Chainlink (LINK) appears poised for a significant correction in the near future, attributed to the emergence of a bearish reversal pattern.

However, sellers should exercise caution. This anticipated downturn may encounter resistance, potentially moderating the extent of the correction.

Chainlink Investors Are Pulling Back

Chainlink price corrected over the last few days, bringing the altcoin to trade at $17.2 at the time of writing. This drawdown is expected to extend further owing to multiple factors, including the receding participation of investors.

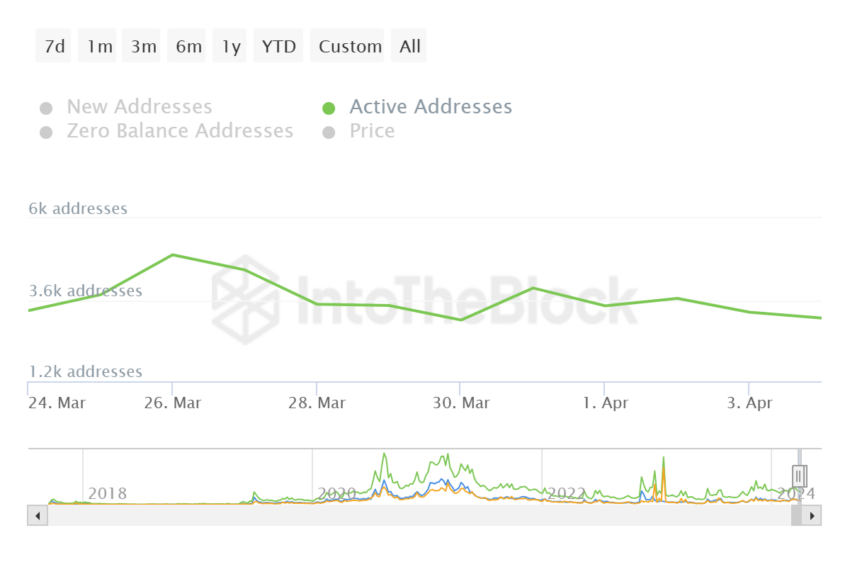

The addresses conducting transactions on the network have noted a nearly 44.7% decline in the last two weeks, falling from 5,560 to 3,070. As the network activity slows down, it reflects that investors’ interest is declining.

Moreover, the Relative Strength Index (RSI) is presently in the bearish zone below around the 40 level. This momentum oscillator measures the speed and change of price movements, with readings above 70 indicating overbought conditions and readings below 30 indicating oversold conditions.

As a result, based on the RSI, Chainlink’s price is highly susceptible to a steep correction down the line.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

LINK Price Prediction: 21% Drop

From a technical perspective, Chainlink is preparing for another correction. A head-and-shoulders pattern develops on the daily chart, which is considered a bearish reversal formation.

The neckline is present at $17.85, adding a level of support, but a sustained close below it could trigger a price correction to $14.02, representing a 21% downswing.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

However, a major cluster of LINK tokens was purchased between $15.56 and $17.48 might halt the decline. Since investors would refrain from selling their holdings at a loss, this level could act as support for Chainlink’s price. Still, Chainlink would have to hold above surge above $17.85 to invalidate the bearish outlook.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.