Discerning the onset of the real altcoin season is akin to predicting the next wave in a tempestuous sea. Yet, certain indicators suggest the market is on the cusp of a significant shift, moving from Bitcoin’s dominance to a broader altcoin season.

Renowned analysts like Michaël van de Poppe and Josh Olszewicz provide insights into the mechanics of this transition. They emphasize the role of market cycles, technological upgrades, and economic events in catalyzing the altcoin rally.

When Altcoin Season Will Start

Bitcoin’s recent sprint from $25,000 to $53,000 has captured the market’s attention, signaling a potential peak and subsequent rotation towards altcoins. Van de Poppe noted the strength in Ethereum as a harbinger of this shift, highlighting the upcoming Dencun upgrade and the potential for a spot exchange-traded fund (ETF), which could significantly lower transaction costs and increase Ethereum’s utility.

This technological leap could invigorate the Ethereum ecosystem, making it an attractive hub for investment.

“The valuation of Ethereum as a whole needs to catch up as it should be at $3,800-4,200 if it’s at the same stage as Bitcoin’s price currently. Bitcoin will consolidate, and money will rotate towards Ethereum,” van de Poppe said.

The concept of altcoin season, or “altseason,” has evolved since its inception in 2017. It is no longer just about a general market upturn but involves selective investments in ecosystems showing promise. Solana, Injective Protocol, and Render Protocol have been identified as frontrunners, benefiting from the current market dynamics.

According to Van de Poppe, the altcoin season following the Bitcoin halving will likely favor these ecosystems, particularly Ethereum, given its recent underperformance and upcoming enhancements in recent years.

“We’re facing an Ethereum Altseason… In every cycle, the dominance of Bitcoin has peaked prior to the halving. Very understandable, as investors are rotating their profits from holding Bitcoin towards other assets to generate a higher ROI as there’s no event that’s going to push confidence within Bitcoin at all,” van de Poppe added.

Read more: 11 Best Altcoin Exchanges for Crypto Trading in February 2024

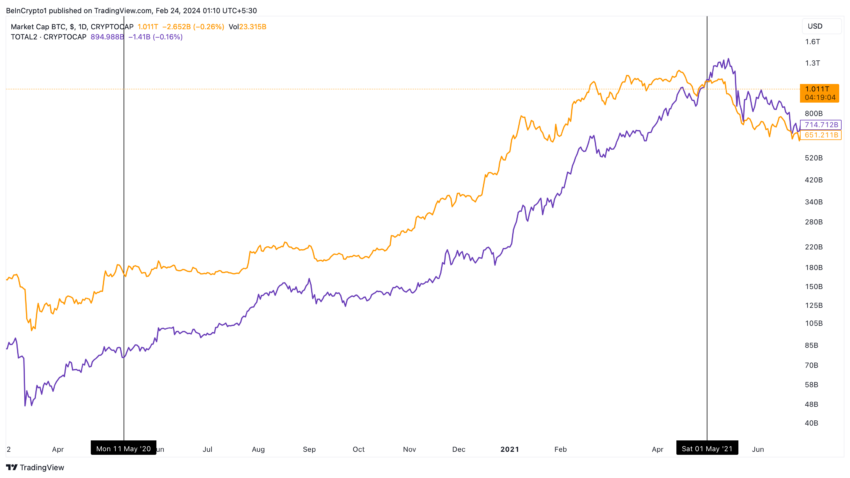

Likewise, Olszewicz pointed to the pattern observed in past cycles. The total market capitalization of altcoins, excluding Bitcoin, tends to catch up and surpass Bitcoin’s market cap post-halving. This phenomenon is significant because it illustrates a shift in investor sentiment and allocation of capital within the crypto market.

The halving event, which reduces the reward for mining Bitcoin by half, historically precedes increased performance for altcoins. This is partly because the reduced Bitcoin reward often leads investors to seek higher returns in the more volatile altcoins.

“You’ll notice historically that the purple line or the altcoins line catches up to Bitcoin post halving. Even though Bitcoin is actually doing extremely well post-halving based on market cap and towards the very end, which is a great signal to watch,” Olszewicz emphasized.

Olszewicz also highlighted the importance of “the crypto wealth effect.” He suggested that the influx of capital into Bitcoin around the halving event eventually finds its way into altcoins. This transition is facilitated by Bitcoin’s increased liquidity and profitability, which, when it begins to stabilize in volatility post-halving, encourages investors to diversify.

According to Olszewicz, the anticipation of Ethereum ETFs could further catalyze this shift. Therefore, redirecting ETF capital from Bitcoin to altcoins and amplifying the “crypto wealth effect.”

Read more: 13 Best Altcoins To Invest In February 2024

Despite the speculative nature of cryptocurrency investments, the insights from Van de Poppe and Olszewicz underline a calculated approach to navigating the market. The key to leveraging the impending altcoin season lies in recognizing the signs of Bitcoin’s consolidation, the impact of technological advancements in Ethereum, and the broader economic indicators influencing market cycles.

Trusted

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.