From the title alone, some readers will already be judging us. And rightly so, on face value. How could we prepare a LUNA price prediction piece when the ecosystem tanked in 2022 — taking down the entire crypto market along with it? The answer is that this Terra (LUNA) price prediction model considers the new ecosystem, which is entirely separate and notably not linked to the Terra USD or UST. This is a stablecoin-free zone!

But how can we predict the future price relevant to the new Terra ecosystem when there isn’t enough historical data in place? Well, we have some ideas. Keep reading to learn more.

Want to get LUNA price prediction weekly? Join BeInCrypto Trading Community on Telegram: read LUNA price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders! Join now

- Terra price prediction and the fundamentals

- LUNA tokenomics and the current trading activity

- LUNA price prediction and key on-chain and social metrics (2022 data)

- LUNA price prediction and technical analysis

- Terra (LUNA) price prediction 2023

- Terra (LUNA) price prediction 2024

- Terra (LUNA) price prediction 2025

- Terra (LUNA) price prediction 2030

- Terra (LUNA’s) long-term price prediction until the year 2035

- Is the LUNA price prediction model accurate?

- Frequently asked questions

This article may be outdated, we suggest you visit our new Terra Price Prediction tool.

Terra price prediction and the fundamentals

To start, we will look at the Terra ecosystem’s fundamentals. But first, it is important to explain the rebranding.

Terra (the old blockchain ecosystem) went belly up in 2022 when its primary algorithmic stablecoin, UST, lost its peg and kept dropping. As the entire platform was hinged on the UST-LUNA (the native crypto of the old ecosystem) balance, things started to go south very quickly. The blockchain crashed, leaving UST and LUNA in shambles.

A few weeks later, Terraform Labs launched a new blockchain protocol — via a hard fork, naming it Terra (the new one) and rebranding the old platform as the Terra Classic. In came a new LUNA (for the new chain). The old native token was rebranded to LUNC.

Did you know? Terra 2.0 or simply the new Terra is built using the proof-of-stake consensus and currently has 130+ validators.

The new Terra

With all the confusion out of the way, we will now build a price forecasting model for Terra (LUNA) — the new ecosystem and its native coin.

Here are the features relevant to the new Terra protocol:

- A smart contract-compatible ecosystem with support for DApps.

- It is open-source and is loaded with new-gen developer tools.

- LUNA, its native crypto, is the go-to method of transacting within the new Terra network.

- Currently, a few projects are building on the ecosystem, including Arbie — a trading bot; and Coinhall — a platform with price charts.

- It is a proof-of-stake (PoS) platform built using the Cosmos SDK.

- Terra 2.0, or the new Terra, is a part of Do Kwon’s regeneration plan — something most have little faith in, at least in this bearish crypto market.

- The new protocol, or Terra 2.0, supports LUNA staking and even introduces slashing penalties to keep the supply and issuance in check.

Here is what the Terra ecosystem looks like currently:

Currently, Terra is still a controversial ecosystem. However, the price of Terra (LUNA) can climb once more builders come on board. The trust score is still low, which will take some time to improve.

LUNA tokenomics and the current trading activity

Terra 2.0 has an interesting tokenomics model. The initial supply is 1 billion, with the distribution spanning across developer mining, alignment, and emergency allocation programs. The token release smart contract allocates coins to the LUNC and UST holders pre- and post-attack.

Currently, only 12% of LUNA coins make the circulating supply. But what about the market-wide sell-offs — something LUNC experienced before going up in flames? Well, LUNA distribution cycles come with vesting (locking) periods, preventing massive sell-offs and price drops. This feature makes us a tad optimistic about the LUNA price prediction.

Despite the controversial outlook, LUNA is doing relatively well regarding the spot trading markets. The LUNA-BUSD and LUNA-USDT trading pairs on Binance take up most trading volumes. Yet, the overall liquidity and buyer confidence, even on other crypto exchanges, is relatively high. We will take a look at the volumes separately during the technical analysis.

It is 2024, and the most popular exchanges like Binance, OKX, Gate.io, and more have LUNA listed with high confidence scores.

LUNA price prediction and key on-chain and social metrics (2022 data)

It’s now time to look at the key charts related to the new Terra blockchain platform and its native crypto, LUNA.

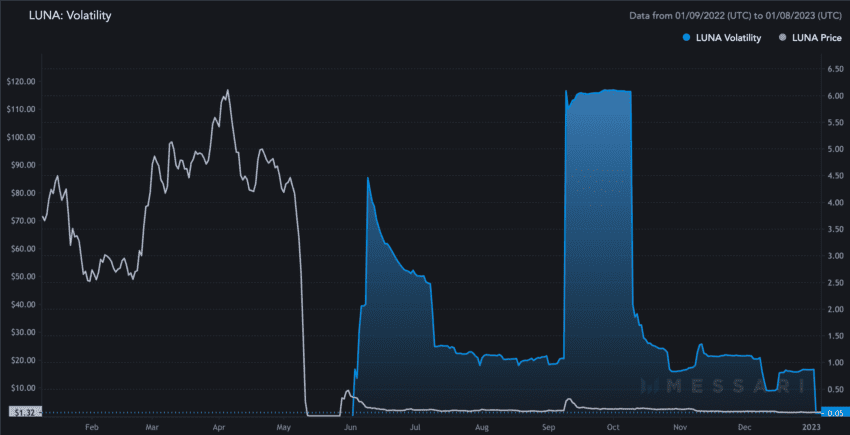

Firstly, here is the volatility chart for you to look at. You can see that the initial volatility in June 2022 and then in October 2022 was the highest. This could be due to the fact that people weren’t very trusting of the new LUNA. However, volatility has dropped over the past few months despite the prices trading at lows.

The development activity relevant to the Terra 2.0 protocol shows an interesting picture. The chart reveals that Terra experienced an increase in development activity over December 2022 despite positive momentum at the price counter. We saw some minor spikes but nothing that could be termed positive for the price.

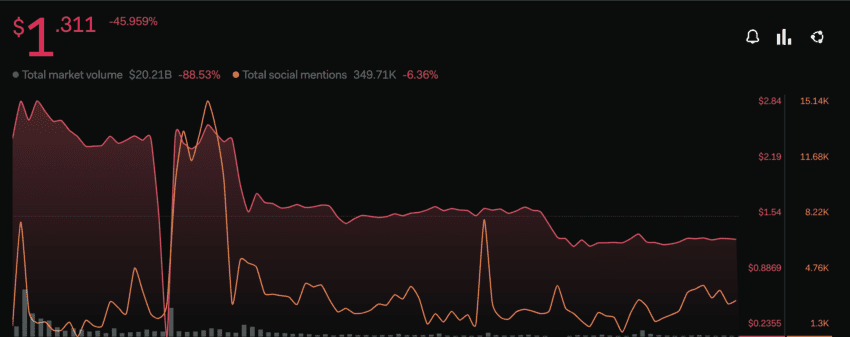

The social mentions dropped by 6.4% QoQ, showing that the initial hype around Terra 2.0 is fizzling out. However, this might be a good news piece, as low hype might also mean fewer controversies. Yet, a clear trend is noticeable: the price of LUNA peaks every time there is a surge in the number of social mentions.

/Related

More Articles

The on-chain and social metrics need to improve if we expect the LUNA price prediction levels to be as bullish as LUNC’s in 2021.

LUNA price prediction and technical analysis

Before we start with the technical analysis of LUNA, it is important to get hold of a few things and concepts:

- Terra Classic might be the old version of Terra, but LUNA is the new coin. It has been around since mid-2022.

- The price chart of LUNC (previously LUNA) is the old price chart that considers the ascent and descent of the original Terra ecosystem.

- The highest price of LUNC (when it was a part of the older chain) was $119.18. Post reaching this level, the prices started dropping. The highest price of LUNA (coin associated with the new chain) was $19.54. This level surfaced back on May 28, 2022.

- The lowest price of LUNA (as part of the new chain) was $1.17, reached on Dec. 16, 2022.

- We will not consider the minimum price of LUNA (when part of the older chain) as the drop resulted from unexpected and unprecedented activity caused by the algorithmic stablecoin UST. The current operating premise doesn’t include any stablecoin of any kind.

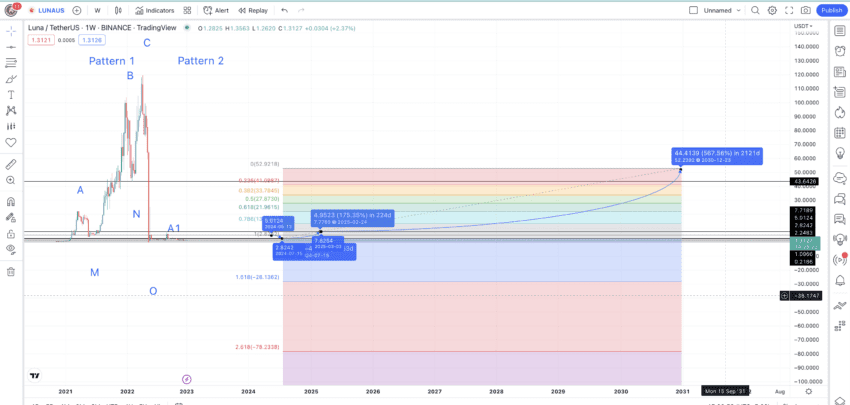

Pattern identification

Looking at LUNA’s weekly chart, there’s a clear pattern. After a flattish trading session comes a peak followed by a bottom and two higher peaks. Each peak is followed by a bottom, which we have marked for your better understanding.

Do note that the drop coming after the highest price (peak C) is forced by the crypto market conditions. We shall exclude the drop value and instead take the average high-to-low drop percentage while calculating for the next set of points.

Therefore, the three higher highs might be the recurring pattern for the price of LUNA going ahead. We have divided the long-term chart of LUNA into two segments: pattern one and pattern two.

Price changes

Now, we will trace the path from A to O as part of pattern 1. Once we have the data, we will use the averages to locate the next point, M1, and even the next high, B1.

Based on the table above, the average high-to-low distance and percentage change come out at 49 days and 70.03. Do note we haven’t taken the values from C to O while calculating the average. This is because the drop can be considered an aberration and not a standard event.

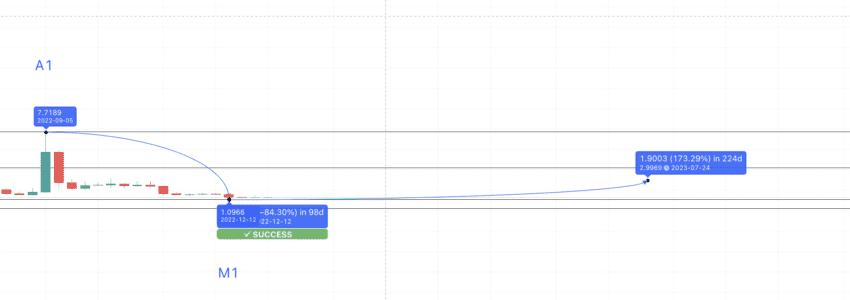

Therefore, if we consider the new high as A1, the next low from which the price of the LUNA token might rise might surface at $2.24. Here is the successful completion of the forecast, suggesting we are heading in the right direction with our Terra price prediction.

However, the drop was lower, and LUNA touched $1.17 a few days back. So, we will take this level and label it M1. That’s closer to the initial drop to M from A — per the table above.

Terra (LUNA) price prediction 2023

We generously expected LUNA to move as high as $2.99 in 2023. It didn’t happen; we could only get $1.3 at most. Here is how our analysis went:

Again, the table data gives the low-to-high average time and percentage change values as 144 days and 1295.39%. Yet, the current state of the crypto market might not be as bullish for LUNA crypto (the new version) as it was for the older version of LUNA. Using the table above, a good price forecast level would be a high of 174.79%. The digital asset might even take the maximum number of 224 days to reach this level.

This puts the LUNA price prediction 2023 model at $2.99 — when the maximum price of Terra (LUNA) is in question. LUNA might reach this level by July 2023 if the ecosystem grows.

The minimum price prediction for 2023 could surface at a low of 70% from the mentioned high of $2.99. This level surfaces at $1.096. Even though the drop, in this case, isn’t 70%, the strong support at $1.096 might stop this digital asset from falling any lower in 2023.

Short-term LUNA price prediction 2023

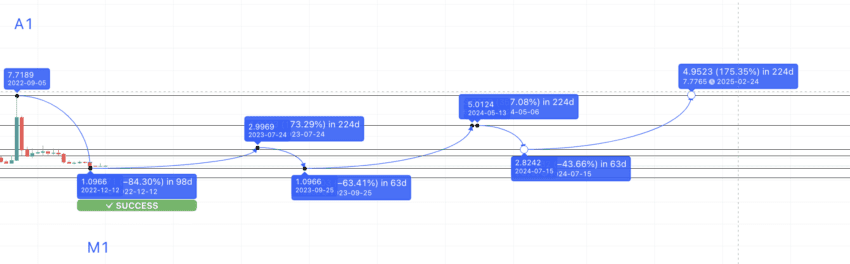

This is a very important section, especially for those who prefer looking at the short-term price movement of digital assets. Here is a daily chart of LUNA, which only includes the values post-28 May 2022. If you see this chart, a lower high (swing high) pattern is in progress. Let us use this chart to see if the price forecast varies from our long-term price prediction for 2023.

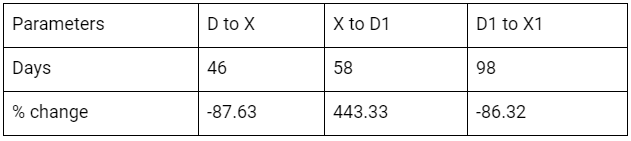

Let us mark the peaks as D and D1 and the lows as X and X1.

The table below has mapped the distance and price change between the highs and lows.

Therefore, if X1 to the next high follows the same path as traced by the table above, we expect the next high to surface at $2.75. Do note that a hike of 443.33% might not be possible in this crypto market when the trading volume is so low.

Therefore, the price prediction 2023 high could be close to the $2.75 mark, courtesy of the strong resistance lines. This almost aligns with our long-term price prediction for 2023, which puts the high at $2.99. The low for 2023 is almost similar to our previous price forecast, as strong support lies at $1.097.

Terra (LUNA) price prediction 2024

Outlook: Bullish

Let us now head back to the weekly chart of the LUNA coin and start from where we left off. Now we have the minimum price of Terra (LUNA) for 2023, we can use 224 days and a maximum percentage hike of 1295.39% for our next price forecast.

However, the bull market might not start till the middle of 2024, so a 1295.39% might not sound realistic, especially for a coin like LUNA. Therefore, if the price rises in 2024, it might go as high as $5.01 — a strong resistance line that LUNA might not breach in 2024. That translates to a high of 357.08%.

However, the ecosystem needs to show strength and growth for these levels to happen.

Projected ROI from the current level: 586%

Terra (LUNA) price prediction 2025

Outlook: Bullish

The low in 2024 can surface at $2.82 theoretically — owing to the strong weekly support lines. However, keeping the current price levels in mind, a low of $0.6 — close to the strong support levels — looks likely. The timeframe could be anywhere between 35 to 63 days. Now we have the 2024 low, the high in 2025 can surface at $7.77 — keeping the 174.79% minimum growth percentage in consideration. This way, the maximum Terra (LUNA) price prediction for 2025 can breach an important weekly resistance of $7.71.

If you look at the daily chart illustrated above, the high in 2025 could be equal to the D1 — one of the peaks made by the new LUNA token.

Projected ROI from the current level: 964%

Terra (LUNA) price prediction 2030

With the 2024 low and 2025 high to work with, we can connect the points to extrapolate the price forecast for LUNA till 2023. Tracing the same growth path, we can put the LUNA price prediction for 2030 at $52.92 per the Fibonacci extension.

However, Terra 2.0 must maintain steady ecosystem growth to reach this level and avoid negative development. If LUNA manages to hit $52.92 by 2030, it might see more aggressive growth in the next few years. For that, the drop in 2030 shouldn’t exceed $33.78 — a 38.20% drop from the high.

Projected ROI from the current level: 7149%

Terra (LUNA’s) long-term price prediction until 2035

Our data-backed Terra price prediction model uses technical analysis to put LUNA’s 2030 high at $52.92. However, if you plan on going long on Terra 2.0, the table below can help you trace the path till 2035. Over time, the price hikes and drops might change depending on LUNA’s market cap, trading volume, and social chatter.

You can easily convert your LUNA to USD

| Year | Maximum price of LUNA | Minimum price of LUNA |

| 2024 | $5.01 | $0.6 |

| 2025 | $7.77 | $6.06 |

| 2026 | $10.49 | $6.50 |

| 2027 | $15.73 | $9.75 |

| 2028 | $21.24 | $13.17 |

| 2029 | $28.64 | $22.36 |

| 2030 | $52.92 | $33.78 |

| 2031 | $71.44 | $55.72 |

| 2032 | $92.87 | $72.43 |

| 2033 | $116.08 | $90.54 |

| 2034 | $150.90 | $117.70 |

| 2035 | $188.62 | $147.12 |

Is the LUNA price prediction model accurate?

Our LUNA price prediction model embarks upon both long-term and short-term technical analysis. The model also considers the tokenomics of the current Terra 2.0 blockchain protocol. Further, we focus on the fundamentals of this controversial proof-of-stake digital asset. And finally, we zoom in on the development activity, volatility, and social chatter around Terra 2.0. All of this has helped us form a well-balanced, realistic, and usable LUNA price prediction.

Frequently asked questions

What will LUNA be worth in 2024?

How much will LUNA be worth in 2025?

Can LUNA reach $10 dollars?

How much will Terra (LUNA) be worth in 2030?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.