Bitcoin (BTC) has soared to $57,000, reaching heights unseen since December 2021. Ethereum is not far behind, nearly hitting $3,300. With the rapid price increase, a veteran trader has given a bold target for Bitcoin price.

On Monday, massive inflows into the spot Bitcoin exchange-traded funds (ETFs) pushed the price to yearly highs.

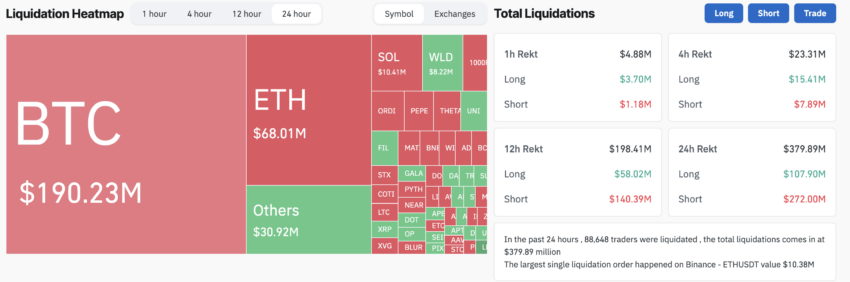

Bitcoin, Ethereum Lead $380 Million Liquidation Spree

The recent surge in value triggered over $380 million in crypto liquidations within 24 hours. Specifically, long trades worth $109 million were liquidated, while short trades saw a higher toll, with $271 million lost.

Consequently, a total of 89,163 trades were wiped out. Bitcoin trades suffered the most, with $190 million liquidated, followed by Ethereum at $68 million.

Read more: Bitcoin Price Prediction 2024/2025/2030

Interestingly, this price rally coincided with a significant influx into spot Bitcoin ETF products during US trading hours. Notably, Grayscale’s ETF saw a slowdown in net outflows for the third consecutive day, hitting a record low of $22.4 million. Meanwhile, other funds enjoyed a surge in inflows, reaching a two-week peak.

Further analysis reveals that the Grayscale Bitcoin Trust (GBTC) experienced a halving in outflows on February 26. This was a sharp decrease from the daily net outflow of $44.2 million on Friday at the week’s end.

In addition, the combined net inflows of all Bitcoin ETFs soared to $519.9 million, the highest in two weeks. Bloomberg analyst Eric Balchunas pointed out that nine Bitcoin ETFs recorded record-high volumes, aligning with Bitcoin’s approach to $57,000 levels.

| Date | IBIT | FBTC | BITB | ARKB | BTCO | EZBC | BRRR | HODL | BTCW | GBTC | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|

| February 21 | 154.3 | 71.7 | 11.1 | 27.4 | 0.0 | 0.0 | 0.0 | 5.9 | 2.2 | (137.0) | 135.6 |

| February 22 | 96.5 | 52.5 | 0.0 | 10.7 | 1.0 | 3.0 | 0.0 | 0.0 | 0.0 | (199.3) | (35.6) |

| February 23 | 125.1 | 158.9 | 7.9 | 6.7 | 0.0 | 0.0 | 1.2 | 2.9 | 4.4 | (55.7) | 251.4 |

| February 26 | 167.5 | 52.5 | 12.0 | 34.5 | 0.0 | 1.5 | 0.0 | 8.7 | 0.0 | (44.2) | 232.5 |

| February 26 | 111.8 | 243.3 | 37.2 | 130.6 | 4.4 | 7.9 | 0.0 | 6.2 | 0.9 | (22.4) | 519.9 |

As of writing, Bitcoin’s price has risen by approximately 8.77% in 24 hours, standing at $56,000. This resurgence aligns with veteran trader Peter Brandt’s prediction. He targets $200,000 for Bitcoin in the current bull market cycle, which is expected to peak between August and September 2025.

“With the thrust above the upper boundary of the 15-month channel, the target for the current bull market cycle scheduled to end in Aug/Sep 2025 is being raised from $120,000 to $200,000,” Brandt explained.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

Still, Brandt warned that a close below the previous week’s low, at around $50,500, would invalidate the bullish outlook. Such a downswing may trigger a steeper correction toward $46,500 or lower.

Trusted

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.