Emails purportedly from the pseudonymous Bitcoin developer, Satoshi Nakamoto, emerged on Friday, courtesy of Martii Malmi, an early contributor to the flagship digital asset. The correspondence adds further depth to Bitcoin’s lore, shedding light on its humble beginnings and Nakamoto’s decision-making process.

These emails surfaced during a legal battle in London involving the Australian scientist Craig Wright, who asserts himself to be Nakamoto.

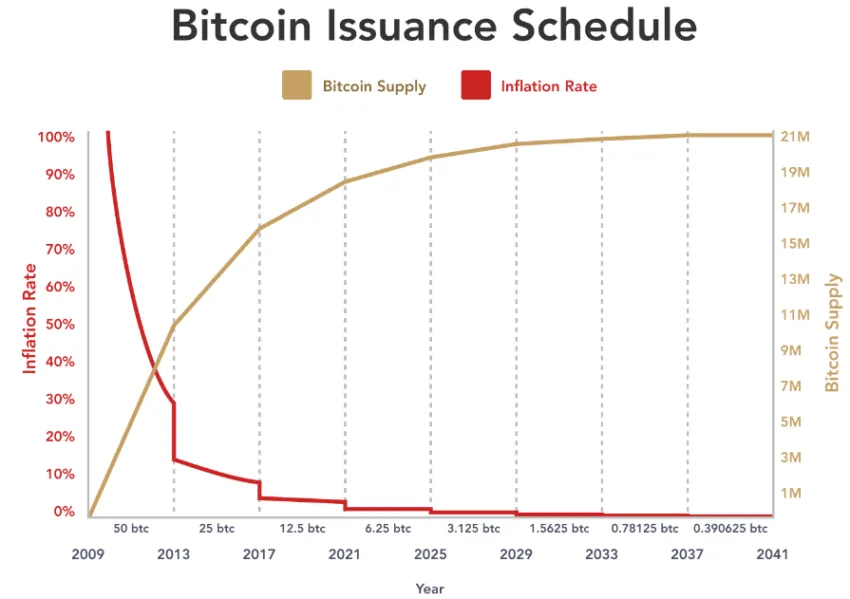

Why Bitcoin Supply Is Capped at 21 Million

The exchange between Nakamoto and Malmi revealed that the decision to cap Bitcoin’s supply at 21 million tokens was not arbitrary but a deliberate choice. Nakamoto described it as an “educated guess,” aimed at aligning Bitcoin’s pricing dynamics with established currencies while acknowledging the uncertainty of future market conditions.

“My choice for the number of coins and distribution schedule was an educated guess. It was a difficult choice, because once the network is going it’s locked in and we’re stuck with it. I wanted to pick something that would make prices similar to existing currencies, but without knowing the future, that’s very hard,” Nakamoto said.

Moreover, Nakamoto emphasized that 21 million BTC represented a fraction of global commerce, ensuring scalability for a worldwide currency system. This decision was made with the anticipation that Bitcoin’s valuation could fluctuate relative to traditional fiat currencies.

“If you imagine it being used for some fraction of world commerce, then there’s only going to be 21 million coins for the whole world, so it would be worth much more per unit. Values are 64-bit integers with 8 decimal places, so 1 coin is represented internally as 100000000. There’s plenty of granularity if typical prices become small. For example, if 0.001 is worth 1 Euro, then it might be easier to change where the decimal point is displayed, so if you had 1 Bitcoin it’s now displayed as 1000, and 0.001 is displayed as 1,” Nakamoto added.

Read more: Bitcoin Price Prediction 2024/2025/2030

These revelations offer valuable insights into Bitcoin’s early development and the considerations that shaped its foundational principles.

Other Revelations From Satoshi’s Emails

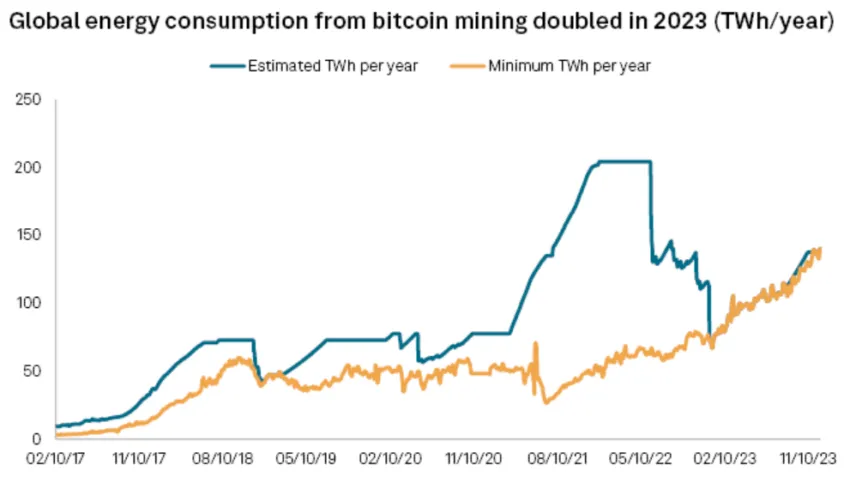

Beyond supply dynamics, the emails delve into various facets of Bitcoin. These include the portrayal as an investment vehicle and concerns regarding energy consumption and anonymity. Nakamoto cautioned against characterizing Bitcoin solely as an investment, highlighting the inherent risks and advocating for individual judgment.

“I’m uncomfortable with explicitly saying ‘consider it an investment.’ That’s a dangerous thing to say and you should delete that bullet point. It’s okay if they come to that conclusion on their own, but we can’t pitch it as that,” Nakamoto explained.

Additionally, while acknowledging the potential for increased energy consumption as Bitcoin scales, Nakamoto argued that it would still be less resource-intensive than conventional banking operations.

“If it did grow to consume significant energy, I think it would still be less wasteful than the labor and resource-intensive conventional banking activity it would replace,” Nakamoto stated.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

Regarding anonymity, Nakamoto cautioned against overstating Bitcoin’s privacy features, warning that transaction histories could potentially reveal users’ identities. The pseudonymous BTC creator said, “anonymous sounds a bit shady.” Moreover, the emails revealed that Nakamoto did not coin the term “cryptocurrency.”

“Someone came up with the word ‘cryptocurrency.’ […] Maybe it’s a word we should use when describing Bitcoin, do you like it?,” Nakamoto queried.

Trusted

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.