Cryptocurrencies are not just randomly named coins. Most have their own self-sustaining micro-economies with unique terms and regulations. Tokenomics is comprised of numerous factors that work to shape the future of a project’s native crypto. This information can give us a window into a crypto’s viability, dynamics, and potential impact. This guide explores what tokenomics entails and its role in determining a cryptocurrency’s supply and demand.

Platforms to purchase the top tokens

Methodology

Our methodology for selecting the top platforms to purchase tokens was exhaustive and conducted over a period of six months. This process utilized both primary and secondary research, and aggregated data across multiple sources. Our methodology evaluated each platform that was best for purchasing tokens according to its offering of security, utility, and payment tokens.

The platforms were then separated by their unique value add to customers. This covered the areas of security, products and features, fees, and many other factors. The selections that made the final cut for the top platforms to purchase tokens are:

• INX

• Coinbase

• Kraken

• OKX

• Binance

• Kucoin

Coinbase for purchasing utility tokens

Coinbase not only supports the buying and selling of utility tokens, but also has unique features that give unique perks to users on the platform. The service boasts a subscription service for lower fees and perks. The platform has both an exchange and brokerage and supports millions of users. Coinbase also services over 100 countries.

OKX for buying payment and utility tokens

OKX serves a global market. It has a large altcoin selection, including payment tokens, and publishes a proof of reserves to ensure customers of solvency. It is also a popular option due to its low 0.1% trading fees for regular users. Additionally, it has a diverse set of products for different users.

Binance for acquiring security tokens

Binance is one of the exchanges that offers a secondary market for security tokens. This made it one of the top options for purchasing security tokens. In addition to this, Binance also has deeply liquid markets, an altcoin selection, and also publishes a proof of reserves to ensure platform solvency.

INX for investing in security tokens

INX is a platform that is built with security tokens in mind. The platform not only caters to users that want to purchase security tokens, but serves as a launchpad for companies that want to debut their tokens. INX is a regulated exchange which provides for a level of safety for both customers and companies.

Kucoin for purchasing payment and utility tokens

Kucoin has one of the largest selections of altcoin out of all large exchanges. This makes it a top option for purchasing payment and utility tokens. The platform also supports spot, derivatives, and margin trading. Kucoin also has some of the lowest trading fees on the market.

Kraken for purchasing utility and payment tokens

Kraken supports a variety of countries, coins and tokens, and fiat currencies. Because of this level of flexibility, this made it a top option for purchasing utility and payment tokens. Additionally, the company publishes a proof of reserves to ensure safety on the platform.

Each platform reflects qualities that made it the top option for purchasing security, payment, and utility tokens. Aside from the aforementioned prerequisites, we followed BeInCrypto’s Verification Methodology, which may be viewed by clicking on the link.

Understanding the concept of tokenomics

Tokenomics (a merging of “token” and “economics”) shapes the structure of a cryptocurrency’s economy. Critical factors like scarcity, market demand, token velocity, and inflation/deflation mechanisms collectively shape a token’s price and determine its overall market behavior. To fully understand the concept of tokenomics, let’s explore what a token is.

What’s a token?

In the traditional financial system, governments hold the authority to issue currency and determine its regulations, essentially shaping the functioning of our economy through money as a medium of exchange. You can understand a token as a form of privately issued currency.

What does a token mean in crypto terms?

In crypto, a token represents a digital asset or ownership stake that is transformed into a standardized format and recorded on an established blockchain network.

“You should be taking this [blockchain] technology as seriously as you should have been taking the development of the Internet in the early 1990’s.”

Blythe Masters, British executive: Twitter

Frequently, people use crypto tokens to secure funding for various projects.

They typically go through an initial coin offering (ICO), where tokens are created, distributed, sold, and circulated through crowdfunding initiatives.

Tokens operate under predefined supply mechanisms. These mechanisms often include fixed supplies or algorithmic issuance rules implemented through smart contracts.

Token economy

Tokenomics encompasses the entire process of coin creation and management. A project’s tokenomics provides crucial insights for investors looking to determine a project’s legitimacy and long-term value potential.

The following key points emphasize the importance of a token economy:

- Incentivization: A well-crafted token economy incentivizes participants to actively contribute to the network, provide liquidity, and drive adoption. This collective effort can result in a gradual increase in the token’s value over time.

- Fair distribution: This helps ensure an equitable distribution of tokens, preventing the accumulation of power and wealth within a select few individuals or entities.

Interested in collecting token rewards? Check out our guide on crypto rewards to learn how you can earn!

Dynamics that might impact a token economy include:

Token burning and buybacks: These practices employed in tokenonomics can significantly impact a token’s value. Token burning involves permanently removing tokens from circulation, reducing the token supply. This reduction in supply, when coupled with consistent demand, can increase the scarcity of the token, leading to a potential increase in its value.

Token staking and rewards: Serve as powerful incentives for token holders to participate actively in the network. Staking tokens involves locking them up for a specific period to contribute to network operations, such as transaction validation. In return, token holders receive rewards, which can be additional tokens or other benefits.

Token liquidity and exchange: Listings are vital for tokens to thrive in the market. Liquidity, achieved through easy token buying and selling, offers traders flexibility and accessibility. When reputable exchanges list a token, it gains visibility, attracts more traders, and enjoys increased liquidity. Improved liquidity and exchange listings contribute to the overall token demand, leading to potential value appreciation.

Role in blockchain projects

Tokenomics is pivotal in blockchain projects by establishing a comprehensive set of rules. Hence, these rules harmonize the actions of various stakeholders, including founders, developers, investors, and users.

Let’s delve into the key components of a robust tokenomics framework.

Key components

The three main types of tokens include utility, payment, and security. Other prominent token types include stablecoins, DeFi tokens, and NFTs. Let’s explore the three main types in detail.

Security tokens

Security tokens are digital assets that leverage blockchain technology to represent ownership or stakes in real-world companies or assets. These crypto-security tokens function similarly to traditional security instruments issued by companies, trusts, governments, or legal bodies.

What are some examples?

/Related

More ArticlesSeveral examples of security tokens include BCAP, which stands for Blockchain Capital’s tokenized venture fund, Sia Funds, and VEVU. These tokens allow investors to hold fractional ownership in ventures or assets through a secure and transparent blockchain infrastructure.

Where to buy security tokens?

INX

INX Digital, or INX for short, is a platform that allows for the buying and selling of cryptocurrencies. It’s unique value add to its customer base is that it also supports crypto security tokens, and serves as a launchpad for platforms launching security tokens. The company is headquartered in Vancouver, Canada but has money transmitter licenses in several U.S. states.

- Regulated company

- Learning resources

- Buy security tokens directly from companies

- Limited selection of spot trading cryptocurrencies

Binance

Binance is the world’s largest exchange by trading volume and assets under management. The exchange is available globally and hosts a suite of products, including but not limited to:

• Staking

• Crypto spot, options, and futures trading

• NFTs

• Proprietary blockchain (BNB chain) and wallet

- Deep liquidity

- Available to many users globally

- Low fees

- Secondary market for security tokens

Utility tokens

Utility tokens are seamlessly integrated into blockchain protocols, granting users access to various services offered within these protocols. Unlike security tokens designed for investment purposes, utility tokens primarily serve as a means of payment within their respective ecosystems.

Examples of these include:

Decentraland (MANA) is a utility token exclusively created for the virtual world of Decentraland. MANA is primarily utilized for purchasing LAND and other virtual goods within the game. Another noteworthy project is ApeCoin (APE), which provides holders access to exclusive features like games, events, and services and also facilitates participation in a project’s governance votes.

Where to trade utility tokens?

Coinbase

Coinbase is an OG cryptocurrency broker that has been around since 2012. The company operates both an exchange and a brokerage. Coinbase has a unique value-add with its services. It offers separate trading interfaces for both novice and advanced users. The company even offers a subscription service to take advantage of lower fees and other unique perks.

- Multiple features and products

- Compliant to regulations

- Publicly traded company in the U.S.

- Customer service

Kucoin

Kucoin is a cryptocurrency exchange that has a robust marketplace for altcoins. In addition to its altcoin selection, the exchange has also become popular for trading crypto derivatives, such as futures. Due to Kucoin’s suite of products, you can also consider it an all in one exchange, as it has a host of products that cover most crypto native activities, such as:

• Fractional NFTs,

• Spot and derivatives trading

• Staking

• Trading bots

- Low fees

- Multiple products

- Proof of reserves

- Not available to U.S. users

Kraken

Kraken is one of the oldest Bitcoin exchanges still in operation. Although, today the exchange has a robust altcoin selection. Moreover, the platform is a popular option for traders that require advanced trading features like order types or advanced interfaces. Kraken is based in San Francisco, California and was one of the first exchanges to institutes a novel proof of reserves.

- Advanced trading features

- Staking services

- Trade NFTs

- U.S. users have limitations

Payment tokens

Payment tokens are specifically designed for facilitating crypto transactions, regardless of whether they are classified as security or utility tokens. They are classic cryptocurrencies that can be used as a means of payment, for example, bitcoin, litecoin, bitcoin cash, and solana. These crypto enable purchasing and selling goods and services without intermediaries typically found in traditional financial and banking systems. However, unlike security tokens, they do not offer any additional utilities beyond their monetary value.

Want to know how you can earn Bitcoin bonuses? Check out our guide on Bitcoin bonuses!

Where to buy payment tokens?

OKX

OKX is an exchange based in Seychelles that serves a global community of crypto enthusiasts. The exchange provides a level of safety for its customers by publishing a proof of reserves and offering a Safety and Expiry fund for platform safety. It is also an all in one exchange, as it provides a host of products.

- Multiple crypto native products

- Proprietary wallet

- Serves multiple countries

- Limited payment gateways

Kucoin

Kucoin is a cryptocurrency exchange that is based in Seychelles and founded in 2017. The exchange has a vast altcoin selection and has become a popular place for trading crypto derivatives. Due to Kucoin’s suite of products, you can also consider it an all in one exchange. The platform publishes a proof of reserves to ensure platform solvency.

- Low fees

- Trading bots

- Margin trading

- Not available to U.S. users

Kraken

Kraken, founded in 2011, is one of the oldest Bitcoin exchanges still in operation. The exchange has a vast altcoin selection; moreover, the platform is a popular option for traders that require advanced trading features like order types or advanced interfaces. Kraken is based in San Francisco, California and was one of the first exchanges to institutes a novel proof of reserves.

- Advanced trading features

- Staking services

- Trade NFTs

- U.S. users have limitations

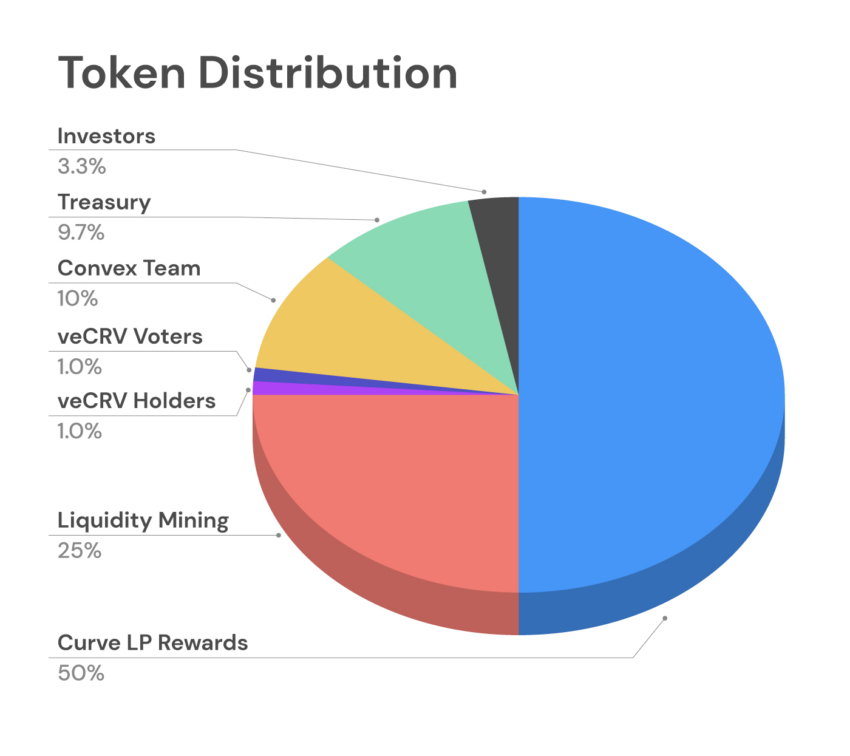

Token distribution

Token distribution refers to the process of allocating existing tokens within a blockchain ecosystem. This often includes the allocation of tokens among various participants, including founders, investors, contributors, and users.

This distribution process can be determined through predetermined allocations or influenced by factors like participation, proof-of-work, or proof-of-stake. There are various methods for distributing tokens, which depend on the underlying technology and project-specific needs. Here are some comprehensive distribution methods:

Token sales

A token sale is a method of fundraising for blockchain-based projects. It is one of the most common methods for token distribution, and it involves the issuance and distribution of tokens to investors in exchange for established cryptocurrencies or fiat currencies. This method allows projects to raise funds for development while distributing tokens to early adopters.

The inaugural token sale took place in July 2013 with the launch of Mastercoin. In 2014, Ethereum’s groundbreaking offering of a blockchain platform that catered to decentralized applications (DApps) captured investors’ attention, raising $18 million.

Airdrops and rewards

An airdrop involves the distribution of free tokens directly to the wallet addresses of eligible users. Numerous cryptocurrency projects employ this method to achieve a network effect, bolster platforms, and build a community. By setting aside a substantial quantity of native tokens and rewarding project advisors and dedicated platform users, developers can facilitate the expansion of their platforms.

An airdrop is often crucial in fostering project awareness and cultivating a strong and supportive community that stands behind a platform or project.

Lockdrops

A lockdrop is a token distribution mechanism utilized by decentralized autonomous organizations (DAO) and cryptocurrency projects to distribute their new tokens. This mechanism differs from an airdrop in that tokens are exclusively provided to individuals who express their interest in the project by locking up their existing tokens.

Investors

Token distribution can incorporate strategic partnerships and investors who contribute valuable resources, expertise, or market access to the project. This approach not only secures valuable support but also facilitates the formation of a network comprising stakeholders who can actively contribute to the project’s growth and adoption. By fostering mutually beneficial relationships, this strategy enhances the project’s potential for success and long-term sustainability.

Token supply and value

Supply and value are essential considerations in crypto tokenomics. Effective supply management is crucial for crypto projects, as it directly impacts the token’s price in the following manners: an increase in token supply, combined with unchanged demand, results in a price decrease.

Conversely, a decrease in token supply, with demand remaining constant, leads to an increase in price.

- Circulating supply: Circulating supply refers to the publicly available and actively traded amount of cryptocurrency coins or tokens in the market. The circulating supply of a crypto asset can vary over time. For instance, bitcoin’s circulating supply gradually increases until it peaks at the maximum supply of 21 million coins. It’s important to note that the circulating supply represents the coins accessible to the public and should not be confused with the total supply or maximum supply.

- Maximum supply: Maximum supply refers to the ultimate number of the project’s tokens that will ever be minted. It can be limited or unlimited.

- Total supply: This is the cumulative sum of the circulating supply and the assets locked in reserve.

Price and market dynamics

Similar to how central banks regulate and stabilize traditional currencies, a similar approach can be advantageous in the realm of tokenomics.

For example, the announcement of a government-imposed ban on cryptocurrency trading can significantly impact the demand and value of a token. Conversely, when a big institution adopts a specific token as a form of payment, it can amplify the token’s desirability and value. Moreover, increasing the token supply in a market experiencing excessive volatility can help temper price fluctuations and foster stability.

Utility and governance

A robust tokenomics framework involves a project that harnesses tokens with multiple functionalities that contribute to the ecosystem and benefit its participants. Illustrative examples include:

- Earning opportunities: through activities like staking, mining, yield farming (LP Tokens), and revenue-sharing.

- Medium of exchange: within a platform or across the entire ecosystem: The most apparent use case for a token is its function as a means of payment for gas fees on the blockchain. For example, ETH’s main utility involves covering transaction fees and deploying DApps and smart contracts, while bitcoin is utilized both as a store of value and a medium of exchange.

- Governance: Governance is a model wherein token holders possess voting rights to shape decisions regarding protocol upgrades, consensus mechanisms, or other platform modifications. This utility model promotes decentralization and community engagement in decision-making processes. For example, the native cryptos of Compound Finance (COMP) and Uniswap (UNI) are among the most widely utilized governance tokens in the web3 space.

Incentives and rewards

Another crucial aspect of tokenomics revolves around how tokens incentivize participants, ultimately ensuring long-term sustainability. In platforms like ethereum and various other proof-of-stake mechanisms, users can lock their tokens to validate transactions. Locking more tokens increases the likelihood of a user being chosen as a validator and receiving rewards for transaction validation. These features effectively incentivize participants to act honestly and uphold the protocol’s security.

Numerous DeFi projects have embraced innovative incentive mechanisms, including yield farming, to foster rapid growth. This phenomenon can be traced back to the distribution of the COMP governance token in June 2020, initiated by Compound. By rewarding both lenders and borrowers within the application with their governance token, Compound set a DeFi trend that is still going strong in 2023.

Access to platform features or services

Tokens serve as admission fees to access blockchain infrastructure or specific products, akin to entry fees at a theme park. This approach incentivizes user engagement, including activities such as paying security deposits, running smart contracts, or covering usage fees.

Token economics vs. token mechanics

Token economics and token mechanics are two important mechanisms that work in tandem to create a successful cryptocurrency token. Tokenomics involves creating a limited supply of tokens and incentivizing users to hold tokens. In contrast, token mechanics focus on the technical implementation of a token, like creating a smart contract that governs the token’s behavior, using a blockchain to record transactions, and implementing a consensus mechanism to validate transactions.

Why should you care about tokenomics?

Tokenomics is of utmost importance when assessing a crypto project. Just as nails fortify a structure, a token must fulfill various roles to guarantee the underlying business model’s robustness, security, and longevity. Tokens serve various key functions within blockchain ecosystems, and a solid tokenomics model is the hallmark of any solid web3 project.

Frequently asked questions

What is tokenomics?

What is a tokenomics example?

What is the role of tokenomics?

What are the benefits of tokenomics?

What are the components of tokenomics?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.