Polygon is one of Ethereum’s biggest allies. It is a decentralized scaling platform for the Ethereum mainnet, with a toolkit like Polygon SDK at its core. As a layer-2 solution, Polygon is one of the more established names in the space with MATIC, its native token usually frequenting the top 10 market cap ranking list. But despite the laurels, should you go ahead and buy Polygon (MATIC)? Here’s what you need to know.

Buy polygon (MATIC) with few clicks on secure platform

YouHodler

Best for free BTC cloud miningOKX

Best for mystery box offerCoinbase

Best for beginnersOur methodology for selecting the top platforms and wallets to hold and buy MATIC

This guide recommends some of the best platforms to use to purchase MATIC. BeInCrypto tested these platforms over a period of six months. Many factors were taken into consideration when selecting the top platforms and wallets.

For platforms such as exchanges and brokers, some of the prerequisites for the top platforms included security, compliance to regulations, user-experience, products and features. Naturally, security and compliance go hand in hand.

Platforms that voluntarily publish proof of reserves, segregate assets, provide advanced account security, and acquire licenses for operations score top marks. Features tend to provide a better user experience, and product diversity sets platforms apart.

For wallets, strong encryption, enhanced security, account controls, and products and features are prerequisites for the top wallet options. Some features may also be distinct when accounting for hot wallets and cold wallets.

Platforms

• YouHodler: YouHodler is regulated in the E.U. and Switzerland. The company offers crypto loans and interest bearing crypto accounts.

• OKX: OKX serves over 100 countries, publishes a proof of reserves (PoR), and has two funds to ensure the smooth operations of the platform.

• Coinbase: Coinbase is a publicly traded U.S. company that offers staking, advanced trading features, and has a subscription for lower fees.

• Binance: Binance is the largest exchange by trading volume and assets under management. It has a diverse suite of products to cater to customers.

• Kucoin: Kucoin is a global exchange that services over 200 countries, that also has diverse crypto products, such as derivatives.

• Kraken: KRaken is based in the U.S., is one of the first exchanges to publish a PoR, and offers crypto derivatives as well.

Wallets

• MetaMask: MetaMask is an Ethereum centric wallet that offers portfolio management services and supports multiple EVM blockchains.

• Wirex: The Wirex wallet gives you access to your Wirex account, all while giving you enhanced security options like two-factor authentication.

• Coinbase: Coinbase wallet is a Metamask alternative that you can use as an extension, mobile wallet, all while supporting non-EVM coins.

• Zengo: Zengo is a popular option for users that require enhanced security and recovery options like MPC encryption and facial recognition technology.

• Crypto.com: The Crypto.com is the proprietary wallet of the eponymous platform that supports over 1,000 tokens and more than 30 blockchains.

• Trezor: A hardware wallet with advanced security, such as Shamir encryption, and coinjoin for transaction privacy.

• Ledger: Ledger is the industry standard for security, its wallet support a plethora of assets, and provides additional features, such as a mobile app.

This methodology was peer-reviewed and fact checked to ensure accuracy. It also aggregates primary and secondary research to ensure the most relevant and accurate information. To learn more about BeInCrypto’s verification process, click here.

- Our methodology for selecting the top platforms and wallets to hold and buy MATIC

- Exploring Polygon

- Polygon competitors: How it compares against other L2s

- Is MATIC crypto Indian? Unpacking the Polygon ecosystem

- MATIC wallets

- Where to buy polygon (MATIC)

- How to buy polygon

- How to sell polygon

- MATIC wallets in 2023

- MATIC price prediction

- Should you buy MATIC or wait?

- Frequently asked questions

Exploring Polygon

So, what is Polygon? Simply put, Polygon aims to speed up Ethereum transactions by providing an off-chain arena. Polygon creates a multi-chain ecosystem, known as a sidechain ecosystem, and also uses the plasma framework, processing Ethereum-centric transactions on the sidechains.

Backed by Coinbase and Binance, Polygon is a tech-intensive decentralized project with a lot going on.

Gonna run out of big brands to onboard to Polygon soon..

Mihailo Bjelic, co-founder of Polygon: Twitter

What is this layer-2 solution, and how does it work?

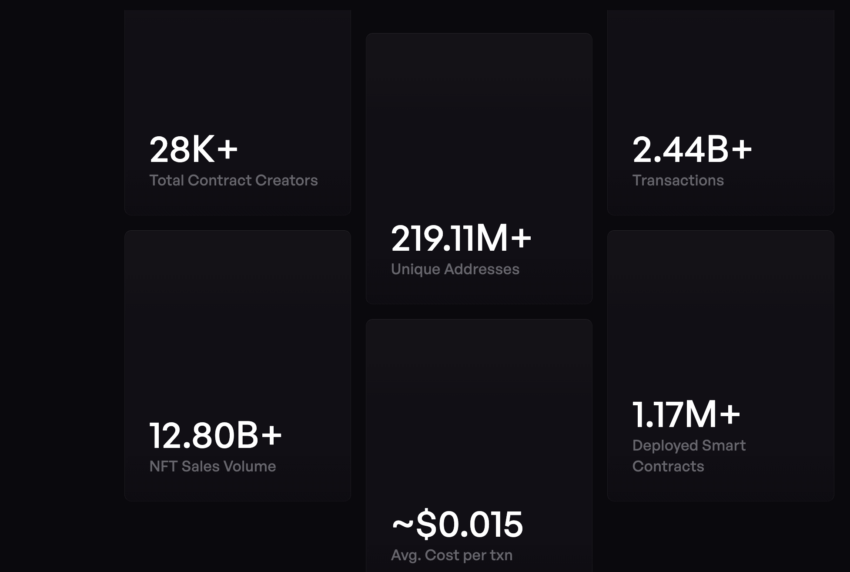

A standard layer-2 scalability client, Polygon feeds off Ethereum’s security while supporting close to 65,000 transactions per sidechain.

The plasma framework and the sidechain ecosystem allow Polygon to host many DApps on the platform. Also, MATIC, the ERC-20 token, is used as the mode of payment across the Polygon ecosystem.

What makes Polygon unique?

There are quite a few exclusive traits that make Polygon work, considering it as your next layer-2 investment or even for technical reasons. These include:

- Presence as a modular chain, with the ability to customize DApps per needs.

- An interoperability-focussed ecosystem

- One of the more secure scalability solutions

- Ultra-fast transaction finality of under two seconds

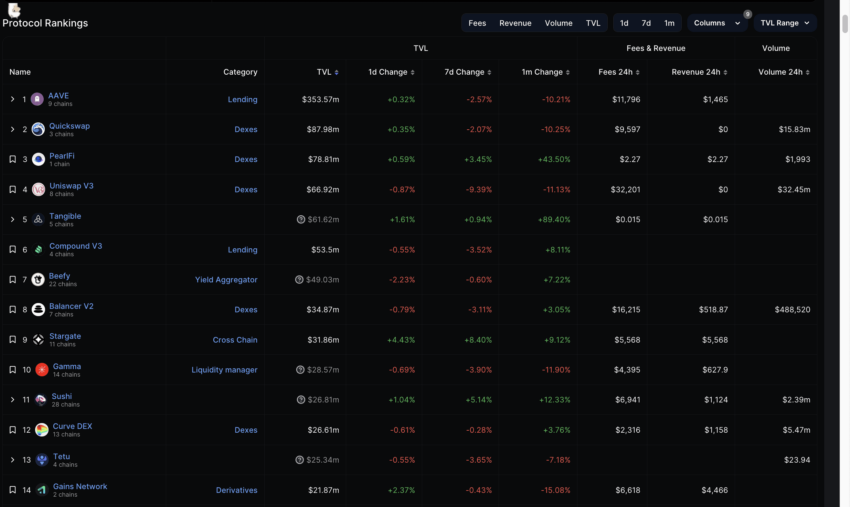

- An expanding network of DeFi solutions

- Proof-of-stake chain and hence highly energy-efficient

- The MATIC crypto supports staking

Another cool thing about Polygon is its ability to bridge assets from Ethereum. The Polygon bridge makes the layer-2 blockchain more scalable and interoperable than ever.

Did you know? Polygon’s Plasma Framework works in the manner initially proposed by Ethereum co-founder Vitalik Buterin.

Polygon competitors: How it compares against other L2s

Now that we have looked at the technical elements of Polygon, let us understand how it competes against other layer-2 blockchain solutions.

Polygon vs. Loopring

In the comparison of Polygon vs Loopring, both emerge as layer-2 solutions in the blockchain domain, yet they cater to different functionalities. Polygon primarily focuses on hosting decentralized applications (DApps) and managing smart contracts, making it a versatile choice for low-cost payments, DApp integration, and smart contract execution.

Conversely, Loopring specializes in decentralized trading with a strong emphasis on automated market makers (AMM) on Ethereum. It stands out for trading financial assets with minimal fees.

Although both platforms promise fast transactions at reduced costs, their suitability varies based on user needs:

- Loopring is optimal for those seeking efficient and affordable trading of Ethereum assets.

- Polygon appeals to users looking for a robust blockchain ecosystem encompassing NFTs and DeFi components.

Polygon vs. Arbitrum

Arbitrum relies solely on Optimistic Rollups for Ethereum scalability. This layer-2 blockchain also supports unmodified EVM-compatible contracts. Polygon, on the other hand, brings an extensive suite of options featuring PoS Plasma, Optimistic Rollups, or even ZK-Rollups, based on requirements.

Polygon also compares with other layer-2 blockchains, including Optimism — with the latter only focusing on Optimistic rollups, whereas the former brings the entire suite.

Is MATIC crypto Indian? Unpacking the Polygon ecosystem

Polygon, originally the Matic network, boasts Indian roots. The ecosystem was ideated by Sandeep Nailwal, Jaynti Kanani, and Anurag Arjun, with MATIC as the native, transaction-specific token.

/Related

More ArticlesThe Polygon ecosystem boasts DApp or, rather, smart contract functionality. Each Polygon smart contract gains its security posture via Ethereum-submitted checkpoints.

MATIC wallets

MATIC wallets are important ecosystem components, especially if you have plans to buy polygon and hold it long-term. While MetaMask is the most accessible polygon wallet and one of the better-known options, you can also rely on software polygon wallet options like Wirex, Zengo, and more. Or, you can go for standard hot wallets like Crypto.com’s DeFi wallet, Rainbow wallet, and more. Of course, using a hardware wallet, such as Ledger or Trezor, is the most secure option.

Choose free wallet to buy Polygon (MATIC)

Wirex

Free non-custodial cross-chain wallet

Zengo Wallet

No seed phrase vulnerability

Coinbase Wallet

Hundreds of tokens supported

Earning with polygon (MATIC)

If you buy MATIC, you can still consider using it to generate additional passive income, all while you wait for the token to surge. A good way to do that is via MATIC staking or to rely on the top yield farms for Polygon like Aave, SushiSwap, and more to generate generous APYs.

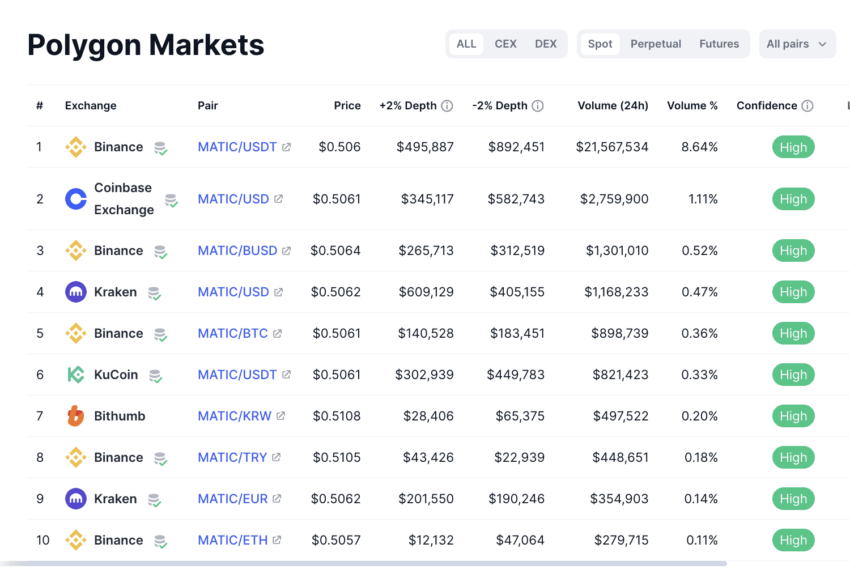

Where to buy polygon (MATIC)

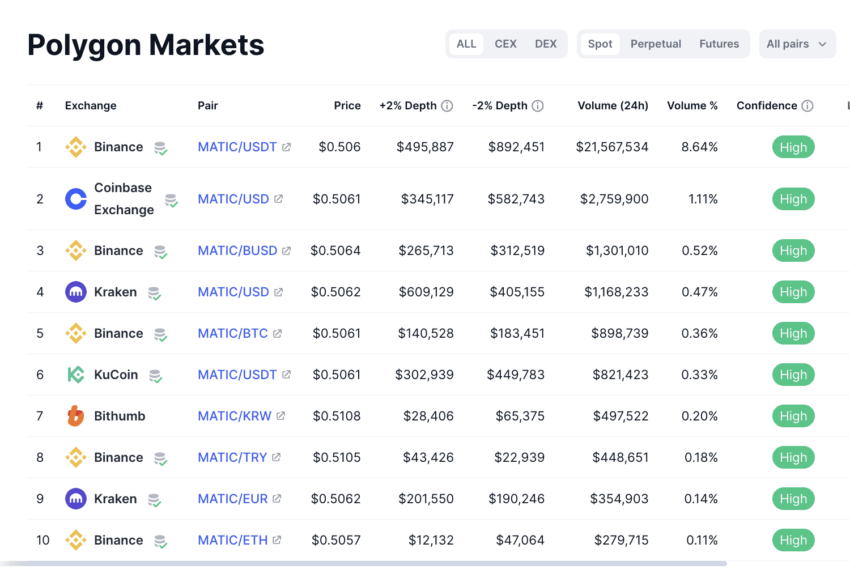

- Binance: With deep order books and tight spreads, we executed MATIC transactions seamlessly on Binance without any slippage. The intuitive interface enabled easy navigation to buy, sell, and trade MATIC efficiently against other cryptocurrencies. Additionally, it’s low fees and advanced charting tools further enhanced our trading experience, making Binance one of the best platforms for MATIC transactions.

- Coinbase: During our testing, we’ve noticed that Coinbase provides a streamlined path to Polygon, catering to both new and seasoned traders. Their educational content is particularly impressive, making it an invaluable resource for understanding Polygon before investing. The added benefit for U.S. users is the platform’s compliance with stringent regulatory standards, ensuring a high trust quotient.

- Kraken: For U.S. traders seeking granular control over their MATIC trades, Kraken offers an advanced trading interface that enables sophisticated order placement and risk management strategies. Its range of order types, including limit, stop-limit, and market orders, empowers traders to execute their trading plans with precision. Additionally, Kraken’s crypto futures offering provides opportunities to speculate on MATIC’s price movements, allowing traders to hedge their portfolios or capitalize on market trends. We found Kraken’s advanced trading interface to be intuitive and easy to navigate, making it an ideal platform for experienced traders seeking to maximize their trading potential.

- KuCoin: For global investors seeking a diverse range of altcoins alongside MATIC, KuCoin is a haven of options. The exchange boasts an extensive selection of tokens, providing ample opportunities for portfolio diversification. Beyond trading, KuCoin offers a range of features, including fractional NFTs, futures trading, and staking services. We experienced the ease of navigating Kucoin’s user-friendly platform and found its staking feature to be a straightforward and rewarding way to generate passive income from our MATIC holdings.

- YouHodler: YouHodler stands out as a unique exchange that caters to a broader range of crypto-related needs beyond trading. Users can earn interest on their MATIC holdings, providing a passive income stream while maintaining their exposure to the token’s potential growth. Additionally, we experienced that YouHodler enables users to take out crypto-backed loans, providing immediate access to fiat currency without selling their crypto assets.

Why we chose these platforms

If you’re looking for a platform to buy polygon, note that all options listed above have been chosen for their good liquidity levels, global presence, decent usability, and solid security offerings. While no transaction within decentralized ecosystems is risk-free, the above options all represent established players in web3.

If you want to buy polygon anonymously, MATIC is also available to buy and sell on a number of decentralized exchanges, including Uniswap, PancakeSwap, and Curve. Choose the right MATIC pair and ensure you check liquidity before you proceed with your purchase.

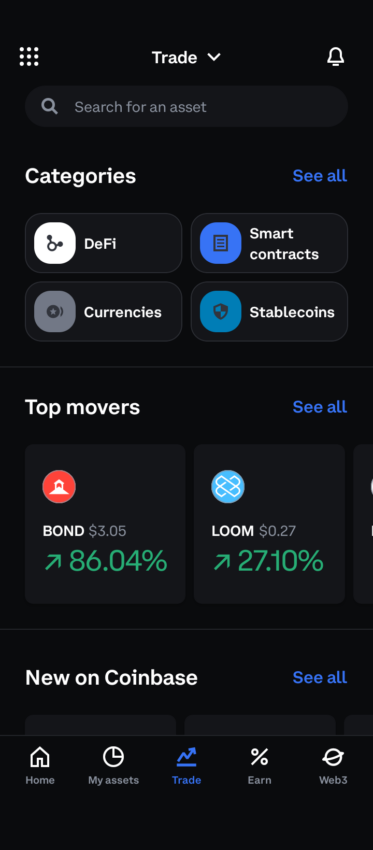

How to buy polygon

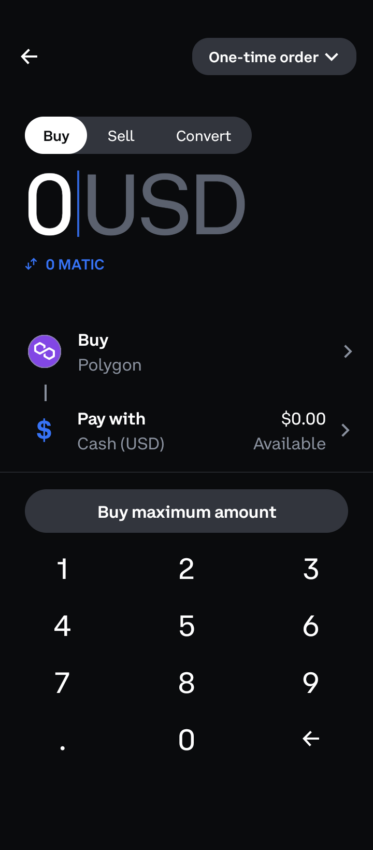

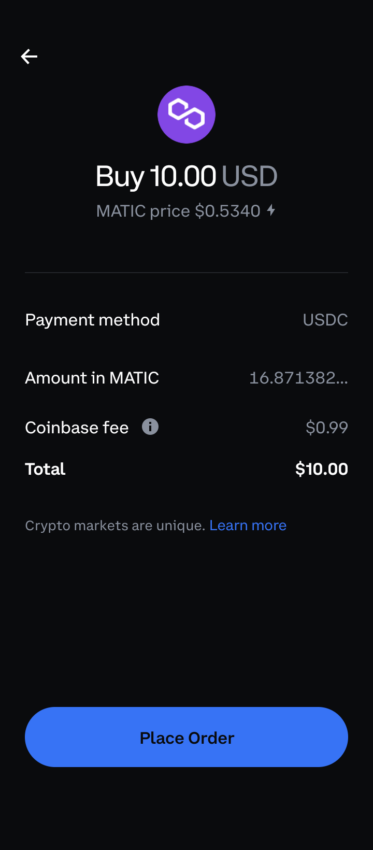

Here’s how to buy polygon using Coinbase, one of our top choice centralized exchanges. Follow these steps to purchase MATIC.

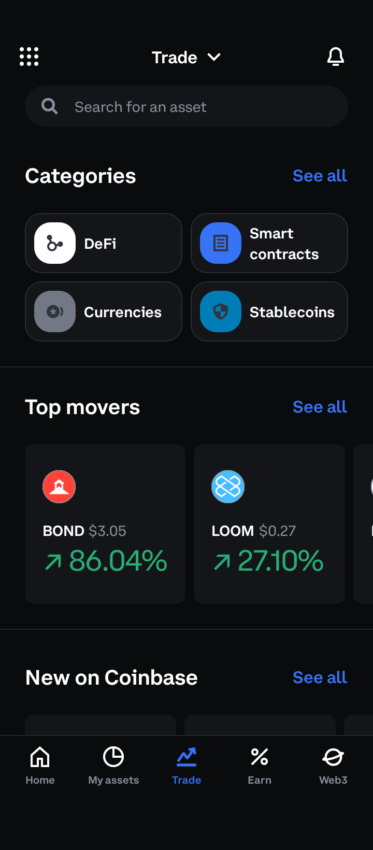

1. Open the Coinbase app, select “Trade,” and search for MATIC.

2. Select “Buy” and choose the amount you would like to purchase.

3. Choose “Place Order” to complete your transaction.

How to sell polygon

To sell MATIC, you should send the wallet-held tokens to a CEX to sell and convert the same to fiat. For standard swaps and cryptocurrency conversions, DEXs can be faster. Exchanges like Binance also offer P2P trading options on MATIC across specific regions. Here, we’ve used Coinbase to demonstrate the process.

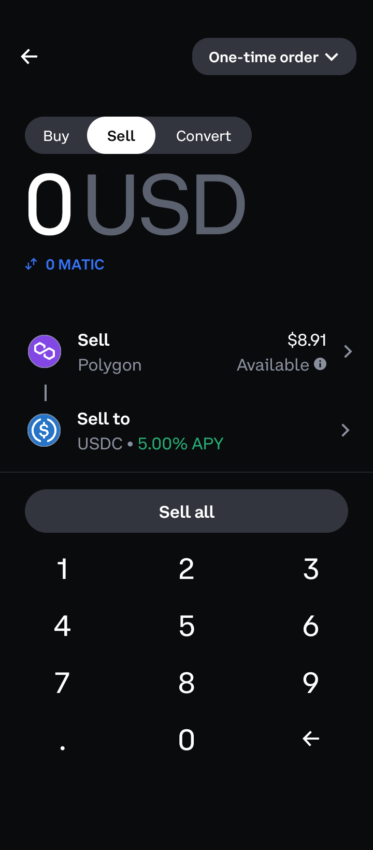

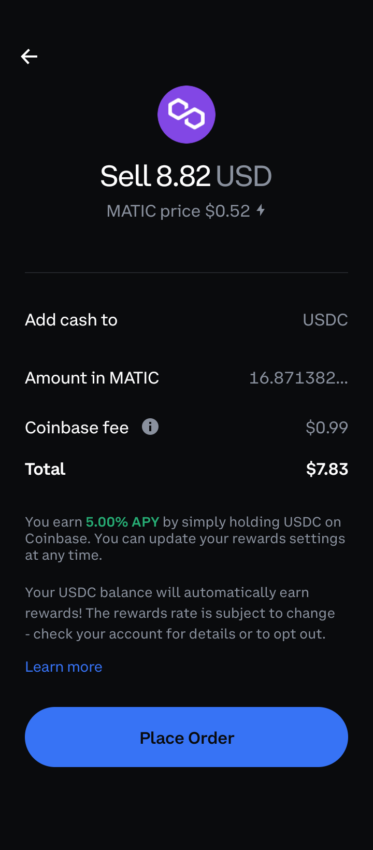

1. Open the Coinbase app and go to “Trade.” Select MATIC in the search bar, then press “Sell.”

3. Choose the amount that you would like to sell.

3. Lastly, select “Place Order” to complete your sell transaction.

MATIC wallets in 2023

Polygon (MATIC) wallets, integral to the Polygon ecosystem, enable the storage and management of MATIC, Polygon’s native token. These wallets facilitate transactions: users request a specific MATIC amount, prompting the network to generate a unique, secure address for the transfer.

MATIC wallets vary in functionality. Basic versions support staking and MATIC transfers, while more advanced wallets offer additional features, including smart contract deployment. Key examples of MATIC wallets include Wirex, YouHodler, Uphold, ZenGo, and Coinbase Wallet, each offering a range of functionalities to suit different user needs.

MATIC price prediction

If you are willing to buy polygon (MATIC), it might be better to hold the coin for a considerable period. Our MATIC price prediction validates this statement, foreseeing a price of $5.35 by 2025 but a level closer to $47 by 2030. Regardless, it is advisable to invest only a small sum in cryptocurrency to avoid significant losses in case the market turns.

Note that price predictions — even those like ours, fortified by comprehensive analysis including fundamentals, social sentiment, and in-depth technical analysis — are not an exact science in the volatile crypto world. Always DYOR rather than relying solely on a single prediction, and only even invest if you believe in the value and longevity of a project.

Should you buy MATIC or wait?

Whether you should buy Polygon in 2023 depends on what you plan to do with the crypto. You can buy polygon anytime if you wish to invest long-term. However, if you wish to buy MATIC for short-term trading, it is advisable to rely on market sentiments, technical analysis, and other factors in order to acquire the native coin at a cheaper tick.

Frequently asked questions

How can I buy polygon?

Where to buy polygon in the U.S.?

Is polygon MATIC available in WazirX?

Is polygon coin on Binance?

Is MATIC crypto Indian?

Who is India’s first crypto billionaire?

Who is the owner of Polygon?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.