Although DeFi is termed the TradFi disruptor, TradFi still plays a significant role in our daily lives. This guide delves into the realm of traditional finance, discussing its advantages and disadvantages and how it compares to decentralized finance (DeFi).

- What is traditional finance (TradFi)?

- Financial institutions in TradFi & roles

- Importance of regulation in TradFi

- Pros and cons of traditional finance

- Understanding the banking system in TradFi

- Exploring key financial instruments in TradFi

- Risk management in TradFi

- TradFi vs. DeFi: A comparative analysis

- The future of TradFi in a digital economy

- Frequently asked questions

What is traditional finance (TradFi)?

Traditional finance, TradFi in short, refers to the established financial system that has been in place for many years. It consists of financial institutions, such as central banks, commercial banks, brokerage firms, investment banks, credit unions, pension funds, retail banks, insurance companies, mortgage companies, savings and loans associations, and mutual funds. These institutions often serve as intermediaries, facilitating transactions between parties involved in financial activities.

If you possess a savings or checking account with a bank, you have already engaged with TradFi. Insurance services, financial assets trading, bank loans, mortgages, and investment services are all part of the TradFi world.

The term TradFi often comes up in relation to DeFi, a relatively new financial system that aims to be decentralized, thus, intermediary-free.

Financial institutions in TradFi & roles

Central banks

Central banks have the authority to supervise and regulate all banks operating within a country’s jurisdiction. Moreover, these institutions are responsible for formulating and implementing monetary policy, ensuring the financial health of a country, financing retail banks, and setting interest rates. Central banks do not interact with individuals. Instead, they act as the banks’ bank, working with them to provide services and products to the public.

Central banks also regulate the circulation of a country’s fiat currency. Fiat money is considered legal tender, meaning that the government recognizes it as the country’s official currency.

Did you know that central banks have different names depending on the jurisdiction? For example, the central bank in the U.S. is called the Federal Reserve Bank or the Fed. The U.K. has the Bank of England, Switzerland has the Swiss National Bank, and China has the People’s Bank of China.

Commercial & retail banks

Retail banks cater directly to retail customers. They offer personal banking services like savings and checking accounts, credit services, and debit cards. In contrast, commercial banks serve corporate customers. These customers could be small or large businesses. Commercial banking includes loan products, trade finance, cash management services, and equipment lending.

Investment banks

Investment banks facilitate raising capital for corporations, individuals, and governments through the issuance of securities. They also serve as intermediaries in processes like initial public offerings (IPOs) and company mergers. Additionally, investment banks assist clients in expanding their investment portfolios by identifying lucrative investment opportunities for optimal profit generation.

Credit unions

Credit unions are non-profit entities that offer lower fees and higher annual percentage yields (APYs) compared to banks. These entities serve a specific group of people with a common employer or a geographical area. The members of a credit union actively participate in its operations and governance.

Brokerage firms

Brokerage firms help both individual and institutional investors in the purchase and sale of diverse financial instruments. This enables customers to engage in trading activities involving bonds, stocks, exchange-traded funds (ETFs), and mutual funds.

Savings and loans (S&L) associations

S&L associations or thrift institutions mainly focus on lending for residential mortgages. Also, S&L associations offer personal loans and checking accounts to their customers. Thrift institutions are owned by their customers.

Mortgage companies

Mortgage companies originate or fund mortgage loans. They often serve retail consumers. However, some mortgage companies only fund mortgage loans for commercial real estate.

Insurance companies

Insurance companies assist individuals and businesses in transferring the financial risk associated with natural disasters, property damage, and accidents. Clients pay a premium in exchange for an insurance policy.

Asset management firms

Asset management firms manage hedge funds, portfolios of high-net-worth individuals, and pension plans. Moreover, they create mutual funds, ETFs, or index funds for smaller investors. The asset management firm then invests the pooled funds in various investments such as real estate, stocks, and bonds.

Importance of regulation in TradFi

Regulations govern the operations of financial institutions in TradFi. Among the most common regulatory requirements are KYC and AML. Know your customer (KYC) entails a mandatory process to identify and verify a customer’s identity. For example, when opening a bank account, customers must provide their names, identification documents, phone numbers, and photos. On the other hand, anti-money laundering (AML) regulations are in place to prevent criminals from disguising illegal money as legitimate income.

In some countries and for some regulations, the central banks ensure that financial institutions comply with the financial regulations in place. In other countries, there are specific regulators for different markets. Without oversight authorities, economies would be at risk of instability.

“Regulatory compliance is critical to managing risk.”

CEO of Mayflower-Plymouth, Hendrith Vanlon Smith Jr

Therefore, regulations in TradFi are essential since they not only keep financial systems stable but also protect consumers and the economy from harm and prevent unauthorized firms from offering financial services.

/Related

More ArticlesPros and cons of traditional finance

TradFi has a longstanding presence and is firmly rooted in comprehensive financial regulations. For these reasons, many people have come to trust and rely on it. Also, consumers can access a wide range of financial services and products tailored to their specific needs.

TradFi is big on consumer protection, meaning it strives to ensure that financial institutions act honestly in the best interest of their customers. However, that doesn’t mean instances of front-running, insider trading, and unequal access are non-existent. Also, money laundering activities via banks occur despite implementing AML laws.

Another issue plaguing the traditional financial sector is slow transactions that take days to settle. On top of this, transactions can get expensive due to the involvement of intermediaries. Financial institutions may also request clients to produce some form of documentation to access financial services.

Understanding the banking system in TradFi

Banks accept deposits from clients who hold savings and checking accounts with them. Additionally, they acquire funds from the government, merging these resources with deposits to provide loans to borrowers. That means banks act as financial intermediaries, facilitating the transfer of funds from depositors with excess capital to individuals and businesses needing financial resources.

Banks generate profits by charging interest rates on loans that exceed the interest they pay on the funds borrowed from the government (via the central bank). As a result, the government becomes the primary depositor and creditor for banks.

Overview of financial intermediaries in TradFi

Banks, credit unions, financial advisors, insurance companies, and other financial intermediaries play vital roles in TradFi. Here are some of the advantages of financial intermediaries:

- Reducing risk: Banks allow individuals or businesses with excess funds to distribute their loans among multiple vetted borrowers. This approach carries lower risk compared to lending money to a single individual. Furthermore, insurance companies minimize the risk of financial loss by providing policy benefits in the event of accidents or catastrophes experienced by their clients.

- Economies of scope: Financial intermediaries can provide specialized services and products to fit various customer needs. For example, commercial banks can create different products for small and large corporations.

- Economies of scale: Financial intermediaries have access to large amounts of cash from depositors that they can loan to multiple borrowers with solid credit ratings. This practice minimizes the overall operational costs.

Exploring key financial instruments in TradFi

A financial instrument is a contractual agreement that holds value and can be traded. The following are key financial instruments commonly found in TradFi.

Stocks

Stocks or equities represent fractional ownership in a company. Shareholders are entitled to a portion of the company’s assets and profits based on the amount of shares they hold. Stocks are equity-based financial instruments.

Mutual funds

A mutual fund is an investment vehicle that pools funds from many investors. It then invests the money in stocks, short-term debt, and other securities. Investors that buy shares in mutual funds receive part ownership in the fund and are entitled to a portion of the fund’s income based on the number of shares they hold. Mutual funds are equity-based financial instruments, with money market funds being a prime example.

Bonds

Bonds are long-term debt-based financial instruments that governments and corporations use to raise money. Therefore, bond buyers give issuers a loan for a certain period of time. Bond issuers are responsible for paying back the loan at face value at a set date (principal), plus a few interest payments.

Treasury bills (T-bills)

Treasury bills, also known as T-bills, are financial instruments based on short-term debt. They are issued by governments and have a predetermined interest rate and a maturity period of 365 days or less. Investors who hold T-bills receive their initial investment plus interest at the end of the specified term. These instruments are considered low-risk as they are backed by the Treasury of the issuing country.

Bank deposits

Bank deposits are funds that customers place at a banking institution through checking, money market, or savings accounts. A bank deposit is a liability that the bank owes to the depositor. As a result, bank deposits are debt-based cash instruments. Moreover, checks and loans are cash instruments since they can transmit payments between bank accounts. Deposit insurance ensures that customer funds are protected up to a certain amount.

Certificates of deposit (CD)

A certificate of deposit is a type of savings bank account that holds money for a certain period of time. Investors collect their initial investment plus interest when they redeem their CD.

Commercial papers

Commercial papers are unsecured short-term debt obligations that banks and large corporations issue to fund operations. This instrument pays a fixed interest rate and has a maturity of up to 270 days.

ETFs

Exchange-traded funds are investment vehicles that allow investors to pool their money together and earn interest. The fund then invests in stocks, bonds, and other securities. ETFs are more flexible than mutual funds because investors can trade them at exchanges throughout the day. This stands in contrast to mutual funds, which investors can only purchase or redeem at the end of a trading day.

Derivatives

Derivatives are financial contracts between two or more people. They derive their value from the performance of an underlying asset. Stocks, market indexes, bonds, digital assets, interest rates, and commodities are examples of possible underlying assets. The four main types of derivatives are futures, forwards, swaps, and options.

Mortgage-backed securities (MBS)

Mortgage-backed securities are debt-based financial instruments. Financial intermediaries create mortgage-backed securities by pooling together mortgages. So, when you buy an MBS, you are lending home buyers money. In return, you earn regular payments on your investment.

Real estate investment trusts (REITs)

REITs are investment vehicles that permit collective investment in real estate. A REIT allows individuals to invest in real estate assets like hotels, shopping malls, and apartments and earn interest.

Pension funds

Pension funds are investment schemes that provide retirement benefits to retirees. Both employees and employers can contribute money to a pension fund. Fund managers invest the contributions, allowing the fund to pay employees an income after retirement.

Credit cards

Credit cards are generally unsecured debt-based financial instruments that enable customers to borrow money within a pre-set limit. Cardholders must pay off the balance plus interest each billing cycle.

Risk management in TradFi

Governments typically implement deposit insurance systems to protect depositors in the event of a bank’s inability to facilitate withdrawals. The financial instruments that a deposit insurance body covers may vary from country to country. Also, deposit insurance agencies may not cover all financial institutions.

To illustrate, the U.S. Federal Deposit Insurance Commission (FDIC) only covers bank deposits up to $250,000 per customer “for each account ownership category.” This cover only applies to FDIC-insured banks.

The FDIC doesn’t insure stocks, bonds, T-bills, crypto assets, mutual funds, safe deposit boxes, and other financial products. That means investors must use risk management strategies like diversification to minimize portfolio risk.

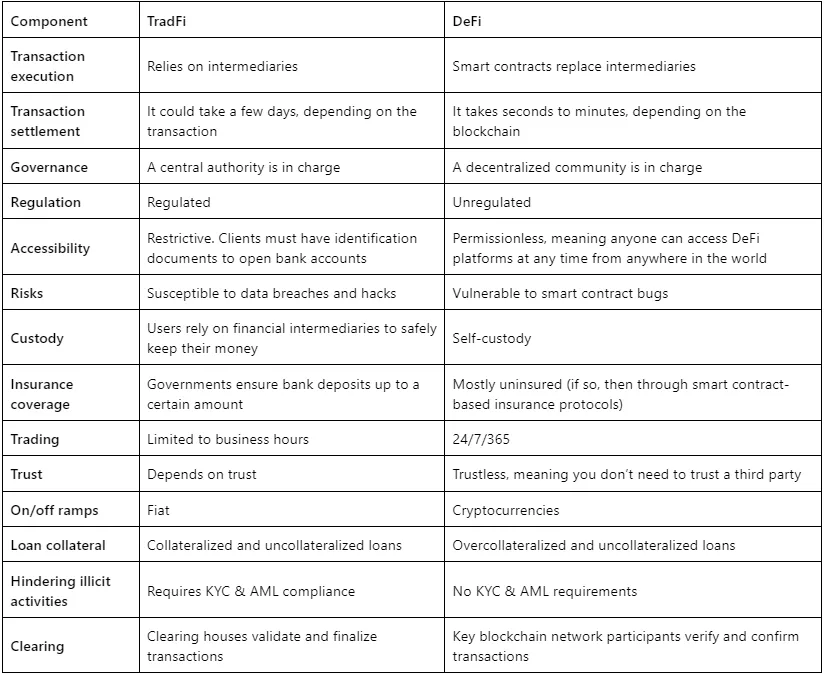

TradFi vs. DeFi: A comparative analysis

The future of TradFi in a digital economy

Decentralized finance is already disrupting TradFi by offering benefits like more financial freedom and increased financial inclusion. These benefits are much needed, especially because the current financial system is restrictive, and 1.4 billion people remain unbanked. Therefore, TradFi businesses could start adopting decentralized structures as more and more people demand financial inclusion and freedom.

However, DeFi can also borrow TradFi’s good practices, like protecting consumers and curbing illicit activities. Ultimately, the two sectors could merge as each borrows from the other, creating a financial system featuring the best of both worlds.

Frequently asked questions

What is the difference between DeFi and TradFi?

What does TradFi stand for?

How big is TradFi?

What does TradFi mean in crypto?

Why is DeFi better than TradFi?

What are some examples of traditional financial institutions?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.