Litecoin appeared on the crypto stage in 2011 as the Bitcoin network’s sprightly sibling. Envisioned by Google’s former engineer, Charlie Lee, Litecoin was always supposed to offer lower fees and faster transactions. After living up to our 2023 Litecoin price prediction, reaching levels as high as $113.58, the native token LTC deserves a more detailed analysis. Throughout this Litecoin price prediction piece, we explore the future price potential of LTC per its illustrious history, existing fundamentals, and short to long-term technical analysis.

Want to get LTC price prediction weekly? Join BeInCrypto Trading Community on Telegram: read LTC price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders!

- Litecoin price prediction and the role of fundamentals

- Litecoin tokenomics and the impact on prices

- LTC price prediction and key metrics

- Litecoin price prediction and technical analysis

- Litecoin (LTC) price prediction 2023

- Litecoin (LTC) price prediction 2024

- Litecoin (LTC) price prediction 2025

- Litecoin (LTC) price prediction 2030

- Litecoin (LTC’s) long-term price prediction until the year 2035

- Is the Litecoin price prediction model reliable enough?

- Frequently asked questions

This article may be outdated, we suggest you visit our new Litecoin Price Prediction tool.

Litecoin price prediction and the role of fundamentals

At its core, Litecoin aims to speed up low-cost peer-to-peer payments. And while the network took inspiration from Bitcoin, there are a few differences, including in regard to the hashing algorithm and transaction times. Here are some of the fundamental perks that set it aside from the herd:

- Block formation time of 150 seconds

- Suitable for micro-transactions and even PoS payments

- The latest MimbleWimble (MW) upgrade ensures a higher degree of fungibility and privacy, making transactions better

- Its ‘Scrypt’ mining algo makes it more accessible to interested miners

- The PoW tag and a 100% uptime since 2011 make it a relatively reliable decentralized project

- The cryptographic defenses put up by the Litecoin ecosystem are the strongest ones across crypto

The best part here is that the MW upgrade is optional, per your needs and preferences.

Did you know? Litecoin also termed digital silver to Bitcoin’s tag of digital gold, was one of the first projects to implement SegWit, a technical improvement with a focus on data storage.

Litecoin tokenomics and the impact on prices

Litecoin has a supply cap of 84 million LTC coins — 4 times that of BTC. Per Litecoin Foundation, it might be 2140 before the circulating supply equals the total supply. As of December 19, 2023, 88.09% of tokens were in circulation.

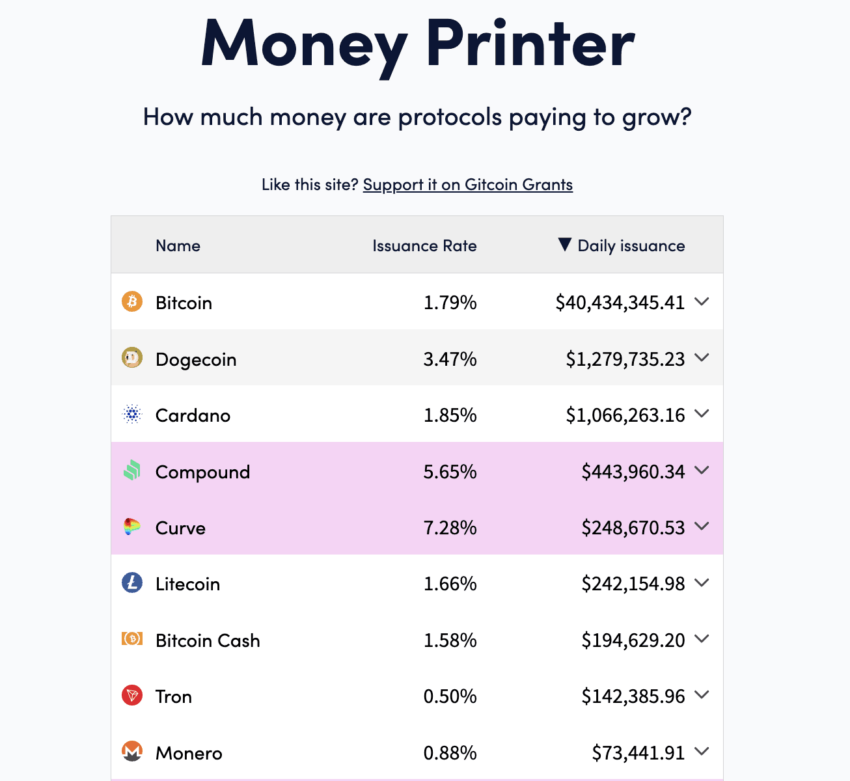

As for the issuance, LTC’s annual inflation was steady at 3.74% in April 2023, with all LTC coins moving to the miners as rewards. This inflation figure is closer to Dogecoin’s 3.55% — another PoW crypto. However, the same has dropped to 1.66% in December 2023, making us even more optimistic about the expected price rise.

Litecoin issuance in December 2023: Money Printer

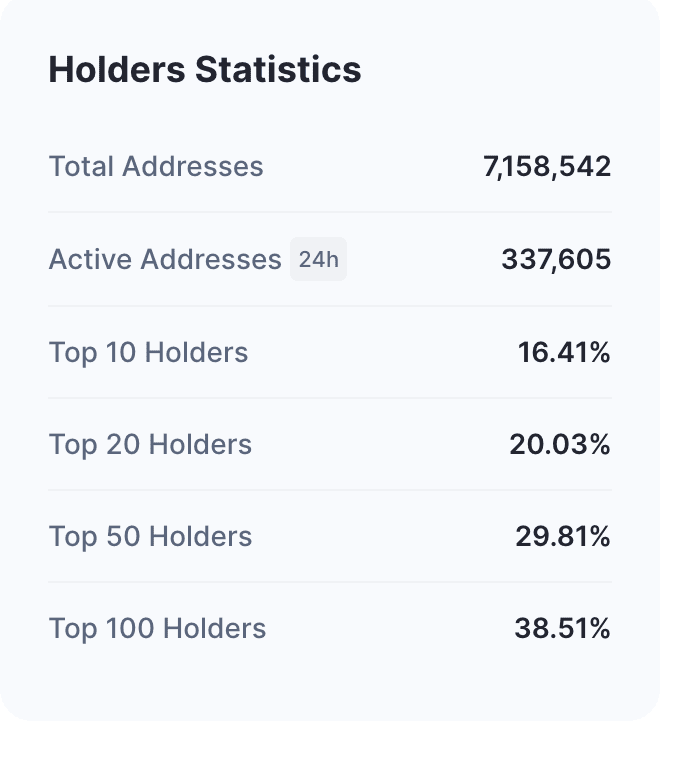

Litecoin also boasts some interesting holder stats. The top 100 LTC holders only manage 38.51% of market supply, making it less prone to market-wide sell-offs and price crashes.

Per the latest insights, the Litecoin whales, at present, only control 13% of the total supply, making LTC one of the more decentralized cryptocurrencies around.

Overall, the annual issuance rate looks good enough to drive more interest in this crypto. Also, the circulating supply isn’t held across select wallets, making the entire tokenomics model even more transparent.

LTC price prediction and key metrics

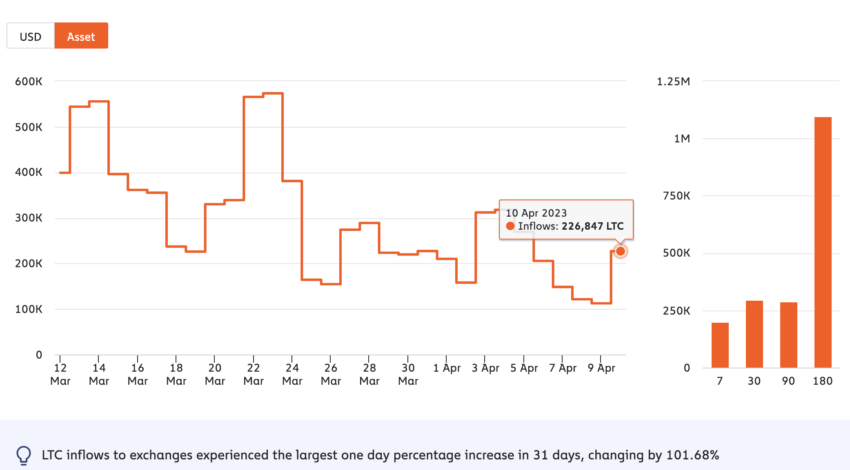

Litecoin’s market intel, as illustrated by Chainalysis, indicates a number of noticeable trends. Firstly, the exchange inflows have dipped overall since March 12, 2023. However, a significant rise occurred on April 10, 2023, with the flow figures hitting 226,847 LTC.

This indicates selling pressure as LTC quickly dropped from the highs of $102 to $86 levels, post the surge in exchange inflows.

Right now, as of December 19, 2023, the exchange inflow is on the lower side but we cannot overlook the occasional peaks, showing that people are moving assets to exchanges. For the prices to gain strength, the inflow should lower considerably.

Exchange inflow Litecoin in December: Chainalysis

Other metrics

Another interesting trend is the surge in the number of active addresses. Coincidently, the active address peak coincides with the recently made bottom. This might indicate that people might be transacting using LTC, primarily for selling. However, this was in April when the prices dropped a fair bit. As of now, the active addresses are higher than the April highs, indicating increased adoption.

Yet, you should look at active addresses in cohesion with the exchange inflows to track the buying and selling pressure.

The positive metric here is the growth in the market capitalization of Litecoin over the past three months. Early March saw the LTC market capitalization drop to $4.89 billion. Yet by April 11, 2023, the market cap returned to hit the $7 billion mark with ease. Yet, the trading volumes have dropped, which might hint at growing volatility. And in December 2023, the market cap has dropped significantly, along with trading volumes, hinting at a lukewarm price-specific response. That explains why LTC is trading lower than its April 2023 levels,

Overall, the Litecoin price prediction looks a tad tepid for the short term, with us expecting a rangebound move or even a consolidation in the near term.

Yet, miners are loading up their LTC reserves, and whales are increasing their holdings. If the market permits, these metrics can push the prices higher over time.

Litecoin price prediction and technical analysis

Our April 2023 analysis

Post our April analysis, LTC did reach the high of $114, in July, before slowing down. Here is how our analysis looked:

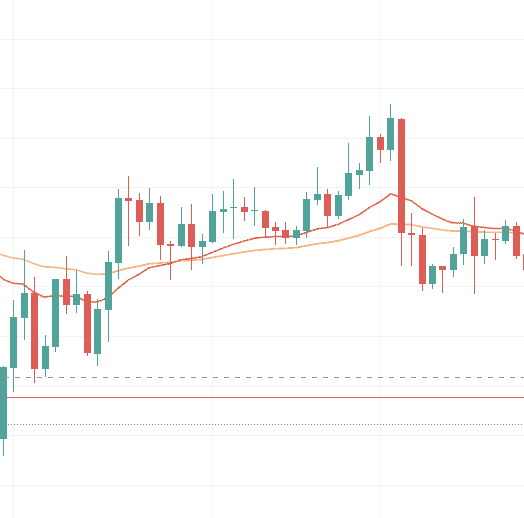

The daily LTC-USDT chart shows that LTC looks to be trading inside the ascending triangle pattern, closer to the upper trendline. This might be a bullish move.

Also, per the resistance levels, LTC must be able to stay above $92.09 or even $93 to have a chance at moving toward $100.41 — another strong resistance level. The RSI or the momentum indicator isn’t giving out any discernible detail. However, a small peak or a breach past 60 could be good news for the price of LTC.

/Related

More ArticlesOur December 2023 analysis

if you open the current LTC daily chart, the price seems to be moving inside an ascending channel. And while we might have been optimistic about the upper trendline breach, closer to the $80 mark, the RSI making lower highs hints at a bearish divergence. For now, a breach under the $68 mark can lead to a deeper correction.

Let us now look at the weekly pattern to locate the minimum and maximum prices of LTC through 2035.

Pattern identification

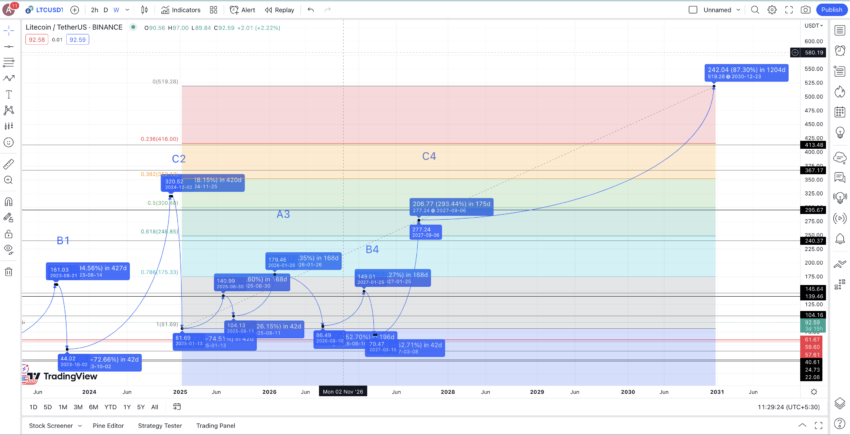

LTC’s weekly chart shows a high, lower high, and higher high formation within the first part of the pattern. Let us mark points A, B, and C.

The last high or the higher high kickstarts another lower higher and a higher high formation. Do note that the next formation is more like a mirror image of the ABC formation, as the highest high point is right at the beginning instead of at the end. We can mark this formation as C-B1-A1.

If the LTC pattern continues, keeping the formation intact, we can expect a new set of points, B2 and C1, post in the short to long term. But then, for the formation to continue, C1 should be higher than A1 — something that happened with the ABC formation.

Can that be a possibility here? The price of LTC is making a lower high, per the weekly chart. The RSI, on the other hand, is looking much more robust. Even though there isn’t any clear bullish divergence, the momentum is looking stronger than the price — which might push the prices higher in the short term to the long term.

Do note that our target is to locate the next high from M2 (the last low on the chart).

Price changes

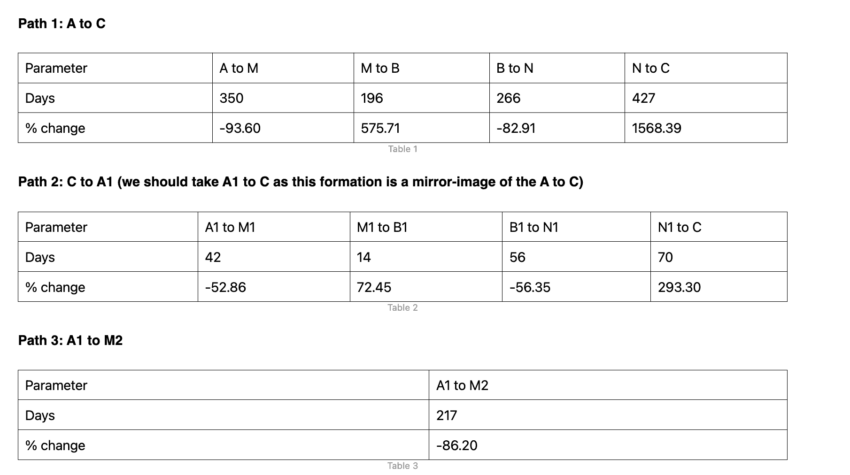

Let us now locate the price change percentages and distances between every high and the subsequent low on the chart. We will have three paths to discuss here: A to C, C to A1, and A1 to M2. Let’s get started:

We can now use all the negative and non-negative percentage figures to calculate future Litecoin price predictions.

Calculations

Adding every negative value in the table above and dividing it by the number of points we considered gives us the following average: 74.38%. Do note that the max time to achieve this low could be anywhere between 42 days to 350 days, per table data.

Now, adding every non-negative value in the table above and dividing it by the number of considered points gives us the following average: 627.46%. The max time to achieve this kind of growth could be anywhere between 14 days to 420 days, per table data.

Also, these future price percentages might not surface accurately as the price of LTC will also depend on the overall state of the cryptocurrency market. At some point during our technical analysis, we might even see a minimum drop percentage of 52.86% (from Table 2) and a minimum percentage growth of 72.45% or 293.30%, depending on broader market sentiments.

Litecoin (LTC) price prediction 2023

The price of LTC was high at $113, which is more like an average of the maximum and minimum price expectations for 2023. This aligns with our Litecoin price prediction. In case you want to see how we predicted the surge, read along.

Now let us use the data from above to chart the maximum prices of LTC in 2023. Do note that 2023 could see the LTC halving happening, and hence it would be possible for sizable growth until August 2023 — the expected halving month.

“If Litecoin isn’t going to zero, it’s going to $30k.”

Shan Belew, Founder of Crypto-Keys.com: X

But then, the crypto market is still moving in a range and not all that bullish. Hence, instead of the average hike of 627.46%, per our calculations from earlier, we can expect a moderate growth of 293.30%. This puts the expected future price of LTC at close to $161.03 by August 2023. We can consider this point B1.

Post-halving, we might see some selling pressure, which could push the price of LTC down by 74.38%, per the average data. This massive drop could be due to the “buy the news, sell the event” habit of the crypto market. Per our expectations, the price of LTC can drop as low as $44.02 by the end of 2023. Do note that the timeline can vary.

Litecoin (LTC) price prediction 2024

Outlook: Bullish

Now that we have N2 at our disposal, and that too at quite a price dip, we can expect buying to resume at LTC’s counter. Therefore, we can finally expect the average price rise of 627.46% to hold in the max timeframe of 420 days. This puts C2 or 2024 high at $320.52 (approximate). As C2 is higher than A1, we can expect the price of LTC to keep following the pattern.

Per the existing formations, the next set of moves could follow a set of lower highs. Also, as we expect the next formation to be a mirror image of the A1-B2-C2 path, the next drop of N3 could surface at a dip of 74.38%. This way, the next price, post the high in 2024, could surface at $81.69. Even though we can see it surface in 2025, per the chart, it is possible for this price of LTC to become the minimum price for 2024.

Projected ROI from the current level: 345%

Litecoin (LTC) price prediction 2025

Outlook: Moderately bullish

Per the historical data, where LTC peaked two years after the last halving cycle in 2019, we can expect the prices to get stronger, even in 2025! However, the price rise can be restricted to 72.45% as for LTC to follow the pattern, lower highs from C2 should form. Hence, the Litecoin price prediction for 2025 could be $140.99 — quite far off from the high it might make in 2024. The timeframe is 168 days — an average of the extremes — 14 days and 420 days — per the tables above.

The next low, however, wouldn’t be as low as there might not be many reasons to sell LTC at such a low price. The lowest figure can therefore be $104.16, a strong support level. This could translate into a 26.15% drop. Hence, the minimum Litecoin price prediction for 2025 could be $104.16.

Projected ROI from the current level: 50%

Litecoin (LTC) price prediction 2030

Outlook: Bullish

The next high, in 2026, could surface at $179.46, using a similar price hike from earlier. We can mark this A3. That would end the standard LTC formation. The next formation could again follow the A3-B4-C4 pattern, with C4 being the new peak. For that, we must first explore the immediate low post the A3 or the 2026 high of $179.46.

In this case, we can expect a minimum price drop of 52.86% as the price of LTC isn’t all that high, and there might be less selling pressure than expected. Hence, the next low could settle at $84.89. This could be the 2026 low.

A price hike of 72.45% from this level can send the next high or B4 to $149.01. The next low could again drop again by 52.86%, and in 42 days, pushing the low in 2027 to $70.47. As the formation expects the next high or C4 to move higher than A3, the next peak could assume 293.30% from the last low, sending C4 to $277.24. This could again be the LTC high in 2027.

Now that we have the 2027 high and the 2024 low ($81.69), we can extrapolate the path till 2030 to project the future price of LTC. This projection puts the Litecoin price prediction for 2030 at $519.28.

Projected ROI from the current level: 620%

Litecoin (LTC’s) long-term price prediction until the year 2035

Outlook: Bullish

Now that we have the key minimum and maximum prices per our charting of the LTC price prediction 2025 and LTC price prediction 2030, we can extrapolate the calculations to chart the path through 2035. Do note that once the all-time high of LTC — $412.96 — is breached, we will see it gaining more strength than usual.

You can easily convert your LTC to USD

Here is a table to consider if you plan on holding LTC till 2035:

| Year | | Maximum price of LTC | The minimum price of LTC |

| 2023 | $161.03 | $44.02 |

| 2024 | $320.52 | $81.69 |

| 2025 | $140.99 | $104.16 |

| 2026 | $179.46 | $84.89 |

| 2027 | $277.24 | $70.47 |

| 2028 | $332.69 | $206.26 |

| 2029 | $365.95 | $226.89 |

| 2030 | $519.28 | $321.95 |

| 2031 | $623.14 | $486.05 |

| 2032 | $810.07 | $631.85 |

| 2033 | $972.09 | $758.23 |

| 2034 | $826.27 | $644.49 |

| 2035 | $1074.16 | $837.84 |

Is the Litecoin price prediction model reliable enough?

Over the years, Litecoin has kept its “pure crypto” stance and P”P payment use cases intact. Simply put, it continues to have the P2P payment use case intact. Yet unlike other Litecoin price prediction pieces that chart insanely high prices regardless of the market conditions, this prediction deeply considers LTC’s fundamental and technical analysis. This Litecoin price prediction model considers the erratic price expectations associated with Litecoin, the changing market capitalization, and other factors to project realistic and attainable expectations.

Frequently asked questions

What will Litecoin be worth in 2025?

Can Litecoin reach $1000 dollars?

How high will Litecoin go in 2030?

Is Litecoin still a good investment?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.