One of the first conundrums faced by crypto beginners is the wallet, a place where all digital assets are “stored.” Technically speaking, unlike cash sitting in a physical wallet, crypto assets don’t actually reside inside a digital asset wallet. Understanding crypto wallets is thus a prerequisite for anyone wanting to participate in the fast-growing decentralized crypto-based financial system.

At some point, they’ll have to choose between a custodial or now-custodial wallet. In this guide, we explain what a non-custodial wallet is and the pros and cons of using it.

How does a cryptocurrency wallet work?

Crypto assets are just data on the blockchain. A crypto wallet is a tool that allows crypto owners to access their assets on the blockchain. Either way, anyone looking to send digital assets across blockchain networks will need to deal with things like wallet addresses/keys.

Every crypto wallet has two main components:

- Public key: If you want to send someone crypto, you will need to know their public key and vice versa.

- Private key: This, as the name suggests, should be kept secret/private by the wallet owner. A wallet owner needs to sign off on any transaction moving digital assets out of a wallet using the private keys.

Wallet keys can be stored on the internet or computer via wallet software. Keys can also be printed out/written on paper, or stored in a hardware device. As a result, cryptocurrency wallets can take on different forms.

What is a custodial wallet?

Before diving into the discussion of the different physical/software forms that a digital wallet can take, it’s important to understand the difference between custodial and non-custodial wallets.

The former is essentially where a crypto investor trusts a third party with the management/protection of their wallet keys. This third-party takes on the role of “custodian,” tasking them with the preservation of crypto owners’ property.

Cryptocurrency exchange accounts comprise the majority of custodial wallets. For example, say a new cryptocurrency investor sets up an account with a major crypto exchange like Binance or Coinbase. Imagine they then purchase cryptocurrency but decide to leave it in their exchange account.

Their crypto is actually held in a custodial wallet by Binance/Coinbase, who now assume responsibility for the management of the wallet keys.

Growth in the popularity of custodial wallets is also rising amid increased investor interest in crypto investment products. Crypto/digital asset Exchange Traded Funds (ETFs) and Exchange Traded Products (ETPs) continue to secure approval across the world.

Issuers of the ETFs/ETPs act as a custodian for investor funds, including in the case of crypto. That means they assume responsibility for the management of the keys for the wallet within which investors’ crypto is being held.

Pros of custodial wallets

For investors with a limited understanding of crypto technology, allowing a third party to manage their holdings can be an attractive proposition. Beginners all too often make the mistake of misplacing their wallet keys and losing access to their holdings.

Crypto beginners may prefer to leave the responsibility of wallet key management to professionals with a better understanding of blockchain technology. For example, large cryptocurrency exchanges store user funds in a complex mix of hardware and software wallets. It may be difficult for many casual crypto investors to replicate this level of security sophistication.

Cons of custodial wallets

Custodial wallets are not without their risks. Crypto holders face the risk of losing their property should the security or solvency of the custodian be compromised.

Those who keep up with the crypto news will remember the abrupt collapse of the cryptocurrency lending service Celsius Network. The platform, which had previously managed tens of billions of dollars worth of investor funds, suddenly halted depositor withdrawals in June.

A string of other struggling crypto lending platforms swiftly followed suit, leaving crypto investors out of pocket to the tune of billions.

Elsewhere, some cryptocurrency purists point out that custodial wallets result in centralization that goes against the crypto ethos of decentralization. Holders of custodial wallet-stored crypto could potentially run afoul of the custodian, or of the government agencies regulating the custodian.

This leaves their crypto at risk of seizure. Meanwhile, crypto custodians are normally subject to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Many crypto purists see this as a breach of crypto user privacy.

Meanwhile, some custodial providers will charge fees that can eat into profits.

/Related

More ArticlesSecure your crypto with the non-custodial Ballet Wallet. Try it now!

What are non-custodial wallets?

Now we understand what a custodial wallet is, and its main pros and cons, what about non-custodial wallets? These are a type of crypto wallet where the crypto owner takes direct responsibility for the management of their keys.

That means if the owner somehow loses/misplaces the keys, then the cryptocurrency in the wallet could be lost forever. As noted earlier, these can come in the form of web browser-based software, ordinary downloadable software, hardware, or in the form of paper. Hardware wallets are widely viewed as the most secure way to store crypto wallet keys.

Pros of non-custodial wallets

As crypto purists who seek to completely shrug off the yoke of centralized government/financial institutions argue, non-custodial wallets hand investors complete control over their assets. When stored in a non-custodial wallet, no single centralized entity can confiscate or freeze a digital asset.

With non-custodial wallets, there is no barrier to participation in the global crypto ecosystem. Anyone with an internet connection anywhere in the world can set up a wallet without facing KYC restraints.

Another benefit of non-custodial wallets is that it is easier to engage in digital asset transfers, as they interact directly with the blockchain. This means that non-custodial wallets, unlike its custodial counterparts, in many cases, have direct access to the growing Decentralized Finance (DeFi) ecosystem.

Cons of non-custodial wallets

Assuming the responsibility of managing one’s own keys is a big one for any cryptocurrency investor, especially if they are managing holdings with significant value. As noted, those who lack experience in crypto technology run the risk of losing access to their funds if careless.

That compares to forgetting the password to an exchange account, an issue that can normally be quickly resolved with customer support. Novices operating non-custodial wallets are also likely more vulnerable to phishing, crypto hacks, and scams than their more experienced counterparts running custodial wallets.

Crypto investors taking custody of their own assets should always adhere to security best practices, such as using strong passwords and two-factor authentication where possible.

Many non-custodial wallets are renowned as user/beginner friendly. But moving crypto from an exchange to a non-custodial wallet nonetheless still presents a new hurdle for beginners. For many, it might be easier and safer to just leave their crypto on the exchange.

Custodial vs. non-custodial wallets

If a wallet is non-custodial, it will give you and only you the private keys associated with the public address. If this isn’t the case, others also have access to the private keys, meaning it isn’t a non-custodial wallet.

Which is better?

This depends entirely on the needs and preferences of the user. Beginners just looking to buy some crypto and HODL may wish to leave their crypto on the exchange. Larger-scale multi-asset investors who lack specific expertise in crypto technology may choose to purchase crypto via ETF and ETPs.

More sophisticated cryptocurrency investors may wish to use a combination. They may maintain some crypto in a custodian exchange wallet for fast trading. Some might also want to keep some crypto in software-based custodial wallets for moving funds in and out of various DeFi platforms.

Additionally, might also want to leave a significant portion of their crypto in hardware wallets, or “cold storage,” for maximum security.

| Custodial Wallet | Non-Custodial Wallet | |

| Who controls private keys? | A third party controls the private key to the custodial wallet where the crypto is stored, handing them control over the assets. | The crypto owner is the only person to hold the private keys to the wallet where their crypto is stored, handing them complete sovereignty over their assets. |

| Beginner Friendly? | Considered the most beginner-friendly (i.e., just leaving crypto in the exchange wallet after purchase). | Many non-custodial wallets are highly user-friendly, but beginners often make mistakes regarding the recording/storing of private keys and when transacting on the blockchain. |

| Crypto Security | Major exchanges/crypto custodians generally employ sophisticated security systems to protect user assets. But crypto owners still risk losing their crypto if the custodian is hacked/becomes insolvent or amid censorship. | Non-custodial wallets vary greatly in their security, with web-based browser wallets seen as the most vulnerable and hardware wallets the safest. Non-custodial wallet owners need to take responsibility for the security of their own crypto. |

How to create a non-custodial wallet

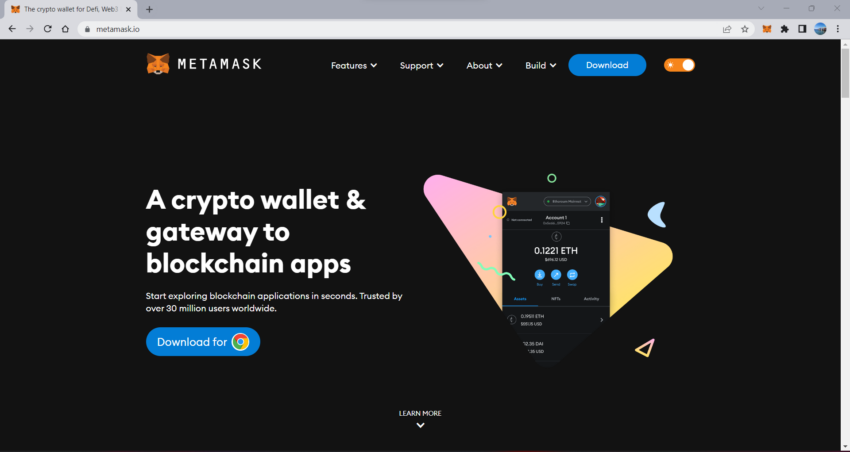

First, you will need to download the MetaMask chrome extension from the application’s website.

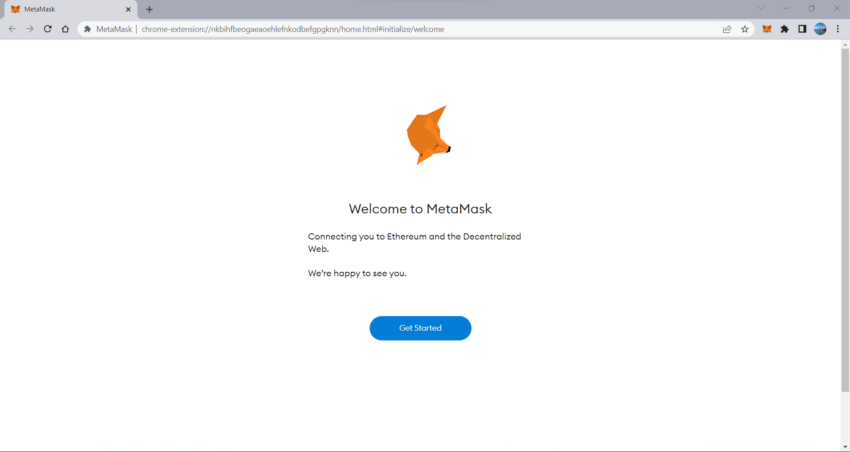

Once you have done that, it will appear as a chrome extension in the upper right. Click on the extension to begin setting up the wallet.

Those who already have a MetaMask wallet on another device will be able to access it via their Secret Recovery Phrase, which is essentially their private key. Otherwise, click on “Create a Wallet.”

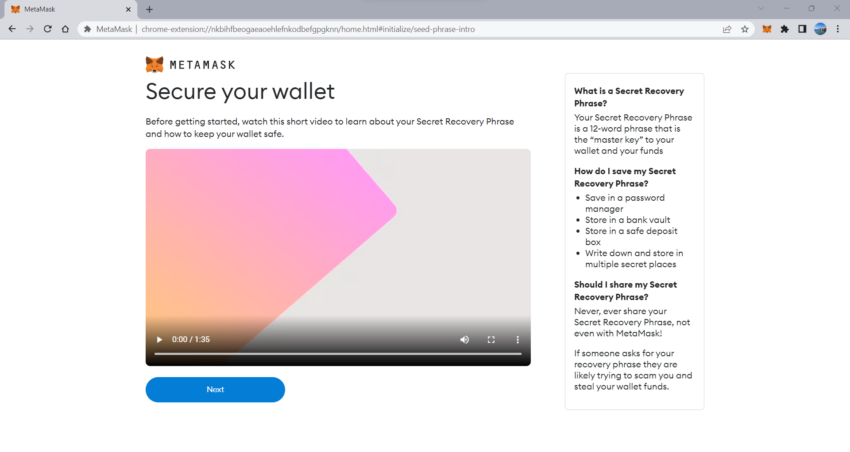

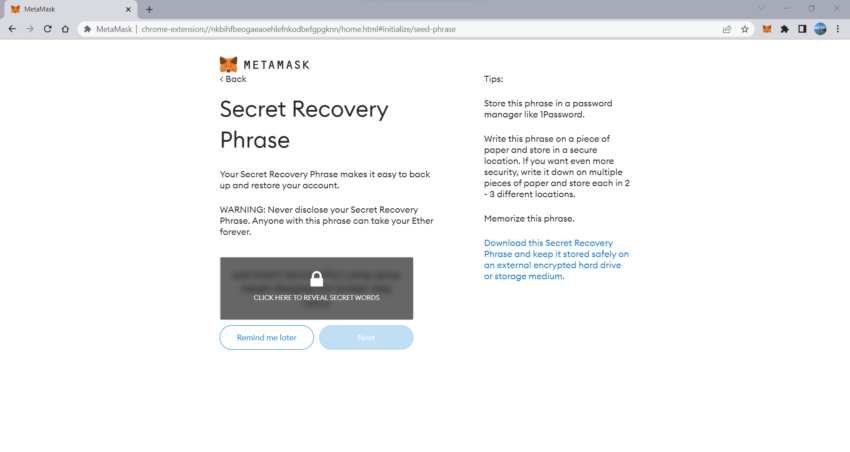

MetaMask will prompt you to create a new password. Make sure it is strong. Once you have done that, you will see a page where MetaMask explains how the Secret Recovery Phrase works and why it is important to keep private.

Essentially, the phrase allows you to access the wallet from other devices. If compromised, a thief could steal all of the crypto you are holding in the MetaMask wallet. It is important to record the Secret Recovery Phrase in a secure way. That’s because, if lost, you may lose access to the funds in the wallet and MetaMask won’t be able to help you.

On the next page, MetaMask will reveal this Secret Recovery Phrase. Write it down. MetaMask then asks for you to repeat back the Secret Recovery Phrase on the next page.

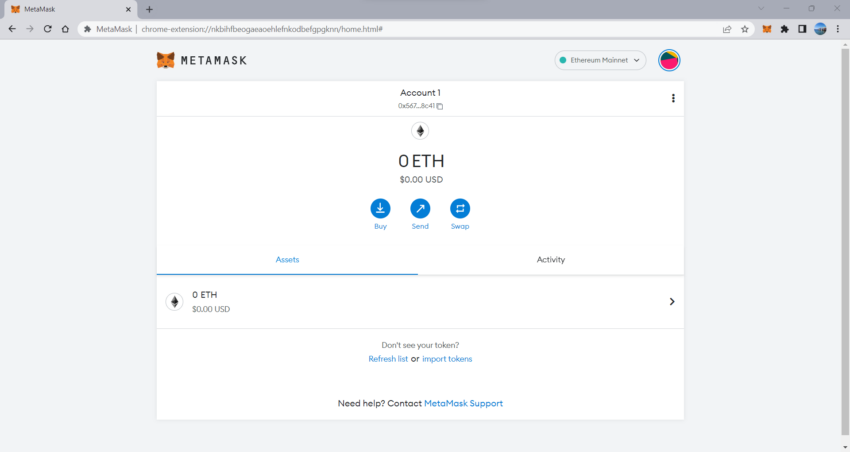

Once done, the wallet is ready. You are now ready to buy, send and swap cryptocurrencies on various blockchains.

Top 5 web-based non-custodial wallets

You have several non-custodial wallets at your disposal. Here, we list five of the most popular non-custodial wallets.

1. MetaMask

Since its launch back in 2016, MetaMask has become one of the most popular non-custodial cryptocurrency wallets. Much of this boom occurred during the “DeFi summer” of 2020. At the time, MetaMask was one of the few wallets with access to multiple smart-contract blockchains.

Wallet critics view MetaMask as one of the most user-friendly options on the market. It functions as a browser extension that pops up when needed as crypto users navigate various Decentralized Applications (DApps). MetaMask wallet users can buy and sell cryptocurrency directly on the application via a trading function.

One of the big drawbacks of the MetaMask wallet is that it can only interact with Ethereum or Ethereum Virtual Machine (EVM) compatible networks. That means its users are unable to interact with the Bitcoin and Solana networks, for example. But the wallet does support Non-Fungible Tokens (NFTs) and has special integration with OpenSea, the world’s largest NFT marketplace.

2. MyEtherWallet

MyEtherWallet, or MEW, is another wallet that has been around for a long time, having first launched in 2016. Like MetaMask, MEW focuses predominantly on the Ethereum network.

The wallet can interact with a range of Ethereum/EVM-based DApps and also supports NFTs. Unlike MetaMask, however, it does support Bitcoin swaps, but offers little compatibility with other non-ethereum/EVM altcoin networks.

Critics generally regard the wallet as very user-friendly. However, MEW users have frequently been targeted in phishing attacks.

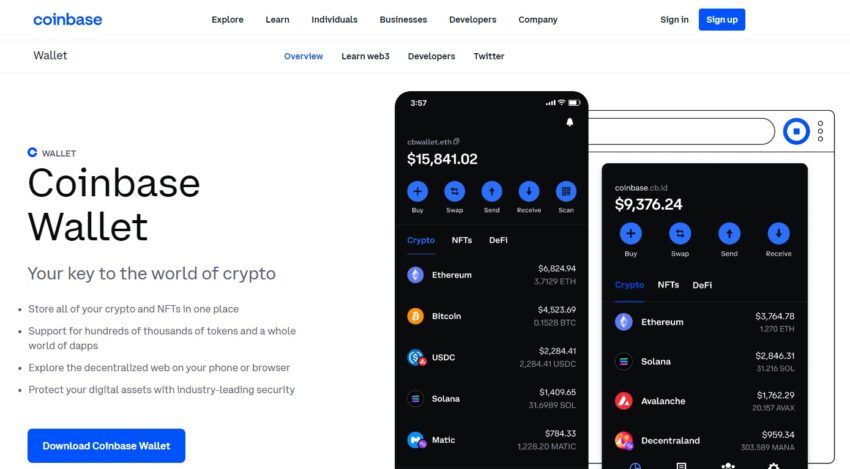

3. Coinbase Wallet

Coinbase launched its own non-custodial wallet back in 2018, and it has become a popular choice among crypto investors owing to its familiar, simple user experience. It has greater compatibility with a larger range of blockchain networks than the above-mentioned wallets.

Users can store bitcoin, ethereum, solana, and a host of other coins and tokens. It functions as a browser extension much like MetaMask and interacts with DApps in the same way. The wallet’s fees are amongst the most competitive on the market.

Coinbase’s wallet is completely separate from its parent company. That means, unlike when setting up an exchange account, there are no KYC requirements. The wallet can be connected to a Coinbase exchange account to facilitate the easy transfer of crypto, but this is optional.

Unlike MetaMask and MyEtherWallet, the code behind Coinbase’s Wallet is not open source. Whilst this might not be an issue for many crypto investors, decentralization purists tend to distrust code that isn’t open to public scrutiny.

Secure your crypto with Coinbase wallet. Start trading today!

4. Trust Wallet

Binance-backed Trust Wallet is another popular non-custodial wallet provider. Trust Wallet is compatible with a range of blockchains and is compatible with a range of DApps in the Ethereum and EVM-compatible ecosystems. The wallet is also compatible with NFTs and digital art collectibles. Users can stake proof-of-stake cryptocurrencies directly within the app.

The wallet has an in-house exchange feature, where users can view prices and charts without having to leave the platform. The wallet features additional security layers including optional biometric and PIN code scanning. Like MetaMask and MyEtherWallet, Trust Wallet’s code is open-source code. Furthermore, much like the other wallets on this list, critics regard the wallet as highly user-friendly.

5. Crypto.com DeFi Wallet

Crypto.com DeFi Wallet offers Crypto.com platform users a seamless way to move their assets into a non-custodial wallet and access a range of features. As implied by the name, the wallet offers users easy access to a range of DeFi applications and products, allowing users to easily generate yield on their assets.

The wallet allows users to store digital assets across a range of blockchains and ecosystems, including support for NFTs, and has a swap feature that allows the easy buying and selling of tokens. Like many of the other wallets on this list, the Crypto.com wallet also functions as a browser extension, improving usability as users browse DeFi platforms.

Safety of non-custodial wallets

The decision of what kind of cryptocurrency wallet to go with is a complicated one for any cryptocurrency investor. Ultimately, each individual will need to weigh up their preferences regarding having more or less control over their crypto, and their preferences for security versus convenience. Each cryptocurrency wallet type has its pros and cons.

Non-custodial wallets are safer than most other types of wallets, for many users, because of many reasons. They do not carry counter-party risk as with custodial wallets. Furthermore, cryptocurrency was created for users to self-custody their assets. When you hand over your holdings to another party, there is no guarantee that they will not lend them, lose them, or gamble them away.

That being said, if you are not tech savvy, custodial services may be a better option for you. However, merely sitting your assets in cold storage, disconnected from the internet, and without revealing your private keys to anyone, makes you inherently safer. Ultimately, the decision is yours alone on how to store your cryptocurrency.

Frequently asked questions

What is a non-custodial wallet?

What is the difference between a custodial and non-custodial wallet?

Is Coinbase a non-custodial wallet?

Is Trust Wallet a non-custodial wallet?

Is MetaMask a non-custodial wallet?

Are non-custodial wallets safer?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.