Layer-2 scaling solutions have been created to help layer-1 chains like Ethereum, Bitcoin, and more scale beyond the limitations. These solutions focus on enhancing throughput without slacking on the ethos of decentralization. Yet, layer-2 scaling solutions have also innovated over the years. In this guide, we discuss everything there is to know, including the different types of layer-2s, advanced solutions, and the impact on gas fees and transaction speeds.

Our methodology for choosing the top exchanges to buy layer-2 tokens

This guide highlighted OKX, Kraken, and Coinbase as ideal for buying layer-2 cryptos such as MATIC, IMX, OP, ARB, and LRC.

Coinbase is known for its user-friendliness and offers a diverse selection of cryptocurrencies for trading in both popular and emerging digital assets. It supports a number of layer-2 tokens. Meanwhile, OKX has some of the lowest trading fees you’ll find in the industry. On OKX, users can also convert any crypto to another with zero fees and zero slippage Kraken also boasts excellent customer service options while providing a wide range of educational material and transparent transaction reports and proof-of-reserves.

Our evaluation process involved an in-depth analysis and testing of each platform’s features. For Coinbase, we focused on user experience and security measures. With OKX, our attention was on the cost-efficiency of their trading fees for both regular and VIP users. Moreover, Kraken was highlighted for its customer support and educational offerings. BeInCryoti used these exchanges over a fix month period, engaging with tools and resources, and analyzing user feedback.

Note that when choosing an exchange, it’s crucial to factor in your location and investment experience before making an informed decision.

Learn more about BeInCrypto’s methodology verification here.

- Our methodology for choosing the top exchanges to buy layer-2 tokens

- What is layer-1 vs layer-2 blockchain?

- Coinbase

- OKX

- Kraken

- Key layer-2 scaling solutions

- Advanced layer-2 scaling solutions: understanding Rollups

- What is the layer-2 solution for scaling Ethereum?

- Gas fees and efficiency in layer-2 solutions

- Challenges and limitations of layer-2 scaling

- The future of layer-2 scaling

- Frequently asked questions

What is layer-1 vs layer-2 blockchain?

Before we begin chalking out the differences between layer-1 and layer-2 scaling solutions, let us understand the concepts using an analogy. Imagine layer-1 blockchains like Bitcoin and Ethereum as standard city roads, allowing vehicles to pass day in and day out. However, over time, these roads can get crammed, urging the need for a network of tunnels and skywalks, helping redirect some traffic, and making the primary road movements more efficient.

Unpacking layer-1 chains

Layer-0 and layer-1 chains are like the foundational blockchain layers. In the case of layer-1 chains, the transactions make their way to the central, main ledger. However, these chains are prone to congestion. A layer-2 blockchain is built differently. It works like an overlaying network, taking transaction data off-chain — which means out of the layer-1 chain.

What are layer-2 scaling solutions?

Layer-2 solutions implement specialized techniques like plasma chains, state channels, and rollups to perform increased transactions at a clip.

A quick example would be understanding how the Ethereum mainnet, the layer-1 chain, works. Due to its growing popularity, Ethereum often faces network congestion, some of which can be efficiently combated using layer-2 solutions like Optimistic Rollups and more.

“I actually think blockchain projects with built-in decentralized governance mechanisms make sense for many apps, though it will take years to figure out how to do it well. That said, I think that approach makes more sense for layer-2 apps on top of less “activist” base chains.”

Vitalik Buterin, Co-Founder of Ethereum: X

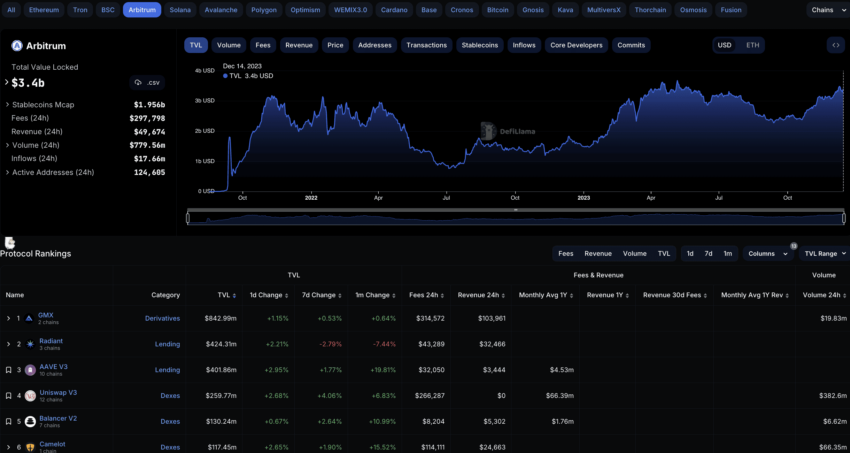

Based on these solutions, we have chains like Arbitrum, Optimism, and more, which have evolved into pretty popular networks.

Plus, if you are only interested in layer-2 cryptos, the best ones around include Polygon (MATIC), Immutable X (IMX), Optimism (OP), Arbitrum (ARB), Loopring (LRC), and more. Here are some of the top exchanges to consider for buying and holding some or all of these layer-2 tokens.

Coinbase

- User-friendly interface

- Strict security measures

- Offers access to more than 200 cryptocurrencies

- Complex fee schedule for simple trades

OKX

- Supported in 160+ countries

- Low trading fees for spot and future trades

- Demo account provided for virtual trading

- Not available in the U.S.

Kraken

- Wide selection of crypto assets

- Provides a wide range of educational material and resources

- Unavailable in some U.S. states

Key layer-2 scaling solutions

Now that we have an overview, let us understand the key layer-2 scaling solutions.

State channels

State channels are highly innovative layer-2 scaling solutions, identified as two-way communication channels. The idea is simple. The transaction only finds a place on the chain when a state channel is opened and when it is closed. This time-bound transaction logging lowers the load on the parent chain, lowering transaction fees and increasing transaction speeds in the process.

It is worth noting that payment channels, like the Lightning Network, are implementations of the state channel technology.

Here is a quick analogy for you to understand state channels better. Imagine you are in a bar, and instead of paying for each drink individually, you open a tab and pay for the consumption right at the end. The tab tracks your orders but doesn’t put a load on your mind in terms of calculations. You only need to worry about opening the tab and closing it.

Besides the lightning network, other implementations of the state channels include the Raiden network for the Ethereum mainnet and the Celer Network.

Did you know? Celer network doesn’t just support off-chain transactions. It also supports off-chain smart contracts, making the concept of scaling more widespread and relatable.

Lightning network

Even though the Bitcoin Lightning Network is one of the more popular payment channels, based on the concept of State Channels, it still deserves a separate mention. Once a lightning network channel is opened, users can transact multiple times, with each transaction broadcasted immediately to the Bitcoin network. And while the broadcasts are instant, the settlement happens only when the payment channel is closed. This way, increased transactions can go through with minimal fees.

The Bitcoin Lightning network is an efficient scaling solution for small businesses interested in bringing forward an ultra-fast and affordable payment setup.

Plasma chains

Plasma chains involve smaller child chains attached to the main network. These child chains are capable of managing smart contracts and handling transactions independently. The summary of these scaled-out transactions is periodically moved back to the parent chain. This way, the plasma chains can still maintain transaction security while offloading transactions.

Imagine plasma chains to be tree branches that can operate independently without relying on the main tree. Additionally, plasma chains come with many benefits — the ability to handle massive transaction volume without slowing down. Plasma chains are great picks for builders looking to build high-speed decentralized exchanges (DEXs) and gaming platforms.

Polygon or the Matic Network initially relied on Plasma Chains but eventually included other layer-2 scaling solutions, like rollups and sidechains, into the mix. Another example of Plasma Chains integration is OmiseGo or the OMG Network.

/Related

More ArticlesAdvanced layer-2 scaling solutions: understanding Rollups

When we discuss advanced layer-2 scaling solutions, we must discuss rollups. For starters, rollups batch transactions into one transaction, increasing transaction volume. However, the concept of rollups is further segregated into zk and Optimistic rollups.

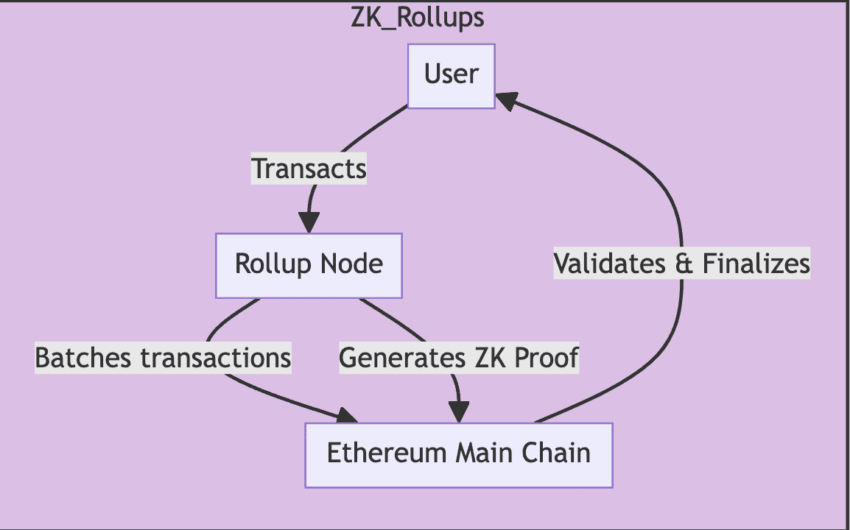

Unpacking zk-rollups

Also termed zero-knowledge rollups, these implementations are all about batching multiple transactions as one and then generating a cryptographic proof to secure the same. The batched transaction (one single transaction now) and the proof are then submitted to the parent chain.

A better way to understand zk-Rollups is to consider a bank slip for deposits. Each slip can have multiple elements on it — like cash deposits, checks, and more. At the end of the day, the bank processes the single slip, handling all the transactions at once, speeding up the entire process in the meantime.

Some of the key benefits of zk-rollups are as follows:

- Reduced transaction or gas fees

- Improved security and privacy

- Faster finality

- The ability to push out a large volume of transactions

Understanding Optimistic rollups

Unlike zk-rollups that come attached with proof, Optimistic rollups are all about bundling transactions and considering them valid unless any transaction is challenged. A better way to understand the concept of Optimistic rollups is to look at the honor system of any self-service store. At a store, it is presumed that all customers will honestly pay for the purchases, and the mechanism to check receipts only kicks in if there is theft suspicion.

Some of the exclusive benefits of Optimistic rollups include:

- Improved scalability

- Simplified fraud-proof

- Compatible with smart contracts

Apart from rollups, there exist other lesser-known scaling solutions like:

zk-STARKs

Better termed Zero knowledge Scalable Transparent ARguments of Knowledge, zk-STARKs are similar to zk-Rollups but offer better scalability and efficiency. Plus, they are quantum-resistant and cannot be hacked using powerful computing setups.

Validium

This scaling solution is also similar to zk-Rollups but with a major data availability-related difference. In the case of Validium, transaction data remains off-chain, making the parent chain even more nimble.

Nested blockchains

You can consider this a blockchain ecosystem where the main chain itself delegates work to other chains, which can also delegate other bits.

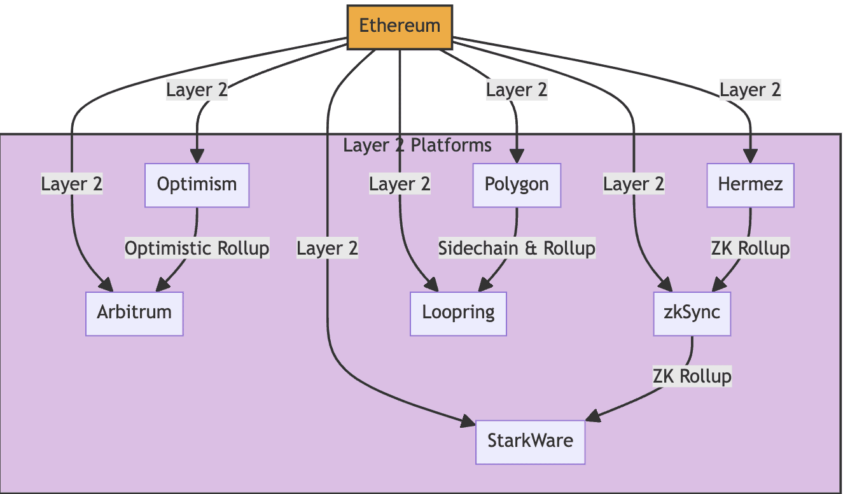

What is the layer-2 solution for scaling Ethereum?

Now that we have explored different elements of layer-2 scaling, it is appropriate to discuss the Ethereum blockchain and learn more about some of its layer-2 solutions. As Ethereum is the largest space for DApps, smart contracts, and more, it is bound to get congested at times, thereby depending on layer-2 solutions for advanced scalability.

For starters, rollups — both zk and Optimistic have important roles to play when it comes to scaling the layer-1 chain.

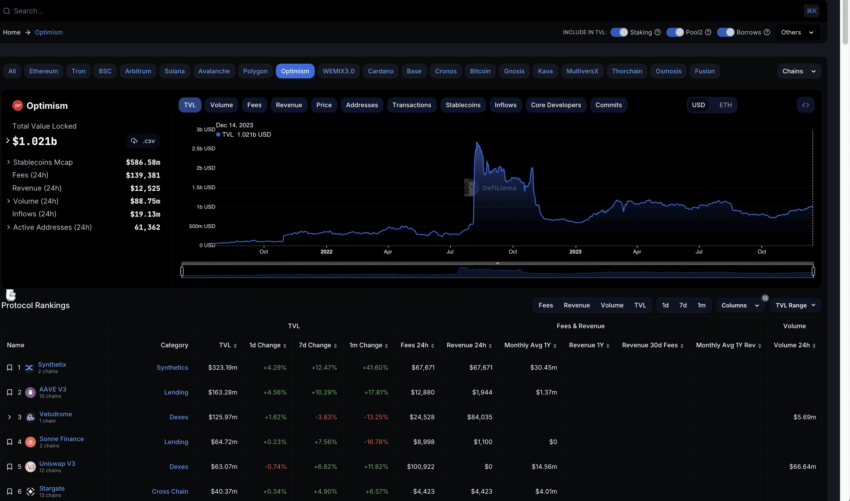

When it comes to Optimistic Rollups, Optimism and Arbitrum are the key Ethereum-specific players to look at. Or, you can also rely on Loopring and zk-Sync in case zk-rollups are your thing.

Zk-rollups offer faster speeds and attract lower gas fees than Optimistic rollups.

Ethereum blockchain also makes room for state channels via the Raiden Network, Sidechains, the Polygon PoS network, and other solutions to scale across different capacities. It is worth noting that several elements of the Ethereum ecosystem are also layer-2 compatible. These include MetaMask, with support for layer-2 and ERC-20 tokens, Bridges for asset transfer, developer tools, and explorers like Etherscan.

Gas fees and efficiency in layer-2 solutions

Even though layer-2s are primarily scaling solutions, they also significantly lower the high gas fees associated with layer-1 chains. Here are the elements that play a synergistic role in regards to lowering gas fees:

- Off-chain transactions

- Batch processing

- Proper use of blockchain space

While the Ethereum network still boasts a transaction speed of 15-30 tps, layer-2 scaling solutions push the same above 1000.

Challenges and limitations of layer-2 scaling

Even though layer-2 scaling solutions come with many benefits for builders and users alike, they aren’t without their fair share of challenges. Some of the more critical ones are as follows:

Complexity

Layer-2 implementations can make the blockchain infrastructure more complex. The additional steps to transact, closing and opening state channels, and familiarity with rollups can be tricky for a general user.

Security concerns

Even though layer-2 solutions borrow their security posture from the parent chain, they are still new and often exposed to vulnerabilities. Plus, there can be data availability issues plaguing rollups, impacting the efficacy of these implementations.

Liquidity concerns

Certain layer-2 solutions, like state channels, require users to lock liquidity up within specific sections, leading to liquidity fragmentation. Plus, capital efficiency can be a concern for transactional purposes, as users might need to allocate funds more than required to keep up with liquidation and other concerns.

Consensus and centralization concerns

Several layer-2 scaling solutions have novel consensus mechanisms that can interfere with that of the parent chain. Plus, centralization concerns might also show up with some sidechains or plasma chains having a smaller set of validators in play, compromising the very ethos of decentralization.

The future of layer-2 scaling

Layer-2 scaling is the need of the hour. It isn’t just a temporary scalability fix but a much-needed innovation that is slowly expanding to mainstream applications, including the growing popularity of zkSync, cross-chain bridges with Polygon leading the charts, and other spaces. While the present state looks convincing, we can expect the layer-2 scaling solutions to spur innovation in areas related to DeFi, NFTs, layer-2 aggregators, and beyond.

Frequently asked questions

What is layer-2 and layer-3 blockchain?

What is layer 1 and layer-2 blockchain examples?

Is Solana layer-1 or 2?

Is Cardano a layer-2 blockchain?

What is a layer-2 scalability solution?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.