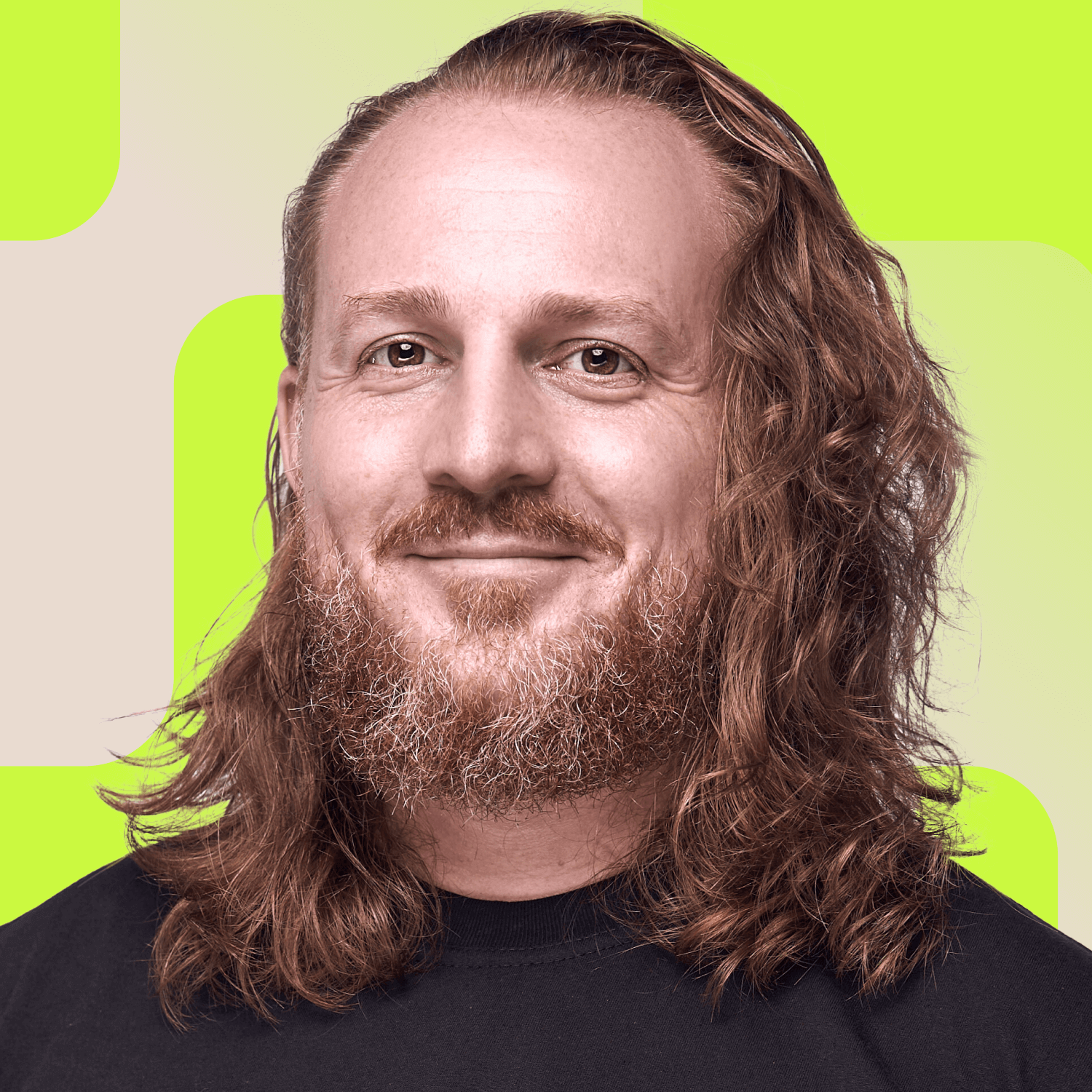

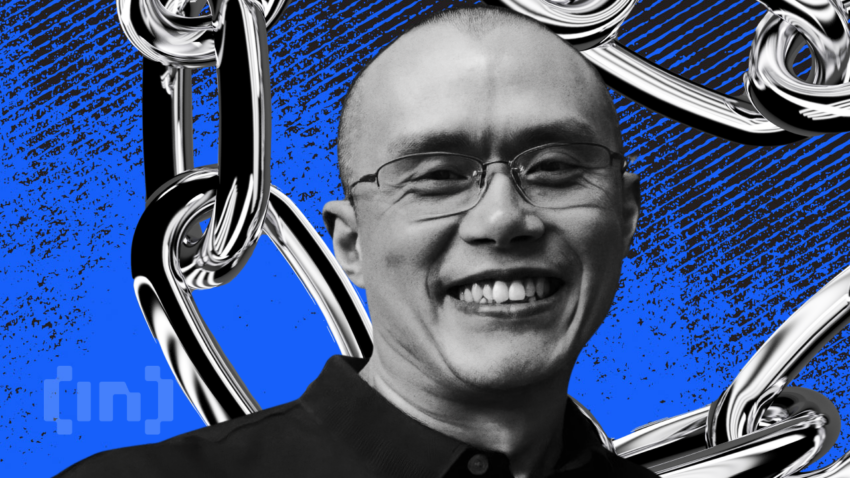

Changpeng Zhao, the billionaire founder of Binance, stepped down as CEO at the end of 2023. This came after a years-long probe and his pleading guilty to breaking U.S. anti-money laundering laws. CZ had an outstanding journey of massive proportions — from selling burgers while in college to building a world-class crypto exchange and becoming one of the richest men in the world.

The former Binance CEO started with $15 million he raised in an Initial Coin Offering (ICO). He faced and overcame a serious test in the exchange’s formative days when the price of Binance Coin (BNB) fell below the ICO price. However, his persistent nature overcame, and Binance became the world’s largest crypto exchange within six months. Here’s everything you need to know about the ex-CEO and Binance, from his rise to fall.

Who is Changpeng Zhao?

Zhao came from humble beginnings in Rural China. As a student in Canada, he flipped burgers at McDonald’s to make ends meet. However, he seems to have always found himself at the right place, at the right time. He went on to become an influential cryptocurrency industry leader.

Education

CZ was born and raised in Jiangsu province, China, on Feb. 5, 1977. At the age of 12, he joined his father, who had migrated to Canada in 1984 to pursue a doctoral degree. Zhao and the other family members relocated in 1989 following the Tiananmen Square Massacre following a student uprising. He joined McGill University and studied computer science. Later, he worked as a systems programmer for Bloomberg and the Tokyo Stock Exchange.

Net worth and achievements

CZ moved back to China in 2005 and founded the Binance cryptocurrency exchange in 2017, which rode the 2017 crypto boom to make a fortune.

Changpeng Zhao is one of the world’s wealthiest individuals globally after building Binance, which became the world’s largest crypto exchange. According to the Bloomberg Billionaire Index, CZ is at No. 42 and wealthier than the heirs to the Walmart Fortune. The Index placed Changpeng Zhao’s net worth at $100 billion in 2022, although it now stands at about $30 billion.

Philanthropy

CZ has used his experience of growing up with failures and setbacks to leverage the power of blockchain for humanitarian causes. Through his Binance Charity Foundation, he donated $3 million worth of BNB tokens in September 2023 to survivors of an earthquake in Morocco. Zhao has said he plans to donate up to 99% of his wealth to charity.

“Personally, I’m financially free. I don’t need a lot of money, and I can maintain my lifestyle in this way. I do intend to give away most of my wealth, like many wealthy entrepreneurs or founders did from Rockefeller until today. I intend to give away 90, 95, or 99% of my wealth.”

CZ during an interview with the Associated Press

Why is Changpeng Zhao important?

The former Binance CEO became a closely watched champion and influential figure in the cryptocurrency industry. The serial entrepreneur who became an expert in trading systems and blockchain technology was recognized in the Bloomberg 50 as among the most influential people of the year 2020.

He built Binance into one of the best crypto exchanges, comprising a wide range of crypto products and services, from derivatives trading to NFTs.

Changpeng Zhao’s entrepreneurial spirit and steering Binance as CEO

Changpeng Zhao stepped into blockchain and cryptocurrencies in 2013 when he joined Blockchain.info as the Head of Development. His work on significant aspects of blockchain wallets and exchange services ignited his fascination with cryptocurrencies. Zhao garnered deep insights into the inner workings of crypto exchanges from holding critical roles in Blockchain.info and OKCoin.

With his entrepreneurial spirit kindled, Zhao made a bold move in 2017, a step that would transform the cryptocurrency landscape forever — his brainchild, Binance cryptocurrency exchange, presented with a user-friendly interface and relatively low trading fees. The exchange quickly gained traction and soon became the largest and most influential, accessible, and influential crypto trading platform.

While he was the Binance CEO, the cryptocurrency exchange launched its blockchains, Binance Chain and Binance Smart Chain (now called BNB Chain), and a decentralized crypto exchange (DEX). Binance also had its native cryptocurrency, Binance Coin (BNB), which is currently among the top five cryptocurrencies by market capitalization per CoinMarketCap data.

CZ and his innovative team navigated numerous hurdles to comply with local regulations besides overseeing the launch of Binance.US to serve the U.S. market.

/Related

More ArticlesChallenges and controversies that CZ and Binance have faced

Ousted Binance CEO Changpeng Zhao steered the cryptocurrency exchange to becoming a force to reckon with in the crypto space. However, that hasn’t been without its fair share of challenges and controversies. The platform and its CEO have a chequered history filled with regulatory scrutiny in numerous countries and allegations of illegal activities.

CZ resigned as Binance CEO in late November 2023 but remains the company’s advisor. He stepped down at a time when the cryptocurrency space is battling with challenges such as market volatility, regulatory pressures, and dwindling interest in crypto.

The story of Binance’s fallen cryptocurrency industry leader highlights the crypto sphere’s complicated and often controversial nature. Among the significant challenges Zhao and Binance have endured over the years include the following:

1. Withdrawal suspension in China

Binance originated in China, but the cryptocurrency exchange was forced out only two months after its founding following a regulatory crackdown. Most of the company’s employees left the country after the Chinese government blocked the platform.

While Binance may have left mainland China in 2017, the company launched a peer-to-peer platform in 2019 that enabled users to trade Bitcoin, Tether, and Ether against the Chinese Yuan. The firm made a significant strategic $200 million investment in China that same year when it joined a financing round with Mars Finance.

However, a ruling on Sep. 24, 2021, issued by the country’s central bank, technically dashed all hopes that any exchanges would operate in China. The central bank barred all crypto transactions in the country and services offered by offshore exchanges. After prohibiting overseas platforms from employing locals in marketing, tech, and payments, Binance finally terminated its Yuan-denominated trading on Dec. 31, 2021.

2. Regulatory breaches and DOJ charges

For as long as Binance has existed, the cryptocurrency exchange has been a tale of mischief and official investigations. In June 2023, the U.S. Securities and Exchange Commission (SEC) alleged that CZ and Binance had enriched themselves by putting billions of dollars from U.S. investors at risk. The complaint alleged that Binance US earned up to $11.6 billion between June 2018 and July 2021, mostly from transaction fees.

Moreover, on Nov. 21, 2023, the US Department of Justice (DOJ) revealed a set of criminal charges against the Binance CEO and the firm. The DOJ accused the company and its chief executive of enabling money laundering across the globe from Russia-occupied areas of Ukraine like Donbas and Crimea to Cuba, Syria, and China.

According to the indictment, Binance allowed transactions amounting to billions of dollars that violated U.S. anti-money laundering laws. This allegedly included at least a billion dollars of sanction evasions and actual proceeds of criminal transactions. A separate indictment personally targeted the former Binance CEO and his former compliance officer for allowing those illicit transactions.

During a press briefing, U.S. Attorney General Merrick Garland announced that Zhao and Binance had pled guilty. Per the statement, the firm agreed to pay approximately a $4.3 billion fine in criminal penalties, including forfeiture.

Zhao also pleaded guilty to violating the Banking Secrecy Act (BSA) by not maintaining an Anti-Money Laundering (AML) and KYC program. As part of the settlement with the DOJ, he agreed to pay a further $150 million fine besides resigning as Binance CEO as he awaits criminal sentencing.

“Binance prioritized its profits over the safety of the American people […]; Binance became the world’s largest cryptocurrency exchange in part because of the crimes it committed. Now it is paying one of the largest corporate penalties in US history.”

U.S. Attorney General Merrick Garland stated during the press briefing: Justice.gov

3. Alleged insider trading

In 2023, U.S. officials examined allegations of possible market manipulation and insider trading at Binance US. According to a Bloomberg report, the Commodity Futures Trading Commission (CFTC) looked into whether the cryptocurrency exchange or its staff benefited from taking advantage of its customers.

The CFTC alleged that Binance abetted insider trading via hundreds of accounts allegedly owned directly or indirectly by Changpeng Zhao. The platform has faced a slew of business curbs and warnings from regulators in Germany, Japan, and Britain on concerns of money laundering and risk to crypto users.

Binance and the collapse of FTX

Sam Bankman-Fried (SBF) launched the cryptocurrency exchange FTX in 2017 and immediately established a reputation with unique features and devotion to compliance with regulatory requirements. The platform made significant inroads into the crypto market and soon became a formidable rival to market leader Binance.

However, FTX’s stability was shaken to the core after the company suffered several setbacks at the beginning of 2022. The exchange’s troubles worsened due to declining trade volumes and regulatory inquiries in some jurisdictions. In early November 2022, just before filing for bankruptcy, SBF contacted his archrival CZ for assistance. He is alleged to have texted:

“I don’t know how things got so bad between us […] I need your help for the sake of the industry and users.”

The sequence leading to the cataclysmic fall of FTX started when the Binance CEO publicly stated his firm would sell its FTT holdings, FTX exchanges’ native token. A whirlwind of chaos followed.

Some people pointed an accusing finger at CZ after the catastrophic outcome. While it may appear casually that Zhao’s actions instigated a bank run on FTX, a closer look would suggest his action expedited an inevitable consequence.

FTX was already on the brink of collapse due to a $9 billion hole in the exchange’s accounts. There were already red flags, such as SBF’s attempts to acquire funding for the exchange and Alameda Research’s financial woes. CZ may have found himself between a rock and a hard place. Selling the tokens quietly would have led to a public discovery followed by accusations of dumping on investors. By openly selling the tokens, CZ was seen to deliver the final blow to an FTX on the sick bed.

Did Binance buy FTX?

Changpeng Zhao is said to have initially agreed to offer a loan and buy FTX.

However, CZ changed his mind after examining FTX’s books and realizing the extent of its financial woes. The revelation came only a day after the Binance CEO announced an agreement to buy FTX’s non-US-based operations following a liquidity crisis comparable to a bank run.

Users flooded FTX with withdrawal requests and piled pressure on the FTT token, which lost 86% of its value in a single day and dropped from a $14 billion market cap in March to $825 million.

As a result, SBF had no option but to put FTX into bankruptcy. Mr. Bankman-Fried was later arrested in the Bahamas to face criminal charges in the United States.

Changpeng Zhao’s crypto regulation stance

Former Binance CEO Changpeng Zhao firmly believes in crypto regulation and has consistently called for governments to consider smart regulations promoting innovation and user safety. According to him, crypto users had a right to safely access emerging technologies and practices like stablecoins, NFTs, yield farming, staking, etc. Since he believed crypto regulation was inevitable, his stance is expressed in the company’s 10 Fundamental Rights for Crypto Users.

In 2022, CZ encouraged world governments to consider crypto regulation instead of battling the industry when cryptocurrency adoption was growing.

“Most governments now understand that adoption will happen regardless. It’s better to regulate the industry instead of trying to fight against it.”

CZ, speaking at a company event in Athens: Via Reuters

For Zhao, crypto regulation was necessary as it would help establish trust with users and institutions interested in the assets. In an interview with TechCrunch, the renowned cryptocurrency industry leader said proper regulation was the best way to achieve crypto mass adoption. He said adequate regulation that didn’t hinder crypto growth would help the industry achieve 10%, 20%, 80%, 99% [crypto] adoption. CZ also asserted that Binance was open to collaborating with regulators and governments to create rules and laws within the crypto space.

The final fate of Changpeng Zhao

When his rival SBF’s crypto empire collapsed in 2022, it didn’t take long for Zhao’s turn to face the wrath of regulators. Years earlier, Changpeng Zhao had allegedly claimed his company’s headquarters was anywhere he happened to be. However, everything changed in March 2023 when U.S. regulators charged the former Binance CEO and his firm for violating US security laws.

Zhao’s admission of defeat is, in many ways, the zenith of a prolonged pursuit by international regulators’ attempts to regulate Binance and, by extension, the entire crypto industry. His capitulation marks the second time in less than a year that the crypto industry has lost its biggest star, Changpeng Zhao’s net worth at $100 billion in 2022.

CZ built the Binance juggernaut to control almost two-thirds of spot trading in centralized exchanges at one point, besides playing a significant role in bringing crypto to the mainstream. His departure comes when the industry is struggling to put scams, scandals, and illicit activities behind it. He faces between 18 months and up to 10 years behind bars under a plea that may have saved him from harsher penalties.

Frequently asked questions

How is Changpeng Zhao so rich?

How much is Binance worth today?

Did ousted Binance founder CZ’s fortune grow by $25 billion in 2023?

Is Binance still safe?

How wealthy is the CEO of Binance?

Who is the owner of the Binance?

Is CZ in jail?

What happened to Changpeng Zhao?