When trading crypto, it helps to know the different approaches available to maximize your potential trading profits while minimizing losses. Risk management tools like stop loss limits are one of the ways to do that. This guide compares stop loss vs. stop limit orders, outlines the strengths and weaknesses of each, and highlights the key distinctions.

What is a stop loss order?

A stop loss order is a type of trade execution order. It allows crypto traders to limit the potential loss on a trade. They do this by setting a predetermined price at which a security will automatically be sold if its price falls to or below that level.

It’s essentially a safety measure that traders use to protect themselves from significant losses by preemptively setting a price point at which they’re willing to accept a loss and close their position. Once the market reaches the stop loss limit, it automatically triggers a market order to execute the trade at the most favorable price.

The crypto market’s volatility is a factor traders need to consider when establishing price limits based on their risk tolerance. The stop-loss order is particularly valuable when it comes to managing losses or safeguarding profits from a long position. This is because the limit can typically be adjusted throughout the period of the open position.

Advantages of stop loss orders

Let’s look at the advantages of using stop-loss orders as a trader.

- Limit losses: By setting a specific price at which to sell a cryptocurrency, a stop loss order can significantly limit a trader’s potential loss. This makes them particularly useful in volatile markets, where prices can change rapidly.

- Automated process: With a stop loss order, you don’t need to monitor the price of your crypto trades continuously. The trade will automatically be executed when the stop loss price is hit. This feature can save investors a significant amount of time and stress.

- Emotion control: Trading and investing in crypto can be emotionally taxing, especially during market downturns. By predefining the selling point with a stop loss order, decisions are based on a predefined strategy, helping prevent panic selling or holding onto a digital asset for too long out of hope or fear.

- Risk management: Stop loss orders are a critical part of risk management in trading. By setting a maximum loss you’re willing to accept, you can better manage your risk exposure and potentially prevent devastating financial losses.

- Flexibility: Stop loss orders can be set at any price, providing flexibility for traders. They can also be adjusted over time to accommodate changes in the market or in your investment strategy, allowing you to secure profits or limit losses as the market fluctuates.

- Cost-effective: Placing a stop loss order typically doesn’t cost anything extra. Most brokers don’t charge additional fees for placing these types of orders.

- Exit strategy: A stop loss order is a concrete exit strategy that a crypto trader can use to guard against unexpected market downturns. It allows you to define your exit point ahead of time and can be particularly useful when investing in volatile crypto assets where prices can change rapidly and unpredictably.

Protection from volatility

Having a stop loss is an excellent safety measure in the volatile crypto markets, where rumors often turn into market-moving news that can adversely affect your trades.

“I don’t think we should legitimize “trust me” rumor trading. It makes the space ripe for manipulation and may even create volatility.”

Vitalik Buterin: Twitter

Disadvantages of stop loss orders

Now, let’s take a look at the drawbacks of using a stop loss.

- Market volatility: During periods of high market volatility, stop loss orders might get triggered unnecessarily due to temporary price fluctuations, leading to an unwanted exit from a position.

- No guarantee of exact price: A stop loss order doesn’t guarantee that you’ll sell at the exact price you set. If the market is moving quickly, your order could be executed at a significantly lower price than your stop price. This is especially so in the case of stop market orders.

- Gap risk: There’s also a risk that the security’s price could “gap down” overnight. This means it opens at a significantly lower price than it closed the previous day. This could lead to the sale of the security at a much lower price than the stop loss price.

- Psychological impact: The use of stop loss orders can sometimes lead to poor decision-making, such as setting the stop price too close to the purchase price, causing the crypto trader to be prematurely stopped out of their position.

- May miss future gains: If the price recovers after hitting the stop loss price, investors might miss out on future gains.

- Potential for manipulation: In less liquid markets, stop loss orders can potentially be seen and manipulated by market participants who may artificially push the price down to trigger the stop and buy at a lower price.

- Complexity for beginners: For new investors, understanding and effectively using stop loss orders can be complex and confusing, potentially leading to mistakes.

What is a stop limit order?

A stop limit order is a type of order where a trader sets a stop loss and limit price. When the crypto hits the stop price, it creates a limit order specifying the price to execute the trade.

/Related

More ArticlesOnce the value of the cryptocurrency hits the stop price, the limit order becomes active, and trade execution takes place as the asset hits the limit price. However, the order remains unfilled if the price movement doesn’t reach the limit price.

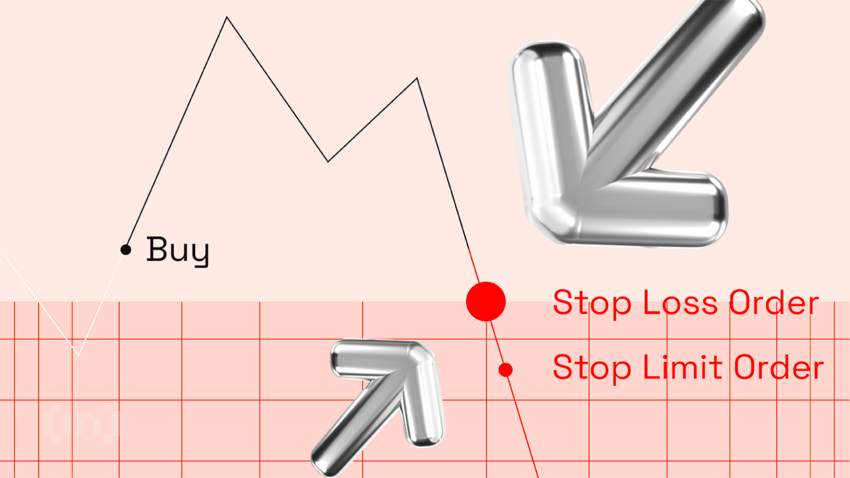

Let’s take the example of the chart above. On June 5, you notice bitcoin is trending downwards. You set up a stop limit to buy it at a stop price of $26,000 and a limit price of $25,200. Once the price hits $26,000, an order to buy at $25,200 will be placed. If the BTC continues to fall and hits the limit price, the order gets filled at that price. However, if it stagnates after hitting the stop price or starts to rise again, your order will not be filled.

Advantages of a stop limit order

Let’s take a look at some of the advantages of using a stop limit order as a crypto trader.

- Price control: Stop limit orders allow investors to specify the exact price at which they are willing to buy or sell a cryptocurrency once a specified stop price is reached. This control can help prevent execution at prices that are unexpectedly higher or lower than desired.

- Limit losses and secure profits: Similar to stop loss orders, stop limit orders can help protect against significant losses and lock in profits by setting a limit at which a crypto asset will be bought or sold.

- Greater precision: They offer greater precision than standard stop loss orders. Instead of potentially selling at a price significantly lower than your stop price during a fast-moving market, a stop limit order only triggers at the exact price set or better.

- Strategic trading: These orders can be used strategically to enter positions at desired price points. Or they can be used to exit positions only when certain conditions are met.

- Protection in volatile markets: Stop limit orders can provide a measure of protection in volatile markets. This works by setting a limit price to prevent selling at a price significantly lower than expected.

Disadvantages of a stop limit order

Given the existence of both stop and limit prices, it is possible that the execution of the order won’t take place. Price movement beyond the stop price only serves as the initial trigger.

- No execution guarantee: If the cryptocurrency never reaches the limit price, the order may not be executed at all. This can lead to missed trading opportunities or unexpected exposure to market risk.

- Market gaps: Similar to stop loss orders, stop limit orders are also susceptible to market gaps. A sell order would not be executed if a crypto asset’s price gaps below the stop price and continued to fall without ever hitting the limit price. The result could potentially be large losses.

- Complexity: Stop limit orders can be more complex to set up and manage compared to regular market or limit orders. This could potentially lead to confusion or mistakes, especially for less experienced traders.

- Possibility of partial fill: If there isn’t enough liquidity at the limit price when the stop price is reached, only part of the order may be filled. This leaves the trader with an open position they didn’t intend to have.

- Manipulation risk: In less liquid markets, visible stop limit orders can potentially be exploited. Market participants may manipulate prices to trigger the stop and then benefit from the resulting trades.

What is the main difference between a stop-loss and stop-limit order?

The main difference between a stop-loss order and a stop-limit order is in the execution method. A stop-loss order becomes a market order to sell (or buy) when the specified stop price is reached, executing the trade at the best available market price.

On the other hand, a stop-limit order, once triggered at the stop price, becomes a limit order to sell (or buy) at a specified limit price or better. This ensures a specific price or better but without the guarantee of immediate execution if market conditions are unfavorable.

Let’s examine the key differences between stop loss and stop limit functions:

Price trigger

A stop-loss order becomes active the moment the price hits the predetermined amount. The (market) order then fills immediately. Conversely, when a trader uses the stop limit function, their order can only fill at the limit price.

Stop limit orders are suitable when entering a market position. The trader can set the maximum price they are willing to spend on the cryptocurrency. The stop loss order comes in handy when an asset’s price crashes and the trader needs to exit their position.

Order execution

Trade execution of a stop-loss order is guaranteed, provided the asset reaches the stop price, and there is enough time before the markets close. However, it cannot guarantee the execution price, presenting a slippage problem where you suffer a much larger loss than anticipated.

On the other hand, the stop-limit order may not be filled if the asset does not hit the limit price. The price, however, is guaranteed. Once the market reaches the stop price, a limit order for a specific price becomes active and is executed.

Risk management

Execution is the foremost priority for a stop-loss order. However, slippage poses a risk, particularly in the highly volatile crypto market. On the other hand, the stop-limit order carries the risk of non-execution. That can expose your position to greater risks without any additional safeguards.

Stop loss vs. stop limit: a verdict

We don’t have to consider these two types of orders better as a stop loss vs. stop limit issue. Most traders utilize both orders in their trading strategy, choosing the right one depending on the circumstances and objectives.

Both orders safeguard against the cryptocurrency market’s high market volatility. By setting limits aligned with your risk tolerance, you can limit potential losses while capitalizing on upward trends to enter favorable positions. While the stop loss order limits potential losses, the stop limit order protects your profits in case unexpected changes in the market affect the prices. Incorporating your risk tolerance into your trading strategy and establishing loss limits is crucial.

Frequently asked questions

What is a stop-limit order?

Which is better, stop-loss or stop-limit?

What is an example of a stop-loss limit?

Why is stop-loss used?

Can you lose money with a stop-loss order?

Why was my stop limit order not filled?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.