Coinbase has announced its plan to list Shadow Token (SHDW), a Solana network (SPL token) asset, on its crypto exchange.

Starting from April 10, 2024, at approximately 12:00 ET, trading will commence, subject to liquidity conditions being met. This move will allow Coinbase users to transfer and trade SHDW within regions where trading is permitted.

Coinbase to List Shadow Token (SHDW)

To ensure a smooth trading experience, Coinbase will initially roll out trading for SHDW-USD pairs in phases once it secures a sufficient supply of the asset. However, users must note that they should not send SHDW over networks other than Solana. Doing so could result in the loss of funds.

In line with its commitment to transparency and customer safety, Coinbase has designated SHDW with an “experimental label.” Coinbase applies this label to assets that are new to its platform or have relatively low trading volumes compared to other cryptocurrencies. The experimental label is a caution to users. It highlights that such assets may experience significant price fluctuations and issues related to low liquidity, including canceled orders.

Read more: Coinbase vs. Coinbase Pro: Which Is Right for You?

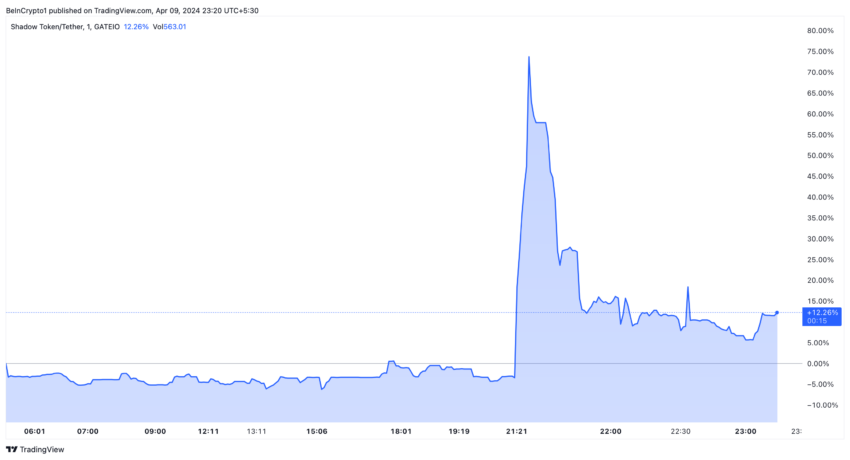

The Solana network contract address for Shadow Token is SHDWyBxihqiCj6YekG2GUr7wqKLeLAMK1gHZck9pL6y. Coinbase encourages users to familiarize themselves with the risks of trading experimental assets and to exercise caution when engaging in SHDW transactions. Especially given the spike in volatility SHDW experienced following the announcement.

Coinbase’s decision to list SHDW indicates its continuous efforts to broaden its cryptocurrency portfolio and offer users a wide array of digital assets. However, certain community members have raised concerns about the company’s strategy of supporting altcoins with low market capitalization.

“[Coinbase] keeps expanding support for a failing, centralized, vaporware chain, and keeps ignoring the far superior alternatives,” a crypto enthusiast commented.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.