The crypto landscape is bracing for a seismic shift with the upcoming 2024 Bitcoin halving, casting a shadow of uncertainty over mining enterprises such as Riot Platforms.

Once valued at $3 billion, Riot now sits at a market cap of $2.1 billion. The looming halving event poses a critical question: Will it drive Riot to a fate similar to Core Scientific’s demise?

Soaring Business Costs

The Bitcoin halving, a mechanism reducing Bitcoin mining rewards by half, is poised to alter the sector’s economics drastically. It’s expected to double the average cost per Bitcoin, ranging between $30,000 to $60,000, or halve mining revenues.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

According to Seeking Alpha, with the historical peak of Bitcoin at $69,000, this shift could be catastrophic for many, including Riot, given its precarious cost structure.

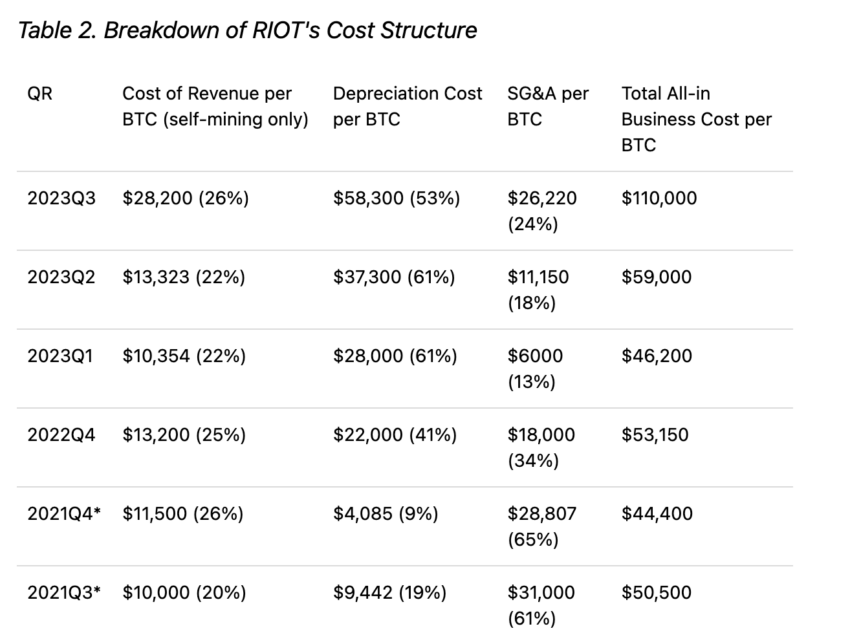

Riot’s primary expenses encompass electricity, hosting, depreciation of mining gear, sales, as well as general and administrative costs. Notably, equipment depreciation is the bulk of these, a trend set to intensify.

Riot’s short-term expansion, adding 26 exahashes per second (EH/s) worth of equipment at $416 million, and a long-term goal of achieving 100 EH/s significantly elevate this cost. Post-halving, this could mean a doubling of depreciation cost per Bitcoin.

A breakdown of Riot’s cost structure is illuminating. The company’s total business cost per Bitcoin has steadily increased, reaching $110,000 in Q3 2023 from $44,400 in Q4 2021. This trend and the halving event could potentially triple Riot’s business cost to an unsustainable $183,000 per Bitcoin.

Can Riot Survive The Effects of Bitcoin Halving?

The situation becomes more concerning when considering Bitcoin’s market performance.

Seeking Alpha further explains that a bull market could see Bitcoin reaching $90,000. However, this falls short of covering Riot’s soaring costs.

“We only expect Bitcoin to hit $90,000 in the coming bull market (which will average $66,000 during the bull market period). Unless Bitcoin surprises to the upside beyond $180,000, we do not expect any distributable income to [Riot’s] shareholders,” said Seeking Alpha analyst.

The company faces a dire scenario: either continue with shareholder dilution to fund operations or confront the reality of its business model’s unfeasibility.

This scenario eerily mirrors Core Scientific’s downfall, attributed not solely to a bear market but to insurmountable mining costs. Core Scientific’s bankruptcy filing in December 2022, precipitated by falling Bitcoin prices, soaring electricity bills, and increased network hash rates, serves as a cautionary tale.

Riot’s stock price, trading at $10.47 on Wednesday and down 44% since its December peak, reflects investor apprehension.

With the post-halving scenario possibly pushing depreciation costs per Bitcoin beyond even the most optimistic Bitcoin price forecasts, Riot’s business model seems increasingly precarious.

Read more: Top 12 Crypto Companies to Watch in 2024

As the Bitcoin halving approaches, Riot stands at a critical juncture. Will it navigate the turbulent waters of increased costs and market volatility, or will it succumb, like Core Scientific, to the harsh realities of the evolving crypto-mining landscape?

Trusted

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.