Getting a good DeFi yield is not as hard as it seems. It is an excellent way to generate passive income, used by hundreds of thousands of investors to boost their portfolios. What’s more, there are many platforms that offer excellent DeFi rates, so there’s certainly no dearth of options.

We list the top six DeFi platforms with the best lending rates, plus analyze what DeFi lending is and how it works.

What is DeFi lending?

DeFi stands for decentralized finance, and it represents an ecosystem that uses blockchain technology to create financial applications. While there are many similarities to the traditional financial system, DeFi applications operate without a central authority to oversee their operations. The blockchain that supports them provides the security and privacy of users.

A DeFi lending protocol allows users to lend and borrow cryptocurrency assets. Whereas traditional systems are platforms that lend money to borrowers, a DeFi lending application allows peer-to-peer (P2P) lending among network participants and eliminates the need for third-party involvement.

By using a DeFi lending platform, lenders can earn a DeFi yield. It is a passive income for crypto holders who want to lend their crypto assets to the platform. The platform also offers long-term investors the chance to earn high-interest DeFi rates. DeFi lending protocols are beneficial for both lenders and borrowers.

You might be wondering why a DeFi lending platform is better than traditional financial platforms. And the answer is that DeFi lending protocols offer a significant advantage — anyone can become a lender and earn interest. Users can also borrow crypto by simply connecting their crypto wallets to the platform.

DeFi lending features

DeFi offers the exact same products and sometimes even more than traditional brick-and-mortar financial institutions. The top financial services offered are lending, borrowing, trading, and investing. On top of these, DeFi protocols use blockchain to provide additional benefits.

Some general characteristics of these lending protocols are:

- Anonymous and decentralized

- Can help users generate a passive income, by lending their crypto assets out to others

- Lending pools are the most popular way to generate interest in crypto-assets.

- To protect against sudden drops in collateral value, borrowers are often required to over-collateralize loans. This condition makes it safer for lenders.

Advantages and disadvantages

To get the best DeFi yield out of any protocol, users must understand how DeFi lending works and who is most suitable to use these platforms to generate a passive income. Let’s consider the advantages and disadvantages of using these innovative financial tools.

Advantages of DeFi protocols

- Improved speed for loan approval: DeFi loans present a huge advantage over traditional loans, with processing being much faster. There is no need to wait for months to get verified, no papers needed, and no need to go physically to a bank. Blockchain makes everything easy for everyone involved. In short, anyone can take a loan, if they meet the conditions of the DeFi protocol.

- Better consistency in decisions: All loans and interest rates have consistency when it comes to design, and all the conditions are publicly outlined.

- Permissionless: All DeFi applications are permissionless, which means that anyone can use the protocols and makes the entire process much easier compared to the traditional lending and borrowing process.

- Programmability: All DeFi platforms are based on blockchains that support smart contracts, which eliminate the need for central authorities as well as potential human errors.

- Self-custody: DeFi loans enable users to have complete control over their digital assets. Simple tools such as crypto wallets offer complete ownership, security, and control over assets.

- Immutability: DeFi protocols have the property of immutability. Users can rest assured that nobody can tamper with the data on the blockchain, and they can audit the smart contracts and their execution to make sure everything is secured.

- Interoperability: Most DeFi protocols now support multiple blockchains, constantly adding new ones. This makes them much easier to use and opens a world of possibilities to their lenders and borrowers

Disadvantages of DeFi protocols

- Limited integration: While some DeFi protocols support multiple blockchains, others limit support to a few networks. It’s unlikely that a crypto user will be able to interact with only one network and will need to use different protocols to access their services. For most users, it’s hard to start using DeFi lending platforms without going through a centralized exchange first, such as Binance or Coinbase.

- Poor user experience: Please take into account that the DeFi space is still in its infancy. These new platforms may also present some malfunctions, and users need to be extra careful when approving transactions from their wallets.

- No governmental oversight: DeFi platforms do not fall under any regulatory framework, and funds deposited in these protocols do not benefit from the insurance mechanisms offered to traditional banks and financial institutions. Users have to trust the creators of the platforms that there are no bugs hiding in the code of the smart contracts that could lead to a loss of funds.

- High volatility: Cryptocurrencies are not backed by governments, which leads to much higher price volatility for digital assets. Lending and borrowing conditions can change in an attempt to counteract the swift price changes.

What are the top platforms with the best DeFi lending rates?

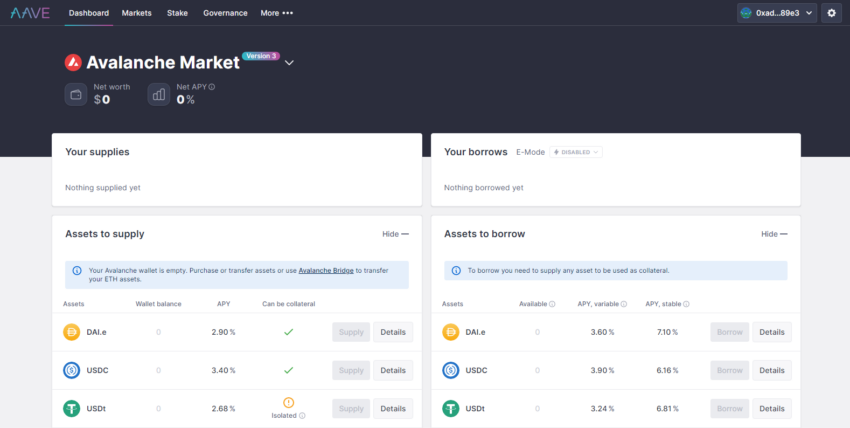

1. Aave

Aave is one of the largest and most popular DeFi lending platforms. Launched in 2017 as ETHLend and originally Ethereum based, Aave has expanded to facilitate lending and borrowing markets for a wide range of assets on multiple networks.

The Aave platform is an open-source liquidity protocol that creates pools for digital assets to facilitate lending for users. On Aave, the TVL tops $21 billion across seven networks — all managed in a completely decentralized manner.

The protocol’s native token, AAVE, enables discounted fees when trading on the platform or when providing it as collateral. The community governs it, and AAVE token holders vote on future developments of the protocol.

Aave offers different DeFi yield and interest rates for each supported asset, and they can be different for each network.

/Related

More ArticlesWhile most lending DeFi rates vary between 1% and 3%, there are some digital assets that can generate a much higher DeFi yield. At the moment of writing, Curve token had an 11% APY, on the Ethereum network.

These rates are subject to change, according to the market. Aave provides documentation to explain how they set their interest rates, as well as an up-to-date list of the offered rates.

As a lender on Aave, you must pay the blockchain fees when supplying and withdrawing your assets.

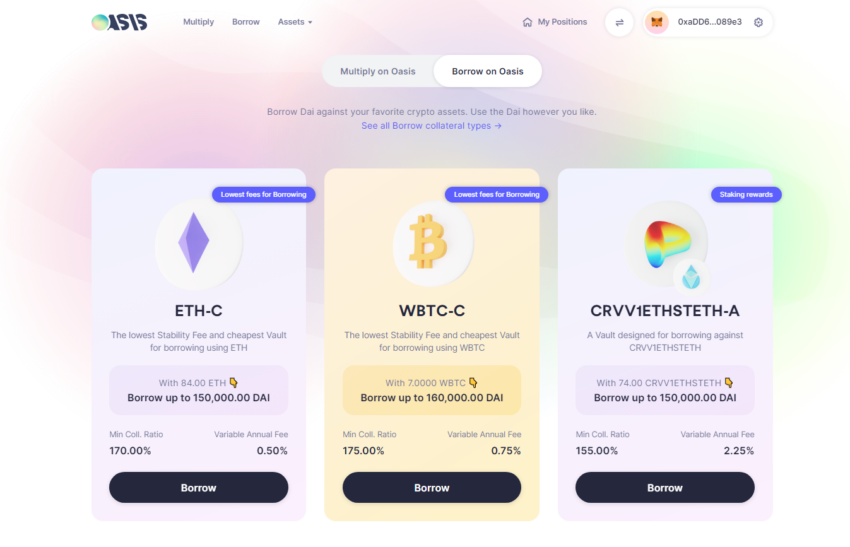

2. Oasis (MakerDAO)

Oasis is the app that allows users to lock up their tokens as collateral to generate DAI, a stablecoin pegged to the U.S. dollar.

DAI is the native stablecoin of MakerDAO, a popular decentralized governance platform. MakerDAO has a decentralized governance group that manages the creation of DAI. This community leverages the embedded governance mechanism found in the Maker protocol to enable the development of DAI.

The Maker protocol features a set of smart contracts designed to reduce the volatility of DAI. It helps lenders and borrowers by eliminating counterparty risk. Oasis users can borrow DAI from the protocol using the app. They can over-collateralize a position with any of the over 20 Ethereum-based tokens, for affordable “stability fees.”

To generate a DeFi yield for DAI, you can access the DAI wallet, which replaced the original saving option known as DAI Saving Rate (DSR) on the Oasis app. MakerDAO offers a flexible DeFi interest rate for DAI, that has ranged from 0% to 8.75%.

DAI holders can deposit their funds into the DAI wallet at any time to start generating DeFi yield. The DeFi rate featured by the protocol comes from the Stability Fees charged to the borrowers.

While there is no fee to access DAI wallet, users need to pay the Ethereum network gas fees for the depositing and withdrawing transactions. In the near future, Oasis DAI wallet will see integration with Compound and Aave protocols to offer better APYs to its users.

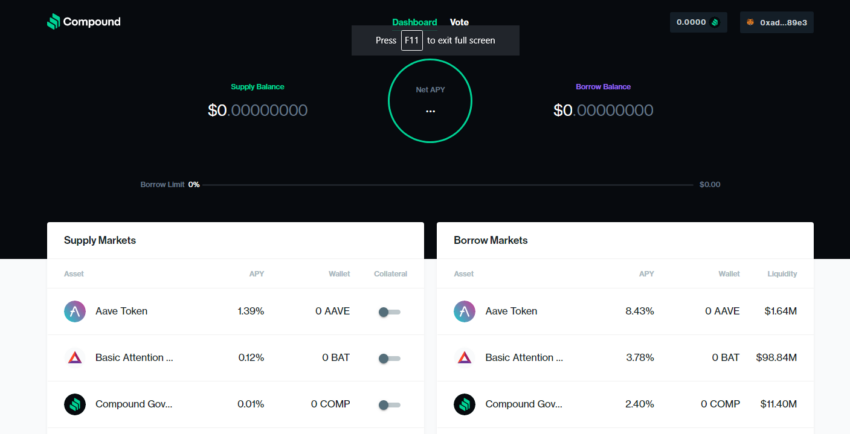

3. Compound

Compound is a DeFi borrowing and lending protocol built on Ethereum.

The Compound protocol can help diversify and grow your crypto portfolio. The protocol will help you earn interest as long as you have your money deposited. At the same time, you can borrow money from the protocol if you want to invest in other assets.

To earn a DeFi yield on Compound, you need to become a lender. The funds go into the liquidity pools, subsequently used by borrowers who pay interest back to the protocol. Compound then distributes the interest back to the lenders, according to their dynamic annual interest rate. Lenders will earn their DeFi yield in the same token they’ve provided to the protocol.

The Annual Percentage Yield (APY) on Compound is different for each token, and some of the highest DeFi rates are 3% for USDT and 2.68% for DAI.

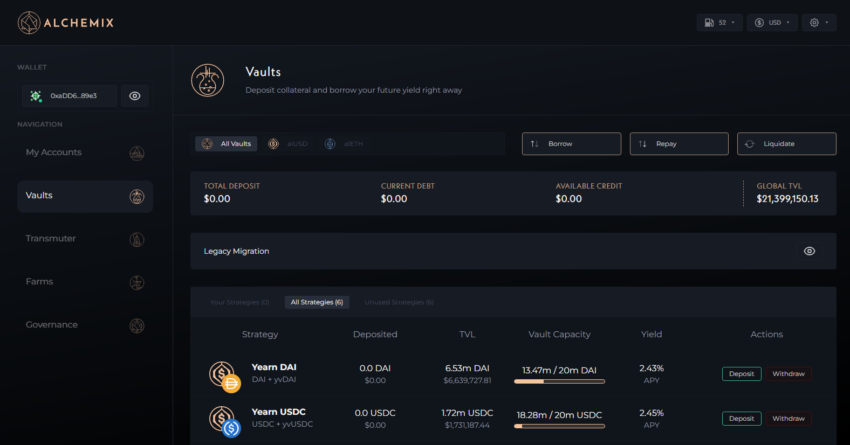

4. Alchemix

Alchemix is an innovative DeFi protocol that provides self-paying crypto loans. The protocol allows you to pay your loans using your collateral for yield farming on other DeFi applications.

Alchemix takes self-paying loans one step further and will determine the future yield of your collateral will determine the crypto loan you get. The protocol tokenizes your interest for what your collateral could yield later. Alchemix pools user-deposit collateral and deposit them in other DeFi protocols. Then, it harvests the profits to repay everyone’s debts over time.

To start engaging with Alchemix you must connect your crypto wallet to the protocol and have at least one DAI in your wallet. Users deposit DAI into a smart contract and receive a token in return that represents their future yield farming potential. This token, called alUSD, can be converted 1-1 into DAI via the Alchemix platform and traded on a DeFi exchange such as Sushiswap.

The smart contract transfers the deposited assets to a Yearn vault, which mints DAI. Alchemix users’ alUSD debt decreases as the yield harvest increases. This means that eventually the loan’s yield harvest “pays back” the deposit.

Alchemix users can create an alUSD coin equal to half the amount of the asset that they deposit. Alchemix has a 50% LTV (loan to value) if we translate this ratio into crypto loan terms. It only accepts DAI and ETH deposits at the moment, but it plans to accept other stablecoins in the future.

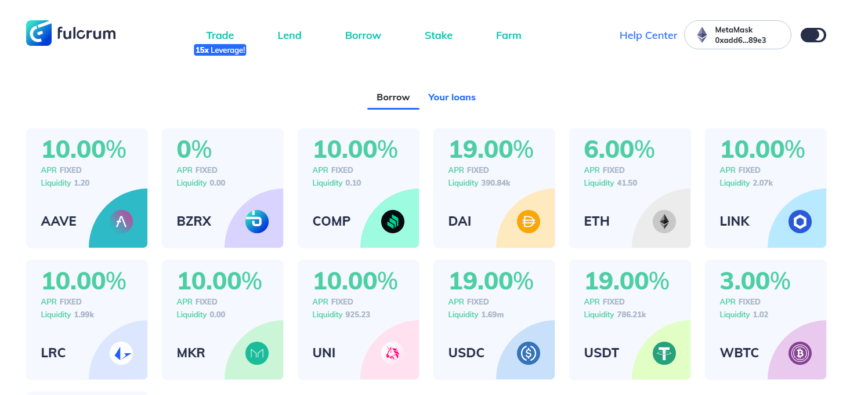

5. Fulcrum

Fulcrum is a DeFi lending platform that allows users to lend and borrow ERC20 tokens. It has recently added Polygon and Binance Smart Chain networks.

The Fulcrum protocol will also mint iTokens (interest-earning tokens) when a new deposit is made. These DeFi tokens can be traded like any other token. The iTokens become more valuable as there is more interest that it collects over time. Moreover, the iTokens can be used as collateral for borrowing from the protocol.

The Fulcrum protocol offers a great selection of popular cryptos for lenders. It offers one of the top DeFi rates for a stablecoin — 8.4% APY for DAI (on the Ethereum network).

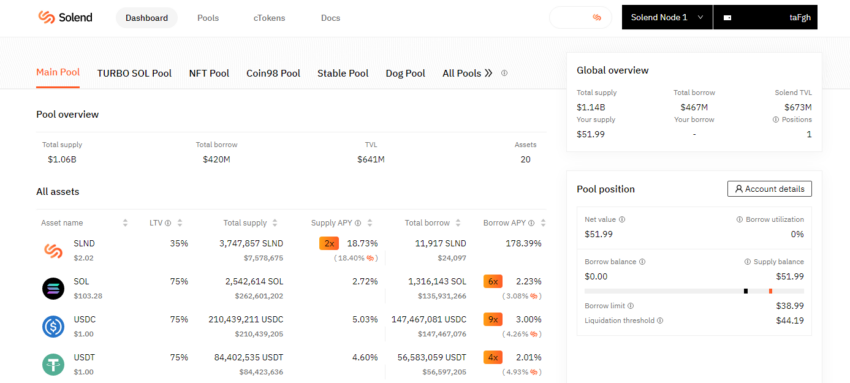

6. Solend

Solend is a Solana-based decentralized protocol for borrowing and lending digital assets. It enabled users to earn interest through lending their assets. Solend focuses on enabling fast and more affordable lending and borrowing.

The Solend protocol is designed to be as simple and secure as possible on Solana. The platform also has its own token, SLND, to reward its early adopters and investors. It also establishes the foundations for running its protocol as a DAO (Decentralized Autonomous Organization), managed by token holders who are largely members of its community.

The users who supply liquidity to the protocol earn the APY that the borrowers will pay. The borrow APY is divided across the whole pool. Supply APY = Borrow * Utilization. If there are 2 Bitcoins in a pool and 1 BTC is lent at 20% APY, each supplier will get 10% APY.

Users can earn some of the best DeFi rates on Solend, but it depends on the provided liquidity. Some of the highest APYs offered by Solend are for its native token, SLND (18%), but also for other tokens and stablecoins such as UST (12.7%), USDT-USDC (7.5%), and RAY (14%).

What’s the best DeFi yield platform for you?

Each crypto investor and user may have a different strategy when it comes to creating a passive income from their crypto tokens. Some may want to deposit their funds for longer to generate more DeFi yield over time, while others are looking for flexible deposits.

Other factors to consider are the platform’s current interest rates, the risks associated with that specific trading platform, and the supported assets. It’s important to ensure that you have the right assets in your wallet and that you understand the conditions of the chosen DeFi lending platform.

It is worth noting that we’ve only mentioned the best DeFi projects, but there are also centralized platforms that generate interest from your crypto holdings.

Frequently asked questions

How much interest can I earn on DeFi?

What is DeFi yield?

How do you earn yield on DeFi?

Why are DeFi yields so high?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.