC and how to buy Bitcoin here

- Should you invest in Bitcoin?

- Bitcoin in 2024: Hits and misses

- Bitcoin (BTC) price prediction and fundamental analysis

- Other metrics

- Bitcoin (BTC) price prediction and technical analysis

- Bitcoin (BTC) price prediction 2024

- Bitcoin (BTC) price prediction 2025

- Bitcoin (BTC) price prediction 2030

- Bitcoin (BTC) price prediction until the year 2035

- Is it safe to invest in Bitcoin today?

- Frequently asked questions

Should you invest in Bitcoin?

Let’s get straight with our readers before we delve into the analysis. Is Bitcoin worth investing in? And if it is, what time horizon should you consider? Keeping 2023 and 2024 in consideration, Bitcoin has surged almost 100% year-on-year.

However, as of Jan. 16, 2024, BTC is down 10.23%, week-on-week, much to the agony of short-term investors. And that’s not it. Some long-term holders who purchased BTC at close to $69,000 in late 2021 are still smarting under a deficit of almost 40%, making three-year-old horizons ineffective.

This is why it is very difficult to pick a time horizon for investing in BTC. What you can do is refer to a reliable BTC price prediction model, check out the expected price of Bitcoin (BTC) across the year, and plan accordingly.

Yes, sentimental drivers like Bitcoin halving and events like Bitcoin ETF approval might show up from time to time. But that would simply help you trade the wave. From an investment perspective, the exposure to Bitcoin should be ultra-long-term — in order to avoid a Bitcoin Pizza Day-type scenario.

Bitcoin in 2024: Hits and misses

Bitcoin is never far from the headlines in 2024. However, this Bitcoin price prediction will not discuss new elements. Instead, we will focus on the BTC price forecasts resulting from current and future events. The first major event has to be the approval of Bitcoin ETFs. Since the approval, the prices have corrected by over 10%, as per BeInCrypto price data.

And if you have been wondering why the price of BTC has weakened post the ETF approval, here are some insights. Grayscale, one of the ETF issuers, is leading asset outflows. It has been depositing BTC to its custodian, Coinbase, exerting selling pressure on Bitcoin.

Did you know? As of Jan. 16, 2024, Grayscale’s ETF, with ticker GBTC, held the highest number of actual Bitcoin in its reserves at 605,891. Next in line was BlackRock, holding 16,362 BTC as of Jan.16, 2024.

But then, BTC dumping isn’t boosted by nefarious intentions.

But then, BlackRock is leading the ETF space regarding inflows, playing a major role in trying to keep the price of Bitcoin from dipping further, though not deliberately.

And while that sums up what’s happening with BTC in January 2024, the BTC price forecast based on these factors has not yielded anything concrete. To locate the future price of Bitcoin, we need to look at the fundamental analysis.

Bitcoin (BTC) price prediction and fundamental analysis

Before you head over to buy Bitcoin, either on exchanges or via P2P avenues that do not incur additional fees, you might want to take a closer look at the fundamental metrics. While technical analysis can help you with the price action, fundamentals in crypto can help you zoom out the details.

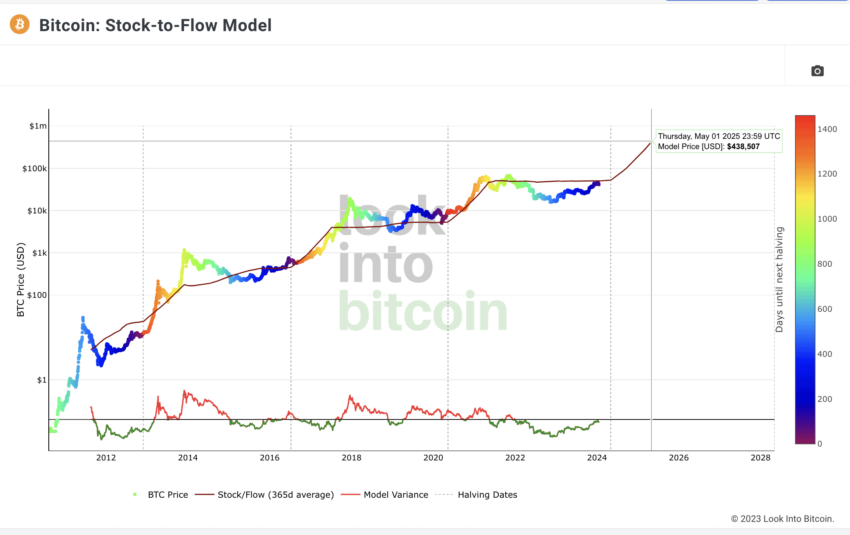

The first and one of the most important fundamental metrics has to be the stock-to-flow model. The S2F ratio seems to be rising with the prices closing in on the fair value or the value proposed by the mode. This indicates that the prices might move sideways for a while, trailing the S2F ratio before moving towards the $100K territory.

Another bullish indication has to be the rising market cap, aligned with the BTC trading volumes.

Active addresses and traders

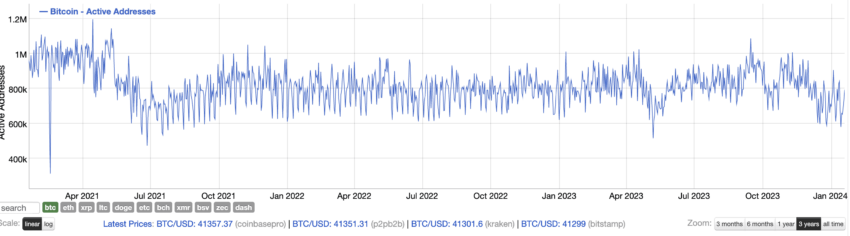

If you look at the active address chart of the Bitcoin network, an interesting trend surfaces. As of 2024, the active address count seems to be dipping, which might signify a holding pattern.

This might not be the most bullish signal instantly. However, if seen with a rising trading volume, we can expect some fireworks post-halving as users are holding and not selling immediately. The BTC that is moving is only led by the traders.

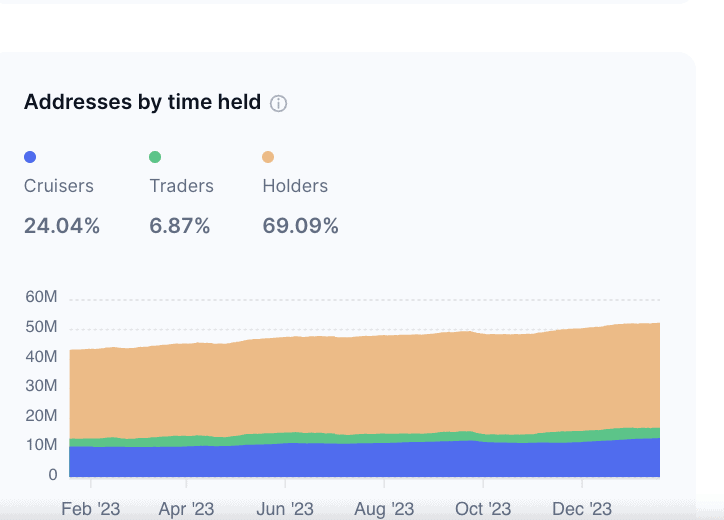

To supplement this hypothesis, here is the Bitcoin holding pattern reported by CoinMarketCap. As you can see, holders comprise over 69% of the addresses, which explains the drop and a bullish outlook.

Other metrics

Bitcoin halving is almost here, and how can we not talk about the miners? As of mid-January 2024, BTC miners are actively selling, which might indicate the need to prepare for the halving.

These rapid sell-offs are keeping the prices in check, so it might not be an alarming sign in the medium to long term. Here is a tweet on the miner outflow.

It is worth noting that MPI, or the Miner’s Position Index, is a more reliable indicator as it takes the total miner outflow and finds a ratio with the 365-day average, yielding more accurate results.

Also, if you have been worried about the miners offloading assets, here is a bit about the miner revenue and Bitcoin NFTs:

/Related

More Articles“Not worried about halving & miners’ revenue. I expect BTC will more than double in USD terms in the 12-16 months following, offsetting the drop in subsidy. Also still think inscriptions probably go on a 2021-NFT style run this cycle. Expect these to trade much higher.”

Will Clemente, co-founder of Reflexivity Research: X

Despite the price hike over the past few months, note that Bitcoin dominance is slightly tilted in favor of altcoins. This could be a reason why the second-in-line Ethereum has been having a field day across exchanges in mid-January.

Besides the mentioned metrics, you can also look at the Bitcoin futures and options space to get a more granular, price-related view. For instance, if the BTC futures prices trade higher than the spot prices, you can see a bullish trend coming in. This is termed Contago, and the bearish or rather the opposite version of it is termed Backwardation. In the options market, a high Put/Call ratio can hint at a bearish sentiment, with Put options being those that bet on the price of BTC going down.

Plus, the presence of Bitcoin on other ecosystems as wrapped tokens and comparison with other PoW assets like Litecoin and more can also contribute to its future price action.

Bitcoin (BTC) price prediction and technical analysis

Before we explore the broader price-based technical analysis, it is important to track the short-term view. Let us now take the BTC/USDT daily chart and explore further:

Short-term BTC analysis

BTC might be in for a deeper correction, courtesy of the dropping RSI or, rather, momentum. This could be due to the miners offloading their holdings at a clip.

As for the pattern, a rising wedge is evident, and the price candles are steadily moving towards the lower trendline. As of Jan. 19, 2024, the $40,692 level is acting as a strong support. If it gets breached, BTC might drop down to $35,000 in quick time.

But then, if the RSI improves and BTC somehow breaks past the upper trendline of the wedge, invalidating the bearish trend, the immediate level to aim for would be $45,218.33. This level coincides with the 0.786 point of the Fib indicator.

Here is what might quickly change the narrative:

Let us now move to the weekly analysis, determining a broader pattern of sorts.

Weekly chart analysis of Bitcoin

Let us now head over to Bitstamp for the BTC/USD trading pair. If we zoom out, an interesting trend surfaces. Historical analysis suggests an A-to-F-type pattern for BTC, with A being the first high, C being a lower high, and E being a higher high. There are higher lows in play — B, D, and F.

Looking closely, you might notice a similar trend forming with A1-B1-C1 already in. The next set of points would be D1, E1. and F1, which might give us the expected future price of Bitcoin.

But the question is, how are we sure that C1 is a fixed point and there would be an E1? The answer lies hidden in the RSI.

Notice how the RSI started peaking at C, the first lower high on the chart. Post that, the RSI peaked, and so did the prices after the 2020 halving. At C1, the RSI is now at a similar level, and with the halving event approaching in less than four months, a price surge seems imminent.

Calculations for finding key levels

Now that we have located the points, it is time to find the price hikes and drops between them. That will help us identify the averages.

Levels for the first pattern A-to-F:

| A to B | -84.40% in 371 days |

| B to C | 342.06% in 189 days |

| C to D | -71.92% in 259 days |

| D to E | 1542% in 399 days |

| E to F | -56.03% in 70 days |

| F to A1 | 142.25% in 140 days |

Levels for the second pattern:

| A1 to B1 | -77.68% in 378 days |

| B1 to C1 | 217.90% in 413 days |

Now that we have all the crucial levels, here are our inferences:

Average price percentage- high to low: -72.51% in 270 days (worst case scenario and during bear markets)

Average price percentage- low to high: 561.05% in 285 days (best case scenario during bull cycles)

We shall now use these data points to locate the future price of BTC.

Bitcoin (BTC) price prediction 2024

Outlook: Bullish

We have the last high or C1. Using the data points from earlier, we can assume that the lowest percentage drop could be 72.51% from this level. However, now that we are about to enter a bull market, BTC might not correct that much. Instead, we can assume it will stay near the $31810 mark, which assumes a drop of 35% and works as a strong support level. This could be the minimum price of BTC in 2024.

From this level, we might expect a 142.25% hike (the lowest price hike percentage from the table above) in 140 days, which also takes the positive halving sentiment into account. Therefore, the maximum price of Bitcoin in 2024 could be $77021.

Projected ROI from the current level: 86%

Bitcoin (BTC) price prediction 2025

Outlook: Bullish

Assuming BTC moves to $77021 in 2024, the next low or the minimum price of Bitcoin for 2025 can be expected to take support near the $59537 level mark. And while we have zeroed in on the average price percentage for a drop at 72.51%, the dips aren’t usually that pronounced at least six to 18 months after a halving.

However, the dip might take the surface quickly, probably towards the early part of 2025. Post this low, you can expect BTC to scale new highs, something that happened 18 months after the 2020 halving event. While a hike of 561.05% might not be out of the question, post the ETF launch and, therefore, frequent sell-offs by asset managers, a more conservative hike percentage of 217.90 — the second lowest percentage move from a low to high — is expected.

Keeping that in mind, BTC can scale a high of $189,313 in 2025. Do note that the dates may differ, and this level might end up surfacing in early 2026.

Projected ROI from the current level: 362%

Bitcoin (BTC) price prediction 2030

Outlook: Bullish

Once BTC reaches a level close to $200K, as of 2025-26, there might come a correction with an eye on the next halving cycle in 2028. Miners in profit might want to sell off their holdings, followed by ETF holders. This might lead to a deeper correction in 2027, which might even continue till early 2027. At this time, a dip of 72.51 percent might be on the cards.

This dip take BTC to as low as $51,466 by the end of 2026 or early 2027. From there, the rise could be limited, as what usually happens with BTC prior to any halving cycle. Therefore, the 2027 high could surface at $124,692.

Now that the expected 2026-27 low and the 2027 high levels are in, let us chart the extrapolated version of the same, keeping 2028 halving in mind. Per our calculations, we expect BTC to make a high of $4,20,248 by the end of 2030. The minimum price of Bitcoin in 2030 could be $2,35,815, which currently coincides with our 0.5 Fib retracement level.

Projected ROI from the current level: 924%

Bitcoin (BTC) price prediction until the year 2035

Now that we have chalked out all the future price levels for Bitcoin till 2030, you can refer to this table to get a more extrapolated look at the future price of Bitcoin:

| Year | Maximum price of Bitcoin (Expected) | Minimum price of Bitcoin (Expected) |

| 2024 | $77021 | $31810 |

| 2025 | $189313 | $59537 |

| 2026 | $147664 | $51466 |

| 2027 | $124692 | $62346 |

| 2028 | $177063 | $109779 |

| 2029 | $398391 | $199196 |

| 2030 | $420248 | $235815 |

| 2031 | $530584 | $265291 |

| 2032 | $384671 | $192336 |

| 2033 | $432756 | $268309 |

| 2034 | $603695 | $301847 |

| 2035 | $679156 | $339578 |

Note that these price levels can differ depending on the growth of the network, the whale accounts activities, criticism surrounding Bitcoin, Bitcoin mixers and anonymous purchases, and trading patterns like short selling pressure and more.

Is it safe to invest in Bitcoin today?

If you plan to hold BTC long-term, you can simply head over to an exchange and buy the asset without worrying about all-time highs or the possibility of a dip. However, if you are more of a “time-the-market” type of investor, you can simply follow this Bitcoin price prediction, wait for some of the outlined possible corrections, and then attempt to time your BTC buy favorably with the market. Remember that the crypto market is volatile, and you should never invest more than you can afford to lose.

Frequently asked questions

How much will Bitcoin be worth in 2025?

How do I trade in Bitcoin?

What is ETF Bitcoin?

Is Bitcoin ETF approved?

What will one Bitcoin be worth in 2030?

Why is BTC going up?

Can you trust Bitcoin?

Who controls Bitcoin?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.