The surge in demand for Bitcoin exchange-traded funds signals a bullish horizon for the price of BTC. Leading this charge is BlackRock’s plan to incorporate spot Bitcoin ETFs into its investment strategy for its Global Allocation Fund.

As disclosed in its recent filing with the US Securities and Exchange Commission (SEC), this move by the world’s largest asset manager accentuates the increasing allure of cryptocurrencies in traditional finance.

Bitcoin in High Demand

BlackRock’s decision to delve into Bitcoin ETFs comes amid a broader market enthusiasm for such financial products. The iShares Bitcoin Trust (IBIT), a product sponsored by BlackRock, has rapidly increased prominence. Since its inception in January, it has achieved record inflows that underscore the growing investor interest in Bitcoin.

This trend is not characteristic of BlackRock alone. Other funds are also eyeing or have already entered the Bitcoin ETF space, catalyzing investment patterns shifting toward digital currencies.

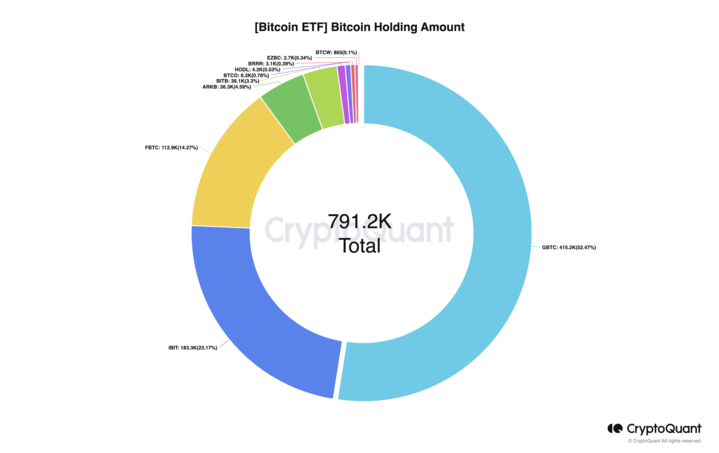

| Issuer | Ticker | Bitcoin Holdings |

| BlackRock | IBIT | 183,345.06 |

| Grayscale | GBTC | 415,231.51 |

| Fidelity | FBTC | 112,917.16 |

| Bitwise | BITB | 26,150 |

| Ark/21 Shares | ARKB | 36,389 |

| Invesco/Galaxy | BTCO | 6,211 |

| WisdomTree | BTCW | 865 |

| Valkyrie | BRRR | 3,161.21 |

| VanEck | HODL | 4,214.16 |

| Franklin Templeton | EZBC | 2,755 |

The allure of Bitcoin ETFs is further evidenced by recent data, highlighting a remarkable influx of approximately $473 million into Bitcoin ETFs, equivalent to about 7,000 BTC on March 7. This robust inflow, primarily into Fidelity’s FBTC, symbolizes marked investor confidence in the potential of Bitcoin as an asset class.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Despite varying performances among the available ETFs, the net positive inflow into Bitcoin ETFs reflects a consolidated market belief in the growth trajectory of Bitcoin.

“The Bitcoin spot ETF approval was a landmark moment in Bitcoin’s history. The structural impact on liquidity and overall trading volume can’t be overstated here… From a regulatory perspective, this is a huge step forward – especially for the US, and can be seen as a major victory for crypto as an asset class,” Matthew Howells-Barby, VP of Growth at Kraken, told BeInCrypto.

The Fuel to $100,000

Notably, these Bitcoin ETFs in the US are poised to eclipse the Grayscale Bitcoin Trust (GBTC) holdings. This shift underscores the changing environment of cryptocurrency investments. At their best, spot Bitcoin ETFs offer a new avenue for institutional and retail investors.

The success of Bitcoin ETFs is occurring against a backdrop of favorable market conditions and a growing recognition of Bitcoin’s potential.

As a result, analysts suggest that the convergence of increasing inflows, supportive market indicators, and an anticipated regulatory green light for options trading on Bitcoin ETFs could catapult Bitcoin prices to new heights. Speculation abounds that Bitcoin could rally toward or surpass $100,000 soon. A mix of technical, on-chain, and fundamental factors will buoy this increase.

“It appears that the Bitcoin spot ETF approval launched an accumulation that, if sustained, puts BTC at $100,000 by October 2024,” network economist Timothy Peterson said.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

This remarkable shift in the cryptocurrency market, driven by institutional adoption and increased investor demand, signifies a new era for Bitcoin and its role within the broader financial ecosystem. As BlackRock leads the charge with its strategic investments, the path to new bullish targets for Bitcoin becomes increasingly clear, highlighting its enduring appeal and potential for substantial growth.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.