If you operate within online web3 social circles, you will probably hear or see the term FUD. But what is FUD, where does the term come from, and can it impact your crypto activities? We cover all of these questions and more in this complete guide on fear, uncertainty, and doubt.

What is FUD in crypto?

Definition and origin of FUD

The term FUD is an acronym for fear, uncertainty, and doubt. Fear, uncertainty, and doubt are all used as propaganda in sales, marketing, public relations, politics, polling, and cults.

FUD is a strategy for influencing perception by disseminating negative, questionable, or false information. However, it is also a natural reaction or apprehension to developing negative information. Here are some examples of how to use the term:

- “Some people spread FUD about Bitcoin, claiming it will crash and wipe out everyone’s investments.”

- “Don’t let FUD deter you from investing in a stock; it’s important to make informed decisions based on thorough research.”

- “Financial pundits often use FUD to create panic among investors, suggesting a looming economic recession.”

Not only is FUD a popular term in TradFi, but crypto has also coopted the term. In the crypto community, FUD is a common expression. It reflects market sentiment, especially when there is a significant price change.

This frame of mind frequently influences how and when crypto enthusiasts trade, buy or hold onto their coins. Therefore, you can see why many consider it an important part of trading.

Psychological tactics and manipulation

As stated previously, FUD is used as a psychological tactic used to manipulate markets — both intentionally and unintentionally. The most recent example of how FUD plays a major role in financial activity is the collapse of Silicon Valley Bank.

We cover the crisis in more detail in our crypto vs. banking guide, but SVB failed for a variety of reasons. One could say that FUD led to the bank run on SVB. The most prominent reason was a bank run, a scenario where many customers withdraw their deposits at the same time.

In the case of Silicon Valley Bank, the fear was due to concerns about the bank’s solvency. However, the mass hysteria did not stop at SVB but actually spread to other banks. While it did not result in further bankruptcies, it did, however, rattle the markets.

If the fear, uncertainty, and doubt are strong enough, one could see how FUD could be used to spread information that would lead to a market downturn. In this case, it would be advantageous for those who positioned themselves in favor of said downturn to spread fear or misinformation.

Understanding the impact of FUD

FUD and investor sentiment

An investor considers many elements when evaluating an asset, such as a TAM analysis, stage of seed funding, or number of investors. However, the public’s general view of an asset or market also plays a major role in how investors decide what to buy.

Market sentiment is just as important as all of the other factors that go into valuation. FUD can impact the sentiment of an asset, ultimately affecting the asset’s price, even if an underlying product or service is just as safe as it was before the FUD. Therefore, FUD is often enough of a deterrent to make investors walk away from a deal or investment.

FUD and market volatility

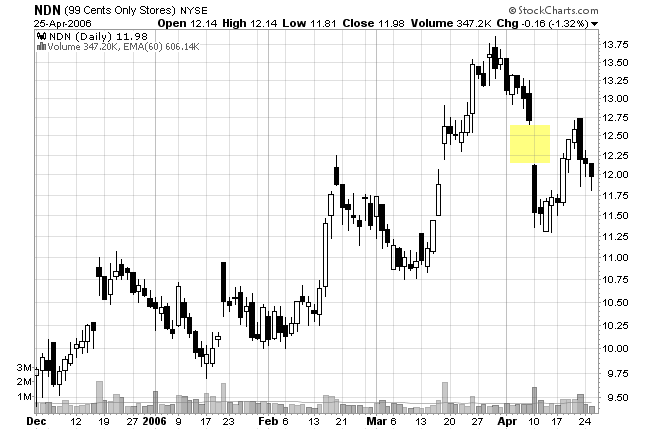

Market volatility is part and parcel of FUD. This is especially present in crypto, although traditional finance examples of FUD exist. For example, you may have noticed gaps when you read chart patterns.

/Related

More ArticlesGaps are common when news causes market fundamentals to change during hours when markets are normally closed, such as after-hours earnings calls.

Because crypto has a smaller market capitalization than many other markets, volatility is often more apparent. As a result, price swings can come from whale movement, supply and demand, and especially fear, uncertainty, and doubt.

The role of misinformation and social media

Misinformation refers to false or inaccurate information that is spread either intentionally or unintentionally. It can play a significant role when dealing with this type of phenomenon.

In the context of FUD, misinformation can be deliberately created and disseminated to induce fear and uncertainty among the public or specific groups of individuals. Social media platforms have become powerful tools for disseminating information, but they also serve as fertile ground for the rapid spread of FUD.

Social media enables information to spread quickly and widely, often through sharing, retweeting, or reposting. If false or misleading information gains traction on social media, it can quickly reach a large audience and create a sense of panic or uncertainty.

Social media platforms tend to foster the formation of echo chambers, where individuals are surrounded by like-minded people and exposed to information that aligns with their existing beliefs.

This can lead to the reinforcement and amplification of FUD as individuals validate and share similar narratives, making it challenging to push back or correct misinformation. Social media platforms generally lack mechanisms for fact-checking or verifying information before it is shared. This allows false or misleading content to proliferate unchecked.

Lastly, anonymity is often exploited to spread FUD without being easily held accountable for the misinformation being propagated.

Strategies for dealing with FUD

Conducting fundamental analysis

Remember, dealing with FUD requires a balanced approach. One effective strategy for dealing with FUD is to conduct a thorough fundamental analysis. Unlike technical analysis, fundamental analysis involves examining the underlying factors that drive an asset’s value, such as a project’s:

- Technology

- Team

- Market demand

- Competitive landscape

- Financials

Focusing on the fundamentals allows you to make informed decisions based on concrete evidence rather than hearsay. Fundamental analysis helps identify solid investment opportunities and provides a long-term perspective, which can counteract the short-term fear and uncertainty caused by FUD.

Evaluating risk and market sentiment

You can also decide whether the potential rewards outweigh the risks by evaluating the investment’s risk. Additionally, you can make a judgment about a specific asset or market by remaining skeptical of market sentiment — the general feeling or mood of market participants.

However, it is important to remember that market behavior can sometimes defy logic or rationality. In financial markets, prices are determined by the actions and decisions of multiple participants, each driven by their own beliefs, emotions, and expectations. These factors can occasionally lead to market behavior that appears irrational, meaning it deviates from what might be considered logical or reasonable based on fundamental analysis.

Debunking FUD through education and research

Lastly, education and research is the most valuable asset for combating FUD. Sometimes rumors may spread; it is a fact of life. By utilizing journalistic principles, such as objectivity, fact-checking, timeliness, and responsible sourcing, you can help deter the impact of most FUD.

Dedicate time to learn about a subject matter, whether it’s a specific cryptocurrency, a financial market, or a particular investment, to acquire knowledge and insights that help you see through misinformation and exaggerated claims.

Debunking common FUD examples

Rumors about regulatory actions

When it comes to combating FUD about regulatory actions, you will find that in our digital world, it is much simpler than in the past. Rumors about regulatory actions are typically easily debunked because legislation, in the overwhelming majority of cases, is public.

If you come across regulatory information that you suspect is FUD, here is a list of actions that you should take to verify its authenticity:

- Verify the source and authenticity of the rumor.

- Cross-reference the information with official regulatory bodies or government statements.

- Seek clarification from reliable sources or industry experts.

- Look for concrete evidence or official announcements before accepting the rumor as factual.

Negative news coverage and market panic

To be clear, media outlets are not exempt from spreading FUD. The accuracy and intent of reporting are better understood by comprehending the possible motivations and context of the news coverage.

Without a doubt, some media companies lean towards certain political parties. Therefore, it is not outside of the realm of possibility for some information to benefit a news outlet to cover, exclude, and in some cases, outright spread misinformation.

Look for alternative sources that present various perspectives on a situation in order to develop a balanced viewpoint. Making an informed assessment of an overall situation requires taking into account a variety of viewpoints.

Fearmongering and price manipulation

In order to spot any potential signs of price manipulation, it is important to stay vigilant and keep an eye on trading patterns and volume. For instance, one may consider it suspicious if a public figure openly spreads negative information about a competitor. It is even more suspicious if they take a short position simultaneously.

It is best to consult independent research or analysis from reputable sources when evaluating the validity of price movements. This outside perspective can provide valuable insights into whether price fluctuations are caused by genuine market forces or by manipulation.

Keep a critical perspective

Navigating the world of cryptocurrencies in the midst of widespread FUD demands a discerning mindset and an unwavering commitment to due diligence. While FUD can cause anxiety and lead to irrational decisions, it is critical to approach the crypto landscape with a critical eye and a broad understanding.

By conducting thorough research, fact-checking information, and seeking insights from reputable sources, we can debunk the myths and false narratives that often accompany FUD.

Frequently asked questions

What is FUD?

Is FUD similar to HODL?

Is FUD a blockchain?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.