After a recent security breach that impacted Curve Finance’s CRV token, South Korean crypto exchange Upbit has suspended deposits and withdrawals. Other exchanges, like OKX, issued a volatility warning in response to the hack.

The vulnerability was discovered over the weekend in the DeFi ecosystem, causing a significant loss of funds.

Upbit Halts withdrawals Amid Volatility

The exploit involved reentrancy attacks and resulted in the theft of around $50 million on July 30. In response, Upbit stated,

“We kindly ask all our users to be mindful of the increased price volatility of CRV.”

Upbit urged caution to its users, advising them to exercise due diligence when considering any investments related to the token. It also noted that it will temporarily suspend CRV deposits and withdrawals to ensure trading safety.

Learn more about the top crypto security flaws here: Top 5 Flaws in Crypto Security and How To Avoid Them

Another crypto platform, OKX, issued a warning on the token landing page. It noted, “OKX will not be held responsible for any trading losses.”

Binance Says Users Unaffected

Binance chief Changpeng Zhao noted on Twitter that Binance users are unaffected. He said,

“CEX price feed saves DeFi. Binance users are not affected. Our team checked on the Vyper Reentrant Vulnerability. We only use version 0.3.7 or above.”

He alludes that Binance’s use of a centralized price feed for DeFi tokens provides an additional layer of security. Zhao also insisted on updating code libraries, applications, and operating systems.

In response to the incident, Curve Finance stated that the attack affected certain stablepools, including alETH, msETH, and pETH, using Vyper 0.2.15. Its CRV/USD stablecoin pools remained unaffected but the wider impact of the exploit has worried users.

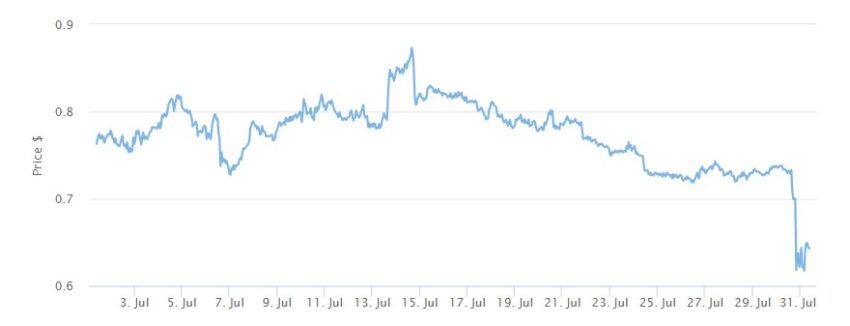

Meanwhile, Curve DAO’s governance token, CRV, has experienced a sharp decline. Its price has dropped over 12% on the daily charts. The market cap of Curve DAO is valued at close to $570 million at press time.

Users should closely monitor developments as the situation evolves to protect their funds.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.