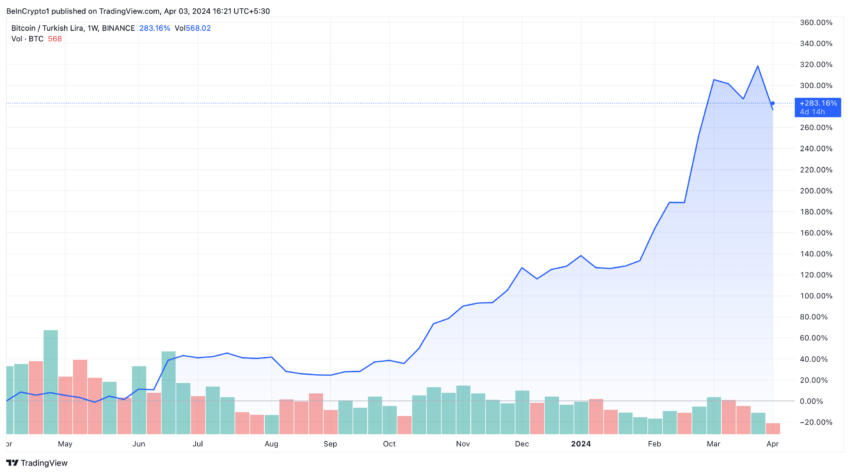

In Turkey, soaring inflation reached 68.5% in March, a stark increase that has propelled Bitcoin to near all-time highs against the Turkish Lira.

The Turkish Statistical Institute’s recent data highlights a 3.16% monthly inflation rise.

Turkish Citizens Resort to Crypto Amidst Soaring Inflation

Key sectors such as education, communication, and hospitality have driven the surge in inflation, with respective month-on-month increases of 13%, 5.6%, and 3.9%. The education and hospitality sectors witnessed the highest annual inflation, recording 104% and 95%, respectively.

Consequently, Turkey’s central bank has aggressively hiked interest rates, now at 50%, to tackle the inflation that stubbornly remains above the desired single-digit target.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Moreover, a significant adjustment in the minimum wage at the start of 2024 has exacerbated inflationary pressures. This policy doubled the minimum wage from the previous year, leading to a complex economic scenario.

Despite a slight easing in March, experts like Nicholas Farr from Capital Economics suggest that stringent monetary and fiscal policies are essential for stability.

“The latest inflation figures do little to change our view that further monetary tightening lies in store and that a more concerted effort to tighten fiscal policy will be needed too,” Farr said.

The Turkish Lira has depreciated nearly 40% against the dollar over the last year, highlighting the currency’s vulnerability. Conversely, Bitcoin has experienced a significant rise in Turkey, reaching peak values since June 2023.

A survey revealed that 58% of Turkish investors view crypto as a long-term wealth-building tool. Additionally, 37% regard it as a hedge against the local currency’s depreciation.

With Bitcoin at the forefront, Ethereum and stablecoins also see substantial interest among Turkish investors. This shift to digital currencies is partly due to the Lira’s devaluation against the US dollar, prompting many to seek refuge in cryptocurrencies.

The Turkish government is responding to the crypto trend with regulatory measures. Finance Minister Mehmet Şimşek indicated that comprehensive crypto regulations are nearing completion.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

These regulations will subject crypto exchanges to stringent oversight akin to that of traditional financial institutions. The Capital Markets Board (CMB) of Turkey will enforce these regulations, ensuring operational, organizational, and capital compliance alongside robust IT infrastructure.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.