Polygon, originally deemed the Matic Network, was originally intended to help scale the once-sluggish layer-1 chain, Ethereum. A layer-2 scaling solution, Polygon has come a long way since its inception in 2017. If you have been looking at Polygon and its native token MATIC as an investment option in 2023 and beyond, this MATIC price prediction piece might be a good read.

For Polygon (MATIC), 2023 was all about scaling a high of $1.52 — a level that aligned with our 2023 Polygon price prediction. Let us investigate what MATIC offers in 2024 and whether we should change our price expectations for 2025 and beyond.

Want to get MATIC price prediction weekly? Join BeInCrypto Trading Community on Telegram: read MATIC price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders!

- MATIC price prediction and the role of fundamentals

- Polygon tokenomics and the price forecast of Matic tokens

- Polygon network and key metrics

- MATIC price prediction and technical analysis

- Polygon (MATIC) price prediction 2023

- Polygon (MATIC) price prediction 2024

- Polygon (MATIC) price prediction 2025

- Polygon (MATIC) price prediction 2030

- Polygon (MATIC’s) long-term price prediction until the year 2035

- Is the MATIC price prediction model accurate?

- Frequently asked questions

This article may be outdated, we suggest you visit our new Polygon Price Prediction tool.

MATIC price prediction and the role of fundamentals

Polygon ecosystem isn’t just an Ethereum-specific scaling solution anymore. Instead, it has a pretty widespread DeFi, NFT, and web3 presence — something we will touch upon later in this discussion.

Coming to the fundamentals, Polygon supports DApps and even allows web3 builders to set up specialized infrastructure with access to chains driven by ZK and Optimistic rollup technologies. Also, it allows Ethereum to experience multi-chain interoperability, combining the Plasma Framework and a novel hPoS or hybrid proof-of-stake consensus mechanism.

As an investor primarily interested in the MATIC tokens, here are the aspects to take note of:

The Polygon ecosystem continuously brings new developments into the mix to speed up building in web3. The zkEVM chain is the most recent feather in its cap.

Lately, Polygon has seen a surge in the number of real-world and blockchain-specific partnerships. Some of the most significant ones include Nike’s foray into the web3 space via Polygon, SHOWTIME’s Polygon association, and a partnership with NuBank — a financial organization backed by Warren Buffet.

And that’s just the tip of the iceberg regarding the giant strides Polygon has made in the crypto arena. Also, y00ts — one of Solana’s most prominent NFT collections — has finally migrated to the Polygon ecosystem — taking the credibility of the MATIC network to a new level.

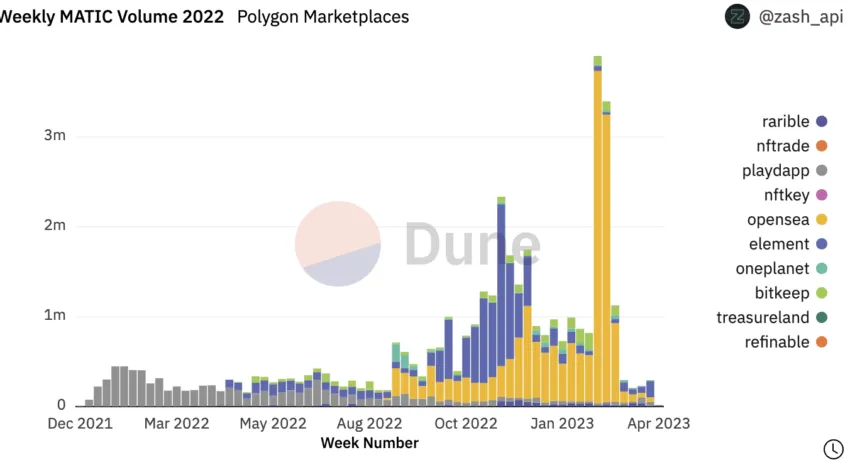

Polygon NFT market: how is it looking?

Per data from Dune Analytics, Polygon’s NFT market has picked up pace in 2023. The weekly MATIC volume, closer to April-May 2023 shot up, led primarily by OpenSea.

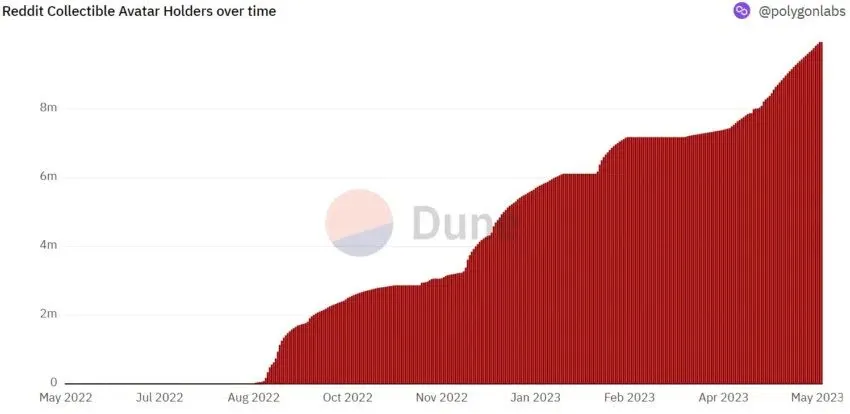

Also, the Reddit collectible “Avatars,” a marketplace launched on Polygon in June 2022, has seen a steady rise in active holders over time.

All these developments show that the state of the NFT market, corresponding to the Polygon network, is filled with numerous possibilities.

On December 20, 2023, another interesting trend has surfaced. Per data from Dappradar, the state of the Polygon ecosystem over the past 30 days has shown a steady dip in the number of NFT buyers.

Polygon DeFi: How’s it looking?

As mentioned earlier, Polygon has a robust DeFi presence. As of April 4, 2023, it is ranked sixth in terms of DeFi TVL, with 400 active protocols present on the network.

Delving deeper into the DeFi world of Polygon, we can see a TVL of $1.33 billion, with AAVE and UniSwap v3 being some of the leading protocols over the past seven days.

However, things have changed in December 2023. Polygon is currently ranked 8th, bested by the likes of Solana and Arbitrum. Even the TVL has dropped by 30-odd million, which explains the tepid price action.

Overall, the NFT and DeFi presence that looked strong in April has weakened a tab bit. Yet, in 2024, amid the bull market waves, these ecosystems are expected to grow further with the new projects migrating to Polygon. Also, its latest computation offloading the zkEVM chain might be good news for the DeFi exposure, with Ethereum to Polygon smart contract migration made easier.

Did you know? Polygon became one of the first Ethereum-native scaling solutions to connect with global brands like Mastercard, Starbucks, Nike, and more — helping them foray into the Web3 space.

Polygon tokenomics and the price forecast of Matic tokens

The token economics model of MATIC follows a participation incentivizing model. Also, there is a fixed supply of 10 billion MATIC tokens, with almost 95.8% currently in circulation as of Dec. 20, 2023. As for the initial allocation, 38% of the entire supply was set aside for public and private sales. 21% went to the Polygon Foundation. Any token allocation apart from retail sales was (is) subject to specific vesting periods.

At present, the top 100 holders of MATIC tokens manage almost 86% of the supply, and all of the token supply is unlocked. This might not fare well in the case of a market-wide correction, should people start dumping their holdings aggressively.

However, if you look at the whale and the nature of holdings, a crucial trend is visible. Even though MATIC whales control over 68% of the supply, holders make up the bulk of the players at over 54%. This negates the chances of a massive sell-off.

Polygon network and key metrics

MATIC prices have surged by over 25% since early 2023. And while technical analysis has a role, some on-chain metrics are in play.

In Q3 2022, almost 24 million new addresses were added. Surprisingly, even in a bear market, the transactions didn’t dip and were holding steady. Also, the Q3 performance of the Polygon Network was better than Q2.

/Related

More Articles

Coming to December 2023, the active address count has been steady, even increasing at times. This shows adoption has never been an issue for the Polygon network.

“Polygon has always tried to give back to the community but you’re gonna see an increased focus on it now.”

Mudit Gupta, CISO @ Polygon Labs: X

But it’s not about the Polygon network anymore. Between January 2022 and August 2022, close to $12 billion in funds came into the network from other chains, including the Ethereum blockchain. This indicates a growing trust factor in this layer-2 network.

Another interesting observation is that transactions corresponding to the Polygon PoS chain stayed relatively steady over Q4 of 2022, despite the FTX crisis. This shows how robust the Matic Network is, an element that should inspire price-related confidence, going into the future.

All these metrics, new and old, look promising for MATIC price analysis in the mid-to-long term. However, the actual movement in the price of Polygon will still depend on the trading volume changes, crypto market sentiment, and changes in the landscape associated with the scaling solutions for the Ethereum blockchain.

MATIC price prediction and technical analysis

Our April 2023 analysis

A few months back, we predicted a bearish divergence that could push the price of MATIC lower than 90 cents. And that is exactly what happened. Read on for the complete analysis that we did.

Now that we have considered the fundamentals and on-chain metrics, it is time to dive deep into the technical analysis of the Matic network. The short-term-focused daily chart has the MATIC trading inside a broadening wedge — a bearish reversal pattern. To have any chance at moving up from here towards the $1.5 mark, MATIC first needs to breach the ascending upper trendline, which also coincides with the immediate resistance level of $1.38.

As of early April 2023, MATIC is trading at $1.12, and the bearish RSI divergence might make the prices go rangebound for a while. On the lower side, the $1.06 level offers some crucial support; if MATIC breaks the same, it might drop to 90 cents.

Our December 2023 analysis

The latest daily chart also hints at a bearish divergence, which might again lead to some short-term correction. However, if the 20-EMA and 50-EMA lines and the $.74 level continue to offer support, pushing the prices higher, the level for MATIC to break for soaring higher could be $0.95.

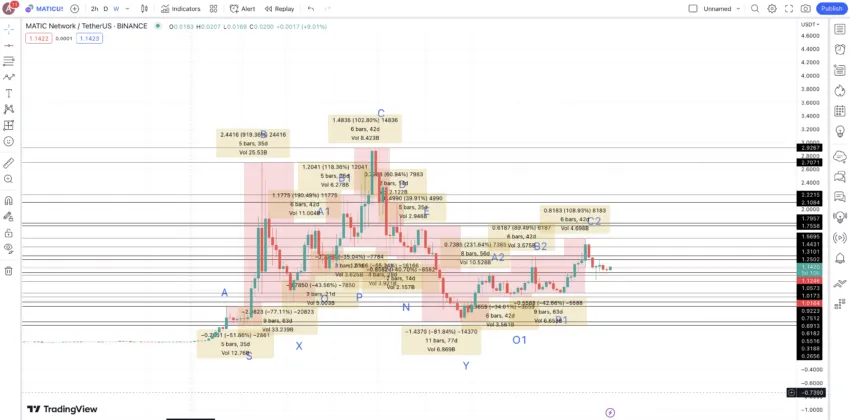

Now let us shift attention to the long-term MATIC price analysis by viewing the weekly chart and identifying patterns, if any.

Pattern identification

Update: Despite the new price levels in 2023, the broader patterns still hold as they rely on historical data and patterns.

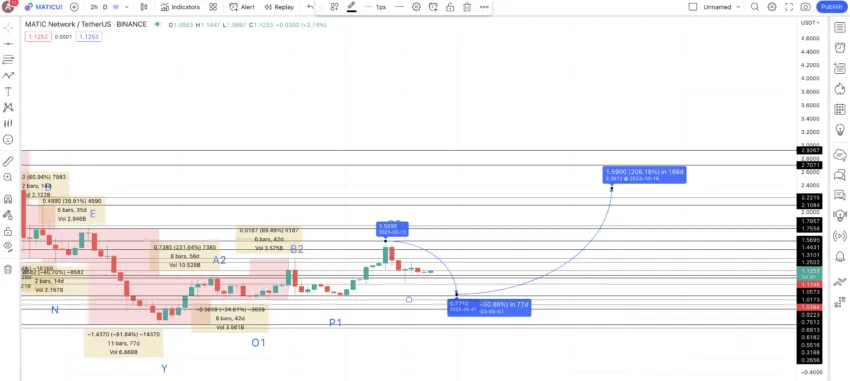

The weekly chart reveals a clear yet interesting pattern. Each leg of the pattern comes with a high, a peak, and then a bottom. Post-hitting the bottom, there comes another set of higher highs (two to be exact) and then the peak, two lower lows, and a bottom.

After hitting that bottom, another set of higher highs is forming (this time three). Per our assumptions, the next high could be the peak of this pattern, after which a bottom might follow a few lower lows (three or more).

Price changes

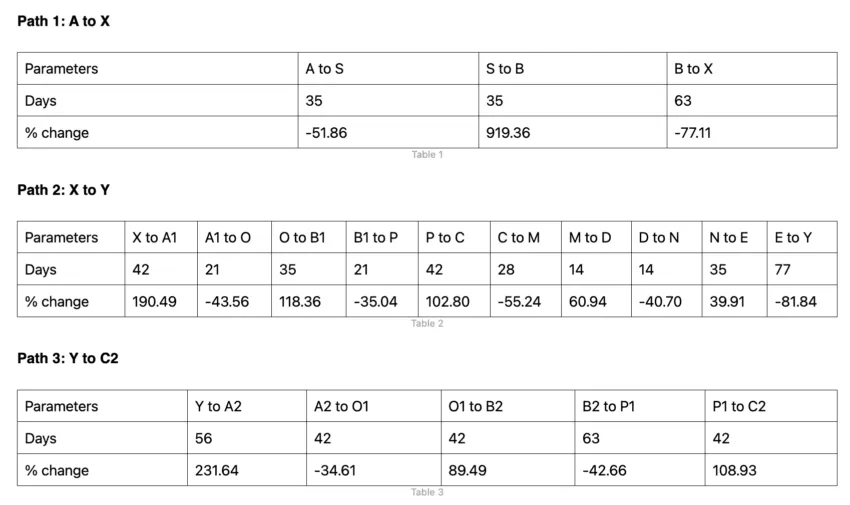

We shall now locate the price percentages and distance between the points corresponding to three separate paths: A to X, X to Y, and Y to C2.

We can use the non-negative and negative column values to track the next low-to-high and high-to-low moves.

Calculations

We will now use the gathered data sets to project the Polygon (MATIC) price through to 2035. Our analysis includes two key trends. Firstly, we observe a low-to-high average price increase of 206.49%. The time frame for this growth can range from 14 to 56 days. Secondly, we note a high-to-low average price decline of 50.73%. This downward trend can occur within a period ranging from 14 to 77 days. These insights form the basis of our long-term projection for Polygon’s price up to 2035.

Polygon (MATIC) price prediction 2023

Note: In 2023, we predicted a high of $2.36, but the adoption wasn’t crazy high, and MATIC had to settle at $1.52. However, that is still a win, considering we are still battling the bear market waves. Here is the detailed analysis in case you want some historical insights.

The last discernible point on the chart is C2. We can now use the high-to-low average price percentage to plot the next low. From the calculations above, the dip is 50.73% in 77 days (max). This projection puts the Polygon (MATIC) price at $0.771, hinting at a short-term correction.

This would be the MATIC price prediction low for 2023. The next high, say D2, could then surface at a high of 206.49%. And while the timeframe (per data from earlier) can be 56 days, the market may take longer to scale new highs.

Therefore, the next high, or D2 (peak of the third path), may show up at $2.36. We have selected 168 days (thrice the max distance from the data above) to plot the same.

Note: As this high is almost three times that of the low, we have taken the distance as three times the maximum one in play.

Also, $2.36 could be the MATIC price prediction high for 2023. (MATIC reached $1.52 instead)

Polygon (MATIC) price prediction 2024

Outlook: Very Bullish

In 2024, we might see the bull market in its full swing. This makes us more optimistic about the price prediction levels.

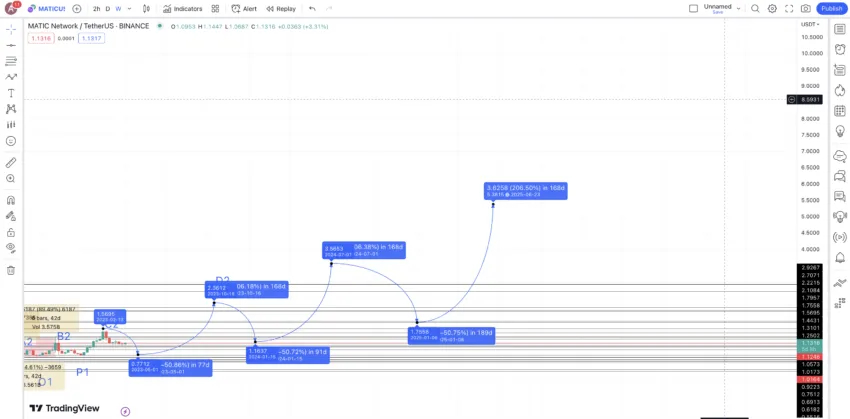

From D2, we can expect the next low to surface at a low of 50.73%, per the data from earlier. Also, by the end of 2023, we can expect the market to strengthen a bit, which might push the new low to 2024. The expected low in 2024 could be $1.16.

The next high, from this level, could surface at $3.56 — a growth of 206.49% — per the calculations using the tables.

Projected ROI from the current level: 362%

Polygon (MATIC) price prediction 2025

Outlook: Bullish

The price of Polygon might make some quick lows and highs post hitting the 2024 high. However, we can expect the low in 2025 to surface at a 50.73% dip by early 2025. This puts the 2025 low at $1.75.

The high from this low could again show up at the peak of 206.49%, putting the same at $5.38 by mid-2025.

Projected ROI from the current level: 598%

Polygon (MATIC) price prediction 2030

Outlook: Very bullish

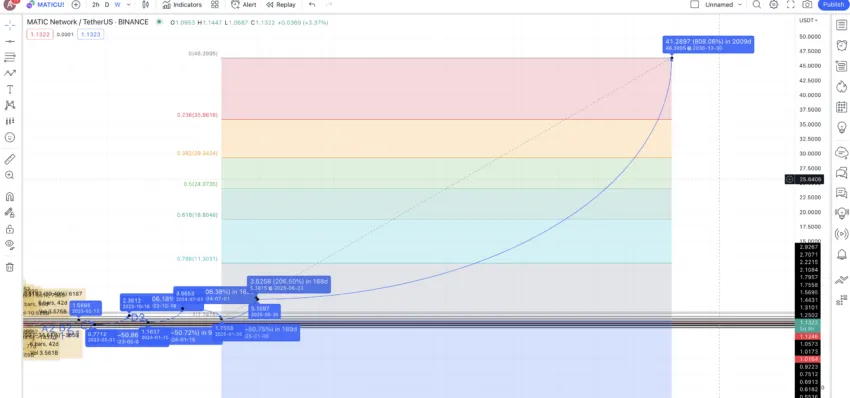

By now, we should know how the MATIC price growth might show in 2025. Now, using 2025 low and 2025 high, we can extrapolate the path to 2030. And following the same growth trajectory places 2030 high at $46.39. This translates into a growth of 808.06% from the 2025 highs.

Do note that this is more of an approximated price prediction, and there might be several minimum and maximum price levels between 2025 and 2030. Considering MATIC’s price history, such aggressive growth might be possible.

Projected ROI from the current level: 5924%

Polygon (MATIC’s) long-term price prediction until the year 2035

Outlook: Bullish

If you wish to hold MATIC through to 2035, here is a table that captures the minimum and maximum prices for the given duration.

You can easily convert your MATIC to USD here

| Year | | Maximum price of MATIC | | Minimum price of MATIC |

| 2023 | $1.52 | $0.51 |

| 2024 | $3.56 | $1.16 |

| 2025 | $5.38 | $1.75 |

| 2026 | $8.07 | $5 |

| 2027 | $10.08 | $6.25 |

| 2028 | $15.13 | $9.38 |

| 2029 | $26.48 | $16.41 |

| 2030 | $46.39 | $36.18 |

| 2031 | $57.98 | $45.22 |

| 2032 | $86.98 | $67.84 |

| 2033 | $104.37 | $81.40 |

| 2034 | $135.68 | $105.83 |

| 2035 | $203.53 | $126.18 |

Is the MATIC price prediction model accurate?

This MATIC price prediction model considers every aspect of Polygon’s journey as one of the more popular scaling solutions for the Ethereum blockchain. The Polygon network looks quite fundamentally robust. Also, the latest associations and partnerships make the Matic Network look even more desirable. To top it all off, we even discuss the short-term and long-term MATIC price analysis to make this price prediction model more accurate, relatable, and attainable.

Frequently asked questions

Can MATIC reach $10?

What will MATIC be worth in 2025?

Is MATIC worth buying?

How much will MATIC cost in 2030?

What is the future of MATIC?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.