Curve Finance is a well-known decentralized exchange. Unlike competitors such as Uniswap, Curve’s protocol does not embrace the instability inherent with most cryptocurrencies. Instead, it focuses its agenda on stablecoin exchanges. This allows Ethereum-based DeFi to ask for lower trading fees and to deliver lower slippage. Furthermore, CRV crypto, the platform’s native token, is offered as a reward for contributing liquidity pools and provides users with the right to vote in the Curve’s DAO.

The platform’s success is largely due to the interest it’s sparked among crypto enthusiasts tired of the market’s growing volatility.

But, are all of these things that regular users can take advantage of? How does the Curve ecosystem function? In this guide to Curve and CRV, we will look at the reasons why this DeFi protocol should stoke your interest.

In this guide:

- What is Curve?

- Curve’s focus on stablecoins

- The origins of Curve

- The Curve AMM model

- Curve pools explained

- Integrating with other DeFi protocols

- Curve DAO explained

- Earning rewards with Curve

- What makes Curve stand out

- Integrating Curve’s core features

- The Curve CRV crypto token and its role

- Price and price prediction

- What will Curve’s future hold?

- Frequently asked questions

What is Curve?

Decentralized Finance (DeFi) platforms have been all the rage in the crypto-world during the past few years. One of the most prominent protocols among them is Curve.

Curve is built on their Ethereum blockchain, similar to many other DeFi protocols. It allows trading through the use of cryptocurrency pools. Essentially, crypto assets are provided by users. These, in turn, are incentivized through rewards for their deposits.

Curve is similar to protocols like Balancer or Uniswap. It allows cryptocurrency users to earn fees from their assets while letting traders exchange those assets at potentially better prices.

While Curve is similar to the protocols mentioned earlier, it does have a feature that helps it stand apart. The protocol focuses on assets that have direct parity with national currencies. Curve is a favorite of stablecoin traders as well as liquidity providers who want to minimize slippage and minimize losses. Slippage is the difference between the expected price for a single trade and what the trade will be executed at. It is a common source of losses on various exchanges.

Curve’s focus on stablecoins

Curve focuses on stablecoins, such as DAI and USDT. These are meant to track U.S. dollar prices. It also caters to stablecoins such as wBTC or renBTC that track bitcoin’s price. The protocol’s main view is on ensuring a certain amount of balance on the crypto markets.

Curve’s goal for stablecoin trading is to minimize fees and price variation. These generally occur due to the many options available on the market. Curve currently allows trading for stablecoins such as DAI, USDT, USDC, GUSD, TUSD, BUSD, UST, EURS, PAX, sUSD, USDN, USDP, RSV, and LINKUSD. Users can also trade ETH, LINK, and a few tokenized BTC assets such as wBTC or renBTC.

The origins of Curve

Like the other projects in the DeFi crypto space, Curve Finance is a relatively new endeavor. The Russian physicist Michael Egorov is the one who introduced its whitepaper in Nov. 2019. The project was officially launched at the start of 2020.

Egorov was not new to the world of crypto. In fact, he had been involved with DeFi protocols since 2018. His resume was also impressive. Egorov had graduated from the Moscow Institute of Physics and Technology before earning a Ph.D. in Physics at the Swinburne University of Technology. He had co-founded the companies NuCypher and LoanCoin.

The Curve AMM model

Curve looks to be an automated market maker (AMM) protocol. It makes use of market-making algorithms and cryptocurrency pools. Meanwhile, traditional decentralized exchanges use peer-to-peer markets that allow crypto users to trade between themselves.

The Curve protocol is characterized by minimum price slippage and a “fiduciary savings” account for liquidity providers. All of these are managed by smart contracts that function on the Ethereum network.

Egorov created this system to provide a means of exchange that would act as a bridge between decentralized stablecoins (DAI, for example) and centralized stablecoins (USDT). This was hoped would help the market to grow.

This bridge created between stablecoins is meant to act, for example, when the stability fee offered by the protocol increases. In such cases, users are unable to convert from one coin to another because of the large fees. The system promoted by Curve looks to allow its users to take advantage of the best available options on the market at the time.

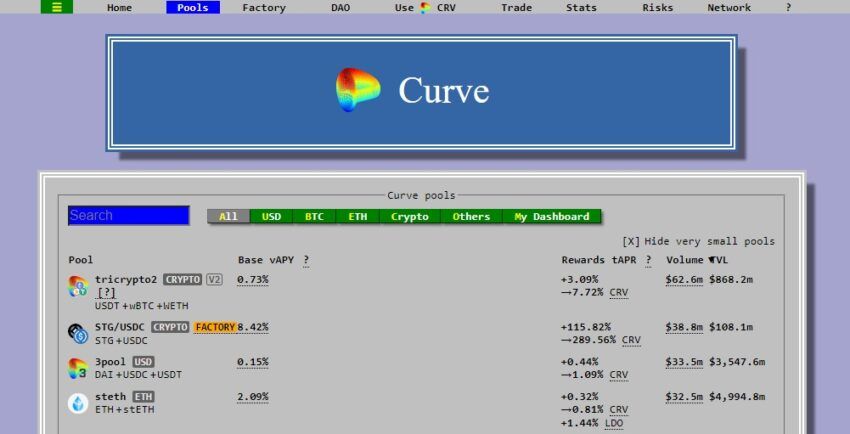

Curve pools explained

Yes, Curve liquidity pools are not dissimilar to Uniswap’s model. In fact, the protocol has often been called a stablecoin competitor of Uniswap, the most famous DeFi on the market at the moment of writing.

/Related

More ArticlesA liquidity pool is a space that is under the control of a smart contract. Through it, large amounts of crypto-asset are accumulated and injected by liquidity providers (LP). This liquidity is used to facilitate loans and exchanges using the assets.

Each one of these loans or exchanges is subject to a small fee or interest. This adds up and ultimately feeds the profits of liquidity providers. Curve builds upon this model. It, however, adds its unique concept about these liquidity pools. Most importantly, instead of using volatile assets, it prefers stablecoins.

Liquidity providers can provide stablecoins, DAI or USDT, for example, to Curve Pools. This protocol will then use the liquidity to offer exchanges for a small fee. These will eventually contribute to the liquidity providers’ profit.

Smart contracts manage the exchange ratios within these pools autonomously. If a pool offers DAI/USDT exchanges, and parity exists between its tokens (1000 DAI and 1000 USDT), then the exchange ratio is 1: 1. If that ratio changes (e.g., 800 DAI or 1200 USDT), the exchange rate will move up DAI. This rebalancing of the rates ensures that there always exists liquidity.

This is the same principle that Uniswap uses. It’s what allows this system to be classified as an AMM. As we mentioned, fees that are charged for each operation determine the profit made by liquidity providers or LPs. The LPs will make more money if they have more pools or markets to draw on.

Integrating with other DeFi protocols

Curve integrates with other platforms to provide additional means of exchange. This allows for higher profits. It is why liquidity pools exist in projects such as Yearn Finance, Uniswap, and Compound. Curve and its pools serve two purposes: to act as an exchange and to provide liquidity for other protocols.

Curve’s platform allows its users to pay 0.04% less per transaction for direct swap functions. The project’s communication insists that it focuses on minimizing slippage. Meanwhile, unlike other DeFi protocols, they reckon, focus on algorithms that maximize their profits. Through its actions, the Curve team believes that they are looking out for the best interest of the crypto community.

Curve DAO explained

The Curve protocol began its journey towards decentralized governance in Aug. 2020. It was then that it launched its very own DAO (decentralized autonomous organization). Its purpose is to manage protocol changes.

Remember that Curve rewards the participation of users with crypto rewards and access to other DeFi protocols. Governance tokens give token holders voting rights and control most DAOs. The CRV token controls Curve’s DAO.

The DAO is responsible for the functioning of the entire ecosystem in Curve. This means that any administrative actions, regardless of importance, can only be implemented once a successful DAO vote is in place.

Anybody can propose an update for the Curve protocol, and they must have at least one CRV vote-locked. These changes can pertain to fees and how they are used. Other aspects covered by the vote include the creation of new liquidity pools or adjusting yield farming rewards. By locking up CRV tokens, holders can vote to accept or reject a proposal.

Curve is a popular platform in DeFi at the moment. Much of the success is due to its core tenets of prioritizing stability ahead of volatility and speculation. Its construction helps it be an interconnected hub in the DeFi ecosystem. With the CRV token acting as a governance mechanism, it can behave as a decentralized organization. In it, its users are the ones that hold the power in equal measure.

Earning rewards with Curve

On AMM exchanges like Uniswap, users earn rewards. This happens whenever a trade is made. Curve has lower trading fees than Uniswap. Furthermore, you can still earn rewards with interoperable tokens that work outside of the Curve platform.

Curve CRV crypto tokens are the native currency of the Curve ecosystem. Sure, you can purchase it directly from a crypto exchange service that supports it. However, users can also earn the Curve CRV crypto token by yield farming. When you deposit assets into a liquidity fund, you receive tokens as an incentive. For example, you can earn the CRV token by providing DAI to Curve liquidity pools. This is in addition to interest and fees.

Yield farming the token increases incentive for a regular crypto user to become a Curve liquidity provider. You not only receive a financial asset, but also own a stake in a strong DeFi protocol.

What makes Curve stand out

To best understand what Curve offers and whether the protocol may be of use to you, let us look at the protocol’s key features:

- Users are able to retrieve their assets from the platform at any time.

- Curve involves a smaller amount of risk as compared to other DeFi protocols. Furthermore, trading fees and slippage are lower because of Curve’s focus on stablecoins.

- Users are able to stake CRV. These deposits provide users with rewards and a chance to vote in the Curve DAO.

- The CRV tokens appear across the DeFi ecosystem. It makes Curve extremely convenient to use.

How does Curve manage to offer all of these features? The answer lies in the very nature of the platform’s design.

Integrating Curve’s core features

First of all, Curve’s trading platform uses a mathematical feature to allow stablecoins to trade at the best price. This is a bonding curve.

The bonding curve here is only on stablecoins. It allows users to trade more stablecoins at lower prices.

Furthermore, Curve encourages crypto enthusiasts to lend liquidity to their pools. They are liquidity providers. For providing liquidity, the providers receive a certain amount of CRV as an incentive.

Liquidity pools use algorithms for determining the asset’s price. The AMM protocol is a smart contract that allows trades to take place without the need for an order book. There is no requirement for a counterparty.

Finally, the platform allows users to stake their CRV. Curve protocol users who stake their CRV get a share of the protocol’s trading fees. They can also vote-lock their CRV to increase your liquidity rewards. Owners of CRV can contribute to the decision process by voting through Curve’s governance process.

The Curve CRV crypto token and its role

The CRV token is at the heart of the Curve platform. It has several uses, as we shall see below.

How the CRV crypto token fits into Curve

CRV is the native token of Curve and operates on the Ethereum blockchain network. The DEX uses CRV throughout most processes across the platform. Curve uses an AMM model to allow its users to trade stablecoins. The coin can be purchased or can be earned as a reward or bonus when you add liquidity to the platform’s liquidity pools.

The Curve platform released its native token in 2020, shortly after the protocol was launched. Around 3 billion CRV tokens had been generated at this point. The token is meant to facilitate all the activities on the platform.

The distribution of the Curve CRV crypto token

Initially, the token was offered as a reward to early adopters. Users who had locked coins on the platform received approximately 60% of the CRV tokens. The Curve team and investors received 30% of the entire quantity. The rest was reserved for project employees and as a reserve for community projects.

At the moment about 2 million CRV tokens are released each day. This means that 750 million coins are issued annually. These tokens can be used to vote for proposals that will affect the rules that govern the Curve ecosystem. Beyond this, CRV can also prove to be an investment given the platform’s almost continuous growth.

The utility of the Curve CRV crypto token

CRV is meant to incentivize and encourage liquidity. CRV is a governance token. It features value accrual and time-weighted voting mechanisms.

Curve platform liquidity providers receive the $CRV as a reward for providing liquidity. This allows the protocol to continue offering very low fees and slippage. Vote locking boost is a key incentive for holding CRV. Through this, the liquidity providers can increase their daily CRV rewards.

Price and price prediction

At the time of writing, CRV’s value is around $2.27. The coin’s market cap is over $880 million, and there’s a daily trading volume of over $108 million. The coin’s value is on a small upward trend. The analysis accounts for the previous few days.

This data gives many analysts reasons to believe that CRV’s value may increase mid and long-term. Numerous factors will contribute to its development. These include its market cap and trading volume, as well as the popularity of DeFi protocols and the increased interest in stablecoins across the crypto world.

Analysts believe that the short-term value of CRV could reach at least $3 by the end of 2022. There are even some who forecast that the coin could hit $5 by the end of this year.

The growth, according to the same analysis, will increase in the next couple of years. A value of at least $4.38. It could have a value of $4.38 by 2024. And, CRV’s value could hit upwards of $10 by the end of 2025.

Beyond that, the optimism of crypto analysts foresees a time when CRV could reach a maximum level of $25.45. If these predictions turn out to be correct, CRV is one digital asset worthy of consideration over a long-term period.

Where to buy Curve CRV crypto token

Available on:

What will Curve’s future hold?

Curve aims to be a disruptor to already popular protocols such as Uniswap. Its main feature is its consistency. With that in mind, Curve focuses on the trade of stablecoins through an AMM model.

With more crypto adopters joining the ecosystem every day, it is safe to say that their desire for stability within decentralized financial systems is going to grow. Curve offers rewards directly, as well as the opportunity of shaping the mechanism’s progress. Considering all of these elements it is safe to claim that Curve has some staying power.

< Next In Series | Exchanges | Previous In Series >

Frequently asked questions

Is Curve (CRV) crypto a good investment?

Is Curve a stablecoin?

What is Curve (CRV)?

What does CRV crypto do?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.