Staking is the process of locking up crypto holdings to support the security of a network while earning rewards. The practice has become a popular way for investors to generate passive income. And while it seems more-or-less straightforward, there are many ways investors could make better choices when staking their crypto. This article will highlight the top five crypto staking mistakes and cover the best practices to follow when staking your coins.

Want to get reviews on the best crypto platforms for staking? Join BeInCrypto Trading Community on Telegram: read reviews, discuss crypto projects, ask for technical analysis on coins and get answers to all your questions from PRO traders & experts! Join now

5 key crypto staking mistakes

Like conventional financial products, staking relates to concepts including currency risk, interest rates, and liquidity parameters. Here are five common mistakes crypto investors make when staking and how to ensure you’re not doing the same.

1: Falling for a high yield

The key metric used to measure the staking yield on an asset is the annual percentage return (APR). Staking platforms usually quote an APR that you can earn on a coin. Some staking platforms will offer a very high APR to attract investors to their platforms. The APRs are often unrealistic figures, supported by high token inflation, which pays for the yield.

- Token inflation – A 100% APR on your asset may seem like an attractive deal, but this is usually all from new tokens that are being issued (inflation). The problem is that these new tokens usually get sold by recipients. This causes the price of the coin you are holding to drop. So you may have earned 100% APY for the year, but the selling pressure may suppress the token’s price, resulting in a loss.

- What is the adjusted yield – The adjusted yield is the annualized reward rate adjusted by the inflation rate of the network supply. Investors should look at their real return (inflation-adjusted) — this will tell them how much they are really earning.

- High yields don’t last – Recently launched coins may have high staking APRs. Investors need to understand that this will come down over time. A new network needs to encourage token holders to stake their coins. As investors do this, the staking yield will drop as more tokens are staked and the staking ratio rises.

Every investor should understand the inflation rate, the yield generated, and the long-term staking yield before staking their crypto.

So what is the correct way to analyze staking yield?

Here’s how to identify the most profitable crypto to stake:

- Research which cryptocurrencies are currently offering the highest staking yields. Websites such as Staking Rewards can provide valuable information on staking metrics.

- Look at the ‘Adjusted yield’ column on the website to determine which assets give you the best inflation-adjusted return.

- From the top 10 assets in the list, choose the one that aligns with your investment strategy and risk tolerance.

- Follow the step-by-step instructions in the “How to stake” FAQ for the chosen asset to begin your staking journey.

It’s also important to remember that staking is a long-term investment strategy. Diversifying your staked assets across multiple cryptocurrencies and networks can help mitigate risk and increase returns. Additionally, it’s always wise to keep an eye on market conditions and update your research regularly.

2: Choosing the first validator in the list

Platforms ask stakers to choose a validator before they stake their crypto. Investors typically choose the first one on the list or the validator with the most staked value and users. There are two problems with this approach:

- The first validator on the list may be foundational (The network hosts its own validators, too), which will contribute to the centralization of the network.

- It may be a random validator at the top of the list. This is unlikely the best validator to choose to maximize your staking rewards.

Investors need to know how to choose a validator and do due diligence before staking their crypto.

3: Not knowing how to choose a validator

Choosing a validator is one of the most important steps when staking your coins. The challenge of selecting a staking provider is twofold:

- It is difficult to determine which providers will be trustworthy in the future.

- In most cases, it needs to be clarified whether a given company follows industry best practices.

The quality of the validator will play a role in your staking rewards. It will also determine your risk of being slashed. A Verified Provider Program (VPP) can help stakers decide which validator to choose. The Verified Provider Program is an initiative to increase trust and transparency in the staking industry by ensuring providers meet a set of criteria. These include, but are not limited to, risk management, longevity, and security measures.

By implementing rigorous verification protocols and promoting adherence to industry best practices, the program empowers delegators to make more informed and confident decisions when selecting from the vast array of available providers. Additionally, the program catalyzes the standardization of industry practices, promoting greater consistency and fairness across the staking ecosystem. Overall, the Verified Provider Program represents a critical component in the ongoing development and maturation of the staking industry.

Key on-chain metrics

Besides doing due diligence on the actual validator and the team behind it, there are key on-chain metrics to look out for when choosing a validator:

- Low commission: Remember that the commission rate is the % of your staking rewards that goes to the validator. Don’t fall for ‘Zero %’ validators that try to bait you into delegating with them and then change their commission later on.

- Is in the active set: The validators in the active set are earning staking rewards.

- Voting power > 0%: The voting % represents the weight that a validator holds when making governance decisions on the network. You typically don’t want to choose a validator with the highest voting power (as this makes the network more centralized), and you also don’t want to select a validator with zero voting power.

- Delegators > 0: A validator may be more popular or trusted if it has more delegators than others.

- Self > 0%: Remember that self-bonded refers to the amount of stake the validator has put up themselves. The higher this number is, the more there is to lose for the validator, and the more unlikely they will act maliciously.

Once you know how to choose a validator, you can apply the same process to most PoS assets. Remember, there is no free lunch when staking your crypto. Choosing a good validator can help you offset most of the key risks of staking.

/Related

More ArticlesSlashing risk

Slashing is a punishment mechanism used in proof-of-stake (PoS) blockchain networks to penalize validators (and those who staked with them) for misbehavior. This can include actions such as double signing or going offline for an extended period.

When a validator slashes, some of their staked cryptocurrency is taken away as a penalty. The purpose of slashing is to incentivize validators to act in an honest and trustworthy manner, ensuring the security and stability of the network. This may sound like a major risk, but most slashing can be avoided by choosing a reputable validator.

4: Choosing the ‘easiest’ staking option

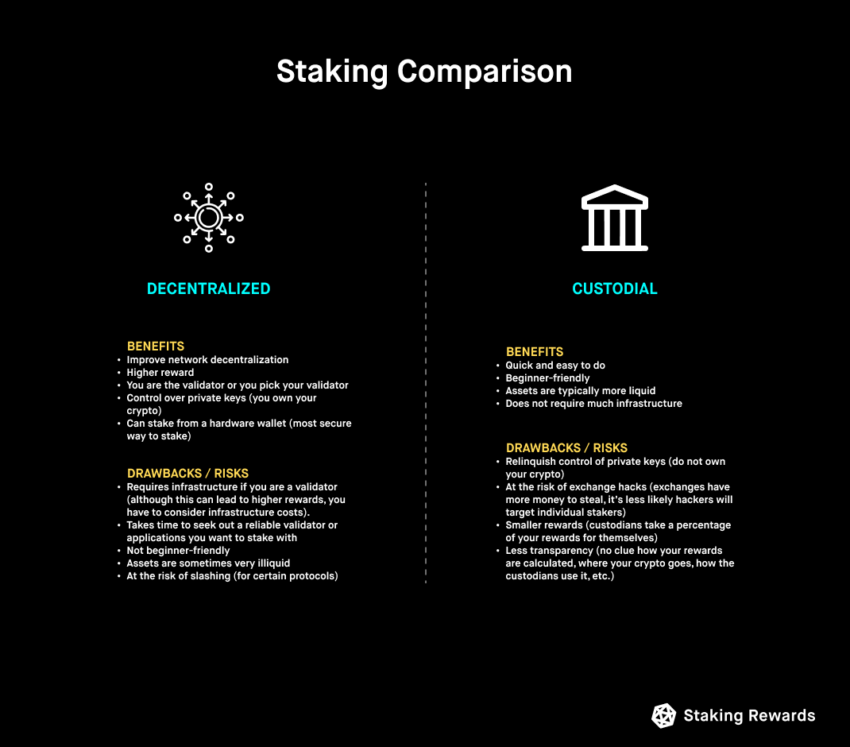

Investors tend to default to the easiest investment option requiring the least effort. This behavior is an investor bias that results in suboptimal decision-making. In the context of staking, investors often choose centralized staking solutions without considering the alternatives or trying to learn how to use a non-custodial solution. Stakers need to understand the difference between custodial and non-custodial staking to make an informed decision:

What is custodial staking?

Custodial staking means you are staking your crypto through a centralized entity (i.e., Binance, Kraken, Coinbase). The exchange is the custodian of your assets, and users entrust the management of private keys to the exchange. In addition, users relinquish control of assets to the custodian and become subject to its terms and conditions.

What is non-custodial staking?

Non-custodial staking means you have sole control of your private keys. This means you have control of your crypto and custody of your assets. Web wallets like MetaMask or hardware wallets like Ledger are typically used for non-custodial staking.

Understanding the differences between custodial and non-custodial staking

Understanding the risks associated with each staking option is important for every staker. One of the biggest mistakes investors make is choosing an option because it is convenient. Prioritizing convenience can cost crypto users dearly, as evidenced by the recent collapse of centralized entities.

5: Paying excessive commissions

Commission rates are levered by staking providers as payment for their validator services. Depending on the platform, fees can be unclear. Suppose an investor chooses a random validator without doing due diligence beforehand. In that case, they could fall into the trap of paying an excessive commission rate to the validator. Some staking platforms will take advantage of this and charge a hefty fee for using their staking services, which the end-user doesn’t usually realize. Check for fees such as:

- Commission fees

- Network fees

Paying fees on staking platforms isn’t necessarily a red flag. Just make sure you know what you are paying and whether you are willing to pay the fees for those services. Commission fees usually hover around 5–10%, depending on the network. Look out for validators that fall within that range.

6. Choosing the wrong platform

When it comes to staking, choosing the right platform is an unspoken art. Choosing the wrong platform is a very real issue. If you are considering staking, you will want to consider a platform based on user experience, security, interest rates, supported cryptocurrencies, liquid staking derivatives, etc. As far as exchanges go, some of the best for staking are:

1. Kraken

Kraken’s staking service is very straightforward, and its user interface is very simple. Instead of simply HODLing, stakers on Kraken can earn up to 24% on their crypto. Kraken offers 21 different cryptocurrencies that you can earn rewards on, and unlike many other platforms, there is no minimum on-chain staking time.

2. eToro

The staking process on eToro is quite simple. Users are paid out their rewards every month. The exact reward percentages depend on what tier members are on, ranging from 75% to 90%. Currently, eToro supports the staking of ETH, ADA, and TRX.

3. ByBit

Bybit gives customers the chance to stake their cryptocurrency with no risk as one of the finest crypto staking platforms. For stablecoins like USDT and USDC, it gives staking payouts up to 5%. Users have the option of making flexible deposits or 30- or 60-day fixed deposits.

The safest way to stake crypto

The safest way to stake crypto will depend on your specific risk tolerance and investment strategy. However, there are a few general guidelines that can help to minimize risk:

- Use a self-custodial wallet like MetaMask, Keplr, or Trust Wallet.

- Choose a reputable staking provider to stake your crypto. When choosing a staking provider, research the company and ensure they have a solid reputation and track record.

- Make sure you understand the risks involved with staking, such as the potential for slashing, and have a clear plan for managing those risks.

- Regularly check the status of your staked assets and the network’s performance to ensure everything is working as expected.

Remember that staking is a long-term investment strategy, and the crypto market is highly volatile. Having a well-diversified portfolio and preparing for market fluctuations is always wise.

Mastering the art of effective crypto staking

Staking can be a daunting process for anyone new to crypto. It can be difficult to understand the jargon and see through the marketing tactics of different staking platforms. But if you learn from these common crypto staking mistakes, you will be on your way to safe, successful staking.

Frequently asked questions

Which crypto gives the highest return in staking?

Can you lose crypto while staking?

Can I get my crypto back after staking?

What is the main downside of crypto staking?

Which staking mistakes should I avoid in crypto staking?

Can your crypto be stolen while staking?

Which coin is best for staking?

About the author

Kilian Boshoff is purpose-driven. He loves researching and figuring out how technology can drive change in the world we live in. He is an avid crypto trader and is a research analyst at StakingRewards.com. Kilian is currently on a mission to pioneer the institutional adoption of digital assets in his home country, South Africa.

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.