Factors that will benefit Bitcoin in 2024 and beyond include the recent inflows into Bitcoin ETFs and the resurgence of on-chain activity. Exchange-traded- funds (ETFs) raked in $542 million as of last Friday as on-chain activity influenced by Bitcoin Ordinals re-incentivizes miners ahead of the 2024 Bitcoin halving.

Grayscale Investments said these factors position the asset to surge given their strength now compared to previous halvings.

BTC Flashes Strong Pre-Halving Signals

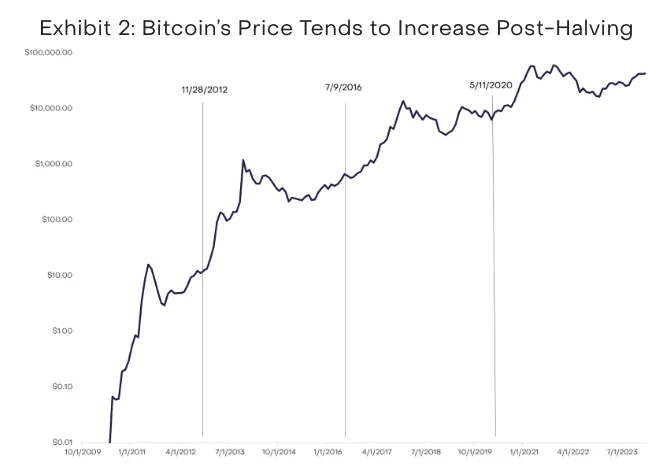

Previous halvings have been preceded by or concurred with external events. The 2012 halving coincided with lower European economic confidence aid a debt crisis. The 2016 Initial Coin Offering surge boosted prices, while COVID-19 increased prices when before the 2020 halving event as people feared inflation from money printing.

Read more: How To Get Free Bitcoins Online in 2023 (Ultimate Guide)

Fast forward to 2024, at least three factors position Bitcoin to increase in 2024 before the imminent April Bitcoin halving and beyond. These include the demand shock caused by institutions buying Bitcoin for their ETFs, the increase in on-chain activity in February, and the incentivization of miners.

Inflows into US ETFs have risen to $9 billion since they launched in January, according to data compiled by Bloomberg. Institutions have accumulated approximately 19,200 BTC in the past few weeks, with half a billion dollars worth of BTC purchased on Feb. 9, 2024. Investor demand fuels the creation of more ETF shares, which causes more BTC purchases.

Bitcoin Ordinals Props Miners’ Revenues

April’s halving reduces BTC released per mined block. This reduction preserves the asset’s value but also means miners will earn less revenue from the mined coins. Therefore, they are taking several measures to survive, including selling BTC reserves and competing for Bitcoin transaction fees.

Last year, the phenomenon of Bitcoin Ordinals, an innovation that embeds digital files on units of Bitcoin called Satoshis, helped miners cope with increasing Bitcoin network difficulty. At times since their launch, Ordinals transactions have been responsible for over 20% of miner revenue.

Read more: What Is Bitcoin? A Guide to the Original Cryptocurrency

The median fee miners earned from transactions increased from $5.17 on Dec. 12, 2023, to a three-month peak of $24.96 in four days. The increase coincided with the announcement of a new Carnival inscription service by OKX on Dec. 14, 2023.

Ordinals have also contributed to a surge in on-chain activity as developers started exploring projects. On-chain analysis revealed the number of addresses with robust activity increased to 891,692 as of 11, 2024. Grayscale predicts the recent ecosystem’s expansion, suggesting that future developer activity will increase bitcoin fees and strengthen its market position further.

“While it has long been heralded as digital gold, recent developments suggest that Bitcoin is evolving into something even more significant. Propelled by a surge in onchain activity, bolstered by significant market structure momentum, and underscored by its inherent scarcity, Bitcoin has shown its resilience,” Grayscale said.

BeInCrypto contacted Michael Saylor, a prominent Bitcoin supporter, for comment but had yet to hear back at publication.

Trusted

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.