The Turkish Lira fell to a fresh low against the U.S. dollar ahead of a central bank rate decision this week. The move has caused Bitcoin prices to reach a record all-time high against the local currency.

On July 18, the Turkish Lira reached a record low of 27.3 to the US dollar, according to TradingView data. It is currently trading at 26.92 following two months of sharp declines in value.

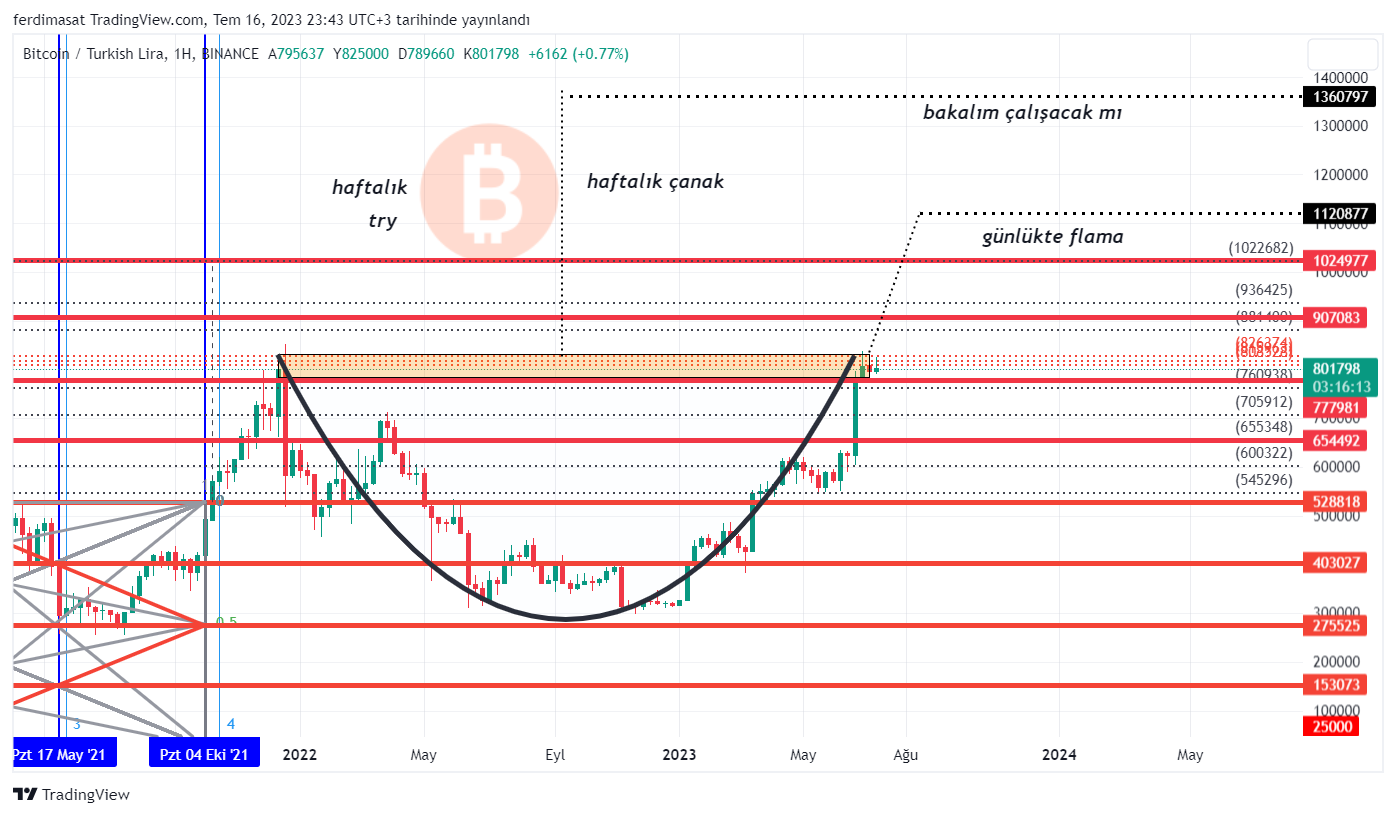

Bitcoin in Turkey Surges

The move was observed by Bitcoin proponent and MicroStrategy CEO Michael Saylor, who shared the chart.

Furthermore, the Lira has lost around 30% of its value against the greenback since the beginning of this year.

According to Reuters, Turkey’s central bank is expected to raise its policy rate by 500 basis points to 20% this week. This is part of its pledge to curb inflation which is already an astronomical 38.2%

As bad as this sounds, inflation in Turkey was at a two-decade high of 85.5% in October 2022.

“News saying that the central bank’s interest rate hike will be below market expectations is triggering the lira depreciation,” one trader told Reuters.

Understand ways to better handle your money with this BIC’s explainer: 7 Ways To Handle Retirement With Increasing Inflation

The declining value of the Lira has pushed the price of Bitcoin to new highs on local exchanges. Turkish traders were sharing charts of the new price peak on BTC/TRY, asking how it could be a hedge against inflation.

BTC prices were 820,600 Lira on Turkey’s largest exchange, Paribu, at the time of writing. At current exchange rates, that works out at $30,470, around 1.3% higher than BTC global spot prices.

BTC Price Outlook

On global markets, Bitcoin prices are at the same level it was this time yesterday, trading at $30,085. It dipped to $29,720 during late trading on July 18 but managed to recover the $30,000 level.

Nevertheless, BTC has retreated from its Ripple-induced high late last week, dropping 5% since then.

The asset has remained tightly range bound for the past four weeks as trading volumes dry up.

A failure to break resistance at $31,000 three separate times in the past three months could spell a revisit to lower levels in the short term.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.