The market is witnessing a significant trend shift as investors appear to buy crypto again. Although Bitcoin is leading the charge, this surge is also noticed on altcoins, fueled by a series of underlying factors that signal a larger transformation in the financial system.

These elements range from Bitcoin’s evolving role in the global economy to emerging investment products that are drawing mainstream attention. Simultaneously, there is a palpable anticipation for an altseason. Understanding these dynamics offers a glimpse into the future of crypto and the potential for new investment opportunities.

3 Reasons Behind Bitcoin Soaring Prices

Bitcoin has exhibited remarkable resilience in 2023, gaining nearly 130% this year. As of late November, Bitcoin’s price climbed to a high of around $38,440, showcasing a robust recovery from its earlier dip to $24,915 in September.

According to Mati Greenspan, CEO of Quantum Economics, this uptick in Bitcoin’s price can be attributed to its emerging role as a global safe haven asset amidst geopolitical uncertainties, sovereign debt crises, and global economic turmoil. He told BeInCrypto about Bitcoin’s significance in these tumultuous times.

“In a world of tremendous geopolitical uncertainty… Bitcoin is playing the role of a global safe haven,” Greenspan said.

Economic indicators like the Consumer Price Index (CPI) also fuel Bitcoin’s popularity as a hedge. Although CPI was flat in October from the previous month, it increased 3.2% from a year ago.

While CPI impacts traditional assets significantly, Bitcoin thrives as the purchasing power of the US dollar gradually declines.

“Bitcoin, being the ideal embodiment of digital scarcity, tends to benefit from the erosion of fiat money over time. So, even though these data points may affect short term pricing, it is the overall economic landscape and the gradual yet steady decline of fiat currencies that give Bitcoin its power,” Greenspan added.

Another reason behind the soaring Bitcoin prices is the filing of new financial products like spot Bitcoin ETFs (exchange-traded funds) from traditional firms like BlackRock and Fidelity. Greenspan described it as a testament to the growing institutional interest in cryptocurrencies.

He affirmed that approving a spot Bitcoin ETF in the United States could lead to a short-term market reaction followed by more stable, long-term growth. Especially because institutions seek regulatory-friendly and compliant ways to add Bitcoin to their portfolios.

“There has certainly been a lot of speculation leading up to the potential approval of a spot Bitcoin ETF in the US. Should one be approved, my guess is that the immediate reaction might be a short pop and then a rapid sell-off as those traders take their profits. However, in the mid-term, it should provide a frictionless on-ramp for institutions to add Bitcoin to their books in a way that’s both regulatory friendly and compliant with various fund structures,” Greenspan added.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Meanwhile, SkyBridge Capital Founder Anthony Scaramucci emphasized a key tenet of Wall Street, “Products are sold, not bought.” He envisaged a scenario where dedicated teams actively promote spot Bitcoin ETFs to financial advisors and brokerage offices.

According to Scaramucci, these teams, equipped with persuasive pitches and an engaging approach, would advocate for incorporating Bitcoin ETFs into investment portfolios, bringing fresh capital to the cryptocurrency market.

“I think that these products, spot Bitcoin ETFs, are going to unleash tens of thousands of people sale force,” Scaramucci said.

Crypto Market Hints at New Altseason

Altcoins, too, have been charting an impressive course. Solana’s native token SOL, for example, has been leading gains among altcoins, signaling a broadening interest in the crypto market beyond Bitcoin.

When asked about the recent performance of lesser-known altcoins like TIA, SEI, and TAO, which are up 182%, 132%, and 250% in November alone, Greenspan admitted to not being familiar with them, emphasizing the vast nature of the crypto market.

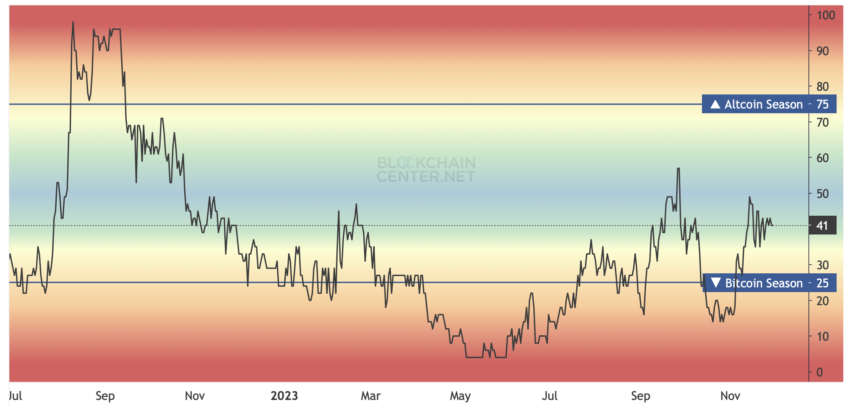

Still, technical analyst Jacob Canfield affirmed that despite such performance by some altcoins, “This isn’t altseason… yet.”

“Most altcoins are bleeding against Bitcoin but are way up in USD. We’ve only had a 4.5% drop in Bitcoin dominance. The real altseason starts when the Bitcoin dominance market structure turns bearish. Yes, there are outliers. [But] this is still the Bitcoin show until further notice.” Canfield said.

As the anticipation for an upcoming altseason builds, Greenspan offered crucial advice for investors looking to buy crypto. He emphasized the importance of thoroughly understanding each altcoin’s unique value proposition and its inflationary or deflationary characteristics.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

Drawing on his decade-long experience in token evaluation, Greenspan noted the advantage of engaging in direct conversations with project founders. Still, he often relies on his intuition to guide these assessments.

With the crypto market emerging from a prolonged bear phase, Greenspan suggested that any projects actively developing in recent months deserve investor attention. This period of building, often unnoticed, could be a key indicator of potential success in the forthcoming altseason, hinting that it may be the right time to buy crypto.

“Definitely get your feet wet as soon as possible, but be vigilant. There are a lot of scams out there. Learn how to self custody and guard your private keys well. Try and stick with the coins that are more established in the market in order to avoid getting rekt,” Greenspan concluded.

Trusted

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.