So, you have staked your Ether on Lido. Once staked, the compatible wallet should now show a stETH balance, while your ETH is now safe with Lido, earning yield as you sleep. But wait, are you content with the yield of 4.8% APR that Lido Finance promises? What if there was a way to earn more yield on stETH using this form of ETH tokenization across the DeFi platform?

You can earn more on your stETH using a handful of ways over a handful of DeFi platforms. Today, we discuss 11 such DeFi avenues to help you get started with amplified yield generation — helping you earn more with Lido’s Staked ETH.

BeInCrypto Trading Community in Telegram: read reviews on the best crypto exchanges & staking platforms, read technical analysis on coins & get answers to all your questions from PRO traders & experts!

- What can I do with my stETH?

- Platforms to earn more on stETH: 11 options

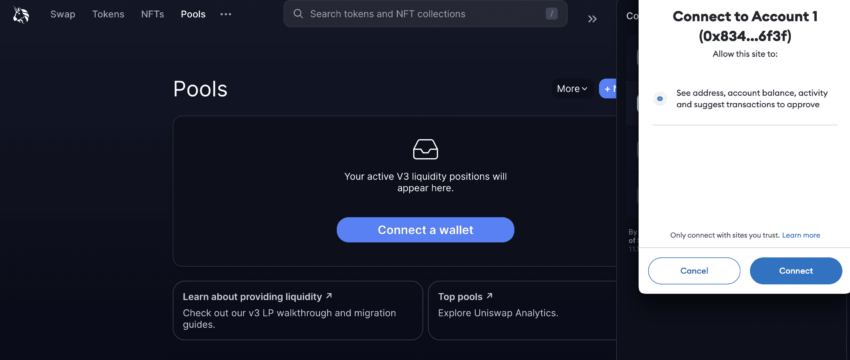

- Providing liquidity to stETH Pools: Balancer, UniSwap, and SushiSwap

- stETH Yield Farming on Curve Finance

- Earn more on stETH with Yearn Finance

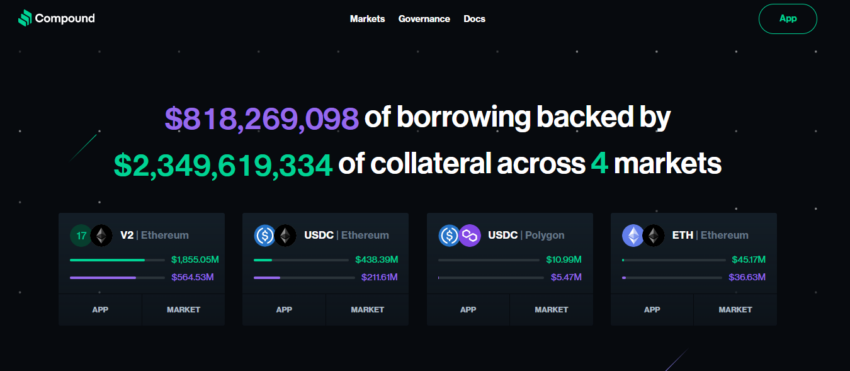

- Lending stETH on Aave and Compound

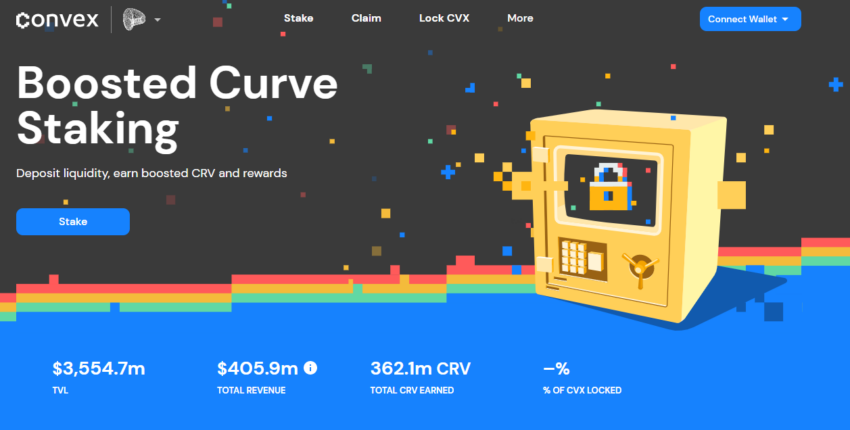

- Auto-compounding yield farming on Convex Finance: Curve included

- Automate reward collection using Concentrator

- Special mention: liquid staking derivatives with StakeWise

- Financial products at Idle Finance

- Multi-strategy yield optimization on Yearn Finance and Harvest Finance

- Participating in token sales or ICOs

- Combining Curve Finance and Yearn Finance for increased yields

- Which strategy to pick and how?

- Staking providers and custody options for stETH

- Risks associated with earning on stETH

- The future of DeFi and stETH

- Frequently asked questions

What can I do with my stETH?

Staked ETH (stETH) is a form of ETH tokenization intended to play an active role in securing the Ethereum network. Unlike traditional staking corresponding to the Ethereum ecosystem, stETH is highly liquid, issued by Lido Finance as a token, and is quite the DeFi heartthrob! Staked ETH is particularly popular on DeFi platforms, with people using this tokenized version of ETH to increase their passive earning potential.

A wide range of DeFi platforms can help you earn more on stETH via the following strategies:

- Providing liquidity to various stETH pools on DEXs.

- Yield farming by depositing stETH on yield aggregators and similar platforms.

- Lending stETH on decentralized lending platforms to earn interest

- Using leveraged farming strategies to deposit stETH and maximize returns in the process.

These strategies have suddenly risen in prominence post-merge, or the ETH 2.0 upgrade to proof-of-stake, with beacon chain-locked ETH now released. This development has led to a rise in volume flowing into the likes of Lido, making Lido staking the most sought-after strategy. But when it comes to earning passive income, Lido staking post ETH 2.0 upgrade isn’t the only way to earn yield.

Platforms to earn more on stETH: 11 options

Before we go in-depth with each platform and strategy, here is a quick list mentioning the yield-generating strategies from staked Ethereum on Lido finance or stETH:

1. Uniswap

Highlight: Popular DeFi platform with a large number of pools.

Conservative APR estimate: 2-5%

Suitability for stETH: High

Pros: Wide use base

Cons: Risk of running into impermanent loss

2. SushiSwap

Highlight: SUSHI tokens reward for liquidity providers.

Conservative APR estimate: 2-5%

Suitability for stETH: High

Pros: Supports a wide range of tokens

Cons: Lower liquidity than Uniswap

3. Balancer

Highlight: Customizable pools

Conservative APR estimate: 2-5%

Suitability for stETH: Moderate

Pros: Dynamic swap fees

Cons: Lower liquidity

4. Curve Finance

Highlight: Low-slippage swaps between stETH and ETH.

Conservative APR estimate: 3-5%

Suitability for stETH: High

Pros: CRV rewards and several staking pools

Cons: Mostly suitable for stable assets

5. Yearn Finance

Highlight: Supports multiple yield optimization and auto-compounding vaults.

Conservative APR estimate: 3.5-8%

Suitability for stETH: High

Pros: High level of automation

Cons: Smart contract risk

6. Aave

Highlight: Lending platform with interest-bearing aTokens

Conservative APR estimate: 3-8%

Suitability for stETH: High

Pros: Collateralized options

Cons: Fluctuating interest rate

7. Compound

Highlight: Popular lending platform with interest-bearing cTokens

Conservative APR estimate: 3-8%

Suitability for stETH: High

Pros: Algorithmic rates

Cons: Smart contract risks

8. Convex Finance

Highlight: Auto-compounding platform.

/Related

More ArticlesConservative APR estimate: 5-10%

Suitability for stETH: High

Pros: Boosted rewards and CVX rewards

Cons: Platform-specific risks

9. Concentrator

Highlight: Yield optimizer

Conservative APR estimate: 6-10%

Suitability for stETH: High

Pros: Expands the Curve/Convex ecosystem with automation

Cons: Smart contract risks

10. Harvest Finance

Highlight: Yield farming aggregator.

Conservative APR estimate: 3.5-7%

Suitability for stETH: High

Pros: Auto-compounding

Cons: Limited control

11. Idle Finance

Highlight: Caters offerings based on risk preferences.

Conservative APR estimate: 1.5-8.5%

Suitability for stETH: High

Pros: Risk-adjusted tranches

Cons: Limited token options

Providing liquidity to stETH Pools: Balancer, UniSwap, and SushiSwap

Decentralized exchanges like Uniswap, SushiSwap, Balancer, and more have asset-specific pools allowing users to trade, swap, and do more with their cryptocurrencies. However, liquidity pools are “for the user and by the user” — an arrangement where you, the person holding stETH in this case — helps create a pool by depositing assets and providing liquidity.

If you hold staked Ethereum (ETH), you can earn more on that stETH by depositing the same in your choice of DEX-specific liquidity pool and becoming a market marker in the process. This way, you can generate additional income on your stETH via trading fees.

The apples-oranges example better explains liquidity

If you are new to DeFi and the concept of providing liquidity to pools is still a little hazy, let’s simplify the concept.

Imagine you are planning to start a marketplace where people can buy/sell apples and oranges. To make the space bigger and facilitate quick trades, you tell more people to bring in their apples and oranges to the marketplace. In return, you promise them a share of the marketplace’s transaction fees generated via trading.

That is exactly how a decentralized liquidity pool works: apples and oranges are synonymous to the stETH-ETH or any other trading pair you wish to beef the liquidity pool with. Your trading fees are akin to the transaction fees associated with the apples-oranges marketplace.

Providing liquidity to pools: important things to know

Before you proceed with liquidity provisioning, here are a few important things to note:

- To provide liquidity to a stETH pool, you must deposit stETH and another asset (the other part of the trading pair) in the same ratio. It can be ETH for a stETH-ETH pool or USDT for a stETH-USDT pool.

- Your trading fees will be proportional to your share in the concerned liquidity pool.

- Once you deposit assets into the pool, the platform issues LP or Liquidity Provider tokens. These are meant to tokenize your deposits. You can redeem these LP tokens to exit the pool with the accrued rewards.

- In some cases, Lido DAO might also run specific liquidity mining programs on specific DEXs. That way, using stETH to provide liquidity can even attract rewards in LDO along with the standard LP tokens.

Which platforms have these liquidity pools?

You can start to earn on stETH via platforms like Uniswap, SushiSwap, and Balancer. We shall also discuss Curve Finance in a subsequent section. The process to hop onto any of these platforms is simple.

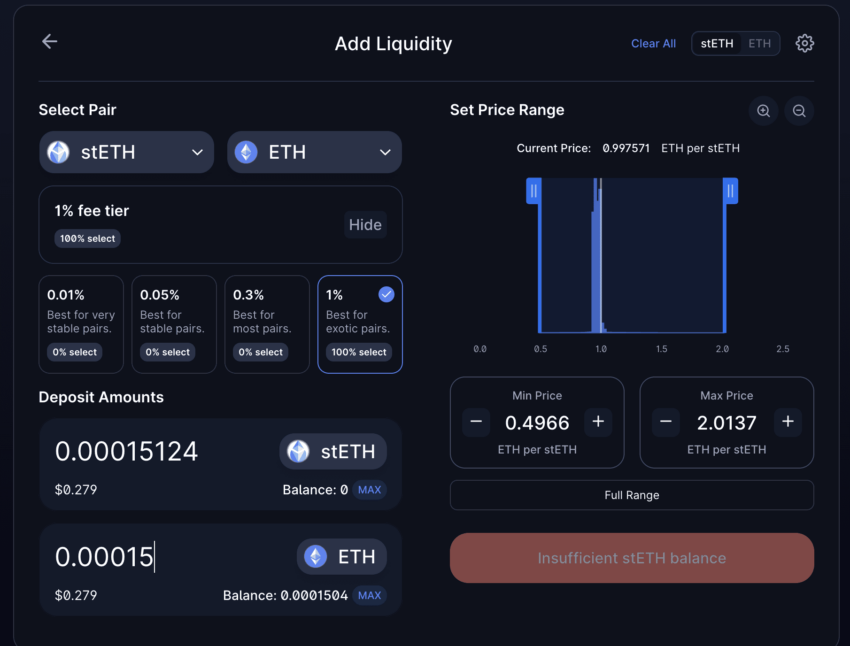

Uniswap takes the lead: most popular

You simply need to connect your wallet (MetaMask here) by visiting the service page of the concerned platform. Once there, you should locate a section called “Pool,” where you will need to look for the “Add Liquidity” section. Your connected wallet will show the assets that you deposit into the concerned liquidity pool.

Once done, you simply need to “Approve” and “Supply” tokens to start filling up the pool. Once you do, the LP tokens of the concerned platform — as a receipt — will be sent to your connected wallet.

The moment you want to exit the pool, you simply need to head over to the “Pool” section again, click “Remove,” redeem the percentage of LP tokens from the connected wallet (the portion of liquidity you want to remove), and confirm the move.

This will move your deposited assets to your wallet, along with the trading fees (generated in the same asset form) that you earned based on your liquidity percentage.

Note: You can even feed in the exact keywords and find pools relevant to your holding and your choice of APR.

Also, there can be many pools depending on what people want to trade stETH with. In some cases, the proportion of assets relevant to the pool is pre-decided, and you are better off following the same ratio while depositing.

Disclaimer: The APY or APR promised by the platform might vary depending on the liquidity pool activity. Including Lido’s reward of 4.8% (give or take), the total combined APR can be close to 8% or higher.

SushiSwap and Balancer UIs

In case you plan on using the SushiSwap and Balancer liquidity pools, here are a few UI snaps to work with:

Balancer and customizable pools:

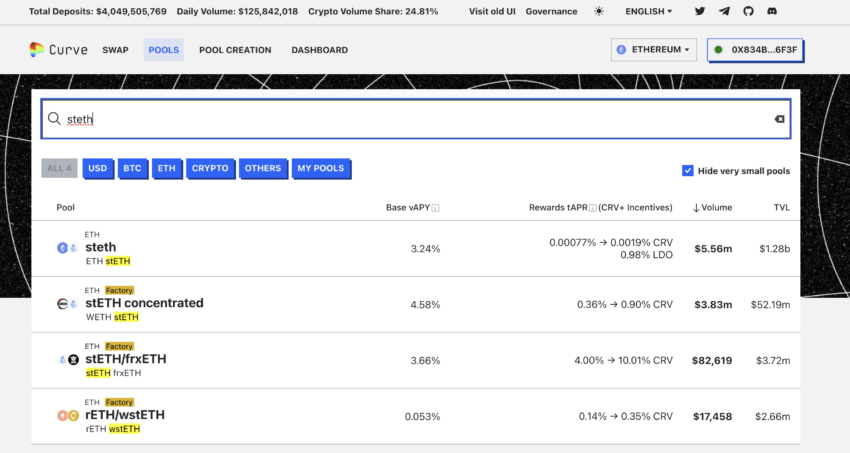

stETH Yield Farming on Curve Finance

Using stETH liquidity pools on DEXs provides a pretty basic rewards structure. If you’re looking to move one step further, you can get into yield farming or, rather, liquidity mining. And Curve Finance can certainly handle the job.

Do note that Curve Finance is a DEX focused on the swap of wrapped tokens and stablecoins. Also, instead of simply providing liquidity, you can earn on stETH by indulging in liquidity mining via Curve. In this case, the LP tokens can also be staked to maximize yield or returns.

Here is how it works:

Liquidity mining on Curve is similar to the process discussed in the liquidity provisioning section. You need to connect the wallet and search for the right pool depending on the assets you hold or the percentage APY you prefer.

The fun aspect of using Curve Finance is that you can earn in multiple ways. This can be via trading fees, standard liquidity mining rewards determined by the pool contract, and the staking rewards associated with the LP tokens.

Curve Finance UI

Here is a detailed Curve interface. You can withdraw your stETH or unstake your LP tokens via a single click. And if you do not own a stETH token, Curve even allows ETH to stETH conversion via swaps.

Did you know? Unlike other DEXs where pools might or might now allow you to stake the LP tokens, every pool on Curve has a built-in gauge to ensure that you can keep earning by staking your LP tokens as and when you get them. The rewards for LP token staking in staking pools are given in the form of CRV tokens, which also accrue inside the gauge.

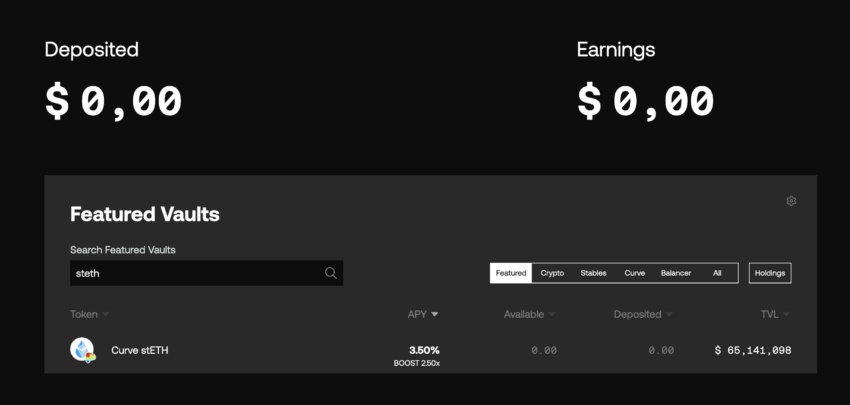

Earn more on stETH with Yearn Finance

While liquidity mining and additional earnings via LP rewards are exciting opportunities via Curve, Yearn Finance also has some attractive offerings.

For the unversed, Yearn is more like a yield aggregator. It allows users to maximize their stETH earning opportunities using strategies like auto compounding and dynamic allocation.

In the case of Curve, you need to manually collect rewards and stake them or rather reinvest them if needed. However, once you feed your assets to a Yearn pool or rather a Yearn Vault, the protocol compounds rewards automatically, reinvesting the same and increasing the options to earn on stETH.

Also, assets deposited to a Yearn vault dynamically move across platforms like DeFi, Compound, AAVE, Balancer, Harvest Finance, and more to get the best yield opportunities.

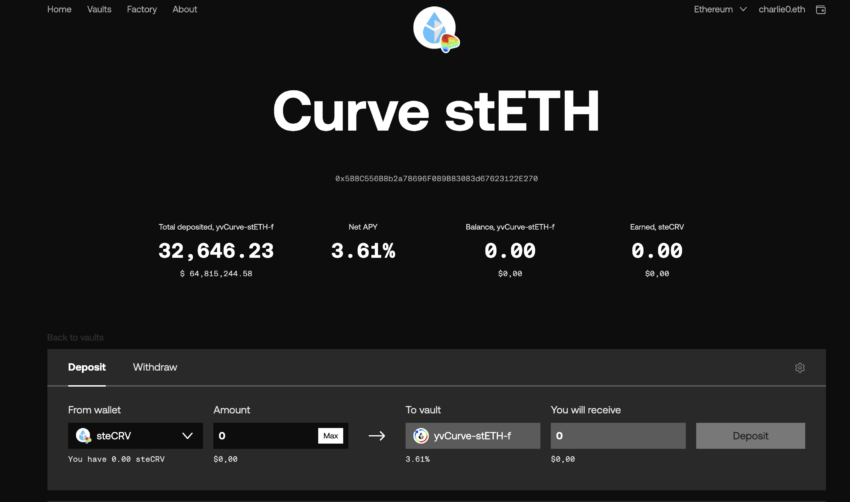

Here is a Curve stETH vault that we are currently eyeing:

Notice you can make a deposit in either of two ways:

- Using steCRV (the LP tokens received if you would have received on depositing stETH to a Curve Pool)

- Using ETH directly from your linked wallet if you haven’t already staked ETH on Lido. This way, Yearn stakes your ETH on Lido, provides liquidity to a Curve (or any other DeFi) pool, auto-grabs you steCRV LP tokens, reinvest them in a Curve guage or any other liquidy mining program, and optimizes yields in the process.

Simply put, Yearn takes care of staking, yield optimization, and even liquidity provisioning. Plus, you can even get a boosted APY, per the declared methodology.

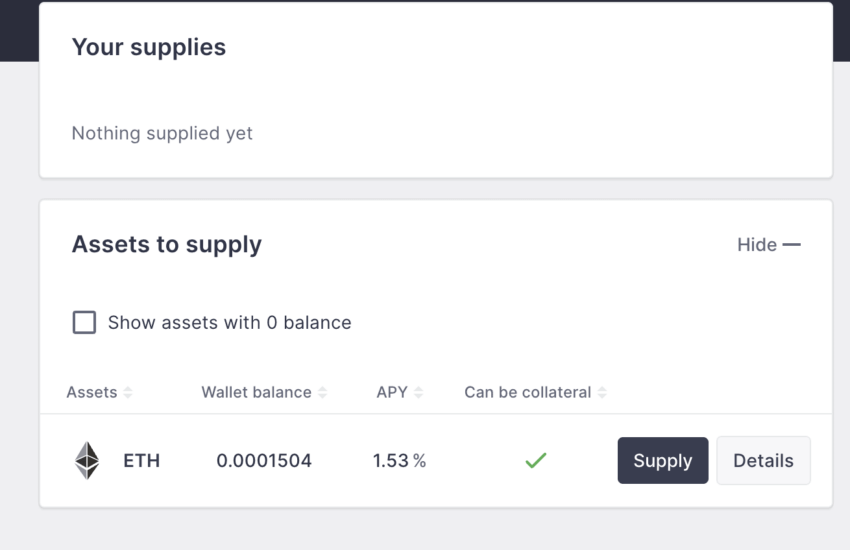

Lending stETH on Aave and Compound

You can earn more on stETH by relying on DeFi lending platforms like AAVE and Compound. You simply need to deposit your stETH onto these platforms. Users who might want to borrow to generate additional yields need to pay you some interest. The interest rate is determined by the supply-demand curve of stETH on these platforms.

Lending on Aave

To quickly deposit and lend stETH on Aave, you first need to connect the wallet with stETH in it. Once done, you can choose what amount you want to deposit. The best thing about AAVE is that it automatically grabs the snapshot of assets that you can supply to the platform for others to lend.

Notice how it shows a standard ETH wallet balance and the possible APY that might be earned on it. The same happens when your wallet has stETH.

Once you deposit, you get astETH or AAVE stETH — like receipt tokens — which increase in value relative to the underlying stETH that you deposited in the first place. While withdrawing, you can redeem the AAVE stETH tokens for the new amount of stETH.

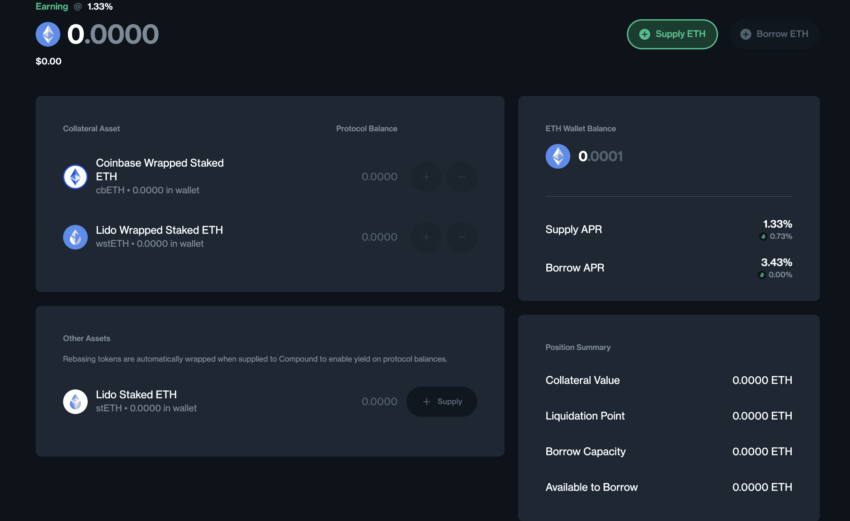

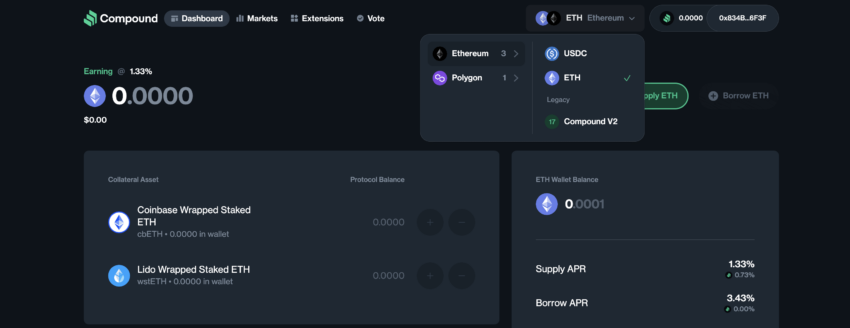

Lending on Compound

Lending or supplying stETH on Compound is similar to AAVE. You need to select the network Ethereum, and you will get the Coinbase and Lido-staked ETH options. Per the latest findings, you can supply any quantity you wish with an APR of 1.73%.

Do note that in the case of Compound, the rebasing tokens, like the stETH from Lido, were wrapped and used as wstETH to manage any supply fluctuations. However, you still get the cstETH token in return, more like a receipt of your lending activity.

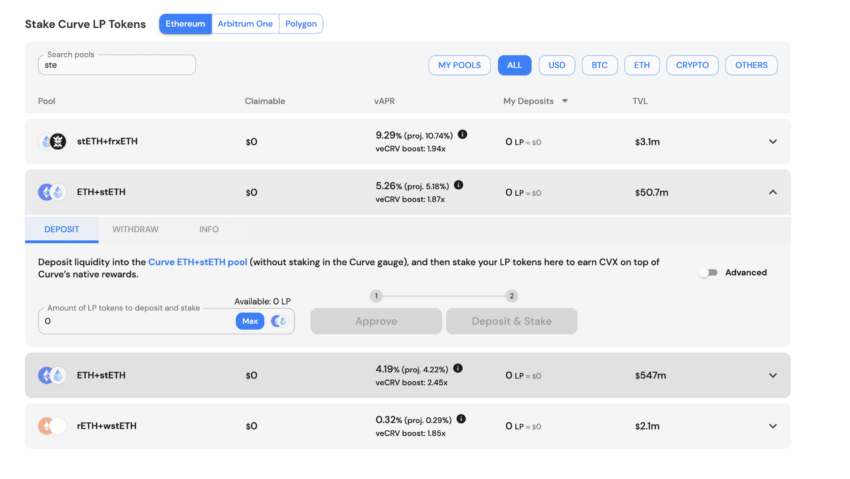

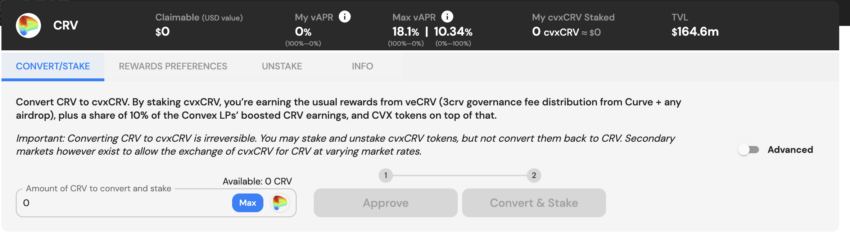

Auto-compounding yield farming on Convex Finance: Curve included

If you liked how auto-compounding works on Yearn Finance, you would also appreciate what Convex Finance can do.

Happily, the process remains simple. You first need to connect your wallet to the Convex UI. Once done, you need to head over to the “Stake” tab and choose the Curve pool relevant to your asset — stETH in this case. As it happens via Convex, you get cvxCRV tokens in return for tracking the share of deposits on Curve and the possible yield.

The idea here is to use the LP tokens generated from Curve’s yield farming for staking on Convex Finance to generate higher yields. Convex auto harvests rewards generated by the Curve Pool(s). And once auto-harvested, the process of reward compounding becomes easier and more rewarding. The cvxCRV tokens can be redeemed to exit the Curve pools and unstake the Curve LP tokens.

Do note that some pools also offer the veCRV boost. This special APR boost is possible when users participate in Curve’s additional incentivizing plans for participating in governance-specific activities. Yearn Finance’s founder announced this boost in a blog post on Medium in 2021.

“We have launched Convex Boost Delegation, this allows you to delegate any unused veCRV to Convex to further increase their yields.”

Andre Cronje, founder of Yearn Finance: Medium

However, this means locking the LP tokens longer, which are picked up by Convex Finance to maximize gains. Simply put, Convex pulls all your LPs from different pools to maximize the potential to earn more on stETH. However, for the veCRV boost or rewards, you would still need to make manual claims.

For the above pool with a vAPR of 5.26%, the veCRV boost component can push the APR to almost 10% using Convex Finance. And this 10% doesn’t include the almost 5% APR that your original Lido staked ETH offers.

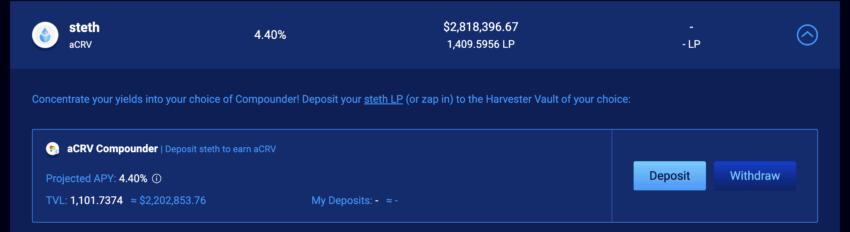

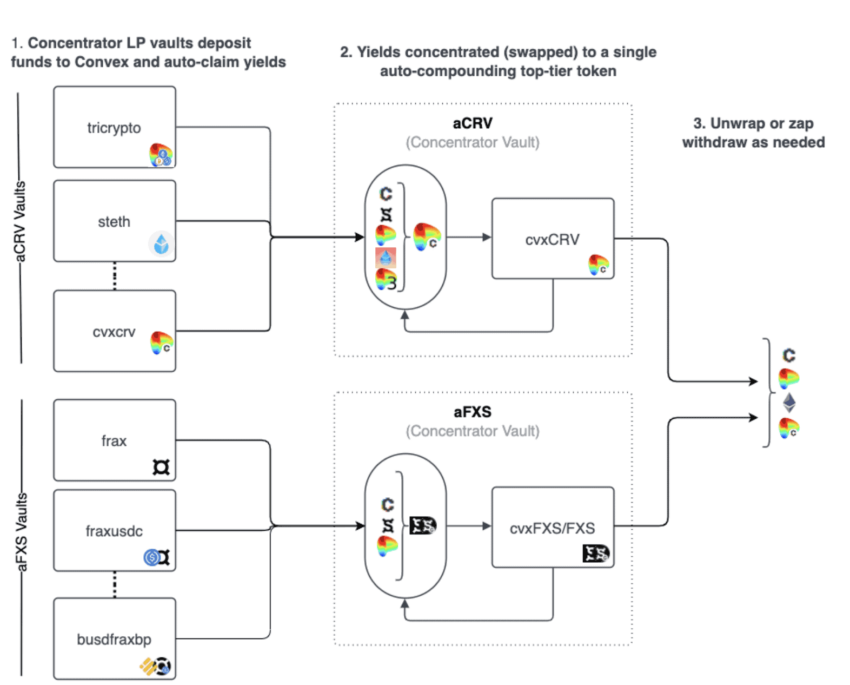

Automate reward collection using Concentrator

It is appropriate to discuss this strategy immediately after discussing Convex. Concentrator by Aladdin DAO can help boost your CVX or Convex-specific yields.

For this to work, you first need to locate the right stETH Concentrator vault, deposit the stETH LP tokens that you would receive post Curve deposits, and get aCRV tokens in return. These are more like receipt tokens.

This way, you are allowing Concentrator to auto-claim every reward token, gather them all, and eventually sell them for cvxCRV tokens. Do note that these cvxCRV tokens have a very high vAPR threshold on Convex, allowing you to maximize your yield on stETH.

Concentrator’s auto-claiming and compounding prowess makes it one of the more sought-after DeFi platforms to earn more on stETH.

However, do consider the vault withdrawal fee while depositing, as a higher number might eat into your yields.

Special mention: liquid staking derivatives with StakeWise

First of all, Stakewise is an alternative to Lido Finance. Simply put, it is another liquid staking solution that stakes ETH as rETH2 and sETH2. However, if you have stETH and are looking for a higher yield, you can swap the stETH for ETH and then re-stake the same at Stakewise. At press time (early May 2023), the staking APR is 5.78% — higher than that of Lido.

Upon connecting your wallet, you can swap the tokens on any DEX. Do note that the stETH to ETH swap will also attract slippage and exchange rate fees.

Financial products at Idle Finance

Idle Finance is a popular yield automation tool that can help you earn more on your stETH. You need to connect the wallet and choose the tranche that you want to deposit your funds into. As of May 3, 2023, there are two tranches — Senior and Junior — with 5.12% APY and 8.21% APY respectively.

Here is why the yields offered by the Senior and Junior tranches differ:

Also, Idle Finance’s strategy is simple. It converts your stETH into Lido-native wrapped stETH tokens to keep the supply volatility in check. The APR takes LDO and other rewards to incrementally and automatically accrue yields.

Multi-strategy yield optimization on Yearn Finance and Harvest Finance

While we did discuss how yield optimization on Yearn Finance works, let us take a closer look at how the process works on Harvest Finance. Once you head over to Harvest Finance’s dashboard, you need to connect the wallet and then head over to any “farm” with the right set of tokens.

We have selected the stETH-ETH farm or vault, corresponding to Convex Finance. Now, head over to Convex Finance, select the right Curve pool, and deposit your stETH into it. Doing this will allow you to get rewards in CRV, LDO, and even CVX, which are then auto-harvested to maximize yield.

Once you get crvstETH after pooling on Curve, you need to deposit the same in Harvest Finance’s farm and get the fcrvstETH token in return.

Do note that almost every Decentralized Finance (DeFi) platform offers a receipt-like token to tag and manage the deposits accordingly. Using harvest finance, you can optimize additional yield worth 3.89% for the stETH-ETH farm as of May 3, 2023.

Participating in token sales or ICOs

Another way to earn more on stETH is by participating in ICOs using stETH. Even though it isn’t a common practice, it might have a place in 2023 and beyond with new projects coming in. Also, with Shapella unlocking staked ETH for withdrawals, stETH-powered ICO sales might not be as elusive as you think.

Any project supporting these will have a smart contract address to take stETH deposits. However, this might be a risky approach due to the growing number of rug pulls and scams. Investor discretion is advised.

Combining Curve Finance and Yearn Finance for increased yields

Another approach could be to use both Curve Finance and Yearn Finance to optimize and increase yields. Here are the steps to follow in that case:

- Locate the right liquidity pool on Curve Finance to deposit your stETH.

- Once done, you will get crvstETH LP tokens that you can either stake in Curve’s gauge or deposit into Yearn Finance’s crvstETH accepting vault.

- While you keep earning APY in trading fees and LDO tokens (probabilistic) from your Curve Finance liquidity mining strategy, Yearn Finance takes you Curve LP tokens, periodically harvest the rewards, and buys more stETH-ETH to feed back into the Curve pool.

- You can even get CRV tokens by staking Curve LP tokens in the Curve gauge and then depositing those CRV tokens into another relevant Yearn Finance vault.

This way, you can maximize your profits, adding them to the original Lido-promised APY.

Which strategy to pick and how?

By now, we have discussed a considerable number of ways to use DeFi platforms to earn more on stETH. But the question remains — which platform or rather strategy should you pick? Well, here are a few pointers to help with that:

Every transaction you make on a DeFi platform will attract some sort of gas fee. Therefore, if you plan to hop from one liquidity platform to a yield aggregator to something like the Concentrator, your position size must be large enough. This way, you can justify the higher fees.

A good way to check the gas fee range is to head over to the Ethereum Gas tracker and pay something that is between the average and high level. That way, you can make a transaction faster. Do note that the gas tracking space changes every second.

The next factor to consider is risk tolerance. While yield aggregators and DEXs offer liquidity pools, liquidity mining or yield farming resources like Curve might be a little safer owing to the reliance on stablecoins and stable asset pools. Also, DeFi projects are based on smart contracts, which can be breached. Therefore, you should only lock or lend the amount that you can afford to lose.

And finally, if we need to focus on the deposit time before proceeding. If you plan on locking funds only for a few months, keeping an eye on the withdrawal fees is important, as that shouldn’t offset the profits you made.

Staking providers and custody options for stETH

As a risk-averse user, you might not want to do anything with the stETH but store. On evaluating the custody options, here are some of the resources that can come in handy:

- Lido: You can keep the stETH staked and stored on Lido itself as it is non-custodial in terms of custody options and offers close to 5% in APR.

- Centralized exchanges: Even though CEXs are custodians, the benefit of centralized exchanges is that some offer built-in stETH staking services. This is hassle-free, but there are always trust-based concerns.

- Hardware wallets: The likes of Trezor, Ledger, and more offer self-custody of the stETH. Plus, you can connect and move your assets from Lido to any hardware wallet, especially if you plan on keeping the ETH staked longer.

- Software wallets: The likes of Trust Wallet and MetaMask are self-custodial but allow you to connect seamlessly to DeFi platforms in case you change your mind and plan to earn more on stETH.

Risks associated with earning on stETH

We all appreciate those high single-figure or double-figure APRs. Yet, be aware of a few risks while trying to earn on stETH. These include:

- Smart contract (security) risks

- Impermanent loss

- Platform-specific exploits

- Regulatory risks

- Counterparty risks

Regardless of the yields a platform promises, it is always advisable to have risk management and due diligence strategies in place.

The future of DeFi and stETH

If you want to earn more on your stETH, try out the strategies and DeFi platforms that we listed above. It goes without saying that stETH has opened many opportunities to generate passive income in this otherwise unexplored DeFi ecosystem. And the best part about stETH-based earning is that you can use each platform individually or combine the efforts to maximize yields.

Eventually, it all depends on how much you are willing to explore. The DeFi ecosystem is constantly evolving, and new platforms with support for Lido-staked ETH are likely to continue to show up.

Frequently asked questions

Can you earn a yield on stETH?

What is a stETH token?

Do you get rewards if you buy stETH?

What should I do with stETH?

How often is stETH paid?

Is buying stETH the same as staking?

How safe is stETH?

Can you trade stETH?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.