The prevailing bullish sentiment in the crypto market is substantially impacting nearly all digital assets. Lesser-known cryptocurrencies like OKT, the native token for the layer-1 blockchain network OKT Chain (OKTC), surged by 80% over the past 24 hours.

Data from BeInCrypto shows that OKT’s price went from $14.7 to a 9-month high of $30. However, its value has retraced to $25 as of press time.

Why Did OKT’s Price Skyrocket?

The remarkable surge in OKT’s price can be attributed to heightened interest from the inaugural inscription-minting event hosted on the OKT Chain.

Inscriptions on layer-1 blockchain networks like OKT Chain operate by storing metadata within the call data of a blockchain transaction. These inscriptions are similar to Bitcoin Ordinals as they essentially create non-fungible tokens (NFTs) based on smart contracts.

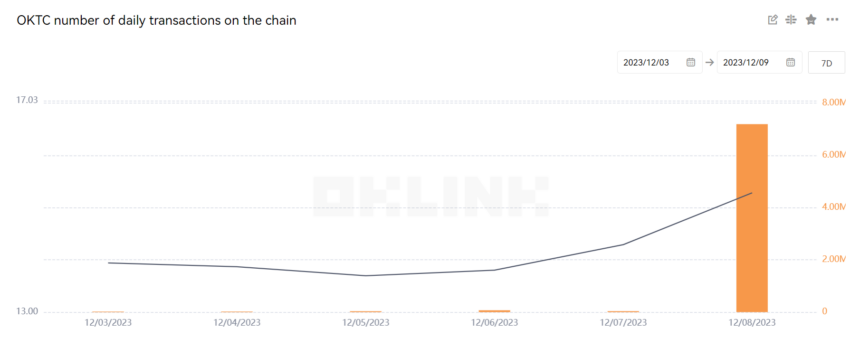

On-chain data shows that transactions on the OKT Chain soared by more than 18,000% during the past week to as high as 7.2 million on December 8.

However, the increased network activity also resulted in significant network congestion for the little-known blockchain network. There are around 100,000 pending transactions as of press time. The OKX Web3 wallet also suffered an outage due to the heightened traffic from OKT Chain.

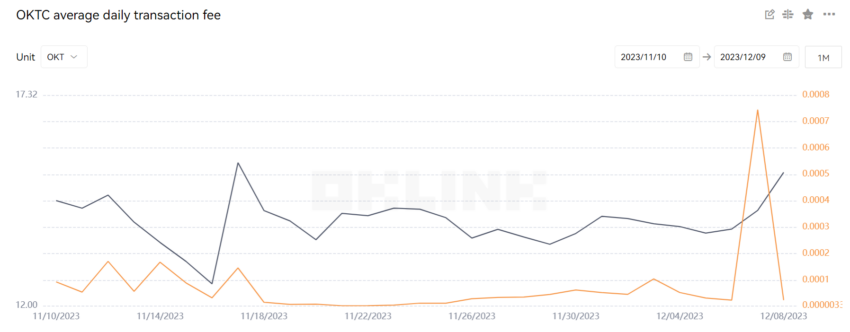

Besides that, the network’s average transaction fee spiked to 0.00074 OKT during the height of these transactions.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

OKT Chain is an Ethereum Virtual Machine (EVM) and Inter-Blockchain Communication Protocol (IBC) Layer-1 network built on Cosmos and backed by crypto exchange OKX.

Inscriptions Adoption Grows

Meanwhile, inscriptions are also driving transactions on several EVM-compatible blockchains, including TON, Near Protocol, and Polygon, to unprecedented highs. For context, inscriptions accounted for over 50% of total transactions on Polygon, Avalanche, and BNB Chain last week.

However, they have attracted criticism from several community members who point out the network congestion and the increasing transaction fees they cause.

Read more: Top 10 Cryptocurrencies to Invest in December 2023

Venture capital firm Dragonfly showed that gas fees for inscription transactions peaked at more than $800,000 two weeks ago. However, the transactions have steadily attracted fees of more than $500,000.

“Inscriptions can skew basic metrics like transaction count… Inscriptions go against every EVM design decisions, with gas costs being the only benefit, at the expense of indexing, non-compatibility, integration challenges,” Hildobby said.

Trusted

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.