Crypto often anthropomorphizes tokens and applications, and CoW Swap is no exception. This decentralized exchange — a digital bovine(!) — has changed how users swap tokens forever. While some might write it off as just another memetic craze, doing so risks missing out. Stick around and learn what makes CoW Swap tick in this beginner’s guide to the revolutionary DEX.

What is CoW Swap?

Before deep diving into CoW Swap, we must make some distinctions. Although the two are often referred to interchangeably, the application known as CoW Swap comprises two implementations: CoW Swap and CoW Protocol.

CoW Swap is the front end of the CoW Protocol and was created using the UniSwap interface as a reference. The CoW Protocol is the backend or underlying technology, set of rules, and smart contracts that power CoW Swap.

To prevent any confusion, we will refer to both as CoW Swap unless noted otherwise. In brief, CoW Swap is a decentralized exchange that offers a unique approach to token swaps.

Origin and development

Initially, CoW Swap originated as a Gnosis DAO proposal. Gnosis Ltd., a company that builds decentralized infrastructure, is also responsible for notable products such as Gnosis chain (formerly xDai), Gnosis Safe, and GnosisDAO.

CoW Swap would eventually move from under Gnosis to form its own DAO. Its name, CoW, is an acronym for coincidence of wants, a problem that the platform attempts to solve. The memetic title would eventually serve as the theme of the CoW Swap front end.

We compared ourselves to competitors in the space and noticed that we never tried out the ‘meme-approach’, we were giving it a chance to see if it would make a difference — and it did! Since we launched CowSwap, people have a brand to identify with, they like to hang out in our Discord and they are having fun with the brand.

Anna George, CoW Swap co-founder: Medium

Anna George is a co-founder and the CEO of CoW Swap. With experience in project management and consulting, George previously worked at Gnosis before pivoting to focus on CoW Swap. The list of contributors to CoW Swap’s development can be found on GitHub.

The rise of decentralized exchanges

Decentralized exchanges (DEXs) became popular early on in crypto. These platforms provided a way for users to access markets without using an intermediary.

Uniswap changed the way users built and designed DEXs. Due to its decentralized liquidity pools, users could share in the profits made from token swaps. New designs were built upon this model, and eventually, the DEX aggregator arose.

Thereafter, many protocols created slightly different designs that improved upon these innovations, such as customizable liquidity pools, one-sided liquidity, and many others. CoW Swap is the culmination of the advent of DEXs.

How CoW Swap works

CoW Swap boasts a few products that it has integrated over the years. However, the protocol is arguably most popular for how it altered the life cycle of a transaction to benefit the end user.

To understand how CoW Swap optimized its approach, you must first understand the problem at hand. In the average life cycle of a transaction (at least on the Ethereum blockchain and EVM-like chains):

- A user creates a transaction.

- The transaction is sent to the mempool via an RPC endpoint.

- A validator picks up the transaction and executes it.

Although, the problem with this process is that it makes the end user vulnerable to MEV opportunities. This ultimately results in a bad user experience (e.g., front running, sandwich attacks, etc.) or poor order execution.

Meanwhile, the user also suffers when using decentralized exchange (DEX) protocols that utilize liquidity providers. For example, users may experience slippage and or high gas fees in this scenario.

Automated market maker (AMM) model

An automated market maker (AMM) is a method that allows digital assets to be exchanged without permission and automatically through liquidity pools rather than a traditional market of buyers and sellers.

Think of an automated market maker as synonymous with an exchange that uses liquidity providers and liquidity pools.

/Related

More ArticlesMost DEXs use the AMM model, specifically a constant function market maker (CFMM). Slippage is considerably more of a worry for CFMMs when dealing with liquidity pools since any change in X or Y in the constant function affects the value of the item traded.

Most DEXs on Ethereum, being forks of Uniswap, also use the CFMM mechanism. Therefore, slippage is a big problem on decentralized exchanges.

Smart contracts and token swapping

CoW Swap solves the problems of MEV, slippage, and gas fees through a novel mechanism. To understand this process, let’s cover the transaction lifecycle in a CoW Swap transaction.

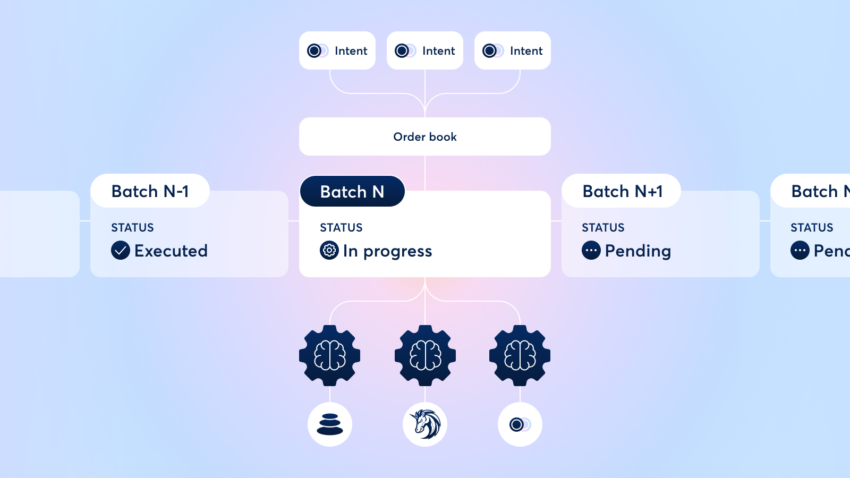

- A user creates a transaction for swapping tokens, which is referred to as an “intent.”

- Before the transaction is executed on-chain or through a liquidity pool, it is first matched with similar orders between other users via an order book.

- If the order is not matched with another user’s, then it can be sent to a liquidity pool via a Solver who aggregates DEXs (e.g., Uniswap, PancakeSwap, etc.) or DEX aggregators (e.g., Bancor, 1inch, etc.) to find the best route/ price.

- These transactions, instead of being executed immediately, are bundled into batches.

- The batches are auctioned off to solvers who can execute them on behalf of users at the best prices and lowest slippage.

- Solvers are compensated in COW tokens.

The benefits of this system are many. By utilizing a meta DEX aggregator, orders settle at the best bid offer. Additionally, the gas fees are minimized because the transactions are batched together. Users do not pay fees on failed orders in this mechanism.

Furthermore, because the auctions are private and bonded via smart contracts, this prevents your orders from suffering from MEV exploits. While CoW Swap has a few more stopgaps in place to prevent MEV, the bottom line is that all users benefit from MEV protection.

Becoming a liquidity provider on CoW Swap

CoW Swap isn’t a decentralized exchange in the same sense that Uniswap is. As a matter of fact, it is closer to a decentralized order book than a market maker. Essentially, CoW Swap uses a hybrid order book and DEX aggregator mechanism.

In layman’s terms, you can’t become a liquidity provider on CoW Swap, as there are no liquidity pools. You can, however, become a liquidity provider on the exchanges that the protocol aggregates to fulfill orders.

If you would like to participate in the CoW Swap protocol itself, you can become a solver. Note that this duty requires a high degree of technical skill.

COW token: The backbone of CoW Swap

The original launch of CoW DAO introduced vCOW, a non-transferable governance token designed to power the CoW Protocol. However, following the enactment of CIP-5, this token became transferable and was rebranded as COW.

COW is a standard ERC-20 token. Initially, the token’s sole purpose was for governance. Today, it is freely tradeable on supporting platforms.

Utility and governance aspects

CoW DAO is an open organization comprising developers, market makers, and community contributors. The primary role of its token is to facilitate governance and oversee critical infrastructure elements within the CoW Protocol ecosystem.

This setup enables stakeholders to engage actively in decision-making, shaping the protocol’s development and future direction. Anyone who holds more than 10,000 COW tokens can advance an improvement proposal.

This governance structure is crafted to synchronize the interests of the users, developers, and supporters, otherwise known as the “CoWmunity.”

Cow token distribution and farming

The COW token distribution has a maximum annual inflation rate of 3%. Out of the initial supply of 1 billion COW tokens, a substantial 44.4% was allocated to the CoW DAO Treasury.

The team behind the CoW Protocol was allocated 15%, and a significant partnership with GnosisDAO is recognized with a 10% allocation, reflecting their collaborative role in the venture.

Additionally, 10% of the tokens were set aside for the CoWmunity airdrop, rewarding early users and contributors, and another 10% for CoWmunity Investment.

Strategic advisors who have provided essential guidance and expertise were allotted 0.6% under the CoW Advisory category. Finally, 10% was reserved for an Investment Round to secure the necessary funding and support for the protocol’s growth and expansion.

Security measures in CoW Swap

CoW Swap utilizes Safe to manage its smart contracts. For the unversed, Safe is a smart contract wallet that facilitates multi-signature (multi-sig) setups. This allows you to manage addresses amongst a group of users.

Multisigs are particularly useful when you run an organization and require the approval of multiple parties before you are allowed to execute a transaction.

For example, if you run a bank that stores large amounts of gold, you would store it in a vault. If there were one key to the vault, stealing gold would be easy due to there being a single point of failure.

On the other hand, if the vault had three keys and required two to open the door to move the gold, this would be more secure in some aspect. Now, replace the gold with crypto and the vault with a digital wallet, and you have a multi-sig.

Decentralized liquidity and smart contract audits

The CoW Protocol was reviewed by Hacken, the results of which found the protocol well secured. However, CoW Swap did suffer an exploit on Feb. 7, 2023. Or, more specifically, one of its solvers suffered an exploit.

In short, CoW Swap has a fund that it allows solvers to use in order to replace certain AMM actions. This fund, which accrues from fees, was exploited. This resulted in the slashing of said solver. Despite this, user funds were never compromised.

A look at CoW Swap’s competitors

CoW Swap could have many or very few competitors, depending on how you classify the platform. If you consider CoW Swap merely a platform to swap tokens, then its competitors include Uniswap, 1inch, Bancor, and similar platforms.

Uniswap is a DEX that became popular for its decentralized liquidity pools, among other reasons. The app allows users to become market makers with a very low barrier to entry.

1inch, on the other hand, is a DEX aggregator. In other words, instead of users receiving tokens on the platform through liquidity providers, their orders are aggregated across multiple DEXs for the best price.

Bancor is similar to Uniswap, with the exception of its single-sided liquidity. This feature allows market makers (a.k.a. liquidity providers) to minimize their impermanent loss.

CoW Swap in the DeFi ecosystem

CoW Swap logs about $1.86 billion in terms of monthly trading volume. This pales in comparison to the top choice, Uniswap, which clocks about $3 billion in 24-hour trading volume, according to DappRadar.

This also puts it below similar platforms, such as Balancer and Curve, which do much more in 24-hour trading volume. Despite its benefits, CoW Swap also receives fairly low fees and revenue compared to its competitors, sitting at about $30k (fees) and $15k (revenue). This may suggest a low utilization rate in the DeFi ecosystem.

Contributions to decentralized applications (DApps)

If you consider CoW Swap an entirely new type of platform, then it has few competitors. This is primarily due to its order book mechanism, DEX aggregation, MEV protection, and off-chain batch auction.

Many exchanges and aggregators have started to rebrand their value propositions to MEV protection. Some of these include Uniswap and Matcha.xyz.

As crypto becomes more popular and intends to onboard more users, this will naturally result in more lost value through MEV, the worst user experience, and, in some cases, a deterrent to adoption. It is only natural that DApps start to offer a way to mitigate this experience.

Although some exchanges have started integrating the MEV protection feature, fewer have started integrating the off-chain batch auctions. Because of this, CoW Swap remains one of a kind.

Impact on the Ethereum blockchain

CoW Swap has opened up a much larger conversation about what a DApp is or what it can be. When you consider CoW Swap’s batch auctions, they vaguely resemble some of the processes of a blockchain, or more specifically, a rollup. This adds to the value of Ethereum as a settlement layer and broadens the horizon of the possibilities of a modular ecosystem.

Revolutionizing on-chain token swaps

When you research for a living, you come across numerous protocols and projects that promise innovation based on some novel design. In most cases, it is just a new implementation of the same old process.

However, in this case, many applications either follow in CoW Swap’s footsteps or build upon the foundation that it has laid. Whether or not the protocol becomes popular, it has changed how we trade crypto forever.

Frequently asked questions

CoW Swap is a decentralized application that takes a different approach to fulfilling customers orders. The result of this approach is minimized gas fees and MEV protection. This is facilitated through batch auctions.

CoW Swap benefits users in multiple ways. Primarily through gas fees and MEV protection. However, it also allows users to receive token swaps at the best bid orders.

Some of CoW Swap’s competitors include Uniswap, Balancer, or Bancor, or 1inch exchange. However, these exchanges differ in implementation. CoW Swap stands out due to its order book mechanism.

CoW Swap has been audited by Hacken. Additionally, the protocol uses Safe by Gnosis to manage its wallets. On top of this, the platform utilizes an RPC that protects from MEV attacks. While no protocol can be considered safe in every scenario, CoW Swap has many stop gaps in place to protect users.

The biggest difference between Uniswap and CoW Swap is that the former utilizes an automated market maker (AMM) while the latter utilizes a ledger order book (LOB). Additionally, Uniswap is a DEX while CoW Swap is an aggregator. There are many more differences that can be noted; however, these are perhaps the biggest differences.

CoW Protocol routes users transactions through an order book. If the orders are not fulfilled then they are routed using solvers which aggregate multiple DEX. The end result is better order execution, gas fees passed on to solvers, and MEV protection.

A DEX aggregator gathers routes user’s orders to find the best trade route. It takes the prices from multiple DEXs and uses the best one to execute customers trade. This results in better prices for the customer.

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.