Kava is a leading decentralized finance (DeFi) project that allows users to lend and borrow multiple cryptocurrencies without intermediaries. With the ongoing demand for DeFi services and products, Kava’s prominent technology and straightforward use case make it a relevant project in the blockchain space. If you want to learn more about Kava and how to use its DeFi platform, this guide is for you. We’ll provide you with everything you need to know to get started, from the basics to how to buy KAVA and more.

Our methodology for choosing the top-performing platforms to buy and trade KAVA

In this guide, we meticulously selected and tested several key exchanges over a period of six months, including Coinbase, Binance, Capital.com, eToro, Crypto.com, Kraken, and OKX. These platforms have been chosen based on an extensive set of criteria ensuring that they meet the needs of a diverse range of crypto investors.

Coinbase and Kraken stand out for their security offerings, from 2-factor authentication (2FA) to configurable account timeouts. All platforms minimize the crypto held on their exchanges and DeFi platforms while providing users extensive educational resources, particularly Coinbase Learn and Kraken Learn Centre.

• Learning resources

• Enhanced account security

• Cold storage of assets

Crypto.com is built on a solid foundation of security, privacy and compliance and is the first cryptocurrency company in the world to have ISO 22301:2019, ISO/IEC 27701:2019, ISO/IEC 27001:2013 and PCIDSS v3.2.1 Level 1 compliance, and independently assessed at Tier 4, the highest level for both NIST Cybersecurity and Privacy Frameworks, as well as Service Organization Control (SOC) 2 compliance.

• Enhanced data security

• Holds assets in cold storage

• Independently assessed for security compliance

Additionally, one key aspect of the testing involved for eToro examined how securely client funds were stored. eToro claims to keep these funds in top-tier banks, which suggests a high level of safety and risk management in financial handling.

• Assets held with reputable banks

• Regulated in the U.S.

• Segregated funds and assets

Upon testing Capital.com’s security features, the focus was on their use of encryption and Two-Factor Authentication (2FA) for account security. The effectiveness of their encryption methods was assessed to ensure that sensitive user information was adequately protected during transmission and storage.

• Enhanced account security

• User data protection

• Regulated broker

When testing Binance’s security features, we focused on evaluating its advanced security measures, including multi-signature and threshold signature schemes (TSS). The multi-signature system was scrutinized to ensure it required multiple keys for transaction authorization, enhancing security against unauthorized access.

• Enhanced encryption

• Advanced account security

• Proof of reserves

OKX was particularly recommended for advanced traders, thanks to its high liquidity in the derivatives market and significant trading volumes.

• Safety and Expiry funds

• Proof of reserves

• Tiered fee schedule favorable for frequent traders

BeInCrypto’s considered selection of these platforms is rooted in their high trading volumes, low fees, and advantageous spreads. Each is a solid choice for anyone looking to buy KAVA.

Learn more about BeInCrypto’s methodology verification here.

Do you want to buy KAVA? Use and test these exchanges

Best for beginners

Best for security

Best for staking

- Our methodology for choosing the top-performing platforms to buy and trade KAVA

- What is Kava?

- How does Kava work?

- What gives KAVA its value?

- Dual coins

- How to buy KAVA

- How to buy KAVA with a credit card

- Where to buy KAVA?

- Kava wallets for beginners and experienced users

- Is Kava a good investment for you?

- Frequently asked questions

What is Kava?

Kava encompasses an intricate and robust ecosystem in decentralized finance (DeFi). Kava is built on the Cosmos blockchain, which you may know allows different blockchains to talk to each other. This interoperability gives Kava a big advantage in connecting with crypto projects and expanding what it can offer users.

At the heart of Kava’s platform is its native KAVA crypto, which has some important roles. KAVA enables holders to vote on governance decisions that shape the platform’s future direction. It also acts as a reserve currency that underpins the financial stability of the whole ecosystem.

One of Kava’s standout offerings is enabling crypto-backed loans and stablecoins on its platform. Stablecoins aim to stabilize prices by pegging to assets like the U.S. dollar, avoiding the volatility we see with other cryptos. This provides a stable way to transact and access DeFi services.

And let’s not forget the technology behind Kava, the Cosmos SDK. This toolkit streamlines building interoperable blockchains and connecting them. For Kava, this integration is key for interfacing with a range of DeFi applications and platforms.

Now, if you are planning to buy KAVA, it is important to understand how the Kava network and the surrounding ecosystem work.

How does Kava work?

One of the most compelling aspects of Kava is that users can leverage their digital assets by locking them up as collateral to take out crypto loans denominated in USDX, Kava’s native stablecoin.

This unlocks the ability to secure multiple collateralized loans and synthesize leverage for any supported crypto asset. For example, a user could lock up their bitcoin or XRP holdings, take out a USDX loan for the equivalent fiat value of those holdings, and then use those funds to acquire additional bitcoin — thus creating a leveraged position.

As a stablecoin pegged to USD, USDX provides stability against volatility, allowing users to earn yield through staking and bonding USDX within Kava’s DeFi ecosystem. This facilitates additional passive income generation opportunities.

Beyond the core lending features, Kava also benefits from a range of applications built by its community, which enhance the overall user experience. A key factor that enables these community innovations is Kava’s interoperability based on the Cosmos SDK, which allows for seamless integration with a diverse array of external wallets, custodians, and other blockchain services.

Kava aims to deliver an open and decentralized platform for crypto-backed lending, leverage, and stablecoin usage. This provides investors and traders with robust tools for risk management, portfolio leverage, and taking positions. Its decentralized approach expands access beyond what centralized entities can offer.

Thanks to its blockchain-agnostic and interoperable architecture, Kava seems positioned for significant future growth by expanding its asset and product offerings. There are further plans to incorporate a wide spectrum of digital asset classes beyond crypto, as well as launch novel synthetic assets and derivatives — which would further boost Kava’s utility and adoption.

What gives KAVA its value?

Before we delve into how to buy KAVA, let’s find out what gives the asset its value.

/Related

More ArticlesKava’s value depends largely on three key factors:

- Technical strength: At its core, Kava relies on having robust technology and architecture. This provides the foundation for everything it aims to offer users.

- Utility: The practical utility Kava provides for decentralized lending, leverage, and stablecoin usage within DeFi is essential for its real-world value.

- Mainstream traction: If Kava gains widespread adoption and usage, it will significantly boost its underlying value. Expanding support for more crypto assets also helps drive traction.

However, Kava’s market price doesn’t always match its intrinsic value due to crypto’s volatility. Speculation often drives short-term price swings. Updates to Kava’s platform, new partnerships, and progress on its roadmap can positively influence KAVA’s price.

Ultimately, Kava’s success in achieving mainstream adoption of its DeFi services is key for aligning its real utility with valuation over the long haul.

Dual coins

Kava uses two different cryptos, USDX and KAVA, to optimize flexibility and usability for users. Having two coins allows the platform to separate key functions and interactions. This dual coin approach is gaining popularity as projects aim to provide focused utility without compromising either token’s purpose.

KAVA

KAVA is the native governance coin on the Kava Network. It enables users to vote on key network parameters, direct upgrades, and manage the collateralized debt position (CDP) system.

Secure the network: When you stake KAVA, you help make the network more secure. Kava picks the top 100 nodes based on the amount of KAVA staked to validate transactions. These nodes then earn rewards for securing the network.

Protection from bad actors: If any validated nodes misbehave, like validating fake transactions, they get kicked out. This protects the network from malicious players.

Passive income with KAVA staking: Besides boosting security, stakers can also earn additional yields. They do this by staking through validators’ bonding curves to get extra returns.

KAVA as a reserve currency: If loans on Kava become overcollateralized, new KAVA can be minted to buy back USDX stablecoins. This helps maintain USDX’s $1 peg. So KAVA acts as a last resort lender to ensure stability.

USDX

USDX is Kava’s stablecoin for quick, low-cost payments and loans. It stays pegged to $1, so it’s great for making payments that need fast settlement, like for businesses. USDX also enables crypto-backed loans on Kava’s platform.

Leverage trading with USDX: Investors can use USDX loans to buy more crypto. This allows you to leverage your assets for bigger potential gains.USDX for hedging and yield holding: USDX helps hedge against market volatility. You can also earn interest by bonding USDX at Kava’s savings rate.

How to buy KAVA

Buying KAVA securely is a relatively straightforward task. Most major crypto exchanges have it listed on their trading platform, so finding one that meets your expectations should not be a big deal. We are using Binance as an example to demonstrate how you can buy KAVA by following a few simple steps. Remember, the procedure will be more or less the same with most crypto exchanges, albeit with a few minor changes here and there.

Follow these steps to buy KAVA on Binance.

- Set up an account: Create an account on Binance either on their website or app. Note that Binance will ask for your personal details and proof of identity to ensure compliance with KYC and AML regulations.

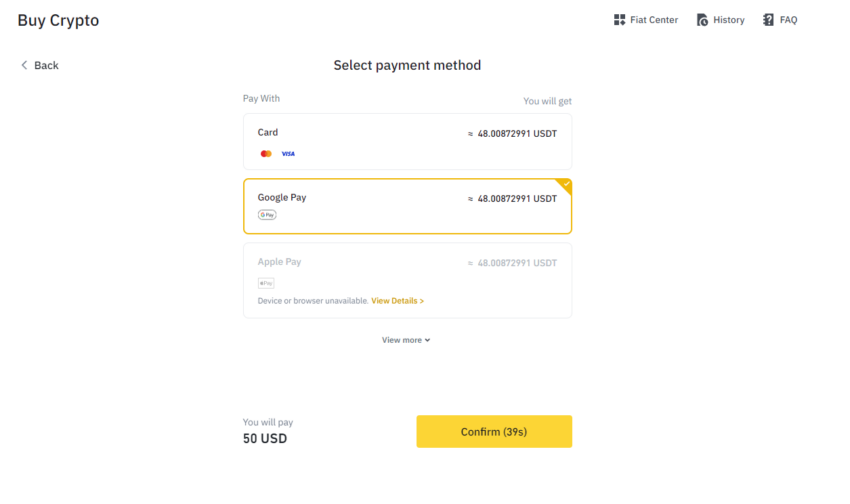

- Select purchase method: Navigate to “Buy Crypto” and choose how you’d like to buy Kava — using a credit/debit card, bank deposit, or third-party payment channels. If you plan on buying KAVA securely with fiat, you might have to first check the availability of KAVA-fiat pairs depending on your time and region. As of mid-November 2023, Binance supports KAVA/USDT and KAVA/BNB pairs on its spot trading desk.

If you don’t already have USDT or BNB in your crypto portfolio, you can buy either or both using fiat and then trade it for KAVA.

- Review payment details: Check the payment details and fees, ensuring to confirm your order within a minute to lock in the price.

- Manage your KAVA: Once purchased, you can hold the asset in your Binance account or a personal crypto wallet, trade it for other cryptocurrencies, or stake it for passive income on Binance Earn.

How to buy KAVA with a credit card

To buy KAVA with a credit card, select a reliable cryptocurrency exchange. Create an account on this platform, then navigate to the “Buy Crypto” section. Select KAVA as the desired coin and choose your fiat currency, such as USD, for the transaction. Follow the on-screen instructions to enter your valid credit card details and finalize the purchase.

Where to buy KAVA?

eToro

Our experience with eToro while trading KAVA was mostly positive for its all-in-one trading platform. It not only offers access to stocks and ETFs but also supports over 59 cryptocurrencies, including KAVA. The platform is ideal for beginners, thanks to its intuitive interface, social trading features, and a wealth of educational resources that can help you gain deeper insights into the crypto market.

Capital.com

Capital.com stood out to us as an excellent choice for buying KAVA, especially with its user-friendly design and decent track record in terms of security. The zero-commission fee structure was a significant advantage, maximizing our investment potential. We also found the demo account feature very useful as it allows trading practice with virtual funds — incredibly useful for testing strategies before putting real money on the line. The low $20 minimum deposit requirement made it easy for us to start trading KAVA without a hefty initial investment.

Binance

Buying KAVA on Binance was overall pretty smooth. We found their market analysis and reports particularly useful for staying ahead of trends and making informed decisions. Binance’s competitive fee structure, coupled with a $20 minimum deposit and $10 minimum per trade, offered us both affordability and flexibility in our trading.

Kraken

Our experience with Kraken for trading KAVA has been pretty smooth and hassle-free. The platform’s staking services, allowing us to earn interest on our KAVA holdings, significantly enhanced the value of our investments. Additionally, Kraken’s user-friendly interface, combined with a low $10 minimum deposit, made it an accessible and practical choice for both novice and experienced traders looking to expand their portfolios.

Crypto.com

Our dealings with Crypto.com for KAVA transactions were marked by fast and secure services. The low fee structure, allowing purchases with bare minimum deposits, made it an extremely cost-friendly option for buying KAVA. Crypto.com’s strong marketing and development teams, evident in its rapid expansion, added to our confidence in using the platform for our crypto transactions.

With their range of features and benefits, these platforms make buying KAVA securely easy for any investment style or experience level.

Kava wallets for beginners and experienced users

For those looking to engage with the Kava platform or invest in its native $KAVA coin, choosing the right wallet is crucial for a secure and efficient experience. Here are some of the best kava wallet choices, each offering unique features to cater to different needs:

- Atomic Wallet: A versatile choice for desktop and mobile users, featuring a user-friendly interface perfect for beginners managing diverse cryptocurrency portfolios.

- Trust Wallet: More than just a storage solution, Trust Wallet supports a variety of digital assets and simplifies activities like buying, selling, and swapping cryptocurrencies.

- Assure Wallet: Combines the functionalities of a web3 decentralized digital wallet and an asset management platform, prioritizing both user experience and stringent asset security.

- SafePal Wallet: Popular among over seven million users, SafePal offers hardware and software wallet solutions with non-custodial private key control and innovative security features like a self-destruct mechanism.

- Ledger Nano S Plus: Maintains the trusted security of Ledger’s original Nano S and integrates premium features, making it a top choice for those seeking a secure hardware wallet.

Is Kava a good investment for you?

Kava simplifies lending and borrowing across a diverse range of supported cryptocurrencies. With its user-friendly collateralization system, it facilitates cross-chain lending and staking. You can earn an Annual Percentage Yield (APY) on your stakes and earn profits from staked funds for loans. The KAVA DeFi platform thus offers an accessible multi-currency lending avenue, embodying the essence of DeFi by providing easy borrowing and lending solutions in crypto.

So, if you plan to buy KAVA, all these factors combine to make it a promising investment choice. That said, like other cryptocurrencies, KAVA is also susceptible to the volatility of the broader crypto market. So, make sure to do your own research first and consult a financial expert, if need be, before you go all in.

Frequently asked questions

Can you buy Kava on Binance?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.