The Polygon (MATIC) price broke out from an ascending parallel channel on October 22. It validated it as support five days later.

During the increase, the price reclaimed the $0.60 horizontal resistance area. Is this the beginning of the trend reversal?

MATIC Reclaims Horizontal Resistance

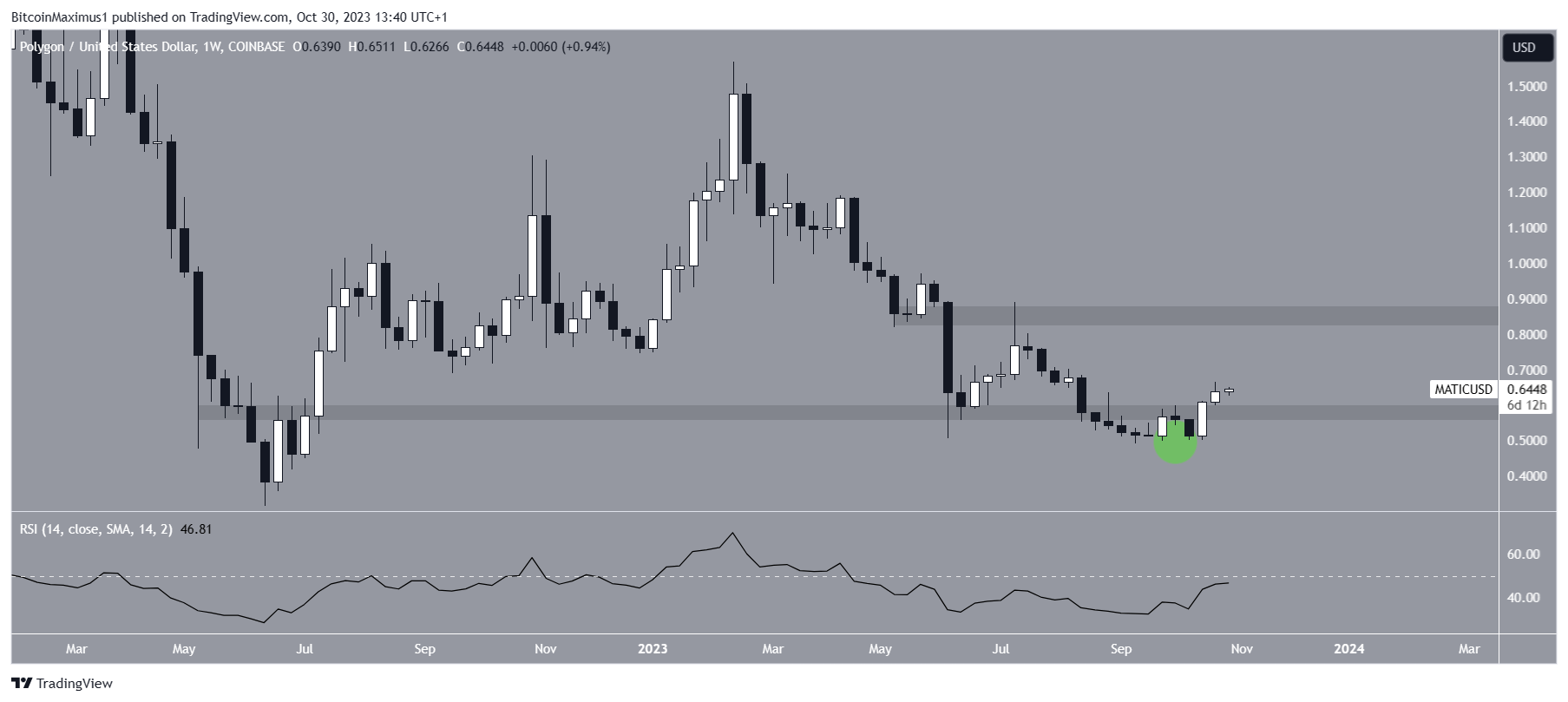

The weekly timeframe technical analysis shows that the MATIC price has increased during the past two weeks. The upward movement caused a reclaim of the $0.60 horizontal area.

This is a crucial area since it had previously provided support since July 2022. While the price fell below it in September, it has now reclaimed the area, rendering the decrease only a deviation.

The weekly Relative Strength Index (RSI) is undetermined.

With the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

Bulls have an advantage if the RSI reading is above 50 and the trend is upward, but if the reading is below 50, the opposite is true.

While the RSI is increasing, it is still below 50, indicating an undetermined trend.

The Polygon Labs team announced last week that the POL token upgrade is live on the Ethereum mainnet. This is a crucial step following extensive development, community engagement, and the successful launch of the testnet.

POL, characterized as a cutting-edge and highly productive token, will serve as the driving force behind an extensive ecosystem of Layer 2 chains based on zero-knowledge technology.

This is made possible through a native re-staking protocol, empowering POL holders to validate multiple chains and fulfill various roles on each of these chains, such as sequencing, generating ZK proofs, and participating in data availability committees, among others.

The POL token upgrade also sets the stage for the upcoming milestones outlined in the Polygon 2.0 roadmap.

This includes the introduction of a new staking layer to support Polygon Layer 2 solutions, the enhancement of Polygon Proof-of-Stake (PoS) with zkRollup technology, and the implementation of a sophisticated, ZK-powered interoperability and shared liquidity protocol for all these Layer 2 solutions.

MATIC Price Prediction – Has Bullish Reversal Begun?

The daily timeframe technical analysis also provides a bullish outlook because of the price action and the RSI.

The Polygon price action shows that the price broke out from an ascending parallel channel on October 22. It returned to validate it as a MATIC price support (green icon) on October 27.

Since such channels usually contain corrective movements, the breakout from the channel indicates that the upward movement is the beginning of a new bullish trend.

Read More: Best Crypto Sign-Up Bonuses in 2023

The daily RSI also gives a bullish reading since the indicator is above 50 and moving upwards.

If the increase continues, MATIC can increase by another 30% and reach the $0.85 horizontal resistance area.

Despite this bullish MATIC price prediction, a close inside the channel’s support line will invalidate the ongoing breakout.

In that case, the price could fall by 20% and reach the support trendline at $0.52.

Interested in AI Trading? 9 Best AI Crypto Trading Bots to Maximize Your Profits

For BeInCrypto’s latest crypto market analysis, click here.

Trusted

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.