Traders are always looking for new memecoins to bolster their chances of getting significant returns. And while Shiba Inu and Dogecoin have stood the test of time, Pepe — a relatively new memecoin — is steadily looking to establish itself in a similar vein. Named after the “Pepe the Frog” internet meme, Pepe is an ERC-20 token with a deflationary mechanism. In this Pepe price prediction piece, we explore all the future price-related possibilities related to this memecoin, tracking its potential price path up to 2030.

Methodology

BeInCrypto has handpicked a few credible and highly relevant crypto exchanges to help traders and investors purchase PEPE. Each exchange was tested for over six months, across several metrics, before being listed.

From ensuring the safety standards to the availability of PEPE-specific liquid trading pairs, BeInCrypto assessed a handful of parameters before zeroing in on these exchanges. Here is why each made it to this list:

Binance

Binance leads others in terms of 24-hour trading volume. However, for PEPE, it offers the following perks:

- Two highly liquid trading pairs — PEPE/USDT and PEPE/TRY

- Easy convert option between 300+ cryptocurrencies

- Supports PEPE Perpetual Futures trading

OKX

OKX caters to both cryptocurrency enthusiasts and the experienced traders. Here are the best traits that make it a great choice for trading PEPE:

- PEPE/USDT pair can be traded on the Futures market

- Spot USDT pair is highly liquid

- Access to advanced trading tools and indicators

Bybit

Bybit is one of the more secure and user-friendly crypto exchanges. For PEPE though, here are the reasons it is highlighted:

- Highly liquid PEPE/USDT pair

- Competitive fees

- Global accessibility

Visit the link here to learn more about BeInCrypto’s Verification Methodology.

- Where to buy Pepe

- OKX

- Binance

- Bybit

- Pepe price prediction and fundamental analysis

- Pepe price prediction and on-chain metrics

- Pepe technical analysis and price forecast

- Pepe (PEPE) price prediction 2024

- Pepe (PEPE) price prediction 2025

- Pepe (PEPE) price prediction 2030

- Pepe (PEPE) price prediction until the year 2035?

- Is it worth investing in Pepe?

- Frequently asked questions

Where to buy Pepe

Before we dive into the technical and fundamental analysis, check the following platforms if you’re looking to scoop up PEPE before any potential price surges. All of the below options are recommended for both buying and trading the ERC-20 token. Remember that memecoins are highly volatile, and profits are not guaranteed.

• Advanced trading tools

• 13.12% of global PEPE volume

• Multiple payment and funding methods

Binance

• High liquidity

• Multiple passive earning options

• Easy user interface

• Highly liquid PEPE/USDT pair

• Access to spot and derivatives market

• Competitive fee structure

Here is a quick look at all the PEPE markets:

Pepe price prediction and fundamental analysis

Pepe is a run-of-the-mill ERC-20 memecoin. Even the website mentions that the token doesn’t have any utility.

Did you know? Pepe boasts a redistributive token allocation system where a portion of each transaction is moved to the token holders, encouraging long-term investment.

If other fundamental aspects are to be considered, Pepe has its eyes set on NFTs, merchandise, staking mechanisms, and more — furthering the long-term price potential of PEPE tokens. Pepe believes in the concept of meme takeover and features a reliable burn mechanism — a move that keeps the tokenomics deflationary.

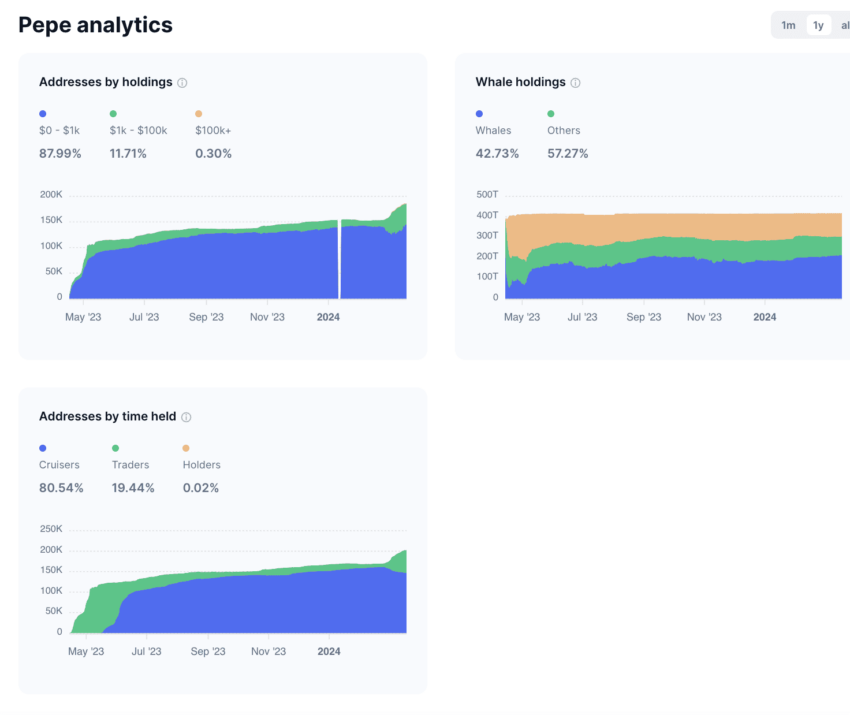

Over time, the future price of Pepe might surge, provided elements like Pepe Academy and Pepe Tools come into existence. But then, Pepe whales still control almost 43% of the supply, which might lead to a deeper, market-wide correction should panic ensue.

Regardless, Pepe’s fundamentals look strong.

BeInCrypto reached out to RK Gupta, co-founder of the Elite Crypto Tool. We asked about the approach investors should follow to ride the PEPE/memecoin wave. Gupta explained that users should “proceed with caution, but look beyond the meme.”

Pepe’s recent surge is a fascinating example of the memecoin phenomenon. While there’s potential for continued growth, the market is known for its volatility. Investors should carefully consider the token’s utility, long-term plans, and inherent risks before diving in. Remember, investing in memecoins should be considered a high-risk, speculative investment.

Another investor’s hack: Don’t neglect underlying tech.

While the meme factor can’t be ignored, many investors get caught up in the hype and overlook the underlying technology powering these memecoins. Here’s a pro tip: look for memecoins built on established blockchains like Ethereum or Binance Smart Chain. These blockchains offer greater security, stability, and potential for future integrations compared to lesser-known chains.

RK Gupta, Co-founder of Cryptokosh/ Elite Crypto Tool: BeInCrypto

Pepe price prediction and on-chain metrics

It is important to note that on-chain metrics are short-term. But then, they do help highlight a trend that could be instrumental in defining the future price of a token. Let us take a look at the metrics that can help with the Pepe price forecast:

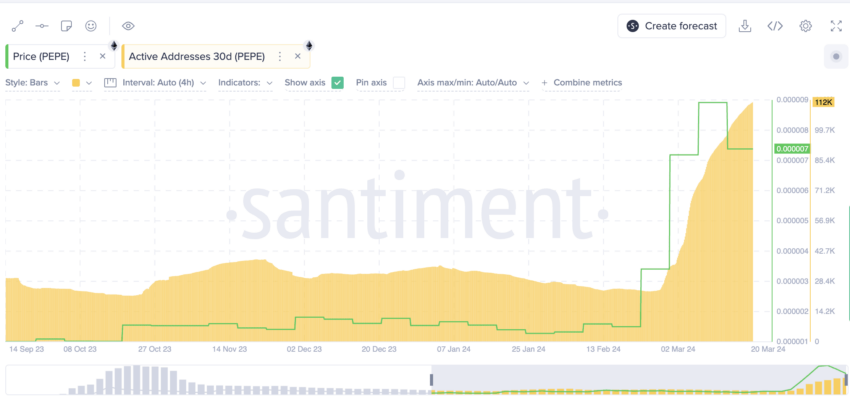

The active address count is probably the most dependable metric. A rise in the number signifies trading interest and the eventual rise in the price of PEPE tokens. Therefore, to gauge the future price of Pepe, it is important to keep track of the active address count and notice the spikes.

Now, let us look at the Nansen dashboard and analyze PEPE further:

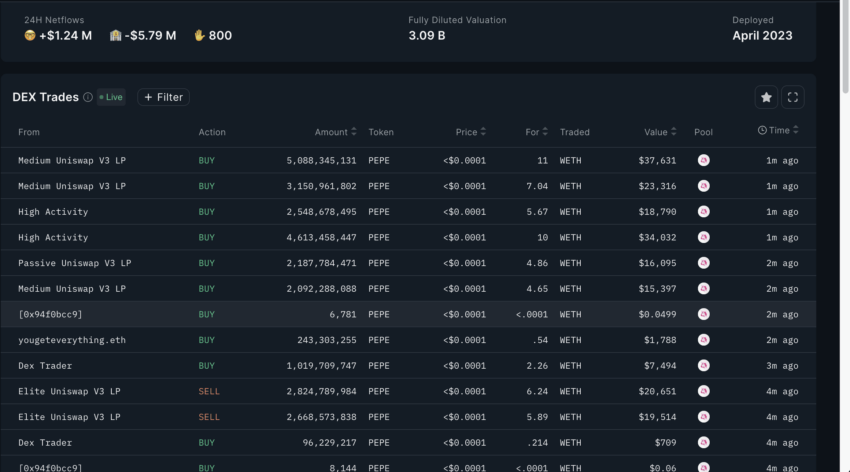

The transactions list shows that most actions are in favor of buying PEPE. Even though the orders aren’t huge, they clearly reveal a bullish trend.

Shifting attention to the Balances tab as part of the Token God Mode suggests that token billionaires have been adding to their PEPE reserves over the past 30 days. The seven-day changes are skewed toward sell orders, but the 30-day balances are mostly green.

On pulling the wallet details of 9977.ethscriptions.eth, the address with the highest percentage of PEPE ownership, we can see that the address isn’t new but is loaded with credible tokens. This might hint at a long-term holding pattern for PEPE. Also, despite the price rise, the address hasn’t offloaded tokens over the past 24 hours or even seven days. This looks optimistic for the price of PEPE.

One step at a time for PEPE:

/Related

More ArticlesPepe technical analysis and price forecast

Besides the fundamentals and on-chain metrics, it is important to analyze the price action of PEPE to understand the potential in the short-to-long term.

Also, increased social activity should not be ignored:

Short-term price potential of PEPE

PEPE’s 4-hour chart indicates bullishness. While the price is making lower highs, the relative strength index (RSI) is scaling higher highs. This could push the prices higher. Also, PEPE is trading inside an ascending channel — a bullish pattern. In case the price moves above the $0.000011 mark, breaching the upper trendline, we can expect the uptrend to continue as high as $0.000013 — per the Fib retracement levels.

A drop below $0.0000061 can invalidate the bullish trend.

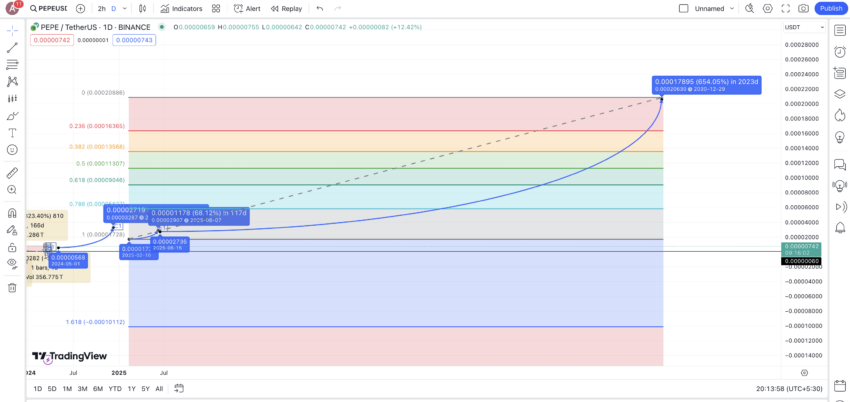

Long-term price potential of PEPE

PEPE is a relatively new listing across most exchanges. Therefore, we do not have a lot of actionable historical data to rely on.

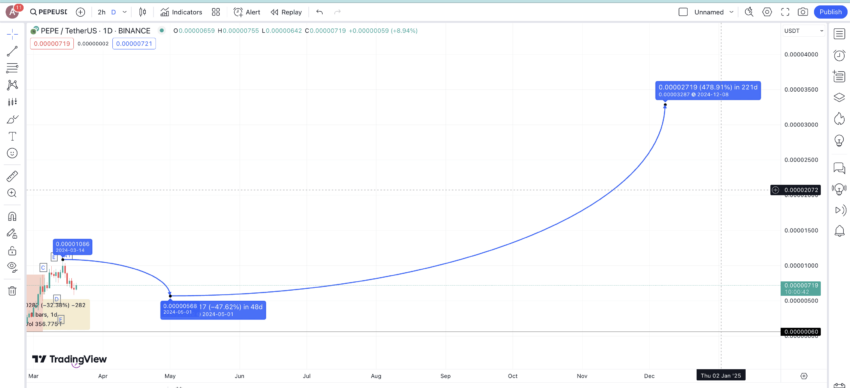

Still, here is the daily chart with one complete and one forming pattern, A-B-C-D-E and A1-?.

The first step is to locate the price peaks and distance taken to move from one point to the other for the first pattern. Here are the values:

| A to B | -86.21% in 139 days |

| B to C | 1323.40% in 166 days |

| C to D | -32.38% in 1 day |

| D to E | 68.30% in 3 days |

| E to F | -24.31% in 3 days |

| F to A1 | 43.57% in 2 days |

We also need to take the E to F and F to A1 levels into consideration to get hold of a few additional reference points. While the timeframes can vary, let us take the average price surge and average price drop values for our future reference:

Average price hike: 478.42% in 57 days

Average price drop: -47.63% in 48 days

We shall use these data points to chalk out the next leg of the pattern that starts at A1.

Pepe (PEPE) price prediction 2024

Outlook: Bullish

Assuming A1 is the first point of a new pattern, we can expect B1 or the next low for PEPE to surface at $0.00000569, or a 47.63% drop, by early May 2024. This could be the minimum price of PEPE in 2024. Also, the timeframe could vary depending on the market conditions and other factors.

The next high, or rather C1 could be at a 478.42% surge from B1. This puts the maximum price of PEPE at $0.00003287. Assuming that the market takes time to warm up, we can see this level by the end of 2024.

Projected ROI from the current level: 350%

Pepe (PEPE) price prediction 2025

Outlook: Bullish

The next level from C1 or D1 could form at $0.00001729 — a drop of 47.63% from the last high, per the average price values from earlier. This could be the 2025 low for the price of PEPE. However, from this low or D1, the surge could be limited as after possibly gaining 450% in 2024, many holders will start offloading their assets.

The surge from D1 could, therefore, be limited to 68.3%, as per the above table data. This puts the 2025 PEPE price prediction high at $0.00002907. Do note that the timeframe can vary.

Projected ROI from the current level: 298%

Pepe (PEPE) price prediction 2030

Outlook: Very Bullish

Now that we have the expected 2025 low and 2025 high for PEPE, we can extrapolate the findings to zero in on the price levels for 2030. Using the Fib retracement tool to connect the swing high and the swing low, we can expect the PEPE price prediction level for 2030 to surface at $0.000208.

Projected ROI from the current level: 2733%

Pepe (PEPE) price prediction until the year 2035?

Now that we have all the key price levels for PEPE till 2030, we can take the calculations forward and chalk the price projections until 2035. Here is the table that captures all the key levels:

| Year | Maximum Price | Aligned Minimum Price |

| 2024 | 0.00003287 | $0.00000569 |

| 2025 | 0.00002907 | $0.00001729 |

| 2026 | 0.00009100 | 0.00003500 |

| 2027 | 0.00012000 | 0.00004600 |

| 2028 | 0.00015000 | 0.00005700 |

| 2029 | 0.00017900 | 0.00006900 |

| 2030 | 0.00020800 | 0.00008000 |

| 2031 | 0.00023700 | 0.00009100 |

| 2032 | 0.00026600 | 0.00010200 |

| 2033 | 0.00029600 | 0.00011300 |

| 2034 | 0.00032500 | 0.00012500 |

| 2035 | 0.00035400 | 0.00013600 |

If you wish to hold PEPE for a long time, say until 2035 or even beyond, we recommend using ERC-20 compatible crypto wallets — cold or hardware — to store the tokens. Also, it is worth noting that for any given year, the price might fall anywhere between the maximum and minimum price of PEPE.

Is it worth investing in Pepe?

At its heart, PEPE is still a memecoin. However, this PEPE price prediction remains optimistic about all the ecosystem-specific use cases, eventually expecting the token to erase multiple zeros from its current price level. But then, the crypto market is volatile. Despite optimistic price projections, you should always have a quintessential do-your-own-research (DYOR) plan in place.

Frequently asked questions

What is the future of the Pepe coin?

How much is 1 Pepe coin worth?

Where to buy Pepe in 2024?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.