Avalanche is a layer-1 blockchain designed for scalability and speed, aiming to address the blockchain trilemma of achieving decentralization, security, and scalability without compromise. This guide dives into the Avalanche project and demonstrates how to buy avalanche (AVAX) with a credit card step-by-step.

Best exchanges to buy AVAX with a credit card within a minute

Paybis

Best for beginners

OKX

Best for demo and spot tradingCoinbase

Best for beginnersMethodology

In order to identify the best platforms to purchase AVAX, BeInCrypto’s testing process was rigorous and thorough, incorporating both primary and secondary research and practical testing. The research element spanned a variety of sources, including scholarly articles, industry reports, press announcements, and a deep dive into product-specific documentation.

Over a six-month testing period, our testing teams evaluated numerous platforms based on a series of critical criteria. Key factors influencing our selection included the structure of pricing and fees, the robustness of security measures, the level of liquidity, adherence to regulatory compliance, the range and innovation of features and products offered, and the overall user experience and usability.

Particular emphasis was placed on platforms demonstrating exceptional security protocols and user account management. Compliance with regulatory standards was also a major consideration, aligning with our focus on security. Additionally, platforms that offered a diverse and rich assortment of products and innovative features were given higher priority. For user experience, we focused on aspects such as intuitive design, smooth functionality, and ease of navigation.

Paybis

Paybis is an instant exchange that allows users to purchase crypto in a non-custodial manner. The service is available in over 180 countries.

• Security: Regulated by FinCEN and FINTRAC

• Products: Buy/sell crypto, wallet

• Fees: 0.49% to 2.49%

OKX

An exchange that was founded in Seychelles, supports more than 100 countries, and has a suite of features for different users.

• Security: Proof of reserves, Expiry and Security funds

• Products: Derivatives, wallet, mining, staking, staking

• Fees: 0.14% maker, 0.23% taker

Coinbase

One of the oldest exchanges that is based in the U.S. and and operates both an exchange and a brokerage.

• Security: Holds broker and money transmitter licenses

• Products: Base blockchain, wallet, staking, NFT gateway

• Fees: $0.99 to $4.19

Binance

The largest exchange by trading volume and assets under management which gives it an advantage in the department of liquidity.

• Security: Offers a proof of reserves and account controls

• Products: Derivatives, mining and staking, NFT gateway, blockchain, wallet

• Fees: 0.1%

All of the aforementioned options reflect the top platforms to purchase AVAX. This methodology was peer reviewed and fact-checked for accuracy. To learn more about BeInCrypto’s Verification Process, click the link.

What is Avalanche?

In 2020, Ava Labs unveiled Avalanche in a bid to target enduring challenges in blockchain technology. Avalanche is engineered for decentralization, scalability, and security — three crucial qualities difficult to achieve simultaneously in one network. Additionally, Avalanche enhances interoperability across diverse blockchain systems. The Avalanche network stands out in the DeFi space, offering a strong platform with a unique consensus mechanism that allows for fast transaction processing for users and developers.

The Avalanche blockchain is smart contract-enabled, allowing developers to build blockchains and decentralized applications (DApps) on the blockchain. These can range from exchanges, wallets, and oracles to web3 apps involving decentralized identity, lending protocols, and payment services.

-Sasha Volkoff, Crypto Ambassador: X

Here are a few key elements that keep the blockchain running:

- Consensus mechanism: Avalanche employs a unique consensus protocol known as the Avalanche consensus, which is different from the traditional proof-of-work (PoW) or proof-of-stake (PoS) mechanisms. It allows for high throughput and quick finality of transactions.

- Validators: Individuals and entities run validator nodes by staking AVAX, which means they lock up a certain amount of tokens as collateral to be part of the network’s consensus mechanism. These validators process transactions and secure the network.

- Subnetworks: Avalanche supports the creation of subnetworks, which are essentially custom blockchains that can have their own validators and can be tailored to specific use cases. This enhances scalability and customizability.

- Incentive structure: Validators receive rewards for their participation in the form of transaction fees and staking rewards, incentivizing them to act honestly and maintain the network’s integrity.

Essentially, technological innovation, a strong incentive system, and continuous development efforts collectively ensure the Avalanche blockchain remains operational and continues to grow.

What is AVAX?

AVAX is Avalanche’s native coin, which secures the platform through staking. It is powered by a unique proof-of-stake (PoS) consensus algorithm called the Avalanche consensus algorithm.

In the Avalanche consensus algorithm, a node compares its preference against that of others in a small group of validators. Therefore, a group of validators receives the node’s message, spreading it to other groups, creating an “avalanche” effect until they achieve consensus.

- How long they stake their coins, determined by proof-of-uptime

- Following software regulations determined by proof-of-correctness

AVAX serves multiple purposes: it is the medium for transaction fees and a source of rewards. Furthermore, the crypto is capped at a maximum supply of 720 million coins, with a current circulating supply of 354.814 million.

The Avalanche mainnet

The Avalanche mainnet consists of the primary network and Avalanche subnets. The primary network entails three in-built chains that help the Avalanche ecosystem to run smoothly, each handling a different application. They include:

/Related

More Articles- The C-Chain: The Contract Chain (C-Chain) implements the Ethereum Virtual Machine, allowing smart contract deployment on the Avalanche network. This capability enables developers to build DApps on its ecosystem. Avalanche stands out for utilizing Solidity, Ethereum’s programming language, for smart contract creation. Additionally, its C-Chain facilitates interoperability through cross-chain functions.

- The P-Chain: The Platform Chain (P-Chain) is responsible for subnets and blockchain creation on Avalanche. Hence, the blockchains can either be layer-1 or layer-2. If they are grouped, they create the Avalanche subnets. The P-Chain is the original subnet and manages the network’s validators.

- The X-Chain: The Exchange Chain (X-Chain) handles the creation and exchange of Avalanche’s Native Tokens, including AVAX. This chain depends on the Avalanche Consensus algorithm.

The C-chain and P-chain depend on the Snowball Consensus Algorithm, a component of Avalanche’s algorithm.

Did you know? The three built-in chains in Avalanche are an instance of a virtual machine? The C-Chain, P-Chain, and X-chain are instances of the Coreth VM, Platform VM, and Avalanche VM, respectively.

How to buy Avalanche with a credit card

You can buy AVAX using various payment methods on leading crypto exchanges, including bank transfer, Apple Pay, Google Pay, and other cryptocurrencies. Buying AVAX with a credit or debit card remains one of the most straightforward options, especially for novices. You can find the Avalanche cryptocurrency on most top exchanges and multi-asset wallets.

Now, let’s take a look at how you can buy AVAX with a credit card. We will use Binance in this step-by-step example.

Create or log in to your Binance account

Log in to your Binance account if you already have one. If not, head on to Binance to register.

Enter your email address and password to complete the registration. The exchange will ask you to verify your email to proceed.

To initiate a transaction, first ensure your account is verified. Although the process is typically simple, if you do run into any account verification issues, do not hesitate to reach out to customer support for help.

Select “Buy Crypto” to choose AVAX as the crypto you want to buy.

Moreover, you can input the amount of USD you want to spend or the number of AVAX coins you want to acquire. Once you confirm this, click the “Buy AVAX” option.

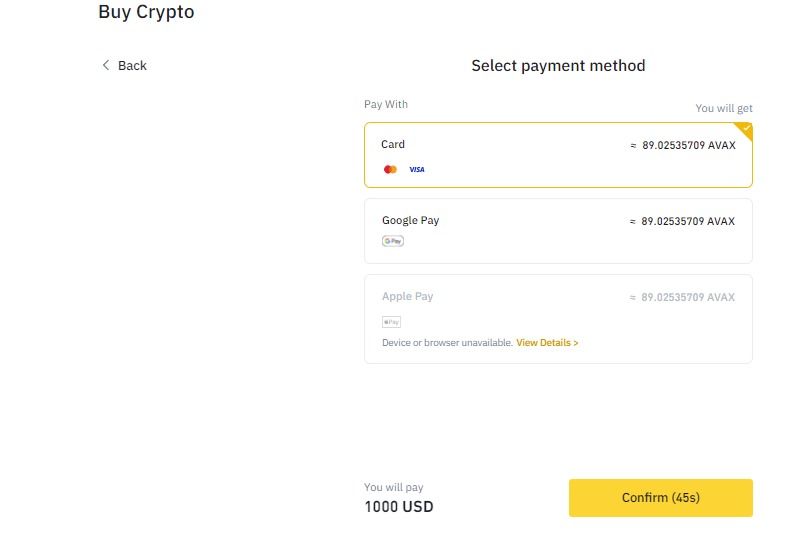

Selecting credit card as your payment method

You must select the payment method and confirm within the time the exchange specifies. Here, you will go with the card option. Notably, Binance supports Visa and Mastercard.

Next, click on “Add your card” and key in the details requested. Confirm the card details, complete the transaction, and await your AVAX.

That’s it! That’s how easy it is to buy AVAX with a credit card on Binance. Shortly after your transaction, your AVAX will arrive in your Binance exchange wallet, and then you should actively transfer them to a personal wallet where you control the private keys.

Navigating wallets

Unless you plan on actively trading your AVAX, you shouldn’t leave them in your exchange wallet. Instead, it’s best to store your digital currencies and tokens in a personal, non-custodial wallet that only you control. You can also opt for a multisig-wallet and air-gapped wallet for enhanced security.

Whether you choose a hot or cold wallet, make sure to implement crypto wallet security best practices to reduce the risk of losing money due to a hack or operational error. Some AVAX wallets will also allow you to stake AVAX if you want to earn staking rewards.

A strong contender in the crypto space

Buying AVAX with a credit card is an accessible and straightforward process. By utilizing platforms like Binance, users can seamlessly navigate through the steps of purchasing AVAX without any major hurdles. With its emphasis on interoperability and a reputation as a central platform for DeFi activities, Avalanche distinguishes itself as a prominent player in the cryptocurrency arena.

Frequently asked questions

What is the cheapest way to buy AVAX?

What is the fastest way to buy AVAX?

How can I buy AVAX?

Is solana better than AVAX?

Is AVAX better than cardano?

Is AVAX a good investment in 2023?