As this 2017 cryptocurrency is gaining popularity, more crypto enthusiasts have been trying to contribute to the network. Fortunately, earning ADA is relatively simple. Most scalable blockchains use a technology that allows regular users to stake Cardano (ADA) to be a part of the network.

The users get rewards for contributing to the network’s development, and the blockchain benefits from a secure environment. In this article, you will understand how Cardano works and learn how to stake ADA to earn passive income.

In this guide:

What is Cardano?

Cardano is a blockchain network created in 2017 by Charles Hoskinson (the co-founder of Ethereum) and Jeremy Wood. Input Output Hong Kong (IOHK) created Cardano.

The network’s native token, ADA, aims to facilitate transactions and promises to provide a better overall experience compared to bitcoin and ethereum. ADA has a total supply of 45 billion coins.

Cardno’s structure is quite similar to Ethereum’s. The project emphasizes its future plans to revolutionize the financial economy and the cryptocurrency world. That’s why the Cardano network uses the Proof-of-Stake consensus mechanism.

How does Cardano work?

Cardano uses the PoS (Proof-of-Stake), a core differentiator to the Bitcoin and Ethereum networks, which use the PoW (Proof-of-Work) system.

The PoW rewards miners for solving difficult mathematical problems to mine a new block on the blockchain. In contrast, in the PoS system, the coin holders verify and generate new blocks on the blockchain.

Proof-of-Stake is a more eco-friendly alternative for blockchain networks in general, as it doesn’t require brute coin hashing (the mining process). By using the PoS system, the blockchain’s development isn’t dependent on hardware.

The backbone of a PoS blockchain is staking pools, which consists of users who come together and use their coins to validate blocks on the network. In exchange, users are rewarded with that blockchain’s native asset. The process of staking cryptocurrency is easy and doesn’t expose users to any risk.

On top of using the PoS system, Cardano assures that the network can be easily scalable, due to the way the blockchain has been designed.

The network has two layers — Cardano Settlement Layer (CSL) and Cardano Computational Layer (CCL) — unlike most other networks, which operate on only one layer. The CSL layer performs and records transactions on the blockchain, while the CCL layer is the smart contract layer that performs automatic transactions.

By design, the Cardano blockchain can perform faster transactions and has lower fees.

In today’s market, most cryptocurrencies aim to find the right balance between speed, security, and decentralization. But few tackle all these issues successfully. Cardano seems to be one of the few, and the platform is constantly developing.

The basics of Cardano are fairly easy to understand, but like with all things crypto, the deeper you go, the more there is to process. If you would like to know more about Cardano, learn everything you need to know at the BeInCrypto Telegram group.

Can you mine cardano?

Cardano has all the green flags to be the network that will make decentralized finance available to the world. But can you mine cardano?

You now know that cardano cannot be mined like you mine bitcoin.

The Cardano blockchain uses the Proof-of-Stake system to validate blockchain transactions. You can not mine Cardano. However, Cardano can be staked. This may be good news for those who do not want to purchase expensive mining equipment to mine Cardano.

/Related

More ArticlesThen the question becomes, “How do you stake cardano?”

Staking Cardano’s cryptocurrency, ADA, is fairly simple. You need to keep your ADA in a wallet supported by Cardano. You can find here the best cardano wallets for storing ADA.

By staking your ADA in a crypto wallet or on a cryptocurrency exchange, you will be rewarded with a certain percentage of ADA. The Proof-of-Stake process uses the already existing ADA to confirm cardano transactions — instead of mining by using hardware to generate the assets.

Staking cardano

The process of staking ADA on the Cardano blockchain is simple. The more coins you hold and stake, the more you receive.

There are two options to stake on Cardano. You can stake ADA using an on-chain wallet, or you can stake your ADA using a crypto exchange, like OKX.

Staking cardano using a crypto wallet

You can stake ADA using a desktop wallet, a browser extension wallet, or a hardware wallet. After considering all the options, you can choose which ADA wallet is best for you.

Yoroi and Daedalus wallets are the two of the most used crypto wallets for staking ADA.

Create a name and a spending password for your wallet. This only happens the first time you set a browser wallet. The name will help you distinguish your wallets, in case you have multiple wallets. You can think of these wallets as different bank accounts.

The spending password authorizes ADA transactions, and delegation to a stake pool or voting. Use a strong, long password that contains both upper and lower letters, numbers, and symbols. You might want to write it down and keep it in a safe place.

You’ll also need to create a recovery phrase that you can use to restore your wallet on a different device, like with any other crypto wallet. For instance, the recovery phase for the Yoroi wallet is a random 15-word password (for other wallets can be 12 words and go up to 24). This seed phrase can be used to restore your wallet without needing the spending password.

It’s important to write this recovery phrase down and store it in a safe location. Without it, your funds will be lost forever, and nobody will be able to access them.

After confirming the recovery phrase, also referred to as the seed phrase, you can practice deleting this wallet from your device and restoring it using the same seed phrase. It’s always a good idea to make sure you know how a wallet works before you transfer any funds into it.

Yoroi wallet for staking cardano

Yoroi is a light crypto wallet that runs as a browser extension on Chrome, Firefox, and other commonly used desktop browsers. After you install the wallet on your browser and set up the new wallet, you will need to add ADA to your balance. This process is similar to setting up a Metamask wallet.

After you have created the wallet, you can transfer ADA to your Yoroi wallet. Click on the Receive button and use the shown wallet address to send your ADA funds for an exchange or another wallet. Make sure you have the correct address.

After receiving your ADA, you are ready to stake it on Yoroi wallet.

From the Yoroi wallet, you need to click the “Delegate List” tab and then search for a staking pool that has low saturation and good growth. After deciding on which pool you want, simply click “Delegate.”

Note that all pools have a cost, which is a fee taken from the overall reward for that pool. The cost is not taken for you when you delegate your assets to the pool.

As you confirm the delegation, you will notice there is a small fee for delegating. The delegating fee is something to keep in mind if you plan to switch from pool to pool.

You’ll finish after you’ve typed the spending password, which you set up when creating your Yoroi wallet. Congrats on successfully staking ADA using the Yoroi wallet.

It’s worth noting that if you send ADA to a wallet that has its funds already delegated to a staking pool, it will that ADA to the next delegation cycle.

Daedalus wallet for staking cardano

Daedalus is a full node wallet. It will download the entire Cardano blockchain onto your computer, which is a safe way to stay away from any third-party network issues.

After downloading and installing Daedalus to your computer, create a new wallet, in case you don’t have one or want to use a different wallet to stake ADA. Make sure to store your seed passphrase in a secure place.

As you open the Daedalus wallet, go to “Delegation Centre” and click on the “Stake pools” tab on the top.

You will have to look for an ADA staking pool. You can search for the name of the pool if you know it.

After choosing the stake pool, you can choose how much ADA you want to delegate to that staking pool.

You can click on the pool to see more info about that pool before you decide to delegate your ADA to it. It’s important to use a pool that is not oversaturated, to keep your rewards at a maximum level. There is a small fee you have to pay each time you decide to delegate ADA to a staking pool.

Rewards are calculated after the following epoch.

Staking cardano on a cryptocurrency exchange

ADA, the cryptocurrency of the Cardano network, can also be staked on several cryptocurrency exchanges. Using an exchange can be a convenient option when you don’t have a lot of experience with cryptocurrency wallets, and you want to rapidly stake your newly bought coins.

There is no time to spare as rewards are generated daily for users who stake their assets. Although the rates may vary, it is important to find a staking pool with a higher Annual Percentage Yield (APY). As the price of ADA evolves over time, the rewards generated from staking can add up to a significant amount.

Many cryptocurrency exchanges offer the option to stake their ADA directly from their exchange wallet, including Binance and Kraken.

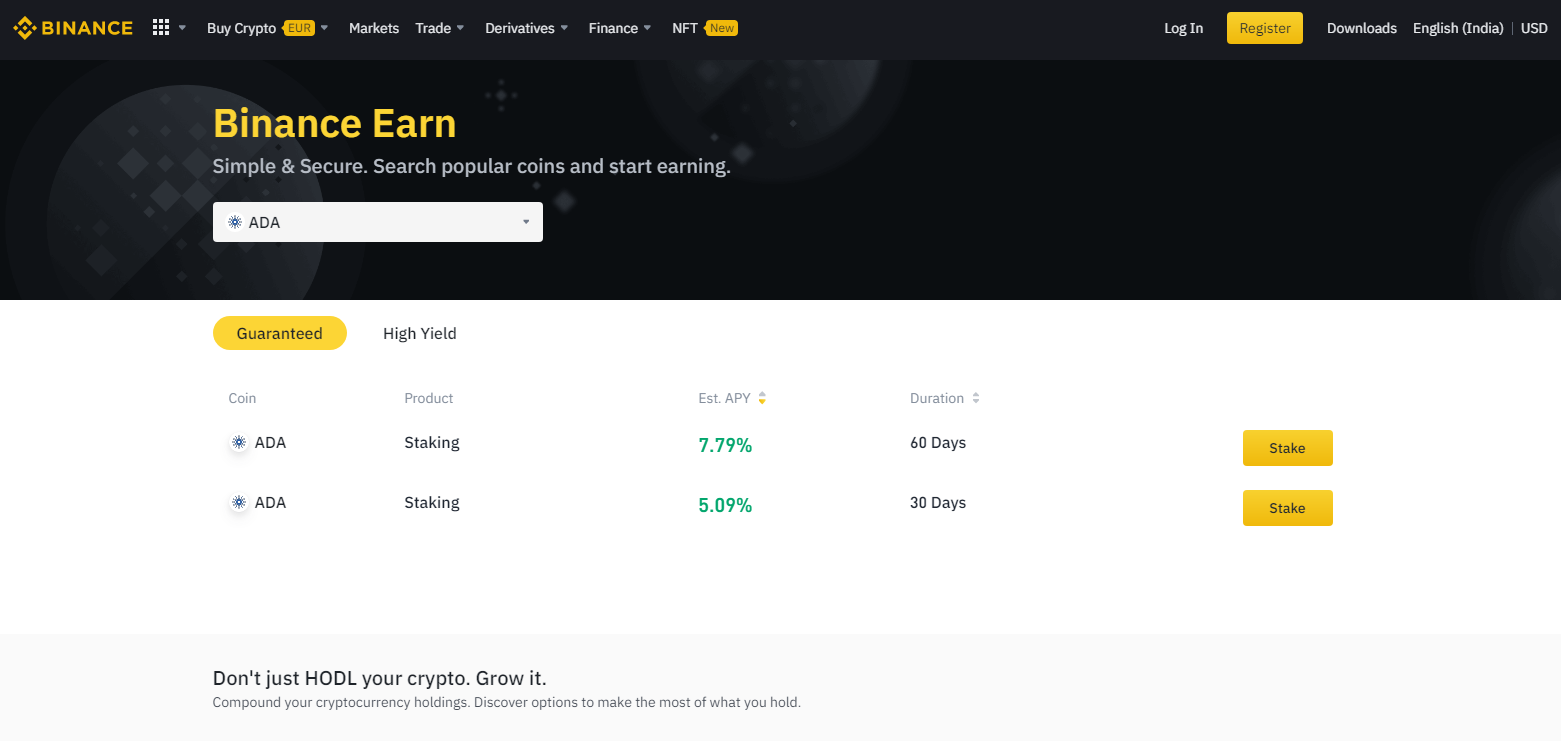

Stake ADA on Binance

Staking cardano (ADA) on Binance is fairly easy. After you created your account, you will need to purchase ADA or transfer some to your account.

To stake ADA, head over to Binance Staking, search for ADA, choose the staking duration (30, 60, or 90 days), and click “Stake Now.”

In the following popup, you can choose the amount of ADA you want to stake. The minimum amount is 1 ADA, and the interest is rewarded daily. Once you set everything, click “Confirm.”

The service was introduced in February 2021, with a 21.79% APY, but has since decreased to around 5%.

The main benefit of staking ADA on Binance is the easy access to all the services offered by the platform, without needing to transfer your crypto to another wallet.

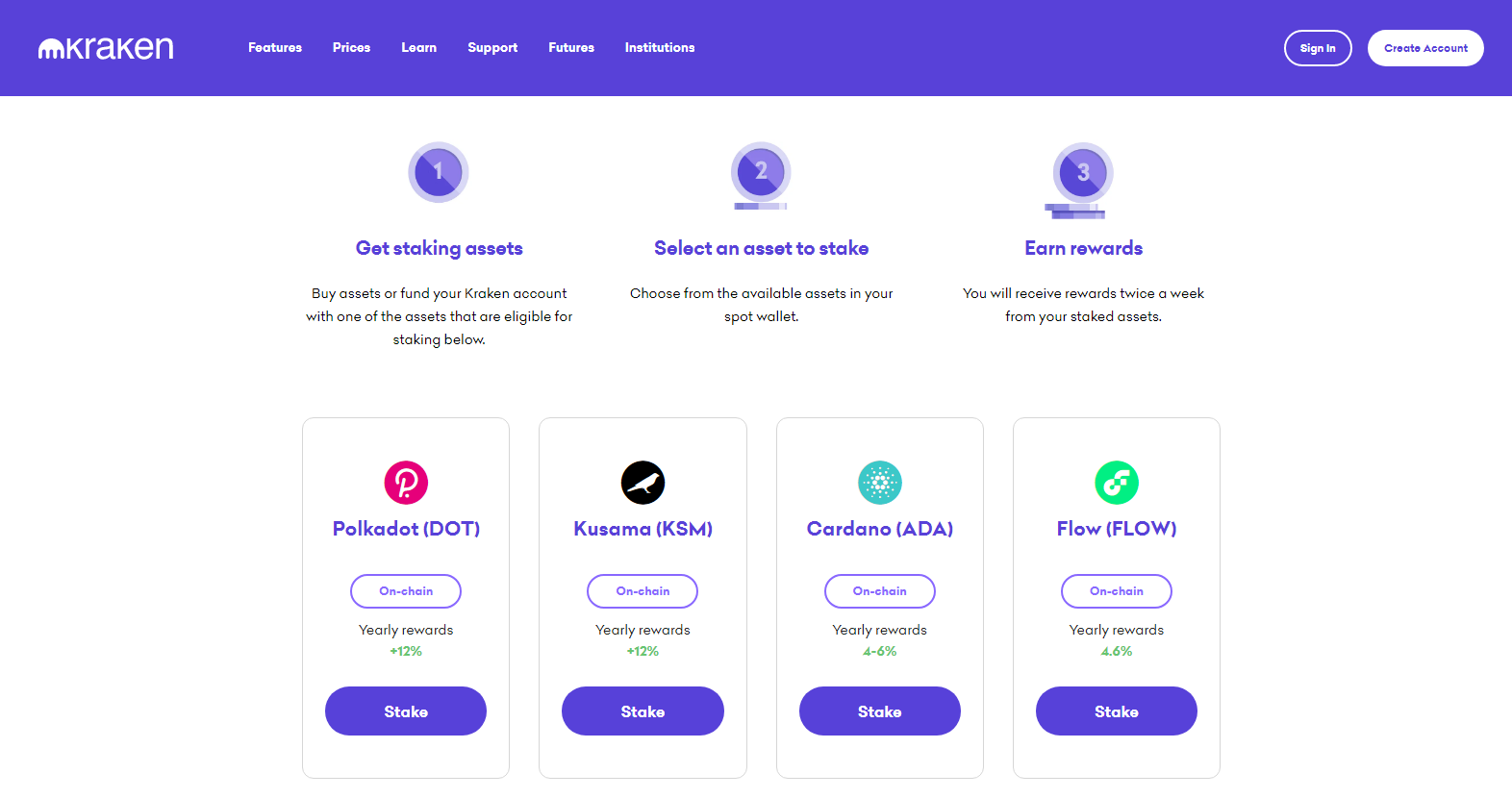

Stake ADA on Kraken

Kraken has an intuitive platform for cryptocurrency owners to trade their assets. As part of its core services, the exchange offers cryptocurrency staking to its users, as a way to earn a passive income from their Kraken wallet.

After you buy or transfer ADA to Kraken, you can start staking. There are no fixed terms for the staking periods. On Kraken, the APY is around 4–6%, and the staking is flexible. That means you can unstake your assets at any given time.

Kraken is one of the best cryptocurrency exchanges to use if you want a flexible staking arrangement for cardano.

Now you know how to start staking ADA

Remember, you cannot mine cardano, but you can stake it. It is one of the best cryptos to stake, as it has a solid project, and its founders and the IOHK company has set out to make it a foundational network for the decentralized future.

If you already have a certain amount of ADA or you simply want to know how to increase your crypto portfolio, you will find staking easy and helpful. In the end, if you want to contribute to the success of a blockchain, you will participate in the process, regardless if it’s mining or staking.

< Previous In Series | Mining | Next In Series >

Frequently Asked Questions

Can you mine Cardano?

Does Cardano have smart contracts?

Who created Cardano?

What consensus mechanism does Cardano use?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.