Rocket Pool staking is an effective way of showing your support for the Ethereum network, all while cashing in on the rewards. Does this sound good to be true? Think of it as part of Ethereum’s ongoing innovation. Rocket Pool is one of the options you have to stake ether. Beginners may have trouble understanding how to use it, however. Here, we explain how to stake ether with Rocket Pool and give you all the needed information.

- Ethereum staking

- What is Rocket Pool?

- How does Rocket Pool work?

- What makes Rocket Pool special?

- Why stake with Rocket Pool?

- Are there risks in staking with Rocket Pool?

- How to stake ethereum (ETH) with Rocket Pool

- What is rETH?

- The RPL token

- Should you stake ethereum with Rocket Pool?

- Frequently asked questions

Ethereum staking

The Ethereum network, dubbed ETH 2.0, is changing its model to the proof-of-stake (POS) system. This will lower transaction costs, improve speed, and provide major assistance to the environment. The increased popularity of the Ethereum network led to many new adopters joining.

Rocket Pool’s Ethereum 2.0 staking pool, a part of the blockchain ecosystem, lowers staking costs. It utilizes smart contracts to establish its validator structures within the blockchain framework. On Rocket Pool, a node requires fewer Ethereum to be staked. Similarly, the platforms mentioned previously reward users for staking their Ethereum, contributing not only to the ecosystem but also to the broader concept of liquid staking in the blockchain world.

What is Rocket Pool?

Rocket Pool is an Ethereum staking pool that focuses on lowering financial and hardware requirements for staking this cryptocurrency. Presently, by putting up 32 ETH, solo users can stake Ethereum on their own node. However, the value of 32 ETH makes it unreasonable for most crypto users. Platforms such as Rocket Pool, Lido, BlockFi, and even Binance or Coinbase are looking to offer an alternative.

The infrastructure and liquidity of Rocket Pool make withdrawals almost effortless. Technical know-how is not a requirement for starting. And, RPL, the project’s native token, maintains the decentralized governance process.

How does Rocket Pool work?

The trustless structure of Rocket Pool functions efficiently due to smart contracts, integral to the crypto community. At the core of this system are crypto users running nodes, playing a vital role within the crypto community. Their primary purpose is to verify transactions on the Ethereum 2.0 network.

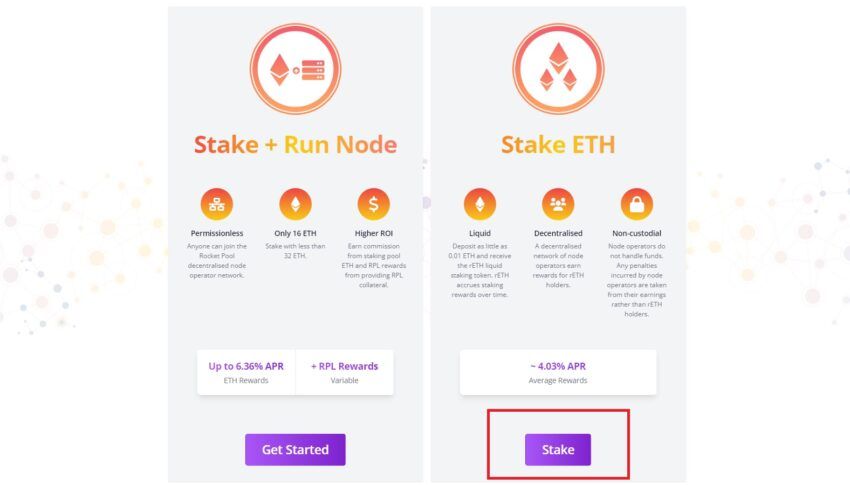

A node operator must stake 16 ETH. This is half of what an individual operator would have to stake outside of the protocol. Once staked, the node performs standard verification of transactions. In exchange for this, the node operator receives an APY. Supply and demand determine the rewards on the Ethereum network. The requirement for validators is to wait for a certain period of time before they can withdraw assets and exchange them for ETH. In the future, they will also be able to burn the rewarded assets for ETH.

Besides this, regular users can also stake Ethereum for rewards. Users must allocate at least 0.01 ETH. Once they do, they receive rETH. This token rewards you over time and is suitable for trading, lending, and collateral use.

Besides these participants, Rocket Pool also endorses so-called Watchtower nodes. The role of this is to report back information to the Ethereum proof-of-work network. The provided information helps set the rETH/ETH exchange rate. It also helps validators withdraw their tokens.

What makes Rocket Pool special?

At the heart of the project stands Rocket Pool’s work within the Ethereum proof-of-work protocol. The platform supports independent node operators, Staking as Service (SaaS) providers, and, of course, pool stakes. SaaS allows regular Ethereum holders to participate in the verification process by delegating node operations to a third party. This helps support the delegation of stake.

Pooled stakers allow Ethereum users to participate in the staking protocol. The deposit requirement, however, is much smaller than for those that need to run their own node. A Rocket Pool staker can deposit as little as 0.01 ETH. This enables a node operator to create a new Beacon Chain validator. As mentioned previously, this enables the maintenance of the consensus algorithm.

Stakers, essentially, act as investors in the Ethereum project. On Rocket Pool, they receive rETH. The rate of rETH as compared to ETH is updated every 24 hours. It’s a dynamic exchange rate. This means that you’ll never receive exactly the same amount of ETH as the ETH that you put in. The rate is dependent on the Beacon Chain rewards, and on the staked amount.

You can trade the rETH reward for ETH through Rocket Pool’s smart contracts. It’s worth mentioning that, technically, rETH has regular ERC-20 token features.

Additional features

A security function within the system makes it so that you can’t unstake your funds for a certain period, usually 24 hours. Unstaking, however, is done simply through the platform. When claiming your ETH, you are essentially burning the rETH token.

Rocket Pool also includes Oracle DAO and Protocol DAO. The first runs oracle nodes that perform extra duties within the network. The Protocol DAO will assist in the governance process. Both of these receive extra rewards in the form of additional RPL tokens.

Why stake with Rocket Pool?

In a nutshell, Rocket Pool provides liquidity, allows for rapid withdrawals of funds, and offers its infrastructure to facilitate staking of values as low as 0.01 ETH. The last part, especially, is great news for regular crypto users looking to stake Ethereum for profit or as a means of supporting the ecosystem.

/Related

More ArticlesBesides this, Rocket Pool endorses a decentralized system. In this, the protocol’s native token, RPL, is used for governance. This allows Ethereum enthusiasts to vote on issues affecting the protocol. Furthermore, this helps create the trustless and decentralized system that sits at the core of Rocket Pool.

Finally, the staking process is simple. It requires little technical expertise for the users wishing to add funds or withdraw them. Users just need to connect their wallets and deposit their funds through the platform. Deciding to unstake will happen after a 24-hour period, and exchanging rETH rewards into ETH is simple.

Are there risks in staking with Rocket Pool?

There is an inherent risk with any operation involving crypto. Thankfully, though, the danger of performing crypto dealings using Rocket Pool is quite small. However, as with any DeFi, which uses smart contract technology, there are aspects to consider.

First of all, smart contract failure is a possibility within the DeFi space. Still, Rocket Pool has received endorsements from several reputable auditors such as Sigma Prime and Consensys Diligence. The protocol is considered secure and fully operational.

As with all crypto endeavors, there is also the cost of an opportunity to consider. While you can stake ETH on Binance, BlockFi, or even Ethereum Launchpad, Rocket Pool has numerous unique features that might convince you otherwise.

How to stake ethereum (ETH) with Rocket Pool

The process of staking ethereum with Rocket Pool is relatively straightforward and requires little technical know-how. Here’s how it all works:

1. Head over to Rocket Pool’s staking section on the official website

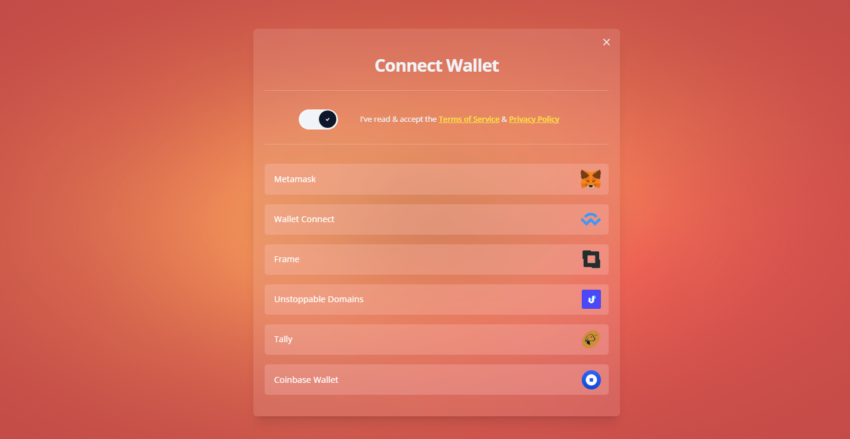

2. Connect your wallet:

MetaMask is the preferred solution for most users. However, you can also use Wallet Connect, Frame, Unstoppable Domains, or Tally.

For the purposes of this guide, we will continue to refer to MetaMask as the default option. If you do not have MetaMask yet, you can download it from the company’s official website.

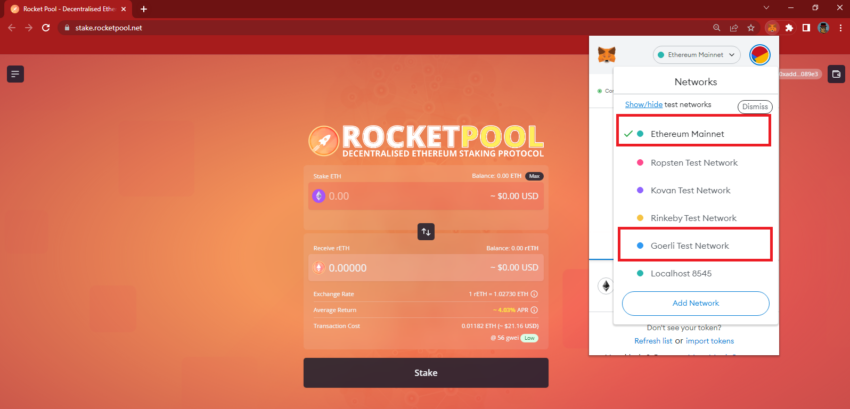

3. Make sure that you are on the right network:

Using the dropdown from your MetaMask connection, select the correct network. You need to select the “Ethereum Mainnet” and “Goerli Test Network.”

4. You can choose to add rETH to your wallet’s balance

This is optional, but it helps to see your rETH balance. To do this, you will need to once again go to the MetaMask extension. From here, click on “Assets,” then “Import Token,” then “Custom Token.”

Once here, you need to manually input the following information:

Mainnet

- Token Contract Address: 0xae78736Cd615f374D3085123A210448E74Fc6393

- Token Symbol: rETH

- Decimals of Precision: 18

Testnet

- Token Contract Address: 0x178E141a0E3b34152f73Ff610437A7bf9B83267A

- Token Symbol: rETH

- Decimals of Precision: 18

5. Stake ethereum

Once you have connected your wallet, you can stake your ETH. On the main page of Rocket Pool’s staking website, you will find the staking conditions. This includes how much rETH you will receive, the exchange rate, and the transaction cost.

6. Confirm the transaction and receive rETH

You are now ready to receive your rETH. The amount will differ from the ETH you staked, as mentioned. The value is dependent on the dynamic exchange rate between the two currencies.

7. Unstaking your ETH

From the same dashboard, you can choose to unstake at any time. Note, however, that a 24-hour waiting period will be required. Technically, if you have waited for a sufficient amount of time, the value of rETH should have increased, provided that the validators have been efficient.

What is rETH?

Rocket Pool ETH (rETH) is the protocol’s liquidity token. It represents the amount of ETH deposited by each user, although it is not equal to it.

An algorithm that calculates the value of the rETH considers the amount staked and the validator’s rewards.

ETH: rETH = (amount of ETH staked on ETH1 / total validator balance on ETH2)

For example, when you deposit 1 ETH for staking, you should receive 1 rETH. This is a mirror of your investment. However, the increase in validator rewards should make your rETH more valuable than what you deposited over time. This means that when you decide to unstake, you should receive a value higher than your initial investment.

Essentially, rETH can be added to various other staking pools. In this way, it compounds rewards and also provides yields through staking on services like Rocket Pool.

The token itself is tradable on Uniswap and Balancer as part of pairs that include wETH.

What can you do with rETH?

You can use rETH on platforms like Alchemix, Curve, and Yearn. This gives you an additional way of using the token in the DeFi ecosystem without locking any of your funds away. Liquidity pools that use rETH can help give you a decent reward over a year, so it’s worth looking into.

The RPL token

RPL is the native token of Rocket Pool. It is issued in the governance process of the protocol. It ensures that the system remains trustless and decentralized and that the community has a say in the way it functions. As a form of insurance, RPL can also be staked on a Rocket Pool node.

Since the operators stake RPL, they also receive an additional reward of the same token. This is created by the administered inflation. Operators can stake as much as 150% of the staked ETH’s value. New RPL tokens are minted every 28 days, a period known as a “checkpoint.”

Tokenomics

“Rocket Pool focuses on sustaining growth, minimizing expenditure, and adapting to new advances in contrast to a focus on maximizing growth and TVL capture by other protocols like Lido.”

Why Rocket Pool is Poised to Take Over in 2023: DeFi Dad on Youtube

RPL is distributed to node operators in exchange for operating on the network. Rocket Pool says that it purposely manages a 5% inflation rate of the RPL token. It argues that this ultimately helps reward its participants.

A simple design accounts for the issuance of the RPL token. Regular node operators that stake RPL receive 70%. The rest of the 30% is split between Oracle DAO members and Protocol DAO Treasury. This is done to offer additional incentives to operators who run essential parts of the network.

Price and predictions

Naturally, the evolution of RPL in all aspects is inherently tied to the staking process of Ethereum on the Rocket Pool network. The price of RPL has increased proportionally to the network increase in popularity as a staking service. Crypto analysts are generally optimistic about RPL’s price valuations.

Should you stake ethereum with Rocket Pool?

Rocket Pool stands out in Ethereum staking services with its decentralization, trustlessness, and community ownership. It simplifies the staking process, allowing regular users to stake with as little as 0.01 ETH, compared to the 16 ETH required for node validators. Validators are compensated with rETH and/or RPL. Staking on Rocket Pool is a secure method to support the Ethereum network and enhance your crypto portfolio, offering an accessible solution in the complex crypto space.

Staking Ether is an important part of the Ethereum ecosystem, but we understand it can be tough for newbies. Join the BeInCrypto Telegram group to ask members if they’ve used Rocket Pool themselves, which should help you out.

Frequently asked questions

Can I stake on Rocket Pool?

What is the best way to stake Ethereum?

When can I stake on Rocket Pool?

What is Rocket Pool staking?

Can you stake RPL?

What is RPL crypto?

How do I buy RPL tokens?

Why is rETH less than ETH?

Is Rocket Pool Liquid staking?

What is the minimum stake in the Rocket Pool?

What is the reward of Rocket Pool staking?

Which consensus algorithm does RPL employ?

How do I choose RPL validators?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.