Ethereum is rapidly progressing towards its ETH 2.0 vision. Amidst the newest entrants, including the Dencun upgrade and Proto-danksharding, comes the novel utilitarian concept of Ethereum restaking. Inherently a simple concept where you end up re-staking already staked Ethereum, this concept aims to make the mainnet more secure while perpetuating energy efficiency.

This guide discusses everything there is to know about Ethereum restaking. This includes its needs, types, benefits, and challenges. By the end of this piece, you should be able to tell apart Ethereum staking and Ethereum restaking and even choose which model makes more sense to your requirements and skill sets.

- How to benefit from ETH for EigenLayer restaking?

- Kraken

- OKX

- Wirex

- Coinbase

- KuCoin

- How does restaking work?

- Economic implications of Ethereum restaking

- Type of Ethereum restaking

- How to restake any ETH?

- Potential benefits of restaking

- Concerns and challenges

- When can you unstake Ethereum?

- The road ahead for restaking and Ethereum

- Frequently asked questions

Methodology

BeInCrypto implemented a thorough six-month evaluation process to select the best platforms for purchasing ETH, considering several key factors such as fees, product offerings, accessibility, security, and more. The leading platforms we identified are:

– Kraken

– OKX

– Wirex

– Coinbase

– KuCoin

Kraken stands out for being among the earliest Bitcoin exchanges, earning its place for ETH purchasing due to its support in over 100 countries, diverse payment options, and fiat currency support, alongside its regulatory compliance emphasizing security.

OKX distinguishes itself as a comprehensive exchange, providing a wide array of services including its own blockchain, wallet, mining pool, among others, and enhances security through proof of reserves.

Wirex sets itself apart as a payment processor offering cryptocurrency purchases and crypto cards. It is regulated with money transmitter licenses across numerous U.S. states, supports various payment methods, and maintains low fees.

Coinbase is notable for being one of the most voluminous exchanges, with straightforward fees ranging from $0.99 to $4.19 based on transaction size, and offers a proprietary wallet, blockchain, custodial services, a brokerage, and an exchange.

KuCoin is recognized globally, offering unique features such as fractional NFTs, trading bots, derivatives, and more. It is accessible in over 200 countries and provides competitive trading fees of 0.1%, alongside opportunities to earn through staking and other features.

This selection process has undergone peer review and fact-checking for precision. For further details on BeInCrypto’s Verification Method, follow this link.

How to benefit from ETH for EigenLayer restaking?

Restaking on EigenLayer will provide a unique experience for its actively validated services and Ethereum itself. One way to capitalize on this innovation is to anticipate the future growth in user experience and preemptively purchase ETH. If you’re looking to buy Ethereum, here are a few platforms that offer secure and user-friendly interfaces to do just that.

Kraken

Kraken, founded in July 2011, is one of the few early cryptocurrency exchanges that is still in business. Jesse Powell — most well-known for his significant contributions to the Bitcoin business — founded the platform. Kraken is headquartered in San Francisco, California, United States. Since its inception, Kraken has grown to become one of the largest and most recognized cryptocurrency exchanges, gaining accolades for its diverse range of coins, solid security measures, and simple user interface. For those looking to prioritize safety and security when buying ETH, Kraken is a great option, thanks to its range of protective features, including 2FA (Google Authenticator and Yubikey), advanced cold storage and hot wallet solutions.

OKX

OKX, formerly known as OKEx, is a cryptocurrency exchange that began operations in 2017. The exchange was initially based in China, but OKX moved its operations overseas due to the Chinese government’s crackdown on cryptocurrency activity.

OKX distinguishes itself with its vast range of Bitcoin trading choices. It is appealing to both regular and institutional investors due to its wide feature set, which includes futures, options, spot, and derivative trading. With low fees and a user-friednly interface, OKX is a solid option for both beginners and advanced traders looking to buy ETH.

Wirex

Wirex was formed in 2014 by co-founders Pavel Matveev and Dmitry Lazarichev. Its initial foundation took place in the United Kingdom. Well known for its leading crypto card offerings, Wirex is a digital payment platform that combines money transfer, payment processing, and cryptocurrency exchange capabilities. Customers can easily convert traditional fiat currency to crypto using this platform. As such, Wirex offers a simple and user friendly vehicle for those looking to accumulate ETH.

Coinbase

In June 2012, Fred Ehrsam and Brian Armstrong established Coinbase. It was founded in San Francisco, California, in the USA. Coinbase’s popularity stems from its user-friendly interface, strict adherence to rules, wide range of supported cryptocurrencies, robust security procedures, extensive library of extra services, and comprehensive educational materials. Those looking to buy ETH with Coinbase will benefit from a straightforward process, as well as solid customer service and a transparent fee structure.

KuCoin

KuCoin was launched in September 2017 by a group of business leaders with blockchain technology experience, led by Michael Gan. The exchange was founded in Seychelles, a country known for its cryptocurrency-friendly policies. KuCoin is well-known for its user-friendly platform, which offers KuCoin Shares (KCS) for revenue sharing. It also provides low fees, a diverse range of cryptocurrencies, including new coins, and strong security measures.

How does restaking work?

Before we discuss Ethereum restaking, it is important to note that Ethereum staking, the first point of contact with the staking providers, is still the protagonist here. With the Ethereum merge shifting the network to a proof-of-stake (PoS) ecosystem as part of the energy-efficient Ethereum 2.0 upgrade, the need for validators locking ETH to secure the network increases, cutting out the miners completely.

“Restaking will increase ETH yields, leading to a lagging boost in the ETH price.”

Ignas, Co-Founder of Pink Brains: X

And while native ETH staking via the Beacon Chain and liquid staking via platforms like RocketPool and Lido exist, Ethereum restaking allows you to take the staked elements from these platforms and share the cumulative staking rights with other protocols and elements of the Ethereum mainnet. This way, an additional layer of security and utility within the Ethereum chain surfaces. Restaking can lend security to other virtual machines, bridges, consensus protocols, and more across the Ethereum ecosystem without each component needing to raise a fresh lineup of validators.

Notably, the Shanghai Upgrade, leading to the implementation of the EIP-4895, played a major role in furthering the concept of restaking. This Ethereum EIP facilitated Beacon Chain staked ETH withdrawals, allowing users to be more independent with their assets.

Unpacking Ethereum restaking in simple words: A real-world analogy to make sense

Here is an easy way of understanding Ethereum restaking and how it works.

Imagine purchasing and assembling a massive versatile toolkit at home for fixing almost everything, from plumbing to electrical connections. Having the toolkit at home is akin to Ethereum staking, whereas your committed ETH works as the toolkit, securing the Ethereum mainnet — your house.

Now, imagine letting your neighbors borrow this toolkit from you. This is with the pre-specified condition that you must have it whenever needed. This is what restaking means, as your all-powerful toolkit can help the neighborhood while you are in charge of its use. Plus, the neighbors send you small tokens of appreciation every now and then, much like the re-staking rewards.

But wait? There might be a few concerns running through your mind right now:

What if your home (Ethereum network) becomes vulnerable now that the staking power or the toolkit is with others? Even though the concerns are genuine, restaking protocols like EigenLayer have smart contracts in place to constantly monitor the usage of these tools and avoid over-commitment. Consider this a tool-specific escrow service that only allows 50% of toolkit use at any given time, leaving 50% readily available for your home (Ethereum).

Why was Ethereum restaking needed?

Yes, an all-powerful toolkit is good to have. But nothing beats the feeling or the rewards associated with ensuring that this toolkit also helps others. Restaking is a choice made by ETH holders to lend security to other protocols and maximize staking rewards in the process.

Did you know? For standard restaking, you need not have staked ETH or liquid staking tokens or receipts. If you have native ETH lying around, protocols like Ether.fi also allow direct re-staking, offering chances at higher rewards.

Economic implications of Ethereum restaking

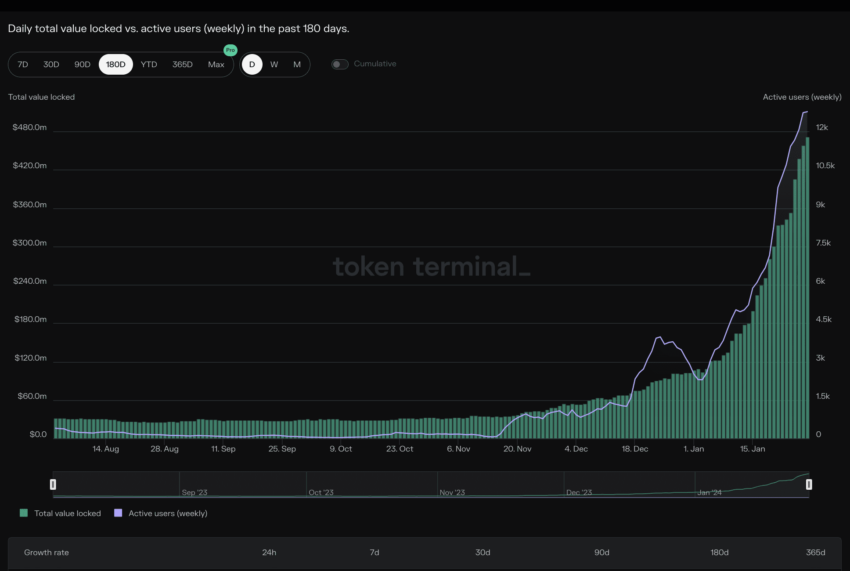

Before we go deeper into the types of ETH restaking, it is important to understand how this relatively new concept impacts the price, future, and other elements related to the Ethereum mainnet. For instance, as of January 2024, the restaking market is being led by the likes of EigenLayer and Pendle Finance, both having a significant decentralized finance (DeFi) presence.

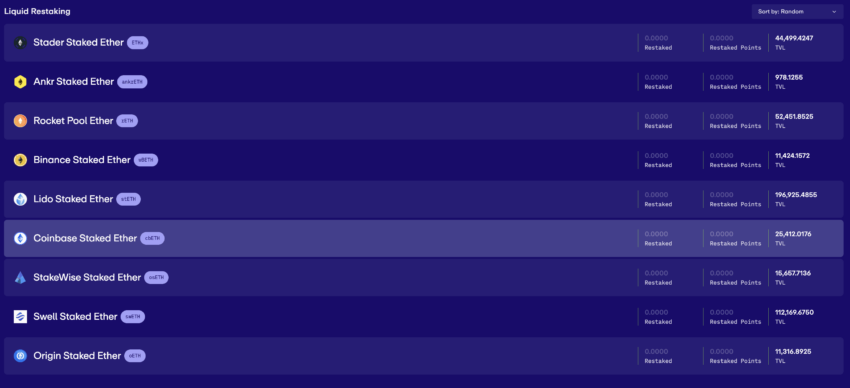

If you simply look at the EigenLayer stats, it is evident that aggressive restaking is in play. Some custody options, like Lido, Rocket Pool, and Coinbase, are even more popular.

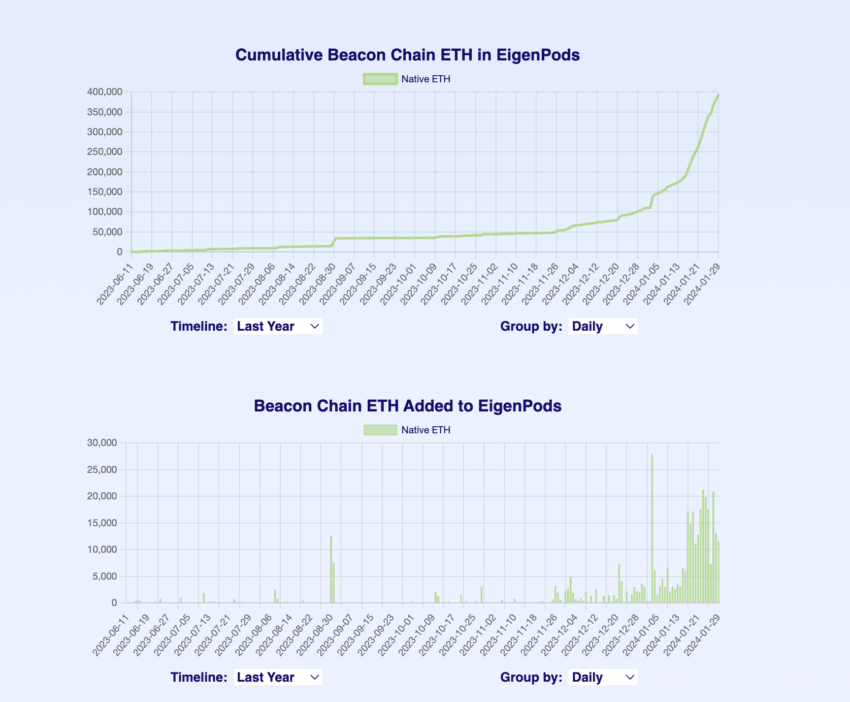

And it’s not just the liquid staking or the custody options that are seeing their staked ETH get restaked. A lot of Beacon chain ETH (native staked ETH) is also making it to the restaking protocols, primarily the EigenLayer.

As for the state of Ethereum, in terms of price action, Eigenlayer came into existence on June 14, 2023, and since then, the price action has been positive.

The DeFi presence of Eigenlayer, the most influential restaking protocol, is ranked 11 at press time and has seen a TVL surge of almost 75% over the past 30 days. As of Jan. 29, 2024, $1.93 billion worth of funds is locked on Eigenlayer.

Surge in the popularity of restaking tokens

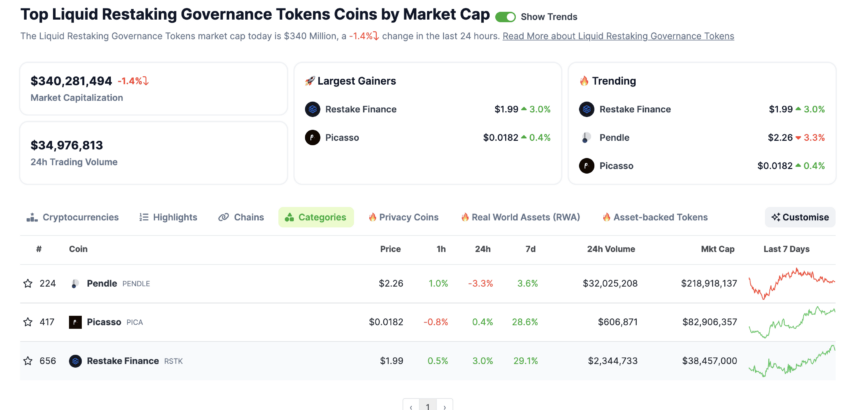

Now, let us unwrap this restaking narrative in detail. Firstly, Eigenlayer is the pioneering restaking protocol. This restaking concept has been used by other players like Pendle Finance, which is using Ether.fi’s eETH — a liquid staking token — to facilitate restaking via Eigenlayer.

/Related

More ArticlesSimilarly, Restake Finance is leveraging EigenLayer’s restaking concept to bring forth a product called Modular Liquid Restaking. Plus, there is Swell Finance, offering a native Liquid Restaking Token (LRT) to help you earn Eigerlayer points.

Exchange and info aggregators like CoinGecko now have a specific category termed restaking tokens. This shows how crucial the economic implications could be if this use case blows up even more aggressively.

Simply put, EigenLayer pioneers a liquid staking ecosystem with several players in the mix.

Type of Ethereum restaking

First of all, the restaking we are discussing is relevant to the EigenLayer concept. This is not the standard restaking where you can stake your liquid staking tokens across DeFi applications to generate yield. Regarding Ethereum restaking via EigenLayer, you can either stake the native Beacon chain-staked ETH or stake already staked ETH on those popular liquid staking platforms.

More experienced users can further explore the following options, which include native and liquid staking restaking along with the existing options:

- Native restaking: This is where validators use EigenLayer to restake the Beacon chain ETH, which is also staked by in the blocks of 32.

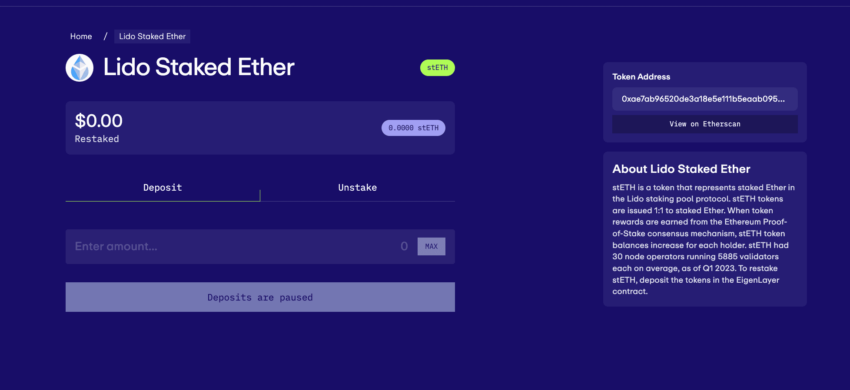

- Restaking LSDs: These are the receipt tokens that liquid staking solutions like Lido, Rocketpool, and more provide. EigenLayer also accepts the same.

- Restaking tokens from DeFi: Some validators prefer staking their wrapped ETH from DeFi, bringing an additional layer of rewards into the mix.

- ETH LP restaking: Finally, some validators can stake ETH on platforms like Lido, restake the stETH or the LSD token (LST token) on a DEX, and then re-re-stake the DEX-specific staked ETH token.

- Automatic restaking: Platforms like Ether.fi allows you to stake your ETH, with eETH as the liquid staking token. Plus, eETH is automatically integrated with the EigenLayer, which gets restaked without you having to head over to the EigenLayer interface separately.

If all that sounds a little confusing, here is a thread that explains it diagrammatically:

It is worth noting that EigenLayer, being the middleware, allows both Beacon chain ETH and liquid staking tokens, or the staked receipts of Ether, to be restaked.

How to restake any ETH?

The first step is to choose how you want to stake your ETH in the first place. If you are loaded and more like a validator with 32 ETH locked into the Beacon Chain, you can head over to the EigenLayer interface and choose “restake” as the option. Therefore, before learning about restaking, you should know how to stake Ethereum, as only staked ETH can be restaked via the EigenLayer.

The thing with Beacon Chain ETH is that while restaking, you need to create an Eigenpod — which is more like a repository of the staked ETH on the EigenLayer. While restaking, you need to change the initially added validator withdrawal credentials — which is like the wallet address for withdrawing staked ETH and staked rewards — to the EigenPod credentials. This way, the rewards and the ownership of the staked ETH are always with you and can be monitored at will. This would come in handy when you want to unstake the re-staked ETH.

The second scenario involves you connecting with third-party solutions, like Liquid staking platforms, yield aggregators (Origin), non-custodial DeFi-specific yield generators (Swell protocol), and more. Each platform allows you to natively stake ETH and get a staked token receipt, such as OETH, stETH, or anything else. These LSTs or DeFi-specific yield tokens with ETH as the underlying asset can be manually re-staked.

Potential benefits of restaking

We know that the restaking process lends additional security to Actively Validated Services, which might include bridges, protocols, DApps, data storage solutions, and more. But there are several other benefits, which extend to the re-staker and also the Ethereum mainnet. Let us explore a few.

Compounding rewards

When you restake the already staked ETH, you can enjoy the perks of compounding rewards. However, unlike the fixed validator rewards, restaking concerns perks specific to the AVS that the staked power is directed towards. Hence, the reward rates might vary.

Minimal startup costs for protocols

Newer Ethereum protocols must invest a lot to assemble strong validator-focussed security implementations. Restaking, just like the toolset example we used earlier, brings the concept of pooled security into the mix, allowing Actively Validated Services or diverse protocols, bridges, and other elements to benefit passively without additional startup costs.

Sovereign protocol architecture

In several cases, protocols must migrate to layer-2 solutions to access low-cost validator services. However, there can be several layer-2 constraints creeping in, including restrictions on transaction types, customization options, and more. Pooled security via restaking ensures that more services can stay on Ethereum.

Besides the mentioned benefits, restaking involves better usage of staked ETH — in addition to the exploration of DeFi-focussed services. Most of the ETH stays within the mainnet, fostering a sense of economic security and capital efficiency.

Plus, pooled staking and security might have a positive impact on Ethereum gas fees.

Concerns and challenges

Ethereum restaking isn’t without its share of concerns. Let us address a few.

Slashing risks

Staking, regardless of the route — Beacon Chain or liquid staking platforms — attracts slashing risks if the validator misbehaves. Restaking amplifies that risk, which can be higher and lower than the usual slashing rate depending on the standards set by the AVS.

Liquidity concerns

Restaking might restrict the flow of free ETH within the ecosystem. Plus, restaked ETH, even when unstaked, might not be immediately available for withdrawal. All these can lead to liquidity concerns within the mainnet.

Complexity

The concept of restaking, involving LSTs and liquidity provider tokens via DeFi channels, can be complex, heightening the entry barriers associated with the concept.

Finally, there might be concerns that moving aggregative security to other protocols might render Ethereum vulnerable at certain points, making room for newer attack vectors.

Here is another way of looking at the posed centralization risks associated with Ethereum staking:

When can you unstake Ethereum?

Even though smart contracts power the EigenLayer, you need not interact with them directly for unstaking. To unstake restaked ETH, you first need to understand what kind of restaking route you want to take. For EigenPod-based Beacon Chain restaking, you simply need to click on the “Unstake” tab or the amount of restaked ETH you want to release.

After that, you need to withdraw the validator access from the EigenPod, move it to your own wallet, and then wait for a seven-day escrow for the validator to exit the queue if you need to unstake all the ETH. For a simple restaked ETH unstaking, withdrawing the validator access is enough.

For unstaking the Liquid Staking Tokens or the LP ETH tokens from EigenLayer, there is a direct unstake option beside the “Deposit” tab. Once you unstake, there is a progress tab. The same amount shows up as the withdrawable LST or LP ETH, depending on the rules set by the AVS EigenLayer in the first place.

Notably, there might be a lag between unstaking and withdrawal options, precisely designed to ensure the integrity and security of the associated protocols and networks. In most cases, there is a seven-day Escrow period to consider for withdrawing the LST or LP ETH tokens to the participating wallet.

Other ecosystems are trying out different restaking narratives:

The road ahead for restaking and Ethereum

The concept of Ethereum restaking has rapidly gathered pace. Yet, most technically aligned users are more interested in the road ahead. With restaking expected to make AVS more powerful and reliable, Ethereum might be able to lead the development of new products. These include financial products, novel consensus mechanisms, and data availability layers. The concept of pooled security could well be a game changer, helping reduce hacks and make the services more resilient.

Frequently asked questions

Can I lose money staking crypto?

What is the profit of ETH staking?

Is staking ETH a good idea?

Is staking Ethereum risk-free?

What is the safest way to stake ETH?

Is there risk in staking Ethereum?

How do I stake Ethereum myself?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.