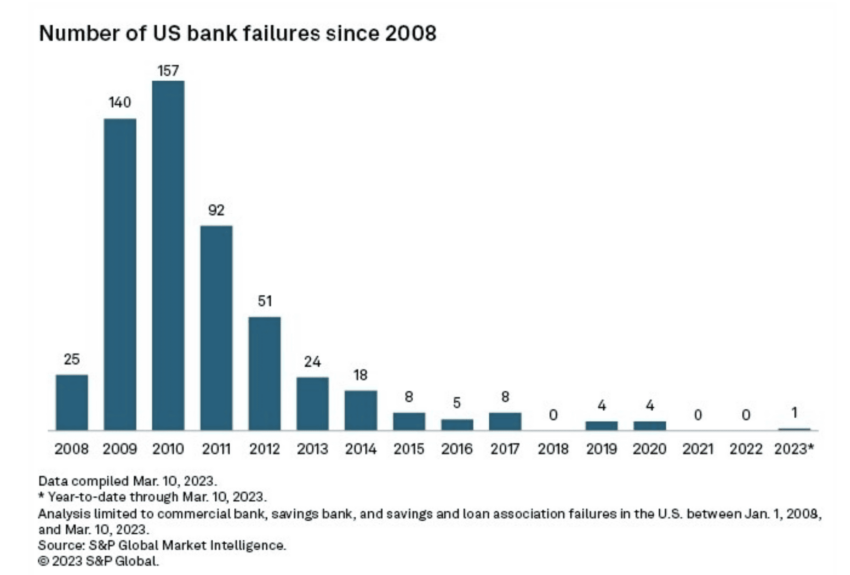

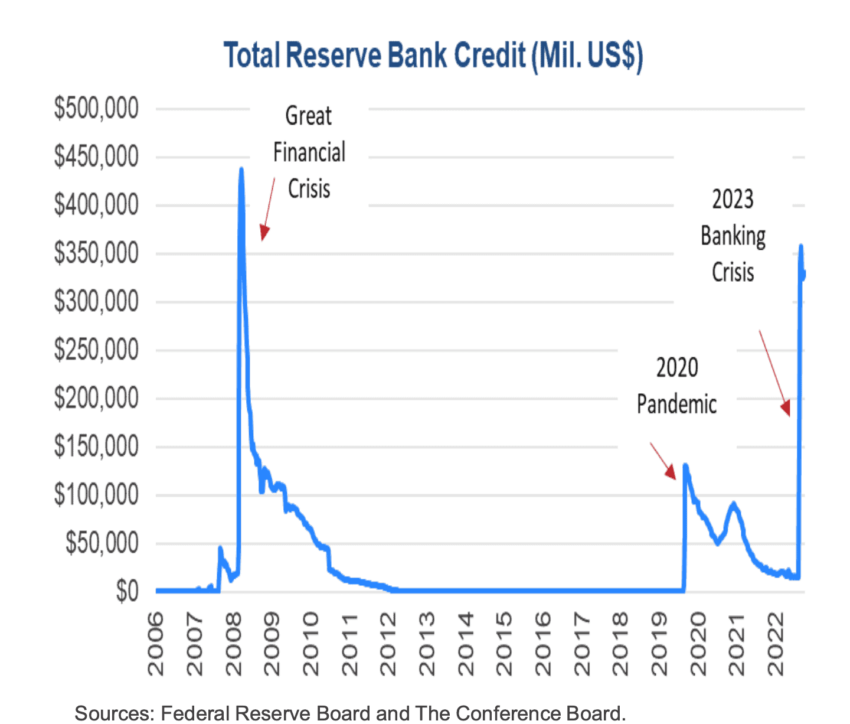

Banks collapsed in the United States roughly once every 90 days in 2023. U.S. banks — regional and smaller-scale institutions — have been trampled by deep-seated vulnerabilities, regulatory mishits, market instability, failure to manage risk, and other factors. As a result, both regional and global financial markets have been disrupted. This guide explains what has happened and why, taking a deep dive into the causes of the 2023 banking crisis, its impact, and possible solutions.

BeInCrypto Trading Community on Telegram: get the hottest news on crypto, start trading with the free Trading Basics course, read technical analysis on coins & get answers to all your questions from PRO traders & experts!

- What is the 2023 banking crisis?

- The timeline of the US banking crisis

- What caused the 2023 banking crisis

- Impact of the 2023 banking crisis

- Role of technology and social media in the 2023 banking crisis

- Navigating the banking crisis in 2024: solutions?

- Lessons from the 2023 US banking crisis

- Economic recovery post the US banking crisis

- Crisis or cure: what’s the long haul like?

- Frequently asked questions

What is the 2023 banking crisis?

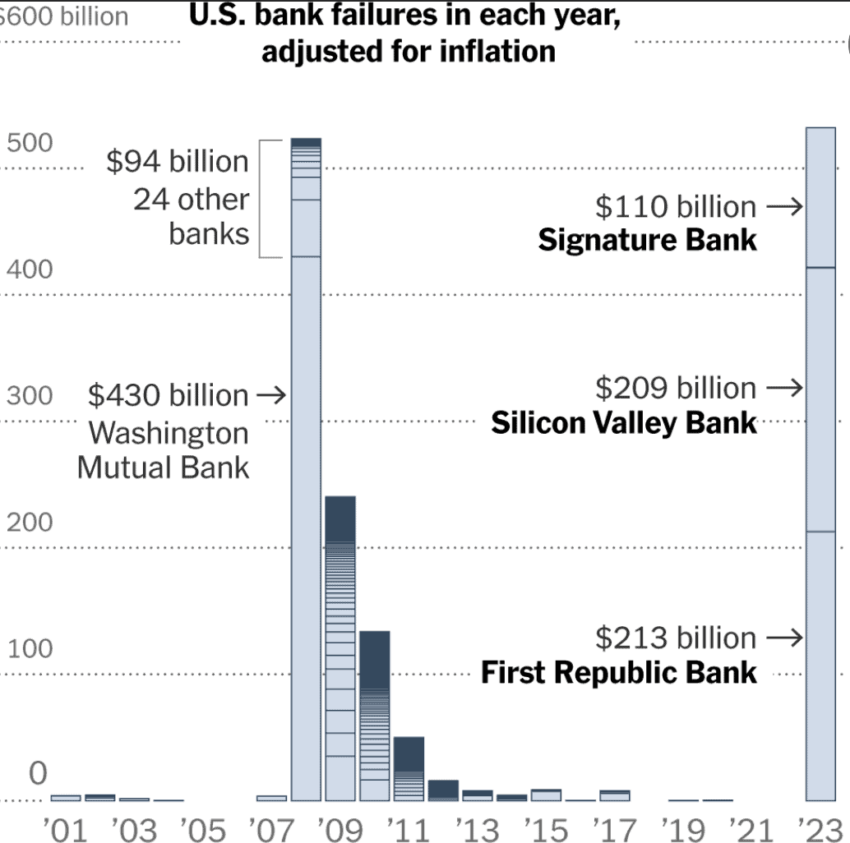

The 2023 banking crisis saw a sudden, yet relatively expected, meltdown of the regional U.S. banks, disrupting the global banking industry. The spate of bank failures had a domino effect — catastrophic yet distinct from the 2008 financial crisis, which mostly targeted Wall Street giants. This was the crisis that put the “too big to fail” tag to rest, as the likes of Lehman Brothers and Bear Stearns were unable to ride out the storm.

This U.S. banking crisis impacted smaller financial institutions like the Signature Bank, Silicon Valley Bank, Silvergate Bank, and the First Republic Bank.

The timeline of the US banking crisis

Even though the U.S. banking crisis is predominantly 2023-focused, the broader timeline spreads back to 2019. Let us delve deeper:

2019 and the early warning signs

The Fed changed the stress-testing norms or the tailoring rules for the banks, lowering the liquidity standards for institutions holding assets under $100 billion. We will see how this furthered the banking contagion in 2023.

October 2022 started the chain reaction

Global interest rates surged, making it harder for banks and even investors to borrow money. This was the first spark to light the “crisis” fuse.

January 2023

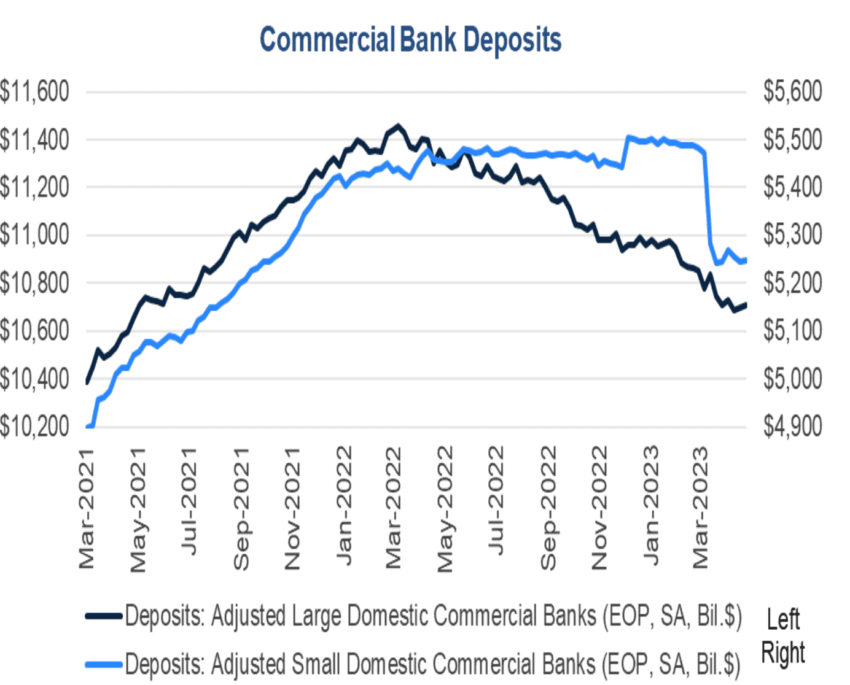

Banks like FRB and Signature Bank started seeing massive capital outflow as investors started pulling out money to fund standard operations. This furthered the financial market instability, bringing in initial signs of a liquidity crisis.

By this time, the rising interest rates had already negatively impacted the bond rates, making several bond-heavy banks like SVB incur unrealized losses. And the liquidity crisis meant that they couldn’t even sell their investments to handle the outflow. Things started going south.

March 2023

On the 8th, Silvergate Bank gave in and announced that it would shut shop — unable to meet withdrawal demands. Silicon Valley Bank did its part by mentioning a loss booking value of $1.8 billion, as it had to sell some of its bond-specific investments in order to meet increased withdrawal demands. SVB Financial, the parent company, saw a subsequent Moody downgrade as the news broke out.

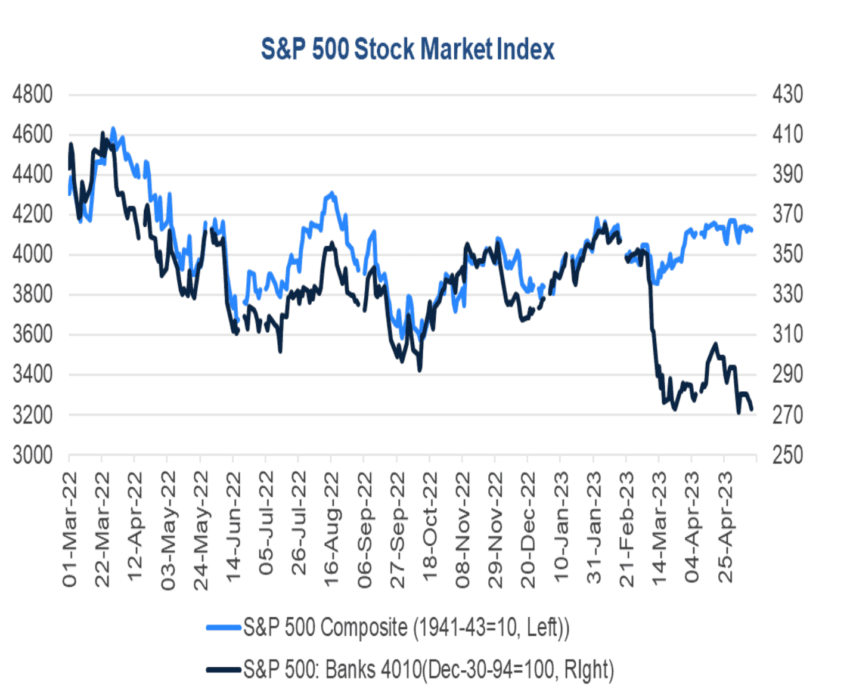

On March 9, 2023, the share prices of SVB plummeted. It also led to a $52 million wipeout in the market value of Bank of America, JPMorgan Chase, Citigroup, and Wells Fargo. On March 10, SVB joined Silvergate in the ground with regulators announcing control of the institution. Also, March 12 saw regulators taking control of the Signature Bank — making the systemic risk concerns real and legitimate.

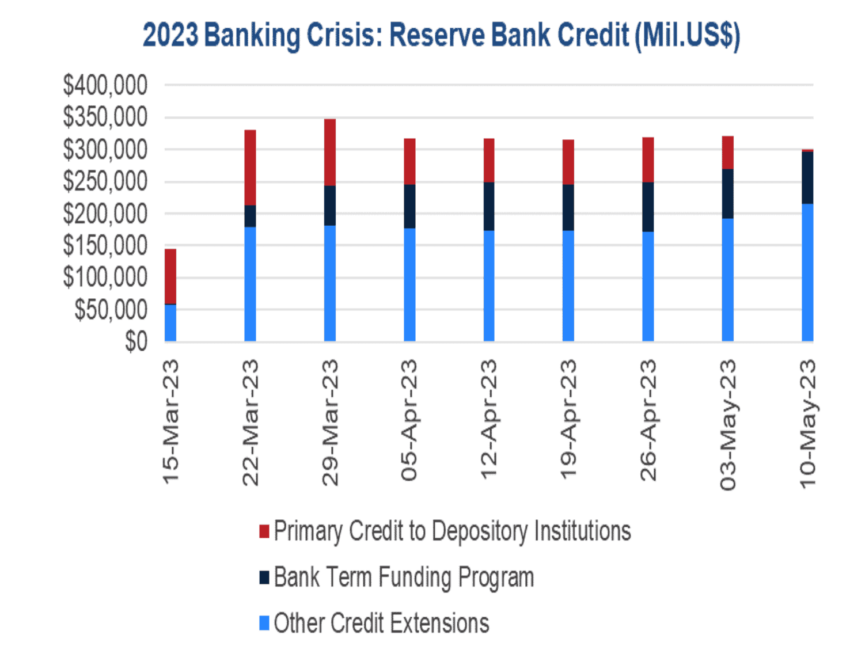

However, regulators on March 12, 2023, announced that customers of the concerned banks would get their deposited funds back. March 11 and 12, 2023, even saw startups scrambling for funds to manage day-to-day startup operations. Also, a new lending program focusing on banks came to the fore — something we shall discuss later.

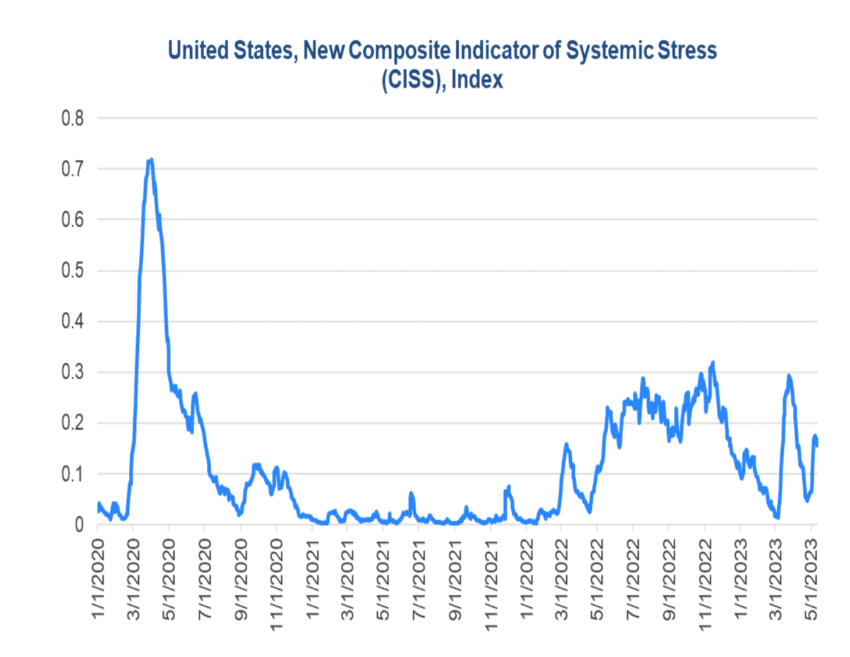

2023 banking crisis moving outward, mid-March

March 15, 2023, saw this crisis spreading outwards (across the Atlantic), with the stock prices of Credit Suisse making new lows. European banks like BNP Paribas and Deutsche also saw a drop in share prices. And while three banks already gave in to the contagion, at this time, the world saw the First Republic Bank getting a “junk” credit rating from S&P Global ratings.

March 17, 2023, saw SVB Financial file for bankruptcy protection. Between March 18-27, UBS, Switzerland, finalized the Credit Suisse takeover. JPMorgan Chase is planning to stabilize First Republic, share prices of First Republic surprisingly rallied 30%, and the Federal Deposit Insurance Corporation (FDIC) mentioned that a bulk of SVB’s assets would move to First Citizens BancShares.

April 2023

April was defined by First Republic inching closer to failure. First of all, it suspended the dividend payments and even mentioned that in March, the bank saw a fall of around $100 billion in deposits. In April, the stock prices of the First Republic Bank started declining steeply.

May 2023

May 1, 2023, saw the regulators taking control of the First Republic Bank. Following this was a fallout concerning other regional banks like First Horizon and PacWest, with the latter reporting a 9.5% drop in deposit value on May 11.

Twitter-based financial experts believe that the banking crisis isn’t over, and there is a lot of instability in the market. Others believe that the crisis might be a deliberate move to organically introduce CBDCs within the economy. However, all of that is speculative.

What caused the 2023 banking crisis

Well, it is impossible to pin the 2023 U.S. banking crisis for one reason. Some experts even called it the Bond crisis, or even a sovereign debt crisis, and not actually a banking crisis.

“Bond crisis, not just a banking crisis.

Sovereign debt crisis, not just a bond crisis.”

Balaji Srinivasan, former CTO of Coinbase: Twitter

Let us delve deeper and understand the causes a bit better:

The global “economic” climate

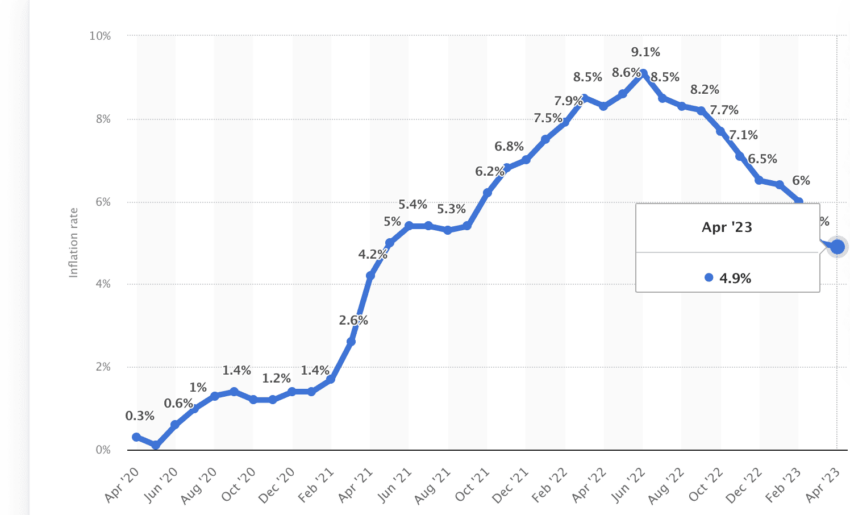

The global growth pace following the pandemic was slow. From crypto to equities, every high-beta asset entered a bear market phase in 2022. And while there were many consequences, the most disconcerting was the sudden dip in the rates associated with long-term debt securities or bonds.

The drop in the long-term bond rates caused a massive value erosion corresponding to the investment portfolio of banks like the Silicon Valley Bank — with heavy exposure to these long-term bonds.

For the unversed, inflation is often associated with rapid financial growth, pushing the value or rates associated with long-term bonds higher. As the Feds, European Union, and other global bodies started hiking interest rates to combat inflation — slowing economic growth in the process — the long-term bond rates dropped, and so did the value of bank investments. And as the banks had to encash these investments at a loss due to rapid withdrawals — also due to interest hikes — things turned quickly turned ugly.

Regulatory oversights and hurdles

The 2008 financial crisis saw regulators implement the Dodd-Frank Act, restricting banks from making speculative investments with investor money courtesy of the Volcker Rule and establishing the Financial Stability Oversight Council and the Consumer Financial Protection Bureau.

While we would need a separate piece to detail the ins and outs of the Dodd-Frank Act, what you must know is that factors involving non-compliance with the act’s verticals, like the Volcker Rule, insufficient enforcement, and a stifled small banking space led to the 2023 U.S. banking crisis.

Did you know? The Dodd-Frank Act came as a Wall Street reform and was signed into Federal law by Former President Barrack Obama on July 21, 2010.

Financial market and instability

As mentioned earlier, the bond rate volatility is what makes the banks vulnerable. Banks like SVB were heavily invested in government-backed long-term bonds, and the interest rate hikes made them less rewarding. And with banks’ investments running at a loss, investors asking for money as part of a quick bank run is never conducive to economic health. Banks ended up selling these bond-specific investments at steep losses, bringing regulators and bankruptcy into the mix.

Vulnerabilities related to the banking space

Although speculative, it’s clear with hindsight that several banking sector vulnerabilities were building up before 2023. These include the battered banks having significant exposure to speculative investments, focusing on excessing risk-taking, and issues related to interbank money lending freeze. These problems made it harder for the banks to cover withdrawal requests. Plus, it even opened the “systemic risk” bottle, unraveling every kind of threat along the way.

Rapid rate hikes and monetary missteps

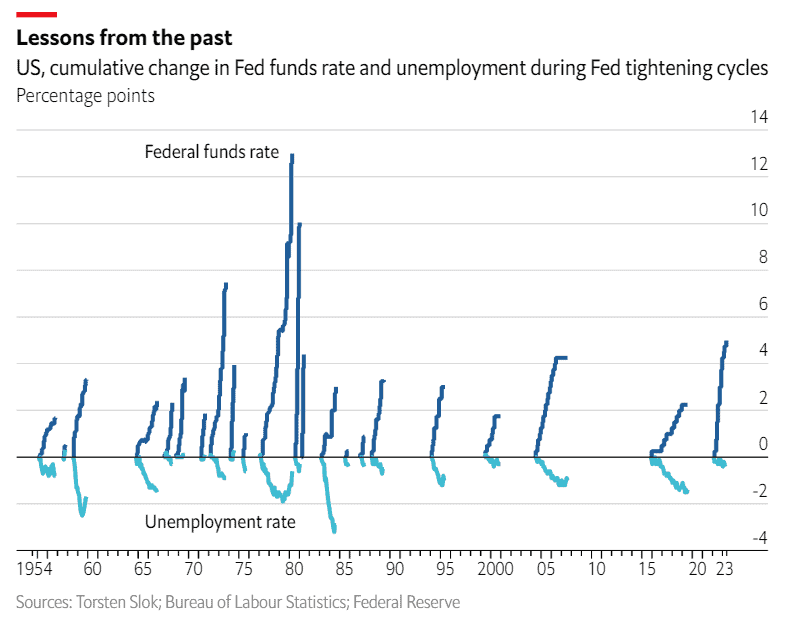

While we did discuss this earlier, here is a quick reiteration. Since 2022, we have seen worldwide interest rate hikes to combat inflation.

All that made borrowing expensive, hitting startups hard and the banks harder as they saw a chain of withdrawals. And while Federal Reserve-driven rate hikes are somewhat necessary to combat the threats of “inflated prices,” quick and miscommunicated ones are often termed monetary policy missteps. These might have worked as the accelerants, firing up the 2023 banking crisis.

/Related

More Articles

Risk Management and Control Failures

Banks mostly always operate in risky waters. And that brings us to the importance of risk management. During the 2008 financial crisis, one element of risk management was religiously trolled — evaluating the creditworthiness of the borrowers. In 2023, there was another risk control and management blunder — overexposure to long-term debt securities.

With causes out of the way, let us look at the impact.

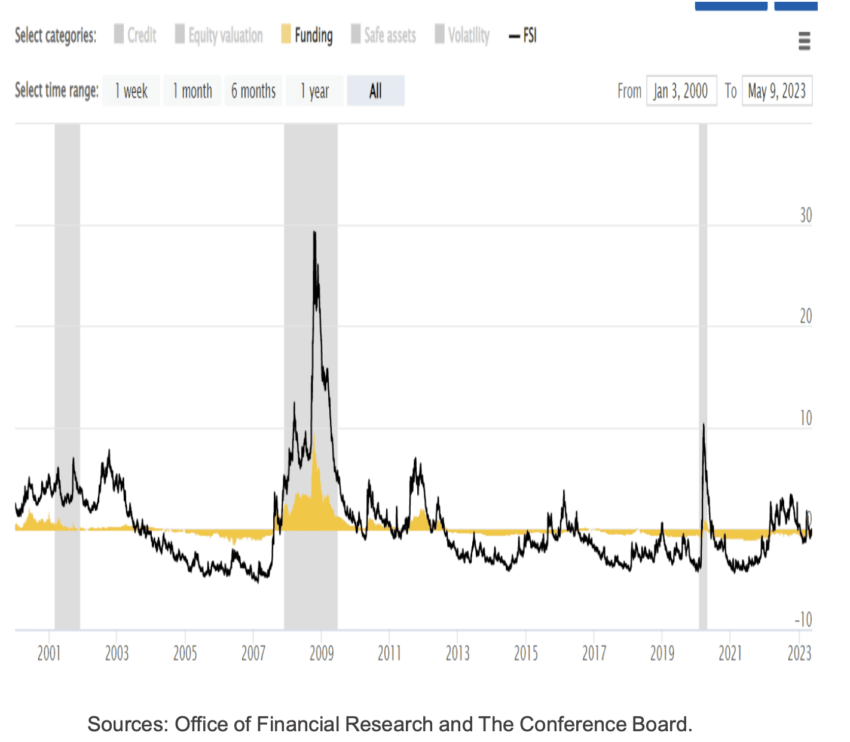

Impact of the 2023 banking crisis

The U.S. banking crisis already has far-reaching effects, not restricted to the national banking sector. Here is how things are unfolding.

Global economy and impact

Several countries, such as Germany, have reported consecutive months of negative GDP growth, a pattern that points to a recession. A number of European banks, including the likes of Credit Suisse and Societe Generale, had to weather the blow of the 2023 banking crisis.

But that’s not it. Here are some of the additional aspects that can feel the impact of this ongoing crisis:

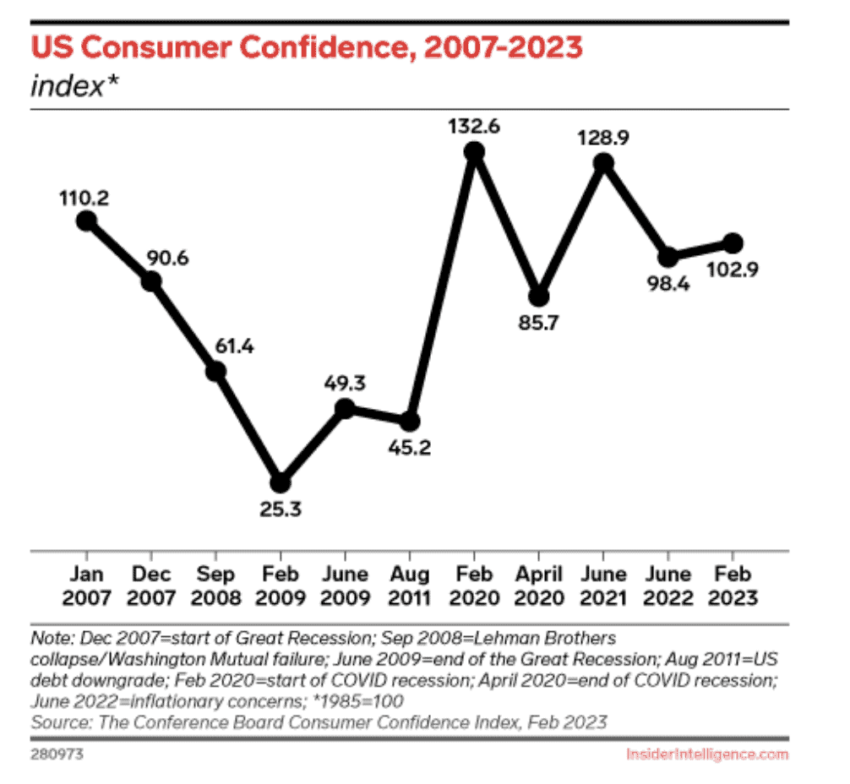

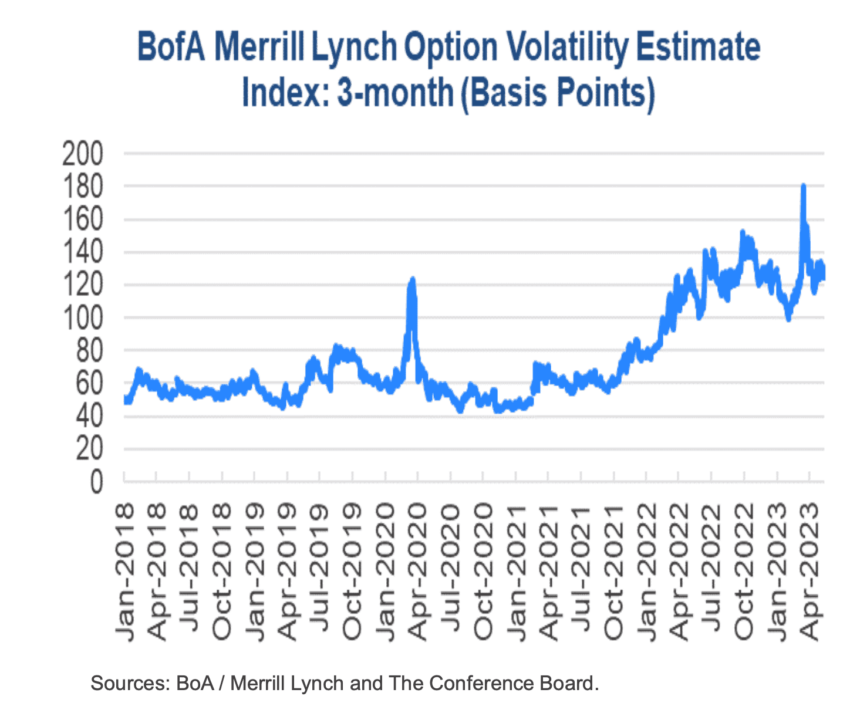

- Market volatility: Per the MOVE (Merrill Lynch Option Volatility Estimate) Index, bond markets continue to be volatile in the wake of the banking crisis.

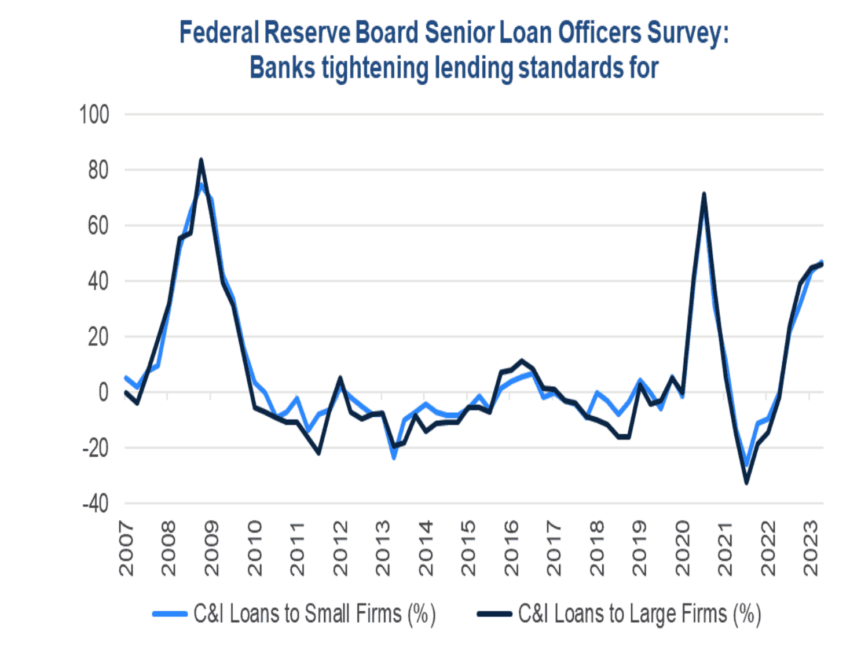

- Credit crunch or tightening: As the credit crunch continues, with even banks scampering for funds, credit tightening at the U.S. shores can impact global economies, especially developing nations that rely on external financing.

- Lower business-specific investment: With inflation being a global issue and the U.S. expected to put its coffers out of reach, global business investments might slow down.

US economy and the impact

Unlike the global economy, the impact of the 2023 banking crisis on the U.S. economy seems more direct. Here are the probabilities:

Recession

Banks failing, credit lines clogging up, increasing government debt: the writing looks to be on the wall as even the Fed economists predict an upcoming recession for the U.S. markets. This expectation, or rather, concern, was highlighted in March’s monetary policy meeting.

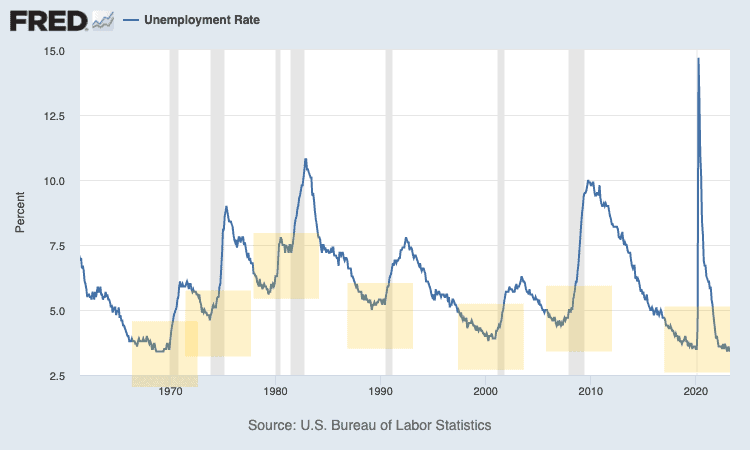

Unemployment

U.S. unemployment rates are low. Good news amid the banking crisis, right? Well, charts reveal that it usually takes around 14 months for unemployment rates to peak once the credit tightening cycle begins.

Note that a recession has inadvertently followed the lowest unemployment rates (local bottoms). A lagging indicator, indeed.

Inflation

Concerns haven’t subsided despite the inflation rate down under 3.2% in December 2023. With the debt crisis looming large and money printing looking like an option, the core inflation rate might not yet be out of the woods. But this might be a double-edged sword. The banking crisis might lower the purchasing power of people, and with the prices of goods rising with possible inflation, we can see a further dip in consumer spending. This might hit the economy even harder.

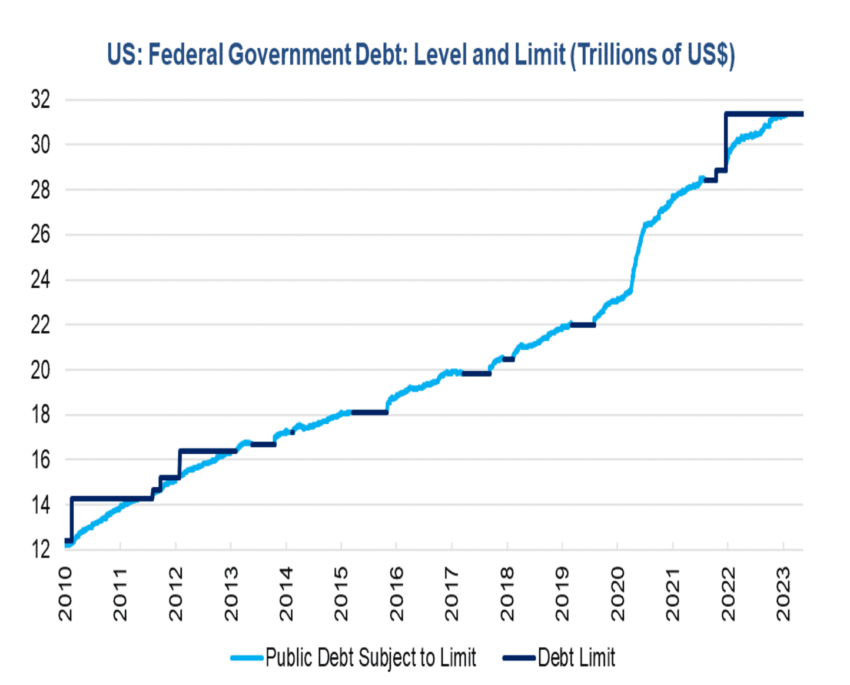

Increased debt

A banking crisis can increase national debt — a way to offset the destabilized economy, courtesy of bank fallout. And yes, we are already at the debt ceiling, it seems.

How were financial institutions affected?

Even though four banks have seemingly failed, the crisis might not be over as of yet. Financial institutions might still feel the impact of:

Failures and rescues

Most banks failed due to shrinking margins, drained deposits, and poor risk control. And these factors might just concern banks that are still standing. Instead, the concerns might end up shaking investor confidence, making other banks prone to failure as well.

Shortage of resources

The U.S. banking crisis has tested the staffing prowess of bodies like FDIC — which has been on its heels since. Any additional burden can relay the processes involving resolution, heightening the impact of this ongoing crisis.

Impact on individuals and businesses

Gauging the impact on businesses and individuals might be trickier to comprehend. However, here are the elements of most concern:

- Minimal access to credit in the form of loans.

- A dip in investments might lead to lower exposure to high-risk assets like stocks and crypto.

- Uncertainty involving businesses with lower consumer spending is becoming a standard.

Well, the impact might be speculative, but the concerns are real.

Role of technology and social media in the 2023 banking crisis

Both social media and technology had a role to play in blowing up the U.S. banking crisis. Here is how:

The modern era has seen global banks connected to each other for capital. And with regional albeit major U.S. banks failing, a large part of the global financial machinery felt the tremors. For the unversed, some of the basic pieces of tech responsible for interbank communications include SWIFT (Society for Worldwide Interbank Financial Telecommunication) and cloud computing.

Also, it is noteworthy that several tech startups, such as Roblox and ROKU, had exposure to SVB, making investors lose trust in the entire sector. Even cryptocurrencies came on the radar of experts, with some suggesting banks’ exposure to blockchain-driven assets as the reason for the meltdowns.

Social media also added gasoline to this entire fiasco, with experts and influencers posting their random theories regarding the crisis. All that worked right into the feedback loop and furthered the fire.

Navigating the banking crisis in 2024: solutions?

Offsetting the negative effects of the U.S. banking crisis might not be so straightforward. Multiple bodies — financial institutions, government and Feds, businesses, and international bodies will have to come together.

Let us see what might be in the pipeline:

How can financial institutions offer help?

Financial institutions, especially banks, can focus on risk management going forward. Working on improving liquidity management by diversifying the sources of funding, HQLA or Holding High-Quality Liquid Assets, better forecasting of cash flow, and having adequate liquidity buffers are some of the best available strategies going forward.

The response of the Federal Reserve and the government

Several coordinated measures have already been implemented to minimize the effects of the banking crisis. These include:

Bailouts

None of the banks that shut shop were directly bailed out, contrary to the past crisis events. Instead, the focus, backed by Federal Deposit Insurance Corporation (FDIC), was on helping the depositors. One such instance was FDIC using the SRE (Systemic Risk Expectations) with a focus on Signature and SVB — giving the rights to uninsured backstop depositors. While loans amounting to $400 billion moved out, there were no direct bank bailouts but moves to secure the depositors.

Policy changes

One of the most significant policy changes amid the ongoing crisis wave is the introduction of BTFP or Bank Term Funding Rate. This Federal Reserve-led policy focuses on improving the liquidity associated with banks, offering one-year collateralized loans. However, BTFP is more of a government response to the liquidity crisis instead of direct bank bailouts.

Stress tests

Federal Reserves stress test scenarios for 2023 were revealed long before the crisis surfaced officially. The set of tests was set to start running in Q1 2023 and go all the way to 2026, with 28 variables in focus. And even though the Federal Reserve included something called the “Explanatory Market Shock” as on the test scenarios, it actually didn’t take the rapid rate hikes into account. Now with the effects of the crisis spreading, new stress tests or scenarios to locate capital structure vulnerabilities could surface.

Apart from the mentioned solutions, here are some of the additional approaches that might already be in motion:

- Support from international central banks.

- Crypto adoption by individuals and businesses to minimize banking exposure

- Embracing digital payments and other kinds of digital adoption on an individual and business level to reduce overreliance on the banking system.

Lessons from the 2023 US banking crisis

The 2023 banking crisis was not just an eye-opener. It was a reality check. Here are the things it taught the world:

Financial market and banking reforms are sacred

Banking failure exposed gaps, regulatory oversights, and inactions. The concept of asset-liability durations, courtesy of the long-term bond rates dipping, came to the fore. And it opened a new can of worms concerning liquidity management. Another thing that everybody learned was that excessive exposure to one industry or sector, in terms of investor concentration, is never good for banks. And finally, it is now clear that strict financial reforms are needed to put all the above issues out of the equation.

Economic resilience matters

Regardless of the reforms, it all comes down to the banks’ ability to withstand shocks like bank runs. The world learned that everything starts falling apart when withdrawal requests start pouring in. And that is where even banks need to understand that investing in only one kind of asset class (majorly) isn’t a good practice. Do note that the introduction of BTFP is one step towards building economic reliance.

In addition to these important lessons, the crisis even stresses the role of technological adaptation, which might include using machine learning and AI for risk assessment.

Economic recovery post the US banking crisis

It remains to be seen what else can the government, federal reserve, and policymakers could muster to bring about economic recovery. Here are the possible ideas that might already be in the works:

- Strengthening the banking space

- Being more prudent with rate hikes

- Restoring the confidence of people in the banking system

- Stimulating economic moves with relevant fiscal policies

- International cooperation for holistic financial stability

And finally, above everything else, it must be about improving transparency with a focus on banks’ balance sheets. This is something the “Explanatory Market Shock” stress test scenario aims to consider. Also, the banking sector still seems a bit off-color, and it might just be too early to say that the banking crisis is over.

Crisis or cure: what’s the long haul like?

Regardless of the approach one takes, it all comes down to building a robust financial system. The worst part of the banking crisis that occurred in 2023 may be behind us. Equally, it may not yet have arrived. Notably, financial markets are no less stressed. The credit spreads are still narrow. Yet, the U.S. banking crisis is a highly complex space with angles spanning bond rates, interest rates, credit lines, and bank runs.

Frequently asked questions

What caused the 2023 banking crisis in the U.S.?

What three banks failed in 2023?

What is the largest bank failure in history?

What is the cause of the banking crisis?

How did the Federal Reserve respond to the 2023 banking crisis?

What was the economic impact of the 2023 banking crisis?

How did the 2023 banking crisis affect Wall Street?

What regulatory changes were implemented after the 2023 banking crisis?

How did the 2023 banking crisis affect the global economy?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.